I occasionally plan to feature interesting emerging managers I come across. This is different from my usual content focused on Big Bay Street. The tone is also different, focusing more on information, rather than infotainment.

Please note: This article was originally published in March 2025 and updated in January 2026, at which time the author joined Bouthillier Capital.

The founder of the eponymous Bouthillier Capital is part of a new wave of Canadian emerging managers who have international pedigree. Mathieu Bouthillier has a Masters degree in Economics, with a specialization in finance, from the University of Edinburgh and has worked for JP Morgan in London. Before going on his own at Bouthillier Capital, better known as B-CAP, he worked for 8 years at BMO Nesbitt Burns managing money for high net worth clients.

B-CAP was founded in 2020 and has been officially managing money since January 2021. The firm has already attracted the support of some leading lights in the Montreal finance community as clients. It is registered in Quebec and Ontario. As part of a push into the institutional market, B-CAP has also constituted a board of advisors and added a financial director. Mathieu is himself a director of the Emerging Managers Board, an industry group. Last fall, B-CAP added a partner, Jean-François Gagnon, a 30-year veteran who previously ran a research-intensive long/short strategy at Fiera and Natcan before that.

At Nesbitt Burns, Mathieu quarterbacked his advisory team with deep research, analysis and a focus on investment strategy. B-CAP is a continuation of this rigorous work. The core philosophy is to invest systematically, minimizing discretionary decisions and the impact of emotions. Quantitative factors that drive investment return, such as total shareholder yield and return on equity are emphasized.

As of 2025, B-CAP focuses on its flagship strategy, called Global Quality.

Global Quality, benefiting from rising dividends

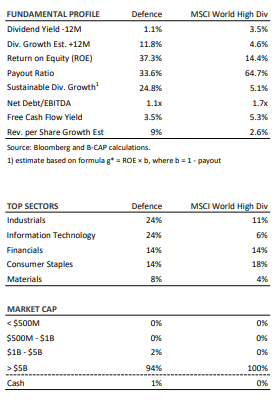

The Global Quality portfolio bets on sustainable dividend growth in large-cap stocks using quantitative filters. Sustainability is evaluated via various factors such as historical and projected growth in revenue per share, profit margins, free cash flow, return on equity, and maintaining a reasonable debt level. The notion of moat is also a major consideration. The Defence model adopts a long-term investment horizon of 5-10 years and focuses on stocks issued by companies with a minimum of $5 billion in market cap. The strategy uses the MSCI World index as benchmark.

B-CAP published a white paper in March 2024 explaining the underpinnings of the Defence strategy.

The Global Quality strategy has performed well in the three years since inception. In 2022, it was down 5.49%, while it was up double digits in 2023 and 2024. The strategy was originally called Defence and so far it has lived up to that label.

You can see some broad portfolio parameters as of the end of 2024:

Fees

Fixed fees start at 0.90% for the first million, then 0.65% for assets above $1m. For accounts above $5m, there's a simple 0.60% fee. Those are very competitive fees.

Building a firm for the long-term

Mathieu is a big fan of Ray Dalio, founder of Bridgewater Associates. He likes in particular his “relentless, educated recalibration of strategies, global multi-asset approach, rigor and serenity.” Another major influence is Howard Marks, founder of Oaktree Capital. He respects in particular his humility about what’s knowable in the markets.

I have attended B-CAP events and gotten to know the founder. Like most CIO-types, his strength is in the craft of investing. Mathieu has a strong understanding of academic finance. But Mathieu is also a methodical business builder. He is active sponsoring all kinds of community events, including a junior hockey team. He brings some marketing acumen and versatile operations skills, which are key in growing assets and building a sustainable business.