Burgundy Asset Management, historically one of the most respected buyside firms on Bay Street, advisor to the rich and mighty, is in flux, to use a polite term. Consider 3 developments this year. First, Richard Rooney, who had been CIO for 20 years, has transitioned to Vice-Chair.

The new CIO is one Anne Mette De Place Filippini. (Don’t worry, I have ordered a background check to see if it’s a real name.)

Today, Burgundy is losing a major mandate from a British institutional client for which it was part of the sub-advisory roster on a £1.7billion fund. Together with other major redemptions, Burgundy is a poster child for the value style being out of favour and relentless competition in the zero-sum alpha game. The British client is St. James's Place, which has roots with the Rothschild family, but is really an Investors Group equivalent, probably worse (high fees, dubious practices). It was likely one of the biggest accounts at Burgundy. St. James’s Place is also a client of EdgePoint, the other Great Canadian Ayatollah of Value, a term I use respectfully.

Burgundy also lost another big account earlier this year, that of Brown Brothers Harriman in New York. The AUM bleed this year alone is likely over a billion or two…or more. The last asset figure reported for regulatory purposes was US $22.3B. This figure was US $26B three years ago. Between June and September this year alone, the disclosed assets appear to have declined by about US $3B. If I just go by 13F filings, also an imperfect indicator, they have less disclosed holdings today than in 2015. In contrast, another buy-and-hold shop I track has doubled its disclosed holdings over the same period.

Burgundy’s Canadian equity strategy, managed by David Vanderwood, is a good representation of the performance issues the firm has been having. As of end of October, their Canadian Equity Fund was down 16% in the prior 12 months. The 3-year compound number was -7% and the 5-year was 0.49%. Energy exposure explains much of the underperformance. Earlier this year, the firm decided to enact a one-year fee holiday on the strategy, which might account for 15-20% of AUM.

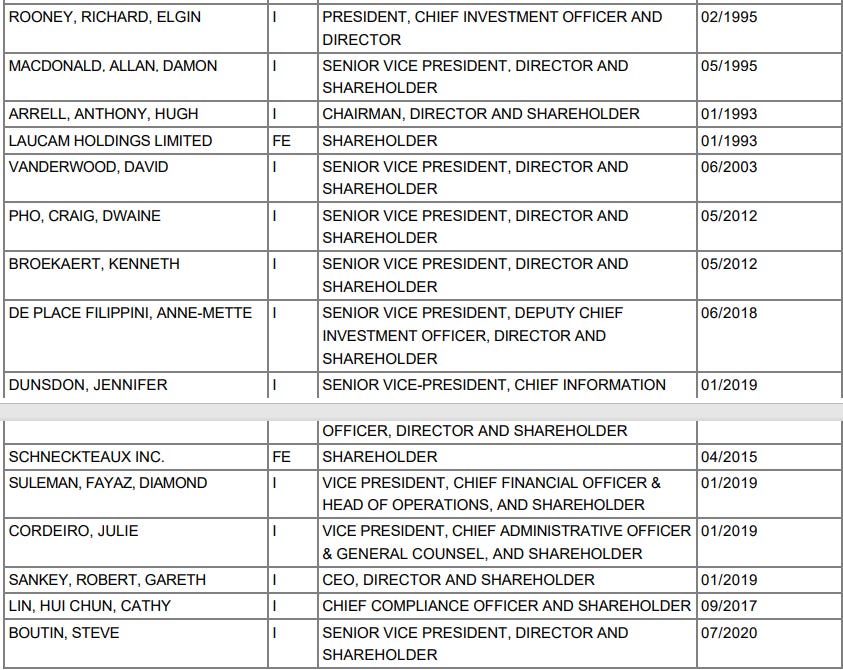

This is a list of Burgundy’s significant executives/shareholders and the date they acquired that status:

Laucam, Tony Arrell’s holdco, owns more than 50% of the business. Richard Rooney owns between 10 and 25% of the business. All the other shareholders are at less than 5%. I am told Burgundy operates an equity compensation structure where “partners” buy into the firm at ~2x revenue minus working capital. Partners would typically get loans to finance their buy-in. Historically, Burgundy was growing AUM at 30-50% per year, so equity was a golden ticket and the loans could be easily serviced. Take a look at the dates above. People who bought into the business in the past few years can’t be too pleased. They’re both working at a tough business and facing the pressure of a leveraged holding that’s under water. Two-thirds of the staff are equity holders. Total staff is about 150 people.

Burgundy operates on a June year-end, so bonuses are paid in July. At the half-year mark, things are looking grim. In January, clients will see their full year numbers. Will Burgundy be able to justify lifting the fee holiday when it’s scheduled to end in April? This equity “partnership” structure creates issues. How to buy out an underperforming partner, for example. No one has the courage to buy into a spiraling business. I am sure you see the irony. To be fair, I know one smart investor, who can read track records just as well as anyone else, who invested with Burgundy earlier this year. Investment styles are cyclical. On the other hand, the disruption of sleepy old business with fat profits is probably not going away. And investment managers are not immune from that trend, it appears. I will have more to say about all this.