“My goal is to create a business that adds value to society; that has a positive social utility. I want to change the industry – to create a legacy – by offering Canadians better investment products with moderate fees.” -Som Seif

Som Seif's fund shop Purpose Investments has now crossed $20B in assets under mismanagement (”AUMM”). I wanted to take a measure of the grandeur of Som Seif’s empire. According to my best estimates, in 2023, the firm earned $61m in management fees across its ETFs and pooled funds. This is a growth of about 9% over the 2022 figure. Purpose does earn some performance fees, but they are immaterial. Cryptocoin ETFs accounted for about 23% of revenues. Purpose's Bitcoin ETF accounted for $11m in revenues. The second biggest contributor was the High Interest Savings fund which tripled its fee stream to $9m.

I hate to sound like a total square, but I don’t believe in crypto, not even the mighty Bitcoin. Som says he started Purpose with a blank piece of paper. Well, that now looks more like a dog’s breakfast, a mish mash of products, everything from private debt to pot stocks. This is the standard fund shop m.o. of throwing stuff at the wall and seeing what sticks. Here are the top 5 fee generators in 2023.

| Bitcoin ETF | $11.3m |

| High Interest Savings | $9.1m |

| Tactical Asset Allocation | $6.9m |

| Credit Opportunities | $5.3m |

| Strategic Yield | $3.1m |

In February 2021, Allianz paid $53.5m to take a 10% stake in the parent holding company Purpose Financial (or a $535m valuation). (Purpose Financial has since rebranded to Purpose Unlimited.) At the time, Purpose Investments had $10B in AUM. Purpose Unlimited also has two other key divisions:

1) Purpose Advisor Solutions offers a turnkey platform for advisors to efficiently launch and operate their business. It last disclosed assets over $5B.

2) Driven is the new name for an expanded version of Thinking Capital, a lender Purpose acquired in 2018. Driven is focused on the SME segment - think florists, gyms, bakeries, cafés.

Brent Belzberg’s Torquest was a backer of Thinking Capital. And so Torquest has ended up being a shareholder of Purpose Unlimited - a fact that Som has not been shy mentioning. Som is of Iranian extraction, Allianz is German, while Brent Belzberg is Jewish. How would you pair them in a doubles tennis match? I probably shouldn’t even mention any of that. Purpose has also received funding from OMERS Ventures, back when Som’s bosom buddy John Ruffolo was the top banana.

Purpose Investments is often the first mover at launching innovative fund schemes in Canada. The Bitcoin ETFs it launched in 2021 has $2.6B in assets. That year, it also launched the Purpose Longevity Pension Fund, an “income-for-life product”. The technical term for this product category is “tontine”. But Purpose doesn’t use that term because tontines have historically had a bad reputation. The essence of a tontine is that investors pool their longevity risk so that if they pass away early, a portion of their assets remains in the pot, to the benefit surviving investors. To date, Purpose’s Longevity product has been a dud, with 2023 fees earned of $30k and Purpose having to subsidize $159k in fund expenses. I am no tontine expert, but they are fully endorsed by finance professor Moshe Milevsky, who I respect. Moshe himself has partnered with Guardian Capital to launch his own tontine products. I think this is a category with potential, it’s a matter of the public learning about them.

A more problematic area at Purpose are its “Yield Shares” where it tries to turn single-stock holdings like Tesla and Amazon into income products. The Tesla Yield Shares ETF, for instance, holds a levered stake in Tesla and writes covered calls. It then advertises a misleading double digit yield. Nothing good can come out of this.

The OSC recently warned the industry that misleading yields is an area they intend to scrutinize.

Fortunately, the Yield Shares ETFs have not had much traction, with Tesla being the largest one at around $100m in assets. So Purpose’s fund innovation, like any innovation, is hit or miss. Purpose has a suite of more than 50 funds, with a handful accounting for the bulk of fees. So if the top line is about $61m, how much would you pay for this business? If Allianz had put $535m in Purpose’s High Interest Savings ETF, it would earn $26m free and clear. That should keep things in perspective

I thought Purpose was just some generic brand, but the deeper meaning is that the firm exists to help client meet their financial goals. I have to say that focusing on “goal-driven investing”, directing clients away from an obsession with beating indices was quite visionary 10 years ago. Som is very attuned to trends and disruptions within the fintech space. He was involved early on with Wealthsimple and introduced them to Paul Desmarais III of Power Corp. He now spins that as being a "co-founder" of Wealthsimple. That is dubious.

As a matter of securities regulation, it is unusual (though not unlawful or impossible) for one person to be an officer of two unaffiliated registrants. Som Seif has been registered as the "Ultimate Designated Person" for Purpose continuously since December 2012. Wealthsimple launched to the public in September 2014. The sequence of events was as follows, as per statutory corporate filings:

- Som Seif becomes a director of Wealthsimple Inc. on May 19th, 2014.

- The next day, Som Seif resigns as director and his wife Kerry Seif is appointed as a director (a Globe article from 2015 identifies her as an investor in Wealthsimple and Som as an advisor).

- Som becomes a director of Wealthsimple Financial (the parent company) in December 2015, while his wife Kerry Seif resigns as director of Wealthsimple Inc.

Anyways, I thought it was curious that Som was a director for just one day, initially. Maybe it was a clerical error. I put some of these questions to Purpose's PR agency, but their answers were evasive. Or "slippery", if you prefer. Early on, Wealthsimple used some Purpose ETFs, but Purpose is no longer a preferred ETF purveyor for Wealthsimple’s robo-advice. Sad! Wealthsimple uses Purpose’s High Interest Savings ETF for its cash account though (and then it tacks on extra cash grab on top).

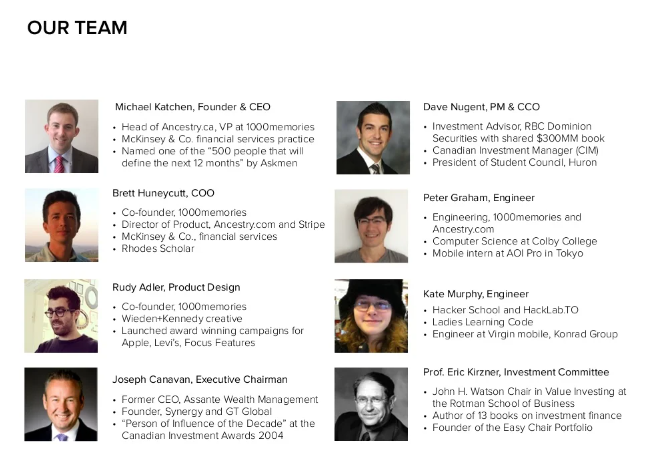

Here's a team roster from Wealthsimple's pitch deck for their seed round financing. Even lead investor Joe Canavan is mentioned, but where's "co-founder" Som?

Under securities law, even pitch decks used for fundraising must not contain misrepresentations. While an omission is not always a misrepresentation, I don't know why a startup advised by Osler from Day 1 would have an unnamed "shadow officer". Or why they felt the need to conceal the involvement of a "co-founder". Anyways, I am just beating a dead horse, I named the three widely-acknowledged co-founders of Wealthsimple and asked their press office if I am missing anyone. They just confirmed those three. When I asked about Som Seif's status as co-founder, they went radio silent.

I didn’t come from money but I always had a dream of very big things. I wanted expensive cars and the things that went along with them. -Som Seif

Som was back on my radar when I saw that he was the Honorary Chair of this year’s Ride to Conquer Cancer fundraiser (where he more brazenly makes that co-founder claim). I don’t put much weight in such philanthropy as evidence of altruism, because so much of it is about self-promotion and networking. But I was impressed that while pursuing his engineering degree at U of T, where he was on the water-polo team, Som found the time to volunteer as a Big Brother to a boy without a father. What do I conclude? That people are complex, have conflicting impulses and defy easy characterization. That is why I never engage in name-calling.

Slippery Som’s origin story, prior to Purpose, is his claim to be the “founder” of ETF firm Claymore Investments. That's another claim that merits scrutiny. In the media, Som has spun a melodramatic tale of how “his” Claymore was “taken away” from him, ie when it was sold to BlackRock. This, despite the fact he was simply the founding CEO of a Canadian subsidiary (with big American parents) from beginning to end, never in control. When he subsequently launched Purpose, he said he had learned a lesson and he was self-funding Purpose so that he controls his destiny. He eventually accepted external money and what do you know, the representatives of Purpose’s financial backers are now the majority on the board of directors. OMERS has two directors, Allianz X and TorQuest have one each. So that’s 4 “outsiders” on a 7 person board. Purpose’s PR people, when asked about control, said Som is the largest shareholder. So maybe he’s not even the majority shareholder. Som may still exercise ultimate control through other mechanisms. Nevertheless, financial investors are in the business of earning a return and I fear they may yet sway Som’s otherwise steadfast moral compass.