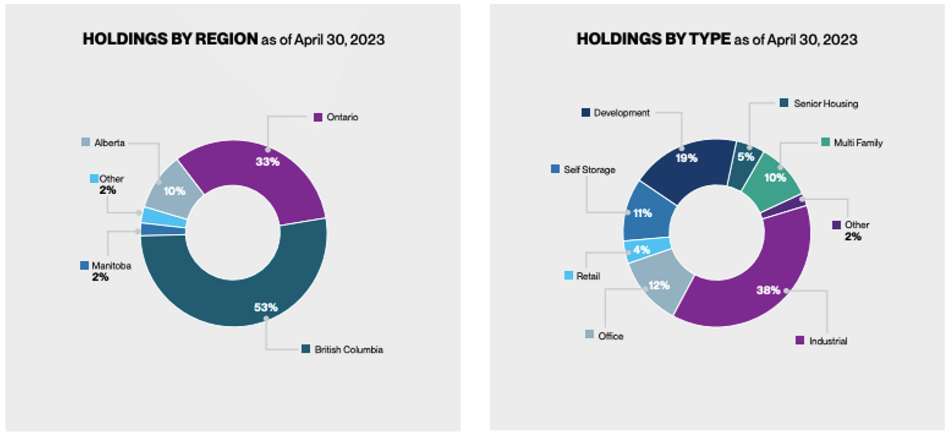

The average Nicola client has a 30%+ exposure to Nicola’s proprietary real estate pools. In addition, clients have about 10% in mortgages. Nicola started their real estate investments in 2000, initially in partnership with Wayman Crosby. Their first formal Canadian real estate fund was formed in 2005. Today, that fund alone has $2.5B in assets (net assets before leverage of $1.3B). Their Canadian real estate fund was up 18.4% in 2021 and 13.2% in 2022. It's compounding at 10% since 2005. Here’s a breakdown of their Canadian real estate holdings.

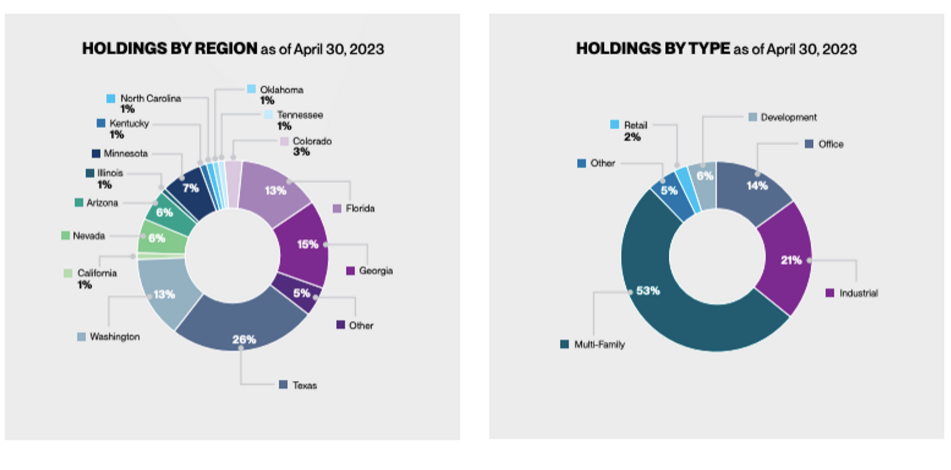

Their US real estate fund has $1.6B net assets ($3.5B gross assets) and has been compounding at 11.8% since mid-2005. It was up 22.7% in 2022. Geographically, Texas is the biggest exposure: 25% of the fund. Given net migration to Texas and the booming energy sector, it’s one of the hottest markets in the US. By asset type, they’re exposed 53% to Multi-Family in the US.

This is a breakdown of their US holdings:

A tutti frutti approach to real estate

Nicola’s “a bit of everything” approach to life can also be seen within its real estate investing. Did you know they are now an active developer via a newer "value-add" fund? They say:

“We now build-to-own more than 25% of our new Canadian and U.S. assets, which provides a lower cost than buying new while providing us with assets that will require far less capital expenditure in the coming years.”

By this logic, they could also enhance returns by quarrying their own marble. In 2022, Nicola partnered with Vancouver developer Coromandel to develop two sites in Vancouver into build-to-rent properties. Coromandel only has a 3.3 stars ratings on Yelp. But that might be the least of its troubles: earlier this year, it filed for creditor protection. The firm came out of nowhere, grew very fast, but took on too much debt. Nicola’s cashflow management policies are probably less rash than Coromandel - John Nicola has often talked about favouring fixed rates and manageable leverage. Even Coromandel has managed to exit creditor protection earlier this year. But it had to do heavy restructuring, including selling its share of the joint venture to Nicola. I guess Trump was right, bankruptcy laws are just a tool that savvy business people use. Coromandel blamed its problems on "the complex, expensive and slow” process for developing real estate in Vancouver. In conclusion, development is more risky, there is no Holy Grail in investing.

By way of further explaining its superior returns, Nicola also says:

“We focus our real estate acquisitions in areas of North America with what we consider favourable demographics and economic growth.”

I have yet to find an opportunistic investor focused on buying asbestos-contaminated properties in ghost towns. This raises the classic finance question of whether a good asset necessarily makes for a good investment. Like everyone, I’m surprised by how resilient residential real estate has been in certain geographies, which shall remain nameless. But at some price, real estate even in the most desirable cities is a bad investment. Another aspect of real estate is that it is undergoing professionalization and institutionalization similar to what happened to equities in the 2nd half of the 20th century. If there are a lot of brains that flock to an asset class, such competition diminishes alpha. It’s hard to say where various real estate markets are in this process. But Nicola goes head first in some of the most competitive real estate markets, that are probably well along this process. For example, they are interested in boosting their self-storage holdings in Toronto. But Miles Nadal and many others are already all over that opportunity!

Here’s a sample transaction: in December 2020, Nicola acquired a 35,000 sq. ft. office building in Redmond, Washington for $32.5m. The sale price of $932 per sq. ft. was a record, beating a previous high of around $500 per sq. ft. The seller was PMF Investments, which has been in the game since 1978 (much longer than Nicola). The deal was brokered by CBRE. The price represented a high four cap rate according to sources, based on the net operating income. If you’re not familiar with the “cap rate” metric used in real estate, think of it as a yield you could expect to earn on your property without taking on any debt. The seller had previously acquired the property for $9.2m in 2017. Meaning they realized a 3.5x on the building’s value in under 4 years. It is mooted that the building could be turned into apartments in the future. Still, review everything I just said about the deal and ask yourself: where is the edge? In reaction to the increasing competition in real estate, many of the smartest players go for “off-market transactions”. I recently came across Steven Scott who has said “We haven’t bought anything that’s been listed for sale in 20 years, it’s all been direct drive.” You can easily partner with him by buying his public vehicles StorageVault or Parkit Enterprises. No need for some money manager.

Cracks in the real estate market

Nicola's private real estate funds offer liquidity within 6 months. In theory, at least. Anyone who follows business news is aware of some emerging signs of stress in some real estate vehicles. In January of this year, Blackstone capped redemptions on its $69B REIT. That fund is also active primarily in the US Sunbelt. This is one among many other examples, here are some recent headlines:

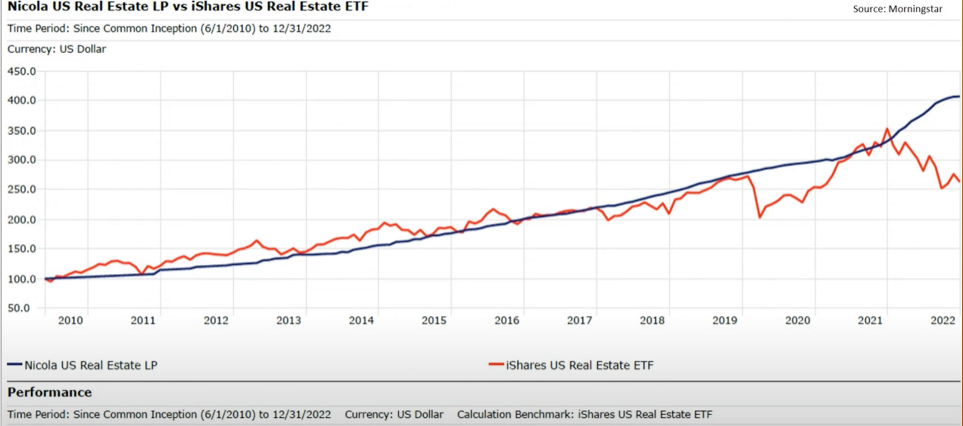

The chart below shows Nicola’s US real estate performance compared to the iShares US real estate ETF. You’ll see the ETF was neck-and-neck in performance between 2010 and 2021. Then in 2022, Nicola’s fund claims a 22.7% performance, while the ETF went down. This last year explains all the outperformance of the past 12 years. You have to ask yourself why would the ETF be such a good proxy for more than a decade and then diverge. The ETF is priced in the open market by thousands of investors betting with their money. Nicola's pricing process is somewhat murkier. Some investment operators are prepared to share property-by-property valuation information, even appraisal reports with clients. You can ask Nicola what their disclosure practices are. Although public investors are occasionally prone to panicking, on balance, I respect the collective wisdom of the market. I don't sense the markets have been very panicky this year.

There is overall a large gap - about 40% - between how publicly-traded REITs have adjusted to rising interest rates and the valuations of private vehicles. Tricon and DREAM Residential REIT are both involved in US housing and so are reasonable listed comparables for Nicola’s US real estate investing. Tricon is up about 8% today vs before the Pandemic. Nicola’s vehicle is up over 40% since the onset of the Pandemic. DREAM is down 35% in the past year vs up 15% for Nicola. These are not perfect comparisons, but they do hint at something anomalous.

Take a look at BSR REIT. It's an owner and operator of multifamily properties in the Sunbelt. It uses a typical Nicola "can't fail" strategy: focusing on urban areas with "some of the lowest unemployment rates in the US, including Austin, Dallas, Houston and Oklahoma City". It is well covered by analysts and has a market cap of US$700m. It was able to raise its Net Operating Income about 10% in 2022. It's down about 43% from its 2022 high. It's down about 8% from its pre-pandemic high.

An investor with exposure to private real estate could opportunistically swap his holdings for some of the cheaper public assets. However, now that Nicola has billions of assets in private real estate pools, I doubt they will liquidate those to buy REITs. Also, how do new clients know that they're buying into these funds at a fair valuation?

It’s a well-known that listed REITs experience a lot more volatility than the Net Asset Value of their underlying holdings. If the clients simply held a portfolio of REITs and paid attention only to NAVs and no attention to market prices, they would also experience lower volatility.

The Venterra connection

A US multi-family property player called Venterra manages a material part of Nicola’s US multi-family assets. I don’t know much about Venterra (except that certain other high-end wealth managers also distribute them). Venterra manages $5B in assets overall. I did come across this story: in October 2020, the Toronto Star published an article titled “Canadian businessman, real estate firm implicated in Channel Islands tax scheme”. The Star has a bias for painting anything offshore in a sinister light, even though the majority of offshore business is both lawful and legitimate. Anyways, Venterra, John Foresi and Andrew Stewart are key players in that story because apparently, tens of millions moved around through a “complex chain of firms” to finance Venterra real estate developments in the 2000s and return profits tax-free.

Venterra principals denied involvement or knowledge of “any investment strategies designed to avoid taxation through the use of fraudulent documents.” They insist they were at “arm’s length” from the impugned mastermind. The Star claims that the records show that Stewart and Foresi invested in their own projects through offshore entities. The Star asked Foresi and Stewart why they invested in their own projects through an offshore entity, but they declined to answer. The article then claims the tax scheme was ineffective on the basis of some expert opinions. The overall article is quite sophisticated, though it might yet fall short of the truth, since the Star doesn’t have perfect information.

Venterra is focused on the US Sunbelt. I like the Sunbelt as much as the next guy, but they tend to be pro-development jurisdictions. Florida had a lot going for it in the early aughts, it didn't prevent it from being in the eye of the storm during the real estate crash of 07-08. Speaking of storms, insurance is getting more expensive, raising as much as 40% this year.

I mentioned in my original Nicola post that if you peruse enough profiles of persons in high positions, occasionally, you should expect to find people with traditional pedigree. Well, credit where credit is due, Venterra’s co-founder John Foresi is a Harvard MBA. I think he had a big tech exit along with his co-founder Andrew Stewart before starting Venterra. Anyways, I make no conclusion as to Venterra. About Nicola, my feelings should be clear, I’d call it a 2 or 3 out of 10 as far wealth managers go.

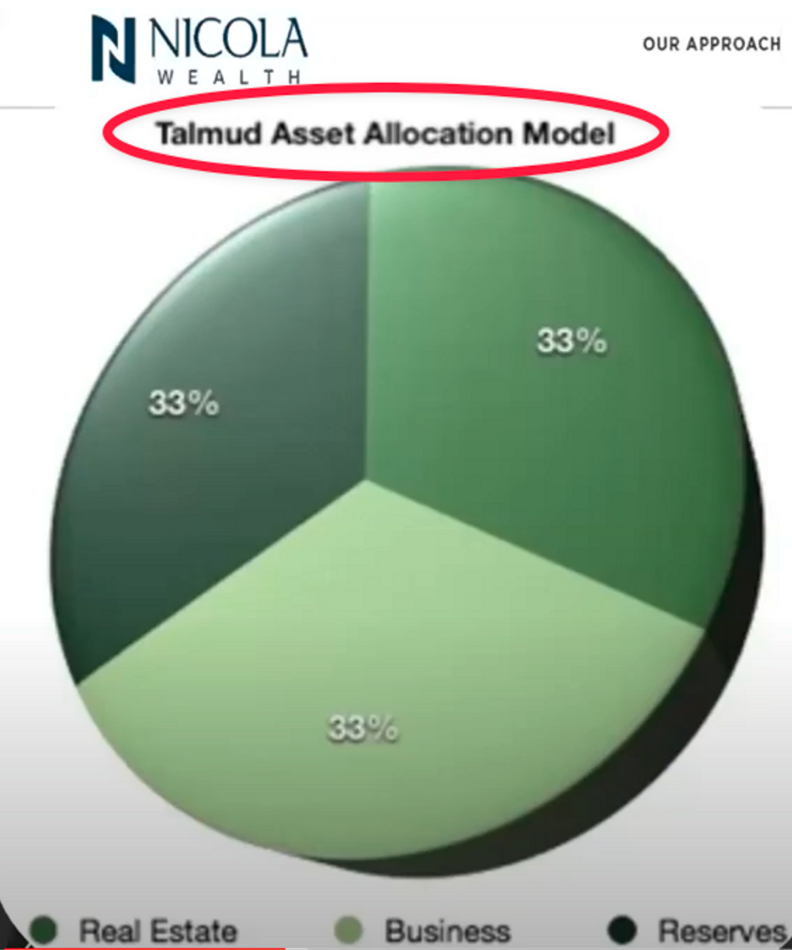

Nicola justifies its allocation to private assets by pointing to things like: "it's the pension fund model" or "look at our track record of low volatility" or the Talmud. Clients should refer instead to the basic logic of how assets work. Even the highest quality assets are prone to fluctuations of 10-30%. The simplified math of real estate is that if the cap rate goes from 4% to 5%, then rents have to go up by 25% for the property to keep the same value. Then clients should consider Nicola's approximate 2:1 leverage and the all-important question of whether they will be able to get their money out when they want to. I am no Talmudic scholar, but I am familiar with two of the foremost modern-day Jewish thinkers, Jerry Seinfeld and Larry David. In their view, those who seek the easy path of "serenity now", will inevitably confront "insanity later".