The Globe is breathlessly reporting that Nicola Wealth and its "Chief Legal Officer", Danielle Skipp swooped in to pick off three advisors from Gluskin Sheff. Those advisors do not have the star cachet of, say, a Bruce Leboff and their assets total about $1B. Per the Globe:

Nicola Wealth’s chief legal officer, Danielle Skipp, said she immediately began pursuing the group of Gluskin Sheff advisers the same day the company announced the transfer to RBC.

“When I saw that it was not an acquisition of Gluskin Sheff by RBC, I quickly realized the entire company – including the advisers – would not be signing individual employment contracts that you typically see with a deal. And that made it a huge opportunity for us.”

I blame OPM Wire for creating an environment where people can be so overtly predatorial. Who is this "Chief Legal Officer" who outmuscled RBC?

Take a look at the men in this photo taken from a Nicola Wealth seminar circa 2013. On the left is phoney-baloney macro prognosticator John Mauldin, with whom Nicola had an “exclusive partnership” in Canada. On the right is Nicola’s second-in-command David Sung. Next to him is his brother-in-law, former hedge fund manager Matt Skipp. The link is Danielle Skipp, who is David Sung’s sister. She’s now Nicola’s leader in Ontario (on top of being the Chief Legal Officer and a Director).

Matt Skipp closed his hedge fund over performance issues and turned his attention to become a business operator - a respectable choice. Danielle Skipp went from being partners with her husband on his hedge fund to working at the dubious BloombergSen before ending up at Nicola.

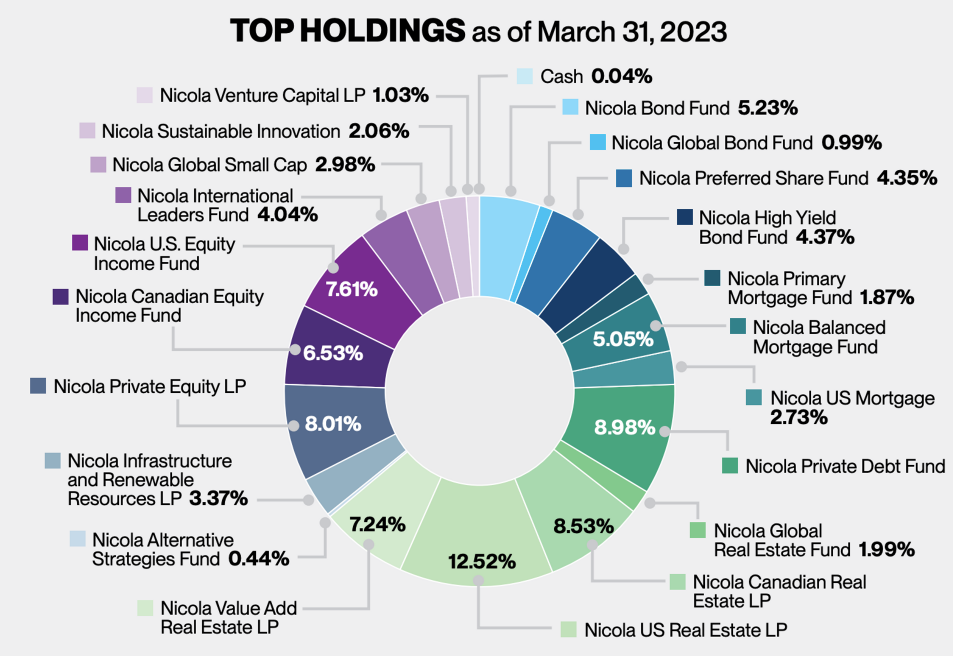

The intellectual underpinning of Nicola was not very strong 10 years ago. Nicola had heroic returns in 2008 and for years afterwards, believed that another big crisis was just around the corner. That’s why they associated themselves prominently with a permabear and a hedgie. I had a very similar mentality around the same time. The proper response to being so misguided is to develop epistemic humility - to understand that you can only do a few simple, limited things well. How then do you explain Nicola leapfrogging in a period of ten years from their primitive understanding of the markets to this dizzying array of complex strategies:

The halo effect at work

The key driver, I believe, is the “halo effect”. You will see people falling for the halo effect fallacy all the time. For example, a successful business mogul who made their money by cornering the market for the plastic things that go at the end of shoelaces will be asked for their advice on everything from child development to fiscal policy. In Nicola’s case, they made a prescient bet on Canadian real estate in the early 2000s. Their track record in Canadian real estate appears to be good. Plus, in the zero-interest rate era post-2008, real estate worked really well and made up for them not adding value on stocks and bonds. And now they get to be globe-straddling allocators. I will cover their real estate activities in some more detail in another post.