Mark McQueen is bigger on Bay Street than I and others might have appreciated, considering he can be found all day on Twitter and is pretty accessible there. When he sold tech lender Wellington Financial to CIBC in 2018, his partner and co-founder Clairvest Group (ie Ken Rotman) got $24m in CIBC shares. Including earnouts, etc., CIBC has disclosed a total consideration of over $100m. The Wellington stake on Clairvest’s books had been recorded at $500k - reflecting how little capital it takes to start an investment firm. I think it’s a safe assumption that McQueen has done pretty well from what started as a side hustle in 2000. For the first five years, he kept his main job as an investment banking MD at Orion Securities. Wellington's first loan was 6 figures and its’ first formal fund was $7m. When it was sold to CIBC, Wellington had a fund of $300m - with 2 and 20 economics. With leverage, the firm could deploy $900m. And it was doing 85% of its lending in the US - aka the centre of the capitalist universe!

“Mark is good at being in places where he meets senior people, well-connected people. He's purposeful about maintaining relationships; they're not just new additions to his Rolodex.” -John MacNaughton, founding CEO of CPP Investment Board and member of the Trilateral Commission

McQueen is an important member of what I would call the sub-billionaire strata of the Toronto WASP establishment. There’s an old Globe article that mentions his involvement in a clique called the “Cartier Club”. The “Cartier Club”, named after a room at the Albany Club on King Street, was a close circle of friends concerned with “wine, fine dining, travel, investments and women.” [The Albany Club is apparently a hub of business and Conservative bigwigs and the source of many of McQueen’s connections.] The Cartier Club included scions of moguls like Duncan Jackman, son of billionaire financier Hal Jackman; Ken Rotman, son of Clairvest Group founder Joseph Rotman and assorted investment bankers and doctors. The Globe wrote about this group because one of the members, former RBC investment banker Andrew Rankin was accused (and eventually cleared) of insider trading. Mark McQueen himself was described as an “investment banker and son of author Rod McQueen”. That was almost 20 years ago and since then, Mark has really come up on Bay Street.

"I didn't even go to Florida until Grade 9.” -Mark McQueen on his bleak middle class upbringing

Rod McQueen was a major business reporter. He has written 20 books, including most recently, A history of Canadian Imperial Bank of Commerce - Volume 5, covering the years 1973 to 1999. Exciting stuff! I’ll wait for the movie though, if that’s OK. Did Rod’s connections help Mark early on? Mayhaps. When he was considering doing an MBA, former Bank of Montreal CEO Matthew Barrett stepped in by saying: “Come to the bank. I'll give you a business degree.” Former Nesbitt Burns President John MacNaughton introduced him to investment banking. So Mark had certain advantages. But his career really soared when he chose to work at the nexus of two of the biggest growth areas in the past 20 years: private credit and the tech sector. At CIBC, McQueen got the chance to deploy billions throughout North America. From a standing start, CIBC Innovation Banking reached $184M of trailing pre tax in five years. RBC launched its competitive response, RBCX, 3 years later. CIBC Innovation Banking was eventually the number 2 bank lender to VC-backed growth companies in the US. Number 1 was the ill-fated Silicon Valley Bank. McQueen claimed when he left the bank that “loan losses are under 10 bps/annum". He has proven the counter-intuitive notion that you can profitably lend money to companies with poor cashflows. Wellington generated something on the order of 11% annualized over its history. Top decile, etc. Equity warrants and leverage explain some of the excess returns.

After leaving as head of CIBC Innovation Banking, McQueen describes his current role as “Angel Investing / Family Office”. But I predict he will re-emerge with a high-level post in the new year. This may be in either the private or public sphere. He has had a number of public appointments before. Most notably, he managed to get the tunnel link to the Billy Bishop Airport built without a penny from the taxpayer, while he was Chair of the Toronto Port Authority. Donald Trump did something similar: managing the rebuild of the long-neglected Wollman Rink in Central Park in 4 months and under budget without any money from the government. And now, he’s on the verge of winning the American presidency - for the third time! So who knows where McQueen will land, especially now that his Tories are on the ascendancy in the polls.

BTW, do you know what people mean when they say that someone has a “patrician air”? Well, never mind, we won’t be needing that here. The Toronto Star says that his likeness “while fastidiously manicured and tailored, still carries the ruddiness of sea winds” from his Isle of Skye ancestors. I don’t know what that means either. Anyways, I will keep my ad hominem attacks for another post. I have to be mindful that McQueen might be a bit on the sensitive side, reportedly. In 2004, the National Post had to publish an apology and pay about $280k as part of an out-of-court settlement of a libel lawsuit. That’s $60k in damages and the rest for legal bills. The Post had apparently described McQueen’s role as a witness in an OSC insider trading investigation in an unflattering way, or so McQueen felt.

I have drawn a lot of the information here from an old Toronto Star article. There’s one passage that I feel should be quoted verbatim to properly understand McQueen: “He is dogged and meticulous, not to be underestimated, according to friends and colleagues. He watched his father – whom he clearly idolizes and constantly references – rise at 4:30 a.m. to write a prodigious succession of business books while holding down full-time newspaper jobs that included postings in London and Washington. Like father, like son; an email from him bears the time-stamp 4:31 a.m.”

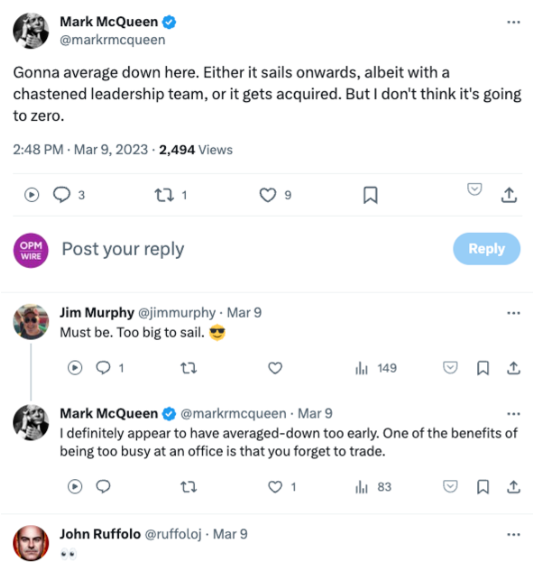

Rod McQueen still maintains a blog and it’s amazing how father and son are similar in outlook, though perhaps not in their looks. I also definitely find Mark wonky and meticulous - more than you’d expect from a self-described “solid B-average” grad of Pol Sci. I guess meticulousness is expected since the lending game is pretty unforgiving to people who are analytically shallow, much more so than stock investing, where mistakes can be overcome by a few big winners. Of course, both activities necessarily involve mistakes and losses. That’s why I’m not even going to name what stock McQueen had in mind in the tweet below….that would be a cheap shot. If anything, inspired by McQueen’s courage, I’m going to say that I’m curious about teen retailer Aritzia given that it’s a fallen angel and there’s meaningful insider buying. If the FDIC seizes it in the next week, feel free to mock me!

I used to read Mark McQueen’s old blog and when he re-launched it this year, I subscribed to it. His new blog has more of a policy bent rather than the Bay Street inside baseball of the old blog. For example, he recently had a two-parter on mortgage interest deductibility as a solution to the housing affordability crisis, which included a table he had done in Excel. Exciting stuff! I can hardly wait for the movie version.

I wrote about McQueen again here: