Do you believe in taint by association? Ninepoint already has to live with the infamy of being Bridging Finance's former partner. Ninepoint is also the longstanding employer of Eric Nuttall, who goes on TV and pretends he can divine the direction of oil prices. If you believe people should be judged by the company they keep, I rest my case.

You might recall that Ninepoint said they'll be carrying out an operational audit of their Third Eye fund as well as the AIP Convertible Private Debt Fund. That second fund is managed by AIP Asset Management, but Ninepoint is the exclusive distributor. The two key principals at AIP, Jay Bala and Alex Kanayev both worked at Third Eye Capital. So it's another aspect of the longstanding links between Third Eye and Ninepoint. Those links started when a partnership was formed between Third Eye and Sprott Asset Management. (Ninepoint got its start by acquiring several funds from Sprott).

Before getting into the weeds of some of their questionable deals, let me highlight some head-scratchers we found. AIP's fund claims 34.35% annualized returns since 2014. That's a pretty impressive number, if it checks out. The heading for that fund's factsheet looks like this:

Notice how it says: "Formally AIP Global Macro Fund LP". Regardless of whether they mean formally or formerly, I hope you will agree that's a pretty ridiculous situation.

AIP really likes to tout all sorts of awards they have won. Many investment industry awards involve some pay-for-play arrangements. All such awards are meaningless noise. The Canadian Hedge Fund Awards claim to be "entirely quantitative". But garbage in, garbage out. In 2020, AIP Convertible Private Debt Fund was ranked first by Canadian Hedge Fund Awards in the "Global Macro / Managed Futures / Multi-Strategy" category. In 2019, they won in the "Private Debt" category. They really have to decide what they are. Here are all the wins AIP advertises, you figure it out, if you care. Just keep in mind that Bridging Finance got a second place finish in the Canadian Hedge Fund Awards just last year.

Jay Bala is the CEO of AIP. You can watch his many BNN interviews. By the very design of these short TV interviews, I don't think anyone comes across as particularly intelligent. But having reviewed some of Jay Bala's appearances, I have to say that he comes across as spectacularly uninsightful. Just very banal macro opinions and superficial comments about companies of the "this stock has gone down a lot, how much further can it fall" variety. And besides the lack of acumen, as a practical matter, you will not have fared well following his advice.

Jay's dealmaking is as spotty as his stock picks. Here's an example. ZoomAway claims to be a "technology that is revolutionizing the hospitality and travel industries." I don't think investors and clients are buying into the revolution in droves, considering that ZoomAway's current market cap is $3.4m and the company had $33k in revenue for the first half of 2021. AIP first invested C$1m in ZoomAway in May 2019. In December 2020, AIP provided a US$5m loan facility at a 5% interest rate for 24 months. Notice that's a loan facility, not convertible debt. AIP charged a $100k due diligence fee, a $100k facility fee plus a $1.8m closing payment. In other words, ZoomAway had to pay $2m for the privilege of having a $5m loan facility from AIP. That's not the sign of a strong borrower.

In February 2021, the original debt was settled with a share and warrant package. After the transaction, AIP owned 45% of ZoomAway on an undiluted basis. The audited accounts for the year ending December 2020 have a going concern warning. In September 2021, ZoomAway changed its auditor. AIP's current portfolio is full of crappy deals like the one just detailed. And yet, as of June 30th, 2021, AIP shows $0 in loan loss provisions. Under current accounting standards, no provisions means that their assets’ credit risk and default probabilities are non-existent. That just doesn't compute.

On November 1st, 2019 Bloomberg News published a story with the title “Fund Brings Convertible Loans to Private Debt, Generates 41%.” One of the closing statements was:

“They restructured the mining company into Cannabix Technologies Inc. and the shares surged in the heady days of the nascent pot market. This time, their timing was perfect. They cashed out their 50% stake when Cannabix’s market value climbed north of C$300 million. The shares have since tumbled.”

Transactions by a 50% owner in public stocks are a matter of public record. There's no corroboration to back up anything remotely as heroic as cashing out their 50% stake at the peak valuation (around C$300m). The company was worth $300m for less than a month and this occurred three years after the two AIP principals had resigned as directors. Our belief is that they exited probably under a C$10m valuation.

We have yet to identify an AIP deal where the equity upside could explain their high historic returns. If you know the answer, please share. In any event, since AIP struck an exclusive distribution deal with Ninepoint in 2019, their performance has become a little bit closer to the norm for private debt funds. Has there been a change of strategy? Our internal notes on red flags runs to more than 20 pages. Ultimately though, we don't care at all about AIP, they're insignificant. But it shows you that Ninepoint - a firm with $8b AUM - is prepared to peddle any old crap to their clients.

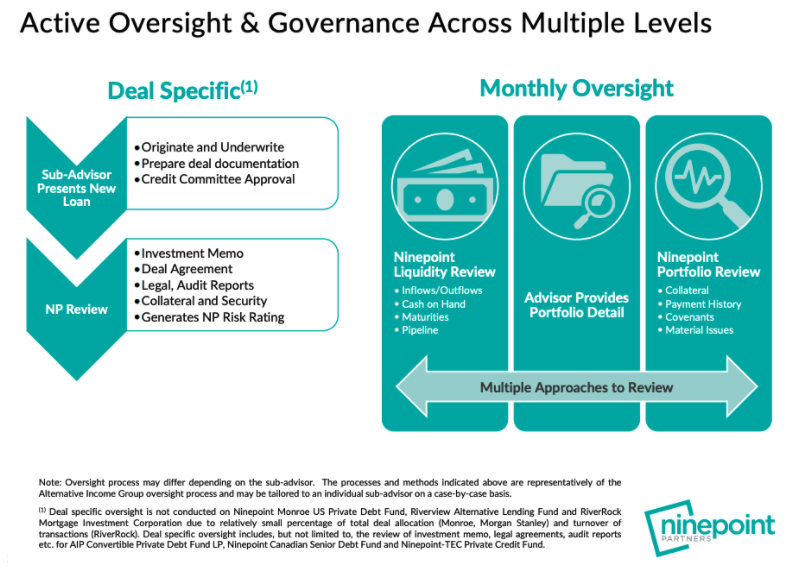

AIP paid Ninepoint about $700k in commissions in 2020. That's for placing about $22m or a commission rate of over 3%. Ninepoint spends three slides in a presentation detailing their "active oversight and governance" of funds they sell. They can use all the chevrons and arrows they want, it's a hollow claim. It's quite an achievement that Eric Nuttall's fund is not the most dubious one in the Ninepoint line-up.