Cortland Credit Group is headed by Sean Rogister. Sean is a former fixed income guy from Teachers pension fund (boring!)...

...turned into an alternative income zaddy (hot!).

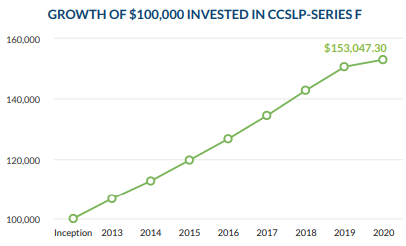

The zaddy look is definitely working for him, as Cortland Credit has had surging assets - from less than $200m in 2017 to $1b now, adding more than $400m just in the last 12 months. Maybe it’s the 96+ months of positive performance, maybe it’s the Sharpe ratio claimed to be in the teens, maybe it’s the designer stubble. Cortland posts gross annual returns around 8% before fees totalling more than 2%.

Key people

The CEO and founder is Sean Rogister. He's a former Teachers biggie, who left in 2008. He was in charge of the fixed income portfolio, which was walloped by the Global Financial Crisis (as was almost every portfolio in those days, obvs). Back then, the Financial Post described Rogister’s exit from Teachers as abrupt and without even a press release.

Cortland’s President and COO is Bruce Sherk, who was previously the co-founder of equipment finance company Nexcap. Steve Hudson’s Element Financial acquired Nexcap in 2013.

Origins

Cortland Credit Group was started in 2013 to help SMEs finance their growth. In 2015, James Kelly joined to build Cortland’s short-term private debt platform funded by institutional investors. James is an institutional sales type of guy. Overall, as of October 2020, the firm’s money was two-thirds institutional.

Interestingly, in 2006 - well before Cortland Credit’s founding - Teachers launched a Structured Investment Vehicle called Cortland Capital. SIVs boomed during the years preceding the subprime mortgage crisis. They issued short-term debt to buy long-term asset-backed securities. No surprise that SIVs were one of the top casualties of the Global Financial Crisis. That included Teachers’ SIV as per the National Post. By the fall of 2008, not one SIV had survived.

Cortland is a type of apple named after a county in New York state. Both Teachers and the new Cortland, run by Sean Rogister, use an apple for logo.

What is Cortland’s real business?

Circa 2016, Cortland’s flagship fund was described as: “a short-term private debt fund designed to provide superior, low volatility returns. Positioned as a conservative alternative fixed income strategy, the main underlying assets are derived from Cortland’s proprietary Supply Chain Finance (SCF) asset-based lending program.” The strategy was recently explained in an interview where Sean Rogister said:

“Cortland is an investment manager that specializes in short-term private lending, so our primary strategy is funding the working capital requirements of small to medium businesses that are a little too small for the major banks. We are a borrowing base lender so what that means is our collateral is generally the working capital assets such as accounts receivables and other liquid assets in their balance sheet. The borrowing base self liquidates in 45 to 90 days so these accounts are paid and when they’re due, we don’t have to do anything they’re self-liquidating and we collect the funds and it’s transferred from the borrower’s bank account to ours automatically and this happens in the neighbourhood of 10 to 20 percent of our entire portfolio per week is rolling the cash, and then being reinvested and it doesn’t happen automatically, we don’t have the financial commitment to most of these borrowers. But as long as their collateral continues to be eligible we will continue the financing”

Until recently, Supply Chain Financing was a sexy term. It was popularized by Greensill Capital, which was backed by Softbank, advised by former British Prime Minister David Cameron and promoted by Credit Suisse. The latter had US$10b in funds that bought securities structured by Greensill. Those funds yielded less than 1.50% and charged 70bps. Earlier this year, Credit Suisse terminated the funds and Greensill went kaput, due to uncertainty over the funds’ asset valuation.

Cortland’s flagship fund’s fact sheet currently states that “our portfolio is mainly comprised of senior secured loans originated and underwritten by Cortland's in-house team with an average term of less than a year.” This description deviates from the 90-days-self-liquidating investments spiel above.

Indeed, records show that not all their investments mature in less than 90 days. For example, Cortland provided a debtor-in-possession commitment to CannTrust for 12 months, extendable for an additional 12 months. Also, a credit facility for The Green Organic Dutchman, a cannabis company, opened in March 2020, was recently amended for the fourth time and extended until June 2023. That credit facility was originally a second lien, subordinated to $32m owed to Maybridge Capital, a private lender part of Knightsbridge Capital Group. As of July, Maybridge got paid with the proceeds from an asset sale.

Cortland’s links with Clearflow Commercial Finance Corp.

Cortland Credit has some links with an obscure entity called Clearflow Commercial Finance. You will recall that Cortland co-founder Bruce Sherk previously founded and sold Nexcap. Nexcap had another co-founder, Glenn Peterson. Glenn is one of the four partners of ClearFlow Commercial Finance Corp.

Clearflow has a history of dubious deals. In June 2018, Cortland engaged Cleaflow to act as a facilitator for a loan to Mohawk Trail Properties. Clearflow was responsible for (1) obtaining and dispersing all funds advanced by Cortland, (2) collecting and remitting all amounts payable by the borrower to the lender and (3) performing functions that Cortland might request from time to time. The borrower agreed to pay a commitment fee of $100k to Clearflow.

After failing to receive interest and principal for more than 18 months and conceding four accommodation agreements, Cortland made a motion to place Mohawk Trail Properties into receivership. They are looking to recoup $16.9m of indebtedness guaranteed by this property in Milton, Ontario, currently on the market for about that amount.

If your heart raced a little faster on reading “Mohawk”, you are a connoisseur... indigenous credit specialist Bridging Finance is a lender to another insolvent entity, controlled by Shawn Saulnier, a director of Mohawk Trail Properties.

Fintech Lendifield Holdings also received financing from Cortland and Clearllow was the facilitator of the loan. Clearflow received a 0.5% commitment fee from Lendifield. According to Lendifield’s latest audited statements, Cortland’s loan was in default since May 2020.

Clearflow is an alleged victim of fraud

Starting in 2015, Clearflow financed the operation of a firearm distributor, Trigger Wholesale. Clearflow had the option to purchase all or a portion of Trigger’s 90-days account receivables at an 85% of face value. An unusually high rate of discount for such a short period. As of October 2020, Trigger owed $48m to Clearflow. Clearflow has accused Trigger of fraud, claiming tens of millions in potential losses. Trigger allegedly falsified invoices and impersonated managers from Canadian Tire and Home Hardware, using fake email accounts.

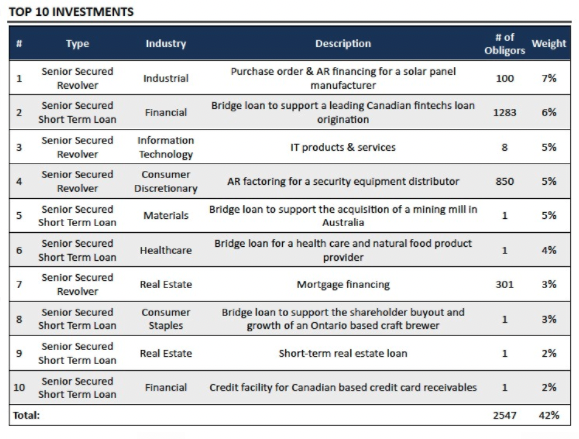

Here’s a list of Cortland’s top holdings in the recent past, you can try to figure where there might be some overlap with some of the Clearflow loans we have mentioned above:

A previous Cortland fund closed

Starting in 2017, Cortland also acted as sub-advisor (and eventually, manager) for Caldwell’s Clearpoint Short-Term Income Fund. The fund’s objective was to provide income, preserve capital and maintain liquidity, by investing in publicly traded bonds and asset-backed securities with a term to maturity of five years or less.

Clearpoint targeted a 5% yield per annum and marketed a “stable NAV and expertly executed risk management process.” The fund was terminated in December 2020. Cortland failed to achieve the target, it delivered low-single-digit negative returns since inception and underperformed by 1,000 bps in 2019.

We present all the above as areas of discussion to pursue with Cortland. If you are a client, you should test their claim that “There is no level of disclosure we cannot provide to our clients.” Our own attempts to get answers were rebuffed by the company, professing borrower confidentiality and competitive reasons. But we discovered one smoking gun that we find disqualifying. Sean Rogister has said that his favorite economist is David Rosenberg.