Last December, 20 years after the launch of Mad Money with Jim Cramer, Canadian securities regulators felt the need to issue guidance about FINFLUENCERS and how securities regulation applies to them. Finfluencers are people who engage in stock picking and/or stock promotion activities online or on social media. I don’t mind if regulators throw the book at fraudsters, but feeling the need to publish this guidance is just another example of regulators justifying man-hours and expanding their empires.

If the regulators really wanted to be consequential, they could apply pressure on the social media platforms - the tech giants which finfluencers depend on. I read a recent report that $7B or around 10% of Meta ad revenues are from clearly deceptive scam ads. Now, there’s a meaty problem the government could go after. But it’s much easier to bully some guy talking about stocks on TikTok.

Probably the most well-known finfluencer at the moment is Amber Kanwar. On her website, Amber calls herself, “Canada’s most trusted and recognizable business journalist.” She has already landed several of the biggest financial institutions in the country as sponsors, less than a year after starting her podcast. Per my analysis, as detailed below, she has violated securities regulations in several instances - that's how easy it is to trip on these pointless laws.

Please note I am not picking on Amber, though I accept that I am offering her as a test case of the regulator's seriousness. The upside is that if she gets leniency, that sets a precedent all the smaller finfluencers can use as a shield. You can trust I am squarely focused on the OSC, because I am a committed free speech absolutist. I believe all these licensing regulations, whether they try to regulate investment advice, legal advice or even psychotherapy are a needless infringement on free speech. Like many effective entrepreneurs, Amber probably operates on the "move fast, break things" principle.

One very basic aspect of finfluencer compliance (in Canada) is that anyone can provide stock-picking advice provided it is not tailored to the needs of a specific investor - in which case, no license needed. However, there's a twist: you have to disclose any financial interest in the security you recommend. (I am simplifying things a bit.) In Ontario, this is all codified in section 34 of the Ontario Securities Act. Although the "finfluencer" guidance is new, section 34 has been on the books for decades.

In a "pledge" posted on her website, Amber says: "I will always disclose verbally if we are discussing a stock that I own."

(Please note that I provided a draft of this post to Amber prior to publication and she has since modified her pledge.) In any event, her pledge is irrelevant to my analysis - the law obligates her to disclose. To be 100% accurate, Amber operates through a limited company, AK Media, but the responsibilities ultimately falls on her (even though she is generally just interviewing and not herself making recommendations). I am skipping the nuances, but the essence of it is that her business has to be looked as a whole.

In the little sampling I have done, Amber just doesn't seem to take her disclosure obligations seriously. I asked her but she did not provide any instance where she did disclose a holding. However, in her year-end review last month, she mentioned that she had been a long-standing investor in Google/Alphabet, but that she decided to sell when her guest Dan Niles made bearish comments on it. This is the smoking gun I needed (to put the OSC in an awkward position, I hasten to add).

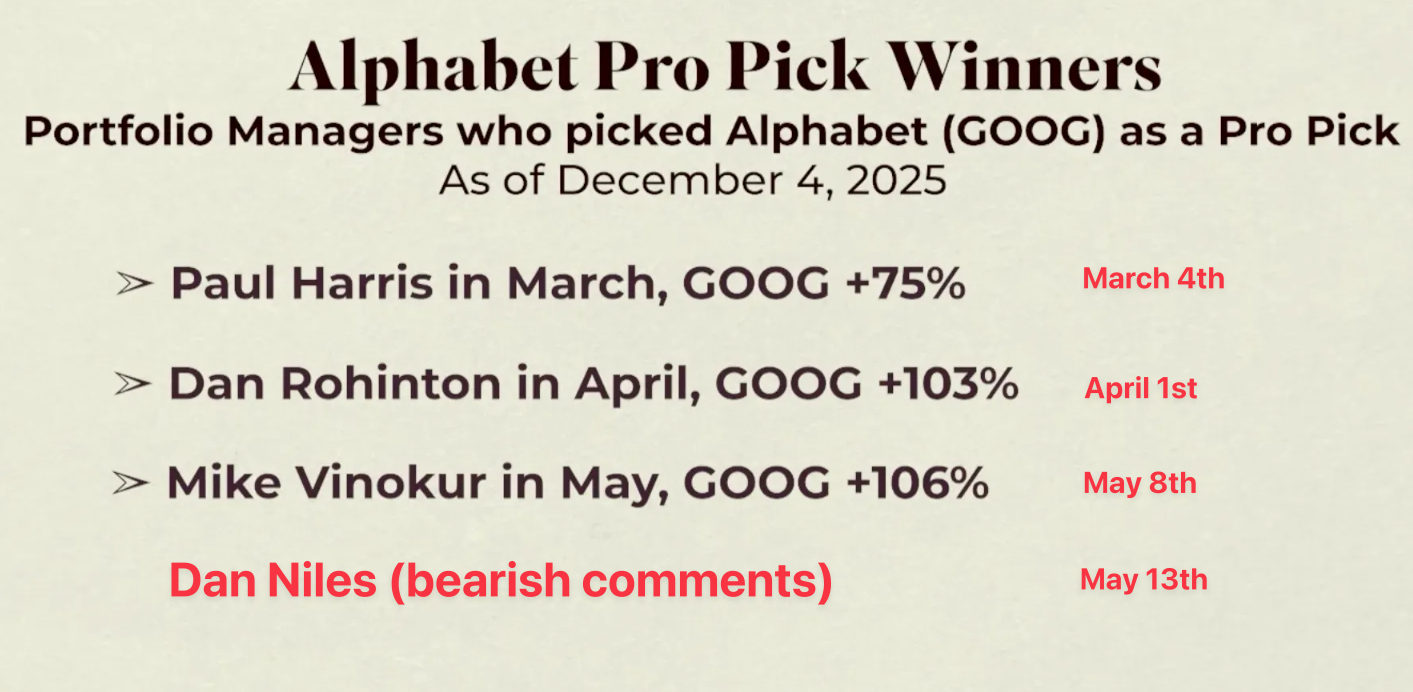

I copy a slide from Amber's year-end show that mentions the 3 instances in 2025 when Alphabet was profiled as a "Pro Pick". I have annotated this slide in red with the dates these shows aired and the date Dan Niles made bearish comments on the stock. Dan Niles came after the three pro-Google guests. We can therefore conclude that Amber's show recommended Alphabet as a top pick on 3 occasions, while she was a shareholder.

Did she, as the Ontario Securities Act requires, disclose her stake? I have reviewed all the relevant clips and she does not make any such disclosures. I don't want to waste your time posting lengthy video clips, but here's an excerpt from her website, where she documents this Pro Pick, without the required disclosures.

I am confident in saying, based on what I have sampled and my legal analysis, that she has at least a few other disclosure failings, besides Alphabet. Another problematic area is a new segment she launched to promote ETFs, on a sponsored basis. After I informed Amber of her deficient disclosures, she tweeted out a "policy update", including updating her ETF Minute segments. I believe her new ETF Minute segments, even after revisions, still fall short of the guidance, which requires some specificity, including naming the recipient of any payments.

In the pledge I pasted above, Amber writes: "I am never paid to discuss specific securities on the show." and also "I do not receive payment from guests." However, the ETF Minutes see her discussing ETFs, sometimes with a guest from the sponsoring issuer. Having such inconsistencies on her website leaves her exposed to the legally more fraught terrain of misrepresentations and deceptive marketing. Regulations also place some of the burden of ensuring compliance on the issuers, but that is not an issue I have examined closely.