Brian Chapman is one of the most successful private investors on Bay Street. He manages his own money through a firm called Clearwater Capital, along with his longstanding business partner Roland Keiper. In January 2004, Report on Business Magazine wrote an article on Keiper, naming him The Smartest Guy on Bay Street. Otherwise, very little has been written about Brian Chapman. This post will hardly break new ground, except maybe that I once saw him having a grocery store-bought fruit salad for breakfast.

Brian Chapman started working at RBC Dominion Securities in 1987, initially specializing in trading preferred shares. Eventually, he was part of Roland Keiper's highly successful proprietary trading group within RBC. The team generated 78.5% compound returns between 1993 and February 1999, when they were fired over tensions over their rich pay packages and short-selling activities. ROB Magazine reported that Keiper was paid $37.4 million during that period, which probably means Brian Chapman was paid around $12m, because his cut of the trading profits was one-third of Keiper’s.

By late 2005, Keiper appears to have been worth $150 million (vs $22.5 million in 1997) (I have some pretty good authority on this, thanks to court records). By my simple 1/3 rule, this would imply that Brian Chapman was worth $50 million in 2005. I have little basis to figure what their returns since 2005 have been. But if they were able to manage an after-tax compound rate of 12% in the past 15 years, that would put Clearwater near the billion-dollar mark. Their original strengths were distressed investing and shorting, so I expect their returns are not as high as they used to be.

I had the chance to meet Brian Chapman in 2003, because he put his name and number at the end of a press release disclosing Clearwater's stake in Call-Net (a telephone company that was then emerging from distress). I was working as a buyside analyst and I had been asked to analyze Call-Net. There was still a lot of fear back then that the company would be in trouble again and Voice over IP was a looming threat. There was a lot to learn and Brian Chapman was the most knowledgeable person I spoke with.

All his insights allowed me to be very confident in advising a buy and repeating that even as the stock did nothing or fell. I recall in particular that he said that Call-Net's CEO Bill Linton and Ted Rogers got along great and he predicted that Rogers would eventually acquire them. Eventually, in 2005, Rogers did acquire Call-Net. I believe Clearwater might have made as much as 22x their money on it, as they were early on the name, post-distress.

I have in my notes: "he had a cool hat, dresses pretty hip and business casual". This is from my CRM, not my intimate journal. I have no idea why I noted that, but I do remember it was a bucket hat. I really should have focused on learning his strategies.

I had some other occasions to chat with Brian Chapman, but I can't say I ever got a full picture of how he thinks. I once asked him how he finds his ideas and he said "They have a way of floating by" and he made a waving motion with his hand. I did not think this was particularly illuminating, but I think he is right. If you keep reading, some ideas will grab you. He also said what he looks for most is near-term earnings momentum. He is not impressed by rigid value investors, who he called self-proclaimed "stewards of righteousness", meaning they are high on conviction but light on serious work. He, in contrast, spends a lot of time researching names, I think he said something like 200 hours per situation. Clearwater definitely operates with high conviction and high concentration. At some point, if I understand correctly, they held as few as 2 or 3 positions.

Keiper and Chapman’s other prop trading colleague at RBC was Greg Boland. (Enterprise Capital, where Greg Boland hung his hat while managing an account for Paloma Partners, was next door to Clearwater.) In 2006, leading Globe and Mail blogger Derek DeCloet, in a fit of pique, named Greg Boland The New Smartest Guy on Bay Street. That's because Boland outmaneuvered Keiper on a trade in Stelco, the bankruptcy prone steelmaker. The Stelco situation was apparently stressful for Keiper, the court record reveals he had trouble sleeping.

That old article mentioned Chapman and Keiper were suing RBC for $43.6 million over their firing and unpaid compensation. I hear that matter has been settled...apparently, Keiper had evidence in the form of a piece of paper, possibly a napkin, with terms scribbled on it.

I see recently that Brian Chapman is on the advisory board of a private client wealth management firm named High Rock Capital Management. So naturally, I was curious to see what they had that was special. Well, forgive me for saying so, but their plainness makes me want to cry. Their slogan is "Disciplined investing". And they charge 1.15% for what appears to be mostly ETF portfolios.

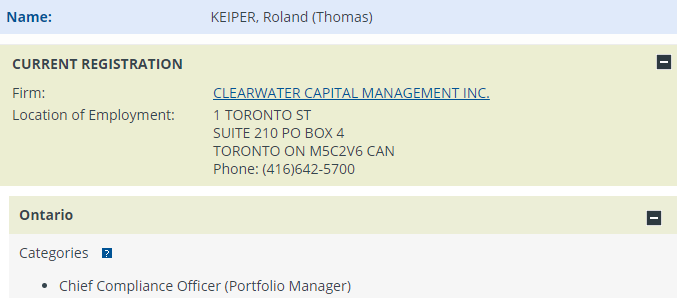

Strangely, Clearwater Capital is itself registered as a licensed Portfolio Manager. Why are moguls like Chapman and Keiper now registered with the OSC, when they are presumably just managing their own money? Keiper is known as a stickler for rules, but the reason is still a mystery to me.

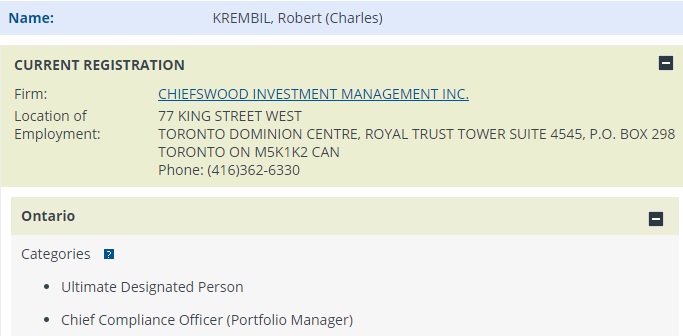

If Keiper is so smart, how come he's the one who's stuck with compliance duties? I hope he's not keeping records on napkins. Keiper is probably not the wealthiest chief compliance officer on the street though. That title probably belongs to Bob Krembil of Trimark and EdgePoint fame.

Someone told me Krembil might be worth $4 billion, which based on the best info I have, seems a bit on the high side. This post is poorly researched, if you have better info, please share via the contact link in the menu.