I saw in March that mortgage titan Stephen "Big Balls" Smith had resumed buying shares of EQB Inc. (the parent company of Equitable Bank and its digital arm, EQ Bank) for the first time in a few years. In the first two weeks of March, he bought $16m worth at prices around $95-$98. He bought a bit more on April 4th. He holds a total of 6.8m shares now, valued at about $650m (that's about 17% of the shares outstanding). The stock has pulled back along with the market after reaching a high of $114. I can’t think of any individual who is more exposed to the creditworthiness of the average Canadian, so if he’s spending millions adding more to a passive position, I guess that’s a vote of confidence about the resilience of the Canadian economy. Forbes pegs his overall wealth at US $5.8B (or C$8.2B).

If you want to use cool industry lingo, the Big 6 banks are called D-SIBs (Domestic Systemically Important Banks. RBC and TD are also Global-SIBs). The smallest of the D-SIBs, National Bank, is worth $46B (vs $3.8B for EQB). EQB is now no. 7. I’m coattail riding along and bought shares. Just using superficial VC-style thinking about TAM (the size of the market), EQB has a lot of potential. Despite the recent retracement, EBQ has been on fire since the pandemic, up 250% over the past 5 years.

Banking disruptors

Many people consider incumbent banks to be a no-brainer investment. But there's no shortage of upstarts trying to disrupt them, going after various niches in banking. The most recent potential new threat on the horizon is the return of global fintech Revolut in Canada. They first tried to launch in Canada in 2019, but had to make a quick retreat to focus on other markets. Now they've placed an ad for a Canadian CEO, so it looks like they might be back. Revolut was last valued at US$60B, is inching towards an IPO, has bank licenses from the EU and UK and it has a very aggressive Russian CEO. Another contender is corporate card and expense management startup Float, which raised $70m in January, led by Goldman Sachs. To date, I have not seen any Canadian fintech go after the core business of banks, ie lending money funded by a deposit base. So EQB is the only real challenger bank in Canada.

I am entirely happy deferring to Stephen Smith's judgement that EQB in the $90s constitutes good value, he's very analytical. I did look into EQB's CEO because I want to be invested with iconoclastic CEOs. While sadly Andrew Moor is not some typical 20-something spring chicken disruptor, he has a lot of experience growing things. When he took over Equitable in 2007, it was a trust company with $3B in assets. EQB now has assets over $132B. And before EQB, he took control of mortgage broker Invis, which he then built and sold to HSBC. Perhaps most significantly, Andrew is originally from England - they're very advanced in banking matters over there. Andrew started his journey in Canadian finance through CIBC Wood Gundy's London office. EQB lost a star executive last month, one Mahima Poddar, head of personal banking. She was a big part of the digital bank and mortgage division. Fortunately, banking is not rocket science.

Cornering the subprime market

Stephen Smith is the original fintech disruptor. I have already written other posts about his background and the mortgage business that first made him rich, First National. What has changed recently is Stephen's audacious expansion in the subprime mortgage space. In 2023, he bid $1.7B to take Home Capital private. This was considered quite bold, given that the Canadian housing market was beginning at the time to look wobbly and Home Capital shares were tanking as a result. Bloomberg reported that even some of Stephen's closest people were concerned about him increasing his already concentrated exposure to the Canadian mortgage market. I thought it was quite bold too, an example of how value investors are often too early.

Stephen explained to the media that as long as borrowers remained employed, the mortgages would be fine - it would take a depression-type scenario before Home ran into issues. Last year, he provided a fuller explanation to trade publication MortgageLogic.news. He said that as regulators tightened the criteria to qualify for prime mortgages, there was a boom in subprime mortgages, which has benefited Home Trust. A mortgage that would have been considered prime 15 years ago is considered subprime today, purely as a result of shifts in regulation. Lenders were forced to shift from relying on the value of the home as loan security to carefully assessing the creditworthiness of the borrower. And so Stephen says that the public market was overly panicky about a housing market crash, despite Home Trust having a much higher quality borrower profile in the 2020s than in the 2010s. Simply put, people today really have to have the incomes to service their loans - the covenants have never been tighter. Source: MortgageLogic.news [paywalled].

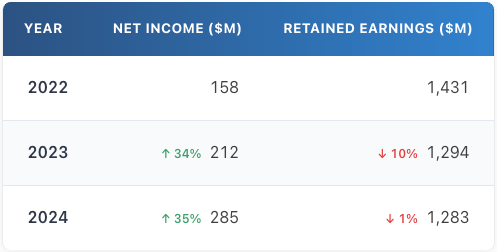

Forbes estimated Stephen's wealth at US$1.1B in 2018 (vs US$5.8B in 2025). We can gain a glimpse into some of his holdings, because it turns out that financial regulator OSFI publishes extensive financial data about the institutions it regulates. Here are some key figures for Home Trust:

You can guess from the income figures going up and retained earnings going down that dividends are getting paid, $645m worth in 2023 and 2024 (the bulk of this went to Smith Financial, about $12m went to the public shareholders prior to the acquisition closing in August 2023). So the acquisition appears to be going well so far. Home Trust already has had a bit of an exit, as last year, Stephen merged it with another big holding of his, Fairstone Bank. His holding company Smith Financial owns about 75% of the combined business, a lending powerhouse he values at around $6B. Outside partners include Teachers and private equity giant Centerbridge.

Mortgage disruptors

The mortgage industry also has lots of new disruptor type fintechs. The most notable success story is Nesto, backed by Power. In 2024, its fifth year of existence, Nesto acquired the much bigger mortgage finance company CMLS. Nesto is now the third biggest non-bank lender in Canada and the combined business has $63B in mortgages under administration. (First National has around $150B.) Incidentally, EQB CEO Andrew Moor is on the board of Nesto. This seems unusual given that EQB itself is quite active in mortgages, to say nothing of the tensions this could cause with Big Balls.

Here's what happened: Nesto was originally a mortgage broker and EQB had an indirect interest in the company through a Power Corp. VC fund. EQB even has a digital mortgage marketplace that was initially powered by Nesto. But around 2021, Nesto pivoted to become a direct lender instead of a broker. And now, it manages more mortgages than EQB.

Of course, Big Balls himself has his fingers in many pies, I am sure they all have the finest lawyers advising them on all this. Other mortgage upstarts include Pine, which powers Wealthsimple's offering. There's also Homewise, Perch, Lendesk, Fraction and Neo Financial. And even OPM favorite Miles Nadal has something called Ourboro that will help you buy a home. Miles's friend billionaire Jay Hennick is involved in sub-prime mortgages, the Hennick family office owns Haventree Bank. The mortgage space has never been more exciting.

Stephen, in that Mortgage Logic interview, dismisses the threat of fintechs that want to digitize the whole mortgage process because he says mortgages are a complex product that require a lot of guidance, even emotional support. I agree, I think mortgage brokers are one white collar profession you can generally trust to add value. Mortgages are just like investing, you have to make probabilistic judgments and take into account your tolerance for risk. If you want to track fintechs closely, I suggest two specialized newsletters on Substack written by Canadians: Global Fintech Insider and Canadian Fintech.

I also learned from that MortgageLogic.news interview that Big Balls would like to offer 100% mortgages (ie no down payment), but the regulator doesn’t want to play along! You can see in this excerpt he presaged his buying of EQB shares and a little bit of the Big Balls persona.

Source: MortgageLogic.news