Some of the very same tech messiahs who made a big deal about the increase in the capital gain tax inclusion rate are applauding corporate welfare. In my view, these are purely self-serving positions without thinking of policy constraints, ie having their cake and eating it too. Let’s focus on VC Allen Lau who famously flipped his startup Wattpad to The Koreans. Here he is applauding one of his portfolio companies getting a US$25m investment from a state-owned entity in Quebec.

SRTX is mostly known for its flagship product Sheertex, "unbreakable" tights made with some innovative material. Tights as in hosiery, not the yoga kind. The product has generally good reviews and has been selling well. The company has been very successful at raising money. From all the buzz and press coverage, I had assumed everything was tracking well. But only a few days after the Investissement Quebec deal, founder Katherine Homuth revealed in a LinkedIn post that SRTX is bleeding $30m per year. And that “We need a big injection of capital. Someone with a lot of willingness to take a moonshot.” She has already raised $250m and has billionaire Lululemon founder Chip Wilson and giant clothing retailer H&M as investors. So I find this “Hail Mary” post on LinkedIn rather perplexing. I assume that someone talented enough to raise $250m, knows that desperation is not conducive to fundraising success. So what's her motivation? Here’s part of what she wrote:

Here’s the truth: Sheertex isn’t profitable. Not even close. We lose millions every year. I’ve cried more tears over this company than I’d care to admit. But we’ve also raised $250M, built one of the most advanced textile factories in North America, and proven there’s demand for a game-changing product. Our tights once cost over $100 each to make. Today, they cost $13. By next year, they’ll cost $5. But we’re still fighting tooth and nail to survive…Every fundraise is hand-to-mouth. Every sleepless night is spent wondering if the next leap forward will be our last. It’s exhausting, terrifying, and somehow still the most fulfilling thing I’ve ever done.

And then founder Katherine wrote again lamenting that the New York Times had preferred a competitor (that uses more conventional material) in a head-to-head comparison. Specifically, this is the Times’ Wirecutter service, which I generally find pretty reliable. I check pretty much anything I want to buy through it. Wirecutter’s tester concluded after running a battery of improvised tests that a competitor called Shapermint was better:

These tights survived everyday wear better, and they lived up to their marketing claims without damage, while the Sheertex tights did not. Plus, I found them to be more comfortable, and I looked forward to putting them on each and every time.

Wirecutter is not infallible, I remember they used to be against air fryers many years ago. For this particular category, I found Good Housekeeping has a much more thorough review involving instruments and multiple testers and they rate Sheertex very highly. Still, it seems like a competitive category, you might say it’s a tight race. There are factors besides durability, such as price and comfort. Sometimes, VCs talk about a “10X” improvement, Sheertex probably doesn’t meet that criteria on a quality / price basis, as best I can tell from cursory research.

To add insult to injury, Shapermint was founded by a young male founder based in Uruguay. As the brand name implies, their core product is shapewear. How much adversity and ridicule do you imagine he has faced? By focusing on profitable customer acquisition, the company captured a fifth of the US shapewear market without any external funding. Shapermint started by selling other brands before making their own stuff. Katherine decries this as an economy that “has turned into a game of selling each other someone else’s products with a prettier label.” I would say this is a classic business strategy of many capital-constrained startups: selling other people’s crap before you are powerful enough to make your own. Even Nike started as a distributor of Japanese sneakers. Amazon, Netflix and countless others used variants of this strategy.

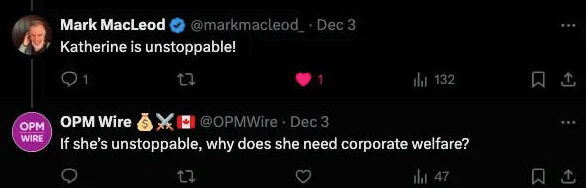

The tech ecosystem and the broader LinkedIn community of corporate wankers were out in force spouting banalities in defense of Katherine and SRTX.

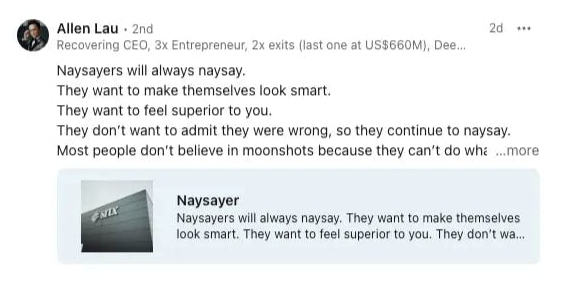

Recurring OPM Wire character Allen Lau was even moved to write a blog post about naysayers. He mostly used the opportunity to recount one of his war stories. The short summary of which is that - stop me if you’ve heard this before - he sold Wattpad for a LOT of money. The irony is that I have never read anything negative written about Katherine or SRTX - to this day. If she hadn’t taken government money, I would have nothing to say. (A previous financing round was also backed by EDC, a federal agency).

Sean Silcoff’s article mentions that Paul Desmarais III helped Katherine “make local connections.” This is a familiar pattern for a clan whose name means “from the swamp.” Why doesn’t he get one of Power’s many divisions to invest? Power Corp. even has a 13% stake in Adidas. Clothing mogul Joe Mimran is also an early backer. He was initially skeptical, but didn't want to miss out, in case it worked. Did you know that Joe started his career as an accountant? Between all these high-powered, globally networked people, why does Sheertex need government money? How can some briefcase-wielding bureaucrat working for the government possibly have better judgment than the collective wisdom of the private markets?

I don’t particularly think that an entrepreneur taking government money is a character flaw, since they owe their best efforts to their shareholders and they have to keep up with competitors who may also benefit from government largesse. But I did want to highlight the wishy-washy policy views of Allen Lau and his ilk. I have a much more coherent view: I believe capital gains and corporate tax rates should be zero and corporate welfare should be abolished. Let them stand on their own two feet, endure the sacrifices and reap the rewards.

In yet another follow-up post, Katherine wonders if she gets worse coverage because she says “female CEOs get dismantled.” Come on, even Komrade Kamala did not stoop to that. Any PR-savvy startup would know the key to get fawning coverage is to have a startup headed by a 9-year old black girl. I found Katherine's grievances to be petty whining about perceived slights, mostly imaginary. Yet, in response, BetaKit changed the title of its coverage of Katherine’s LinkedIn cri de coeur. Don’t worry, I have lots of problems with men too, like this horsecrap federal handout to Cohere:

But I have already written a lot about Cohere.

“The idea of being taken down when I’ve already been pushed to my limits felt unbearable.” -Katherine Homuth

I do think the life of an entrepreneur is tough, but so is being a plumber. Why does she have to take money from some guy working a burger grill? Katherine has some grandiose notion of re-shoring all textile manufacturing to Canada or that the Western world needs to build again. That might be a legitimate point, but why are her aspirations more important than the aspirations of a single-mom waitress who might want to go back to studying? Just because Katherine can build a PowerPoint presentation? Money doesn’t grow on trees, these are ideas that should live or die entirely on their merits as judged by the private markets.

I do believe in a strong safety net for individuals though. When my family first immigrated to Canada, we lived in a small apartment on Chabanel St. in the garment district of Montreal. My parents had to be on welfare for a few months. I still remember accompanying my mom as she went floor-to-floor in the textile factories of Chabanel St. asking if there was an opening. Finally, a petite Vietnamese woman said she needed someone to put the finishing touches on her clothes. That was Ms. Tri. I was reminded of Ms. Tri when I saw a recent picture of VC Allen Lau. Zing! You thought I was going for some sappy immigrant story, didn’t you? We always keep tabs on Chabanel St. and there are always schemers and dreamers trying to revitalize both the neighbourhood and the industry, with varying levels of success.