Over his career, Daniel Debow has found himself through a combination of luck and skill in interesting situations with some high and mighty people. When he was a student at Stanford University, he met venture capitalist Peter Thiel, the early Facebook backer. Later on, Daniel would go on to found his own startup, which he sold to Tobi Lütke’s Shopify. And as someone who is comfortable with both corporate law and technology, he rubs shoulders with Galen Weston on the board of the Loblaw Companies. Daniel Debow may yet become a billionaire himself: he is both a serial entrepreneur and a prolific angel investor in startups, with many notable wins to date. Earlier this year, he left his VP job at Shopify, tweeting “I’m an entrepreneur. Time to do new, hard things.”

Raising money is a hard slog and Daniel Debow has been on both ends of the table. Angel investors are often bored wealthy people who like to lord over their professed “expertise.” A lot of business success can be explained by narrow specialization and some degree of luck. Daniel Debow is much more self-aware about this - and has some claim to be an all-around superstar from the earliest stages. While completing the combined JD/MBA program at the University of Toronto, he had internships at prestigious investment bank Goldman Sachs and Sullivan & Cromwell, the Goldman Sachs of law. And he achieved the highest GPA in the combined program. But upon graduation, he chose a less conventional path by joining fledgling startup Workbrain, where he was a "General Purpose Smart Guy." His rationale was simply that it seemed more fun.

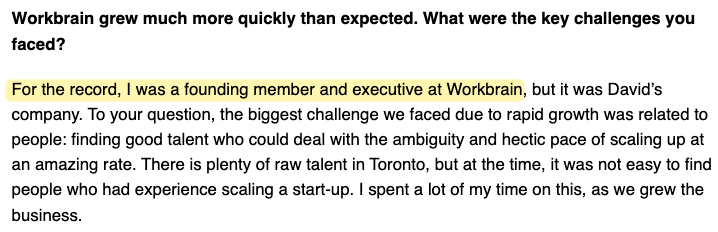

It also proved productive. Despite launching around the peak of the dotcom bubble in 2000, Workbrain turned out to be one of the more notable Canadian tech success stories of that era. The workforce management software company grew sales from zero to $100m in about 6 years and was acquired in 2007 for US$227m. In cash - which is an important detail given the ensuing Global Financial Crisis. Daniel worked on the original business plan for the company and I commend him for accurately representing his role (see image below). Take note, Som Seif, Reza Satchu, etc.

Daniel took a year off from Workbrain to complete a Masters in Law at Stanford University specializing in Science & Technology. While at Stanford, he met legendary tech and life guru Peter Thiel - who had also worked briefly at law firm Sullivan & Cromwell. Peter explained that he left law because he sought a more “stochastic” life, meaning one that benefited from randomness - which validated Daniel’s own path. Daniel’s very first job after his undergrad in psychology was helping a Jewish fraternity expand to 50 more colleges across North America. Very stochastic!

Following the Workbrain exit, Daniel Debow co-founded Rypple, which wanted to bring employee performance reviews into the social media age. The startup raised $13m from, among others, former Rotman School dean Roger Martin (a Workbrain director), resource investor Seymour Schulich and Peter Thiel. His co-founder David Stein is Seymour Schulich's son-in-law. Rypple was acquired by Salesforce in 2012 for US$51m. This gave him exposure to another tech titan, Marc Benioff. His next startup Helpful was acqui-hired by Shopify in 2019. Shopify’s current Head of Engineering, Farhan Thawar was a co-founder. There was probably never a bad time to join Shopify, but Daniel got to experience the exponential pandemic-fueled meltup of the ecommerce enabler, when it was portrayed as an Amazon-disruptor.

Daniel made his mark even more as a prolific backer of startups, investing millions into more than 90 companies. Big unicorn wins include Wealthsimple and legaltech startup Clio, which are valued at a few billion dollar each (depending on how the market feels). Xanadu, involved in the white hot quantum computing space, was last valued at a billion dollars. Other notable startups he has backed include Ada, Clearco, Ritual, Sheertex, North, Layer6, GoInstant, SkipTheDishes and Borrowell. He was a founding partner of startup program Creative Destruction Lab ("CDL"), contributing significant time and money early on. CDL has been a successful growth story in its own right.

Daniel takes a hands-off approach to his investments, stating: "I don't provide a lot of loving care to the startups I invest in. My attitude is angel investors aren't going to make it happen, it's up to them. If they call me, that's great. Otherwise, I am not checking up on them.” He has a humble attitude about his skill as an angel investor. He takes to heart a line from a book about the film business by William Goldman: “Not one person in the entire motion picture field knows for a certainty what’s going to work.” This is often summarized as “Nobody knows anything.”

Daniel is the first investor his acquaintance Mike Katchen approached when he was starting financial giant Wealthsimple back in 2014. So, if you want to see the best early-stage deals, he’s the man to know. If you want to see the worst early early-stage deals, he’s also your man. Early-stage investing is very much hit-or-miss!

“I’m completely lazy, messy and absent-minded. I regularly get in trouble with my wife for forgetting to pay bills and parking tickets, and I’ve had my credit card cancelled more times than a responsible person should.” - Daniel Debow speaking to Toronto Life

Daniel is passionate about music (he plays the bass, the playlist he's mentioning above is here). He is involved with some "music spaces" (recording and rehearsal studios), including the Pine Island Retreat in Stoney Lake and the Root Down Studio in Toronto's Westside. Daniel is most topical these days because he has emerged as the voice for a large swath of Canada’s tech crowd, who feel this country is failing to reach its full potential. From young founders who feel they have to move to Silicon Valley to seek fame and fortune to unnamed billionaires who have decamped for friendlier tax climes, it is claimed this country is no longer “builder-friendly.” Here to propose solutions is a new initiative called Build Canada. As befits its origin in tech circles, it is mostly a website, for now. Just a few weeks ago, it was a mere Whatsapp group where tech luminaries such as Tobi Lütke, Harley Finkelstein and investor John Ruffolo shared their policy gripes. And now, the Build Canada website allows you to efficiently email policy memos you support to your local MP and the relevant minister. It’s almost as user-friendly as Amazon’s patented 1-click buy button! This is clearly the “ship fast and iterate” approach that many of the most brilliant entrepreneurs adopt.

Daniel Debow was quick to point out in a CBC interview discussing the initiative that a builder is not solely someone who writes code. He said it could be an entrepreneur in landscaping, farming or a fisheries too! Daniel predicted all the way back in 2012 that "talking to computers" is the next big thing. If you have used ChatGPT, that era is certainly upon us. He spent many years teaching a course on the legal and policy impacts of exponential technologies like machine learning and quantum computing at U of T's Faculty of Law. The “builder” crowd will eagerly await news of what “new, hard things” Daniel Debow will launch next. Daniel has said: “Courting investors is like dating. You’d never ask someone to marry you on the first date.“ As a result of his stellar career, Daniel is now supremely connected and has a track record of being a prescient trend-spotter. He will have a better chance than most at raising millions. As for whether it will be a venture in farming, fisheries or landscaping, your guess is as good as mine.