On Monday, leading blog the Globe & Mail named and shamed some Bay Street firms that had taken advantage of pandemic-related federal wage subsidies (aka CEWS). I had already revealed a fuller, more fun list back in December here...

...but I missed Onex-owned Gluskin Sheff. Applying for pandemic aid is quite a comedown for a firm that once positioned itself as a luxury brand. Ira Gluskin must be rolling over in his grave. (This is a figure of speech, like saying it's raining cats and dogs - Ira is very much alive.) This is a blemish on Gluskin Sheff's glorious history, especially in the 90s and aughts.

Overall, the Gluskin Sheff platform has detracted from Onex so far. In fact, in the depths of the pandemic meltdown, Onex recognized a $100m goodwill impairment charge on its acquisition. When Onex acquired Gluskin Sheff in 2019, they stated two objectives:

1) to diversify and expand distribution channels (for Onex funds)

2) to grow AUM

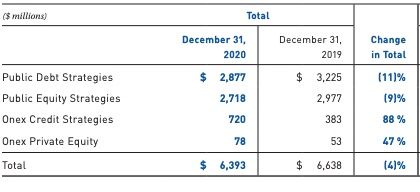

Onex overall manages about C$37B of fee-generating assets, up 10% over the past year. Onex paid C$445m for the acquisition. Gluskin Sheff clients have added about C$1B in Onex funds as of end of 2020. This occurred primarily by shifting clients from Gluskin Sheff public strategies into Onex credit strategies. So Gluskin Sheff itself bled AUM in its own public strategies on the order of -10%. You can look at the details of Gluskin Sheff assets in this table, in USD:

In 93, Gluskin Sheff made $40m in profits between 4 partners. Today, with considerably more overhead, they generate base annual fees of around $80m on an AUM of C$7.7B as of end of 2020. That's less money than 5 years ago. Onex has implemented some fairly drastic fee cuts, but they still charge 10-20% performance fees on about C$3B of assets. The management team at Onex have invested $65m of their personal money in Gluskin Sheff products, which is some form of alignment. In contrast, they had $535m invested in their private equity strategies. In summary, Gluskin Sheff cut fees, while losing assets, so it's not going great.

In the past, Gluskin Sheff has had very strong performance that they were happy to advertise, but try to find any investment numbers on their website now. You can't! Except for long-term mountain charts generated mostly by stars who have left (such as Brad Dunkley, Bill Webb and Jeannine LiChong).

Aside from fee cuts, I cannot discern anything particularly transcendant the new owners have done. They did part ways with fortuneteller David Rosenberg - but that's probably the most obvious management decision in the history of business. They have the same $3m minimum relationship size they have had for many years. They have added the "holistic financial planning" thing that wealth managers do now. Take for example these blog posts on income splitting and home office expenses! Boring!

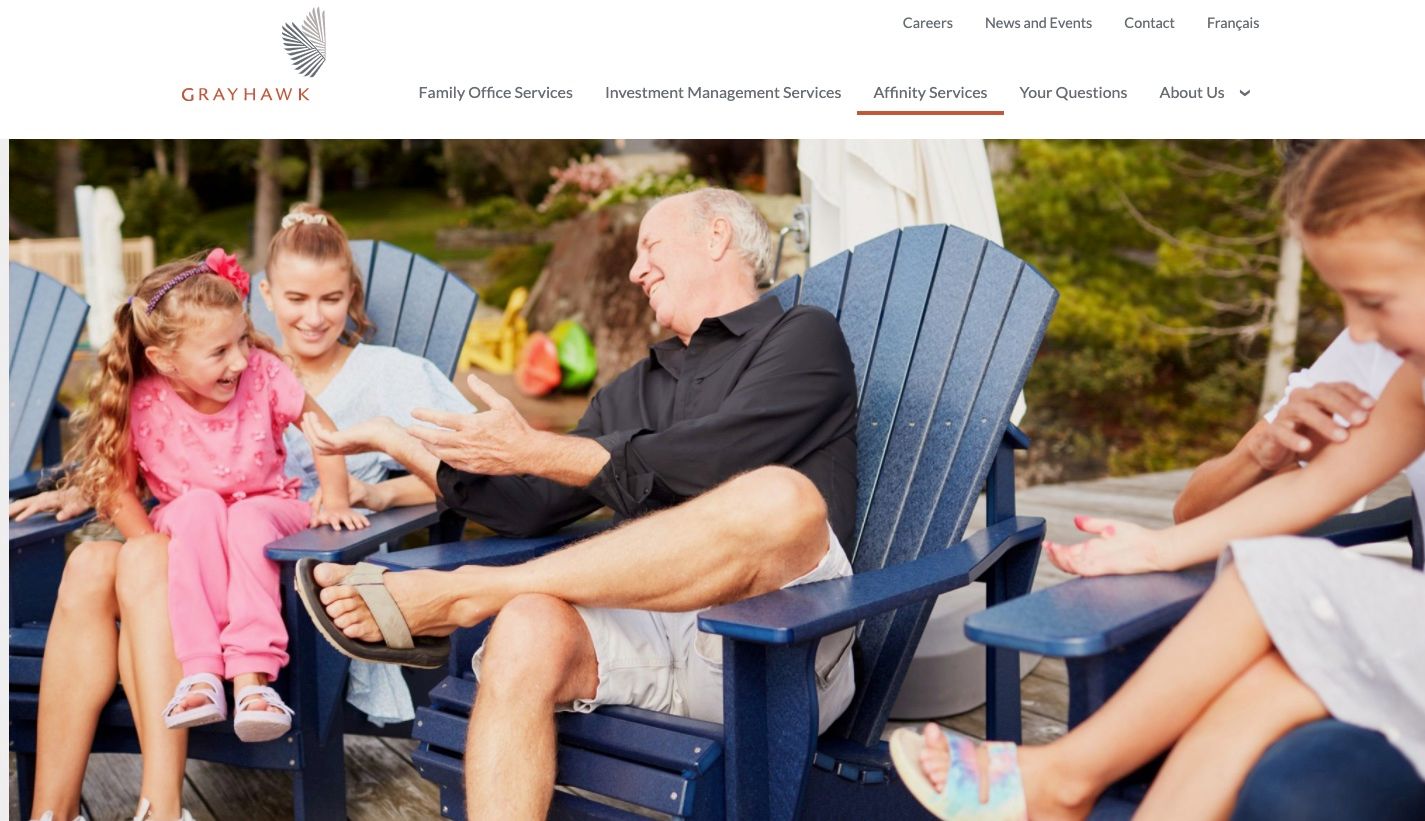

In the past, I was a fan of the Gluskin Sheff design aesthetic and marketing, as part of their previous luxury brand positioning. I still remember some of their ad copy, such as: "Are you a billionaire trapped in a millionaire's body?" These days, their website is quite bland.

This is a marketing technique I call Non-Threatening Grandma. As a marketing guru, I recommend it myself. Inexperienced marketers often ask me: since the majority of the High Net Worth money in the boomer generation is controlled by a Mr. Moneybags, shouldn't our website feature nubile young women? Rookie mistake! What they don't understand is that regardless of who generated the wealth, wives will often have a veto right on financial decisions. You can't afford to tick them off! Now, you might wonder: isn't there even a sliver of wealth that's under the control of red-blooded males? You are crazy! Today, of course, gender roles as well as identities are completely fluid. That's why a progressive upstart like Grayhawk went with a Non-Binary Grandparent:

Nice legs. The only exception I found to this family values motif is this Lothario in Pleated Pants Chatting Up The Office Hottie. Edgy! He's probably telling her about the benefits of spousal RRSPs.