I want to share a scoop I learned about the Gluskin Sheff IPO. Admittedly, the IPO took place in 2006. But I am the first to report on this angle, so it’s still a scoop. The IPO caused a smörgåsbord of glückschmerz. For years, major Bay Street personalities carried this glückschmerzburden privately, but I am finally bringing all this to light. Glückschmerz means the pain of seeing someone else’s good fortune. It’s the opposite of schadenfreude, try to keep üp.

The disparities in outcomes I will highlight would create fissures in a hunter-gatherer tribe in Papua New Guinea that uses seashells as currency and whose most luxurious economic output is papaya fruit. To say nothing of what it does to the much more financially-driven people of the Gluskinverse.

In-grüppe glückschmerz

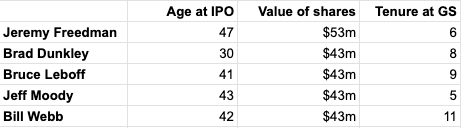

Thirty-year old Brad Dunkley had shares worth $43m at IPO. What’s more, his stake was the same as other colleagues with longer tenures at Gluskin and much longer careers in the industry. I summarize all that in the following table:

You can figure some of the glückschmerz-inducing incongruities yourself. Ira Gluskin and Gerald Sheff’s stake was worth $149m each. They had been building the firm since 1984. Bill Webb recruited Brad Dunkley from Wilfrid Laurier when he was 12 years senior. They ended up with the same stake. Jeff Moody only spent 5 years at Gluskin before collecting the IPO windfall. Jeremy Freedman, COO, had the biggest stake after only 6 years at the firm. Bruce Leboff had started in an investment role at the firm but had transitioned into more of an “asset allocation and risk management” client-facing role at the time of the IPO. But he still cashed in.

Of course, the new partners had to pay to buy shares from the founders using some private market formula. But the IPO valuation was, at the minimum, 20x what they paid to buy. A stupendous return on a fairly safe investment in a few short years. Plus, I imagine borrowing at favorable terms was arranged to facilitate the purchases, further boosting the ROE.

A relatively junior client support person, Joanne Lauria (who followed Gerald Sheff from the time he was working at Cadillac Fairview) got $10m worth of shares. Many other people did not get any shares at all. Overall, the stock compensation scheme at Gluskin Sheff was less than scientific and I am told this is a matter of regret - some people got too much. Although I also understand it is felt that Brad Dunkley deserved every share as the finest graduate Gluskin Sheff ever produced.

How Brad’s star rose at Gluskin Sheff

Brad got the job at Gluskin because he researched the heck out of a stock called Groupe Laperrière et Verrault. His former baseball coach worked at one of their plants and so he got to tour it. From the start, Brad worked closely with Ira. In the early aughts, Ira and the firm were riding the income trust boom. This was a tax-driven phenomenon where many companies with steady cashflows (and several not so steady) were converting into high-yield securities. In 2004, noting the deteriorating quality of many income trusts, Brad had the idea of shorting some of them in a hedge fund structure. This took some creativity because income trusts could have yields of 9%, which the short seller must pay while short the security. This strategy achieved 20% annualized for a few years. And that’s the main reason Brad was so valuable to the firm.

I once heard some veterans discuss jokingly in reference to Brad Dunkley that he was Ira Gluskin’s latest catamite. I had to look up that word, it refers to the practice in antiquity of keeping a boy as the intimate companion of an older man. I hasten to add this was jocular parlance, without substance, pure locker room talk, probably fuelled by envy. Even a lady as classy as Melania Trump has said that locker room talk doesn’t count. It’s especially unfair considering that Ira was a pioneer in that the first two portfolio managers he hired were women. Nevertheless, I have come to believe that there’s a homoerotic undercurrent to many mentor-protégé male relationships that you see so frequently in business. No wonder women feel excluded! Listen, maybe “homoerotic” is not the right word, I never said I was an expert at language. At the very minimum, there’s a bit of a frisson. Re-watch the movie Wall Street with your newfound homoerotic lens and you will see exactly what I mean.

Speaking of erotic lenses, Bruce Leboff has a new pair. I’ll cover what’s going on with the unwind of Gluskin Sheff in another post.

In the late 90s, Gerald Sheff had been against opening a hedge fund, which cost him a partner. That’s Martin Braun, who then launched the Adaly Opportunity Fund in 1999. Martin also had an exit of sorts in 2006, extricating himself from Trapeze Asset Management, which hosted his hedge fund. Trapeze at the time had about $1.4B in AUM before the firm had something close to an 80% collapse in the 07-08 bear market. Martin’s fund was unaffected and is still around, now housed at JC Clark. JCC is headed by Brad’s friend Colin Stewart, who got the other investment co-op job when they were both at Laurier. Colin hitched his wagon to another famous money manager, John Clark. JC Clark now manages about $250m across 3 funds. I heard Brad - he of the $4B hedge fund operation - say on a podcast that he’s friends with Colin Stewart. Glückschmerz, being a social theory, is not as reliable as Newtonian physics. This means that there’s only a 99.99% probability that Colin hates Brad’s guts.

Out-grüppe glückschmerz

The earliest two PM hires of Ira Gluskin were Kiki Delaney and Anne MacLean. Kiki Delaney left in 1992 to found her own firm, Delaney Capital Management, which is still around. When Kiki left, the firm hired another woman, Laura Wallace. Anne MacLean left to manage a real estate fund with Michael Cooper at Dundee (that eventually became the DREAM REIT platform). She then joined Rob Grundleger at Groundlayer Capital in 2002, where she was CIO until April of this year. The firm has some $200m in assets.

Someone once suggested that I should talk to Anne about a stock she was knowledgeable about, but warned me she was a “Chatty Cathy”. I had to look up that expression too. Some people say it’s a sexist stereotype. Would it have been better if they said she was a “Gabby Gary”? Anyways, you can’t do anything about it, because I am once again invoking the locker room rule. Full disclosure, these discussions took place in office settings, not in a locker room, but that’s fine because, despite its name, locker room immunity is context-dependent, like litigation privilege, not location-dependent like Parliamentary privilege. Anyways, just to be on the safe side, I didn’t call her.

It’s not surprising that there was a wave of departures in the 90s, as Gluskin Sheff hit some rough patch (charging 2/20 fees on what had become average performance). After massive redemptions and a bear market, the firm only had about $700m in assets as of 2003, just 3 years prior to the IPO. This figure then grew to $3.5B by the time of the IPO. If Ira Gluskin and Gerry Sheff wanted to inflict glückschmerz on the senior people who left the firm in the 90s, they could not have concocted a better plan than the highly visible IPO.