“It is an extraordinarily difficult time, and as a result, sometimes there are casualties.”

-Heather Reisman, on the demise of her competitor Lichtman’s Books in 2000

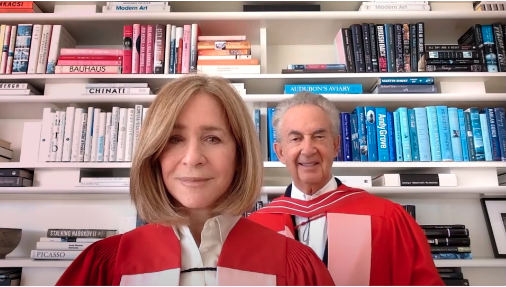

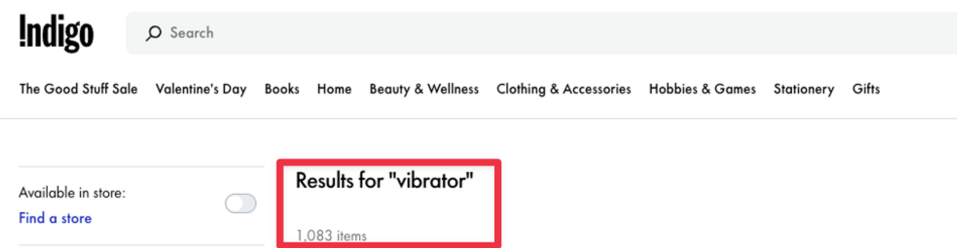

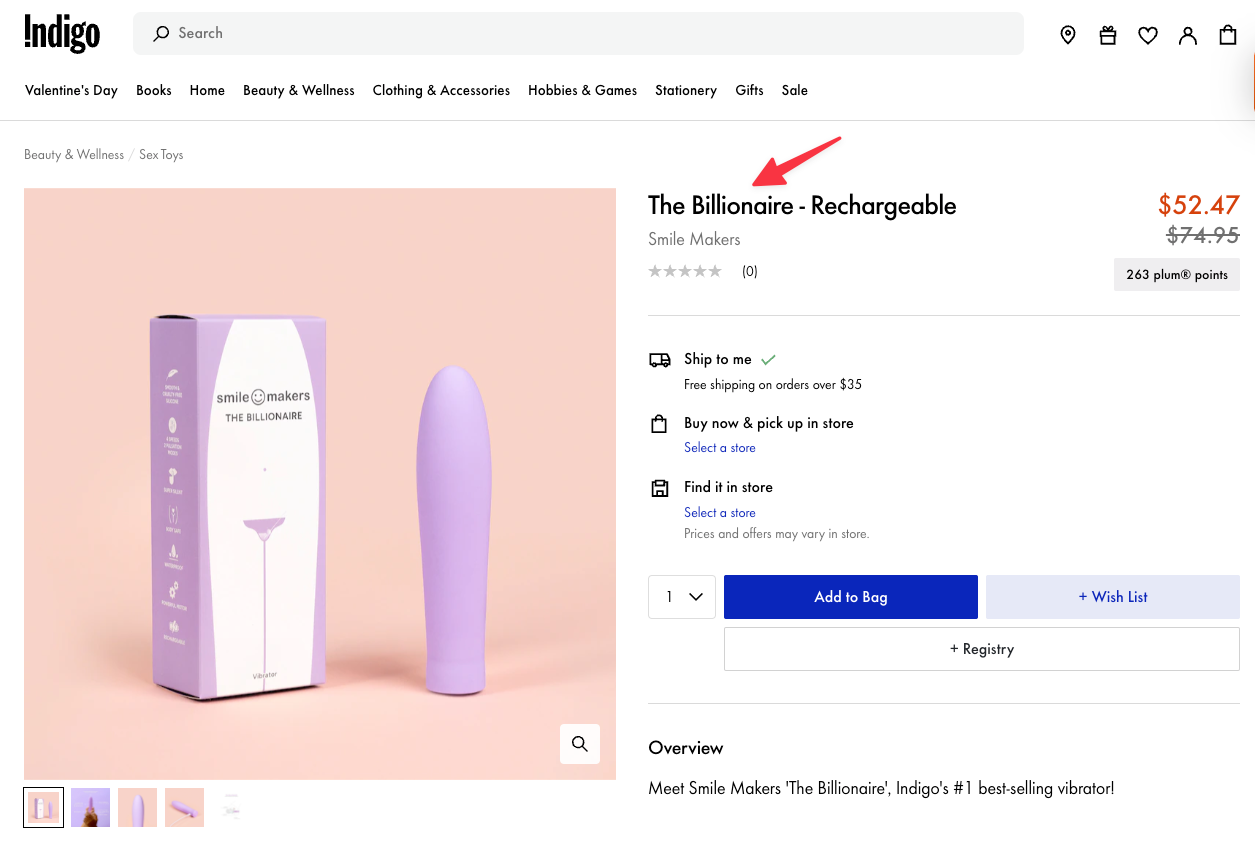

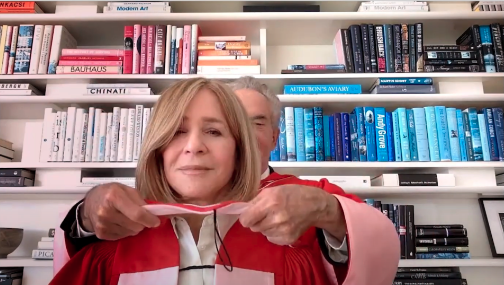

Heather bet her career on Indigo, but it has been one big saga. Indigo shares are down 90% over the past 5 years. One month, she retires, the next month, she’s back as CEO. One day she’s selling books, another day, she’s selling vibrators. Customers are understandably confused. Here she is taking a definite stance on vibrators:

The lady doth protest too much, methinks. Between the ransomware attack, the vandalism and “somehow vibrators turning up at its stores", Indigo really has to beef up its security. If anyone doesn’t know, Heather is one half of a power couple with Onex founder Gerry Schwartz. Gerry, now 82, is still Chairman of Onex. He retired as CEO last year. Is Heather wealthy independent of Gerry Schwartz? Heather might be the “Chief Booklover” at Indigo, but she owns 5% of the shares vs Gerry Schwartz’s 56 percent stake. The company has had cumulative losses of more than $300m over the past 5 years. Total equity is negative $71m. Gerry’s vehicle Trilogy Retail Holdings extended a $45m credit facility last year, which Indigo has been using. In 2018, the stock was trading as high as $20 and Gerry bought some more shares around that price. Now it’s trading under $2.

Heather, now 75, is trying to turn around the company and refocus it on selling books. Indigo stores currently are an abomination combining a bookstore, gift shop, a cafe and a homeware emporium. The new Indigo at The Well is apparently the vision for the future. There are templates for turnarounds though: in the UK, a Russian billionaire bought Waterstones out of bankruptcy in 2011 and brought in one James Daunt as CEO. He led a restructuring and sold the chain to Elliott Management, the hedge fund of billionaire Paul Singer. Elliott then brought James Daunt on to revive another chain they owned, Barnes & Noble. That chain is also now doing great and expanding.

Turns out there’s much I don’t know about the book trade. For example, against all expectations a decade ago, ebooks only have 18% of the market share. Personally, I think books these days are often a vanity project for the author and a trophy to display for the buyers. I only go to an Indigo store when I need a last-minute generic gift for someone I don’t know well. But if they stop selling vibrators, why would I ever go? Don’t panic though, on the website, they still feature several vibrators ranging in price from $30 to $300. I usually just go for whichever is a Heather’s Picks.

Heather’s every move is dissected by the mainstream press as if she’s some business virtuoso. I read several blog posts on Indigo by one Kenneth Whyte, publisher of Sutherland House Books. He was much more incisive. He speculates that Gerry is the guiding hand behind some of the recent maneuvering at Indigo. Such as the purge of 4 directors in mid-2023. And that after more than two decades of supporting Indigo, Gerry is fed up and wants a return. Gerry has more time on his hands now that he’s no longer CEO of Onex. Is Gerry calling the shots behind the scenes and bringing private equity-style ruthlessness to Indigo?

Indigo has added several directors with real book and retail expertise. Other remaining notables on the board include: Jonathan Deitcher, an RBC DS advisor, Andrea Johnson (daughter of Heather and Gerry), Donald Lewtas (a former Onex MD). Mitch Goldhar, the billionaire real estate investor (and Onex director) has also left the board.

Early on, Indigo made a hostile takeover of its bigger rival Chapters. Chapters founder Larry Stevenson and Heather have had an acrimonious rivalry from Day 1. Heather initially wanted to bring US chain Borders into Canada, but Larry lobbied the government to block the move. These days, Larry runs mid-market private equity shop Clearspring Capital Partners. Many young people want to break into private equity and many older people in finance tell me that’s where they would go if they were starting today. But private equity is just a label. Working for Indigo might be just as good an opportunity to learn and to get exposure to Gerry Schwartz, the OG of Canadian private equity. Right now, Indigo is laying off people, but you send Ger an unsolicited PowerPoint with a Porter’s Five Forces analysis of the vibrator market and I guarantee that doors will open. Indigo might also turn into a distressed situation, which is even hotter than private equity. Real estate investor Mitch Goldhar is worth US $2.4B (vs US $1.5B for Gerry), so private equity is not the be-all, end-all.

In the 70s, Gerry Schwartz worked at Bear Stearns, on the same LBO team as the three co-founders of the legendary private equity firm KKR. The face of KKR, Henry Kravis, also married a Canadian, Marie-Josée Kravis. Henry is worth US $10B+. Jeffrey Epstein happened to be a contemporary of Schwartz and Kravis at Bear Stearns, but that’s neither here, nor there.

One thing that the most recent revelations in the Epstein saga illustrate is that the upper strata often don’t apply an ethics filter in picking who they associate with. Because they are more interested in networking, courting power, etc. In 2001, Heather Reisman and Gerry Schwartz held an event at their Rosedale home in honour of someone who at the time was on the Canadian terror watch list - Nelson Mandela. (He was also a pal of Castro, Gaddafi and Arafat. Please don’t share any of this with Mark McQueen, he’ll start agitating for Mandela statues to come down.) Worse yet, in 2019, Schwartz and Reisman hosted a big fundraiser at their Nantucket home for Liddl’ Pete Buttigieg, aka Mayor Pete. Now, that is truly offensive. Heather is a big fan of Ayn Rand, but Indigo’s curation and her Heather’s Picks often tend to be progressive. So if you’re inconsistent, I will say you’re unprincipled, if you’re consistent, I’ll say you’re an ideological simpleton. You can never win.

I think the Schwartz-Reisman power couple are fine philanthropists, whether intentionally, like when they gave $100m to UofT or unwittingly, by running warm places for people to read books for free. If you have any relevant info on any aspect of this story, please share. Now, watch this again and pay close attention to the body language. How do vibrators just turn up? I hope they gave a quick rinse with soapy water before reselling them.