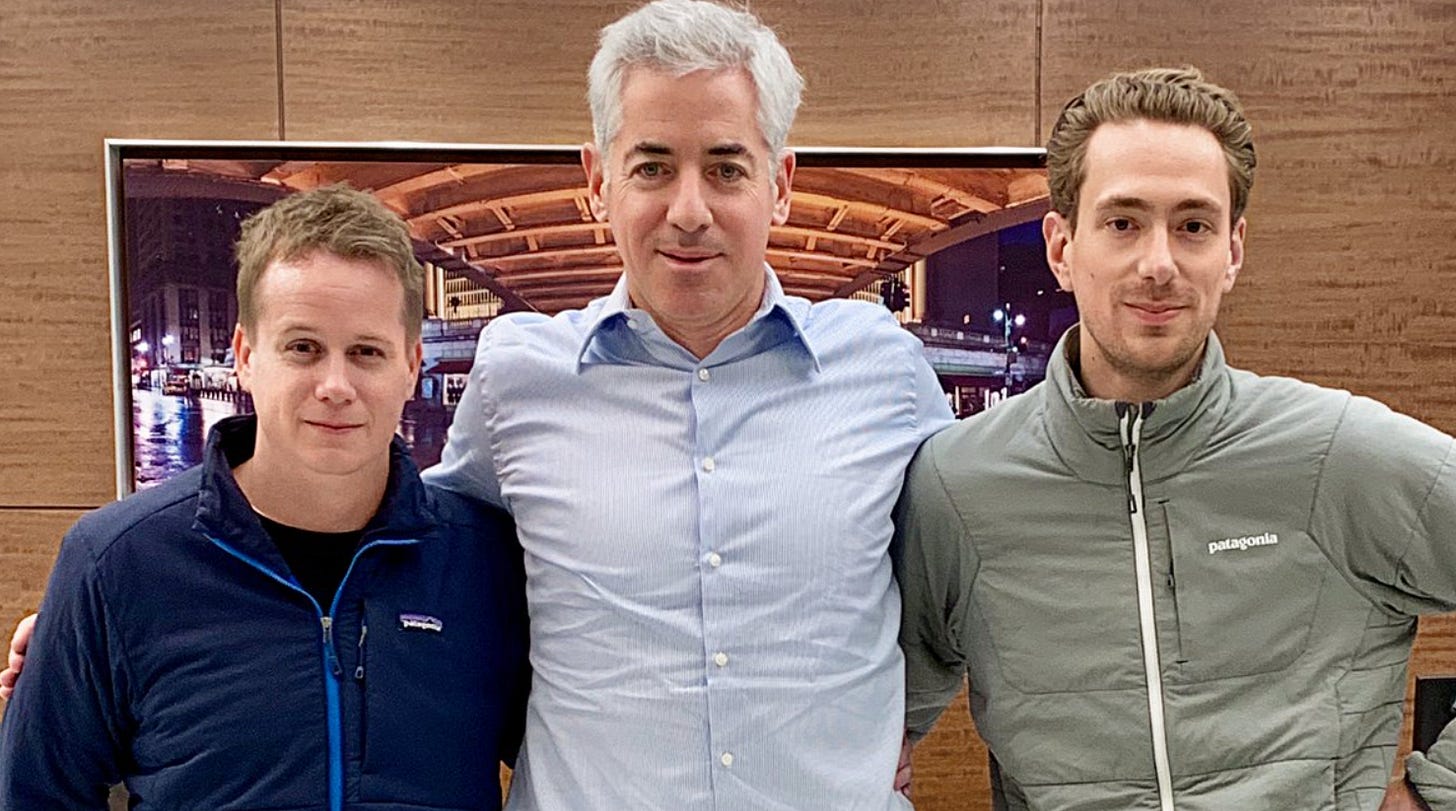

Victoria-based tech investor Andrew Wilkinson has parlayed a lunch auction won at a cost of $57,700 in 2018 into the priceless stamp of approval of investor with a resurgent Midas Touch, Bill Ackman. Ackman's hedge fund Pershing Square is up 60% YTD. Ackman has now backed Andrew Wilkinson to the tune of $40m (using personal funds). Ackman’s holdco Table Holdings will be one of the significant shareholders of WeCommerce, a key recent initiative of Andrew Wilkinson.

Andrew combines deep knowledge of both Silicon Valley and Mungerian thinking. This results in a fluid, highly opportunistic playbook. He's sort of the Charlie Munger of Tech.

WeCommerce was started in October 2019 with the aim of starting, buying and investing in the world’s top Shopify businesses. To date, those acquisitions have been in the Shopify ecosystem, ie services that are complementary to Shopify’s own software offerings. WeCommerce is now going public via a merger with a TSX Venture-listed SPAC, Brachium Capital. The company is in the process of raising some $60m in equity, in a deal led by Canaccord and TD Securities. The syndicate includes - please don’t have a heart attack - PI Financial. So a SPAC is buying a budding ecommerce roll-up that piggybacks on Shopify. So 2020.

Andew is most notably the founder of MetaLab, one of the world’s largest web design agencies. MetaLab was the firm behind the very first version of Slack. Andrew re-invested profits from MetaLab in a wide variety of “wonderful internet businesses”, organized under the Tiny umbrella brand. His m.o. is essentially to fade the typical VC hyper-growth mentality, in favour of cash-flowing, more predictable internet businesses. In dealing with sellers of business, Tiny aims for answers within 48 hours, an offer in 7 days and a close within a month. All with no in-person meetings. The Tiny empire has now grown to over 300 employees and more than $100m in revenue.

Tim McElvaine, a value investor who worked for many years with Peter Cundill is another backer. He will be on the board along with Shane Parrish, the legendary blogger behind Farnam Street and Sara Elford a former Canaccord analyst. WeCommerce is led by Andrew’s business partner Chris Sparling, who owns 20% of the Tiny holdco. Ryan Graves, a billionaire early Uber employee is also an investor in WeCommerce.

Andrew has said that for the first 10 years of his business career, no one was willing to give him capital and that just getting credit cards was hard, so he has definitely moved up. I first wrote about him last year: here.