Many people said I could never become presidential and yet I have not written anything incendiary in many months. I have pulled a complete 180, just like Trump after he won the election (the first time). Of course, I am only human, so occasionally, I will have presidential relapses. I am afraid today is one such day.

Prime Quadrant claims to have $15 billion in Assets under Consultation, a metric they invented. That includes any money that they're influencing, whether under their discretionary control or not. That money comes from 150 Ultra High Net Worth families. So the average family client of Prime Quadrant has something like $100m. In any event, I have no doubt that Prime Quadrant advises at the very high end of the market. It probably has the most clearly defined high-end wealth advisory brand in Canada.

At the foundation of Prime Quadrant is a premise that you will find recurs in many of my posts. That premise is: I have made a lot of money, therefore I must know something about money matters. So Ian Rosmarin retires as an executive of a dental supply distributor, finds himself with some wealth, discovers the foolproof "endowment model" and instantly becomes an investment guru. In 1997, unhappy with the solutions that existed to take care of his money, Ian founds Prime Quadrant. The original focus was on helping people move money offshore and choose niche money managers. As you can imagine, the focus was on "alternative funds", not boring conventional funds. Specifically, they wanted double-digit returns with single-digit volatility (hence, Prime Quadrant). At the time, they were open to anyone with at least $1m. And they used to charge 80 bps.

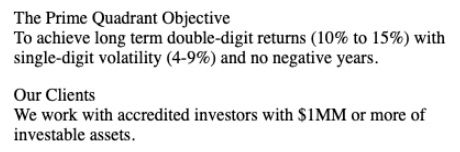

As late as April 2009, Prime Quadrant stated a long-term double-digit return objective, as you can see here:

And yet, in a mid-2011 letter, Ian Rosmarin takes credit for a 9.8% annual return going back to 2000 and re-states their return objective as "high single-digit/low double digit":

This looks like a classic case of moving the goalposts to wherever the ball lands. And no mention of volatility and "no negative years". Incidentally, achieving 9.8% annualized between 2000 and 2011 trounces the stock market, but that's not a fair comparison given the other asset classes involved in an endowment model. So that requires more analysis if, in the first place, you're comfortable dealing with a firm that engages in these sorts of shenanigans. The return objective stated above (double-digit returns, single-digit volatility and no negative years) which used to be prominent on their website is nowhere to be found now. That objective is the very name of the firm! The Prime Quadrant has moved! The inconvenient reality of cold, hard numbers has been replaced, first with a fish motif:

Finally, now it's all about feelings:

I guess the Prime Quadrant has changed to Purposeful Authenticity on the Y-axis and Tenacious Humility on the X-axis. My Purposeful Authenticity is off-the-charts, but I really have to work on the standard deviation of my humility.

Eventually, tax laws eroded the benefits of moving money offshore and Prime Quadrant transformed itself into a typical multi-family office firm. Tax, estate planning, mediating disputes with your brother-in-law, that sort of thing. Today, they make custom fee arrangements based on a client's needs (unrelated to the size of a client's assets). But they do charge minimum fixed fees, such that only account size of several million will find it worthwhile. Prime Quadrant can advise on everything from hedge funds, to private equity, real estate, fixed income, to how to divide your cottage between your heirs. You can read any number of my stories that should dispel the myth that merely because a person has made money, they become a money expert. It's sort of like saying "I have had a concussion, I am now a neuroscientist."

The driving force behind Prime Quadrant over the past 10 years is one Mo Lidsky (Ian Rosmarin is now Chairman Emeritus). Officially, Yevgeniy Lidsky, Mo is a Top 40 Under 40 type, now around 38 years old. I'll write more about his background in another post. I have listened to him speak, he comes across as genuine, he admits his mistakes - like losing money in 2008, almost falling for a scam. He has a somewhat serious demeanour, which is good, I don't trust anyone jovial. I do believe he shows appropriate epistemological humility. Nevertheless, I doubt he got all these wealthy clients by telling them that nothing is knowable. You combine clients who are accustomed to having the best, a firm that pushes shiny alternative products and the elusiveness of alpha in the past 10 years...that's a recipe for dashed expectations.

One of Mo's key initiatives was the Prime Quadrant Conference, organized annually, ostensibly for the benefit of charity. This was modelled on the SALT conference that SkyBridge organized annually in Las Vegas. That's Anthony "The Mooch" Scaramucci's firm.

Prime Quadrant was able to attract big names to its own conference, including Carlyle co-founder David Rubenstein, Apollo Global founder and Epstein pal Leon Black and several others. Even The Mooch himself one year. They were also able to get the legendary billionaire US real estate investor Sam Zell to speak twice. It's quite a feat to get all these legends to fly to Toronto to speak. It was an impressive production, I am sure it raised the firm's profile and it drew all the usual suspects family offices. However, many people don't know this, but having an edge in investing and kissing Sam Zell's ass are two distinct skillsets. I will give you a minute to absorb this new knowledge.

One of their conferences had Sherry Cooper. Surely you know Sherry? She has called every market top and bottom since the Toronto Stock Exchange opened in 1861. Prime Quadrant's model is rather unique. Since so much of what they do is bespoke, you can't pin down (and dismiss) their performance, except by conjecture. I am therefore only 99.99% confident that their overall performance is nothing to write home about. I have, however, conclusively determined that Mo Lidsky is a weak, sappy writer. In one bizarre LinkedIn post where he talks about a senior citizen Filipino barista, he "couldn't stop thinking about", Liddle Mo Sunshine writes:

Eleanor Roosevelt famously said, “The future belongs to those who believe in the beauty of their dreams.” May each of you, my dear friends, carve out your rightful stake in that future and inspire everyone around you to do the same.

I want to puke.

Despite his writing being full of this sort of banality, Mo is a published author, four times over. He has written on investing and philanthropy. His latest book is called Selling Snake Oil. Isn't he too young to be writing a memoir?

Here's another excerpt from Mo's LinkedIn profile:

I just got diabetes and I'm feeling nauseous again. LinkedIn sucks, amirite? For all of Mo's pontification across multiple asset classes, the reality is that he's not even licensed to manage a portfolio of ETFs. Many of the senior people at Prime Quadrant don't have the advisor license either. Mo had an unconventional background before joining the investment industry with Prime Quadrant, mostly in the non-profit sector and owning a chain of auto restoration shops in Ohio. Mo's license allows him to pitch exempt products, such as hedge funds, to accredited investors. In order to be a "real" discretionary portfolio manager (or even advisor) in Canada, you need to have the CFA or the CIM or be grandfathered under old rules or make out the special merits of your particular case. I hope the OSC keeps an open mind on that last point. After all, I have amply proven that people with traditional pedigree add no value. It therefore follows that the real investment geniuses are to be found from other fields, such as, perhaps, auto restoration.

Anyways, those are just some opening remarks, I'll have more detailed posts later on. Send any information you have. I should clarify that I have respect for the business model Liddle Mo has built. And it's not entirely impossible that the firm adds value on the investment side, which would be a real bonus. Some of these wealthy people are just looking for a friend anyways. Especially one who is purposefully authentic, yet tenaciously humble.

I wrote some Mo here: