As you know, few investments have created more aggregate wealth in the past 30 years than the Canadian housing market. In Oshawa alone, homeowners are sitting on trillions in gains - most of it just in the past few months. This is a cautionary tale of two myopic entrepreneurs who, oblivious to the benefits of owning equity in homes, repeatedly took the mortgage side of the deal. In the process, they scraped together a few billions, leaving most of the upside to astute Canadian homeowners. Kids, let this be a lesson for you.

Someone told me about a Canadian billionaire called Moray Tawse. I had never heard of him. They said he was big at First National Financial. The higher profile mogul most people associate with First National is Stephen Smith. Turns out that Moray Tawse owns almost as much of First National. That’s 22.4m shares for Stephen and 20.4m for Moray or a 37.4% and 34% stake respectively. Moray owns some preferred shares as well. Stephen was CEO since founding up to January 12th of this year and has now become Executive Chairman. Moray is EVP and now primarily oversees commercial mortgage origination activities. Both are credited as co-founders.

First National has a market cap of $2.7B these days, meaning that both founders are worth about a billion each on the strength of that stake alone (and if Moray is a few million short, just wait till some dividend cheques roll in - FNF currently yields around 5%). In 2019, they sold a total of 1.2m shares of First National, but they’re clearly very committed to the business both with their wallet and time. And that is not the whole story, as both Stephen and Moray have extensive other interests. They have received more than a billion in dividends over the past 15 years. Stephen has diversified into becoming a one-man financial services conglomerate. Moray Tawse is a leading winery owner both in the Niagara region and in Burgundy and he has extensive real estate holdings. I’ll have follow-up pieces with more details on each of the founders. But here's the short version of the First National story.

Just before founding First National in 1988, Moray was a manager at Guaranty Trust and Stephen was working for a small investment dealer (First Canadian Securities). Moray was good at originating mortgages from brokers and Stephen’s specialty was selling packaged loans to institutional investors. Moray describes the start of their partnership as follows in company literature:

I found Stephen’s business card, gave him a call and said why don’t we work together to originate, package and sell the mortgages for our employers? He thought that was a good idea and so off we went. One day, we were together in Vancouver seeing a mutual client, and we said to each other, we’re working hard, we’re making money for our employers, why don’t we do it for ourselves? It seemed like the logical thing to do.

Their first office was above a pub in the Yonge and Eglinton area (currently a Firkin pub). Their launch coincided with the birth of the mortgage securitization market and so they thought they had great timing for a new business model. But apparently, the securitization market collapsed within weeks of their start. They nevertheless adapted and were profitable from the first year and started growing the team.

Since then, the mortgage market has grown enormously in volume and sophistication. The Big Banks are happy to fund “alternative lenders” who compete with them. All manner of risks can be parcelled and sold off to others. First National now has over $120B of mortgages under management (30% of which are commercial mortgages). It is the largest non-bank mortgage originator and underwriter in Canada, holding about about a 5% share of the single-family market.

Moray describes their respective strengths as follows:

Stephen is the big picture, analytical guy and I do what I’m best at in marketing and sales.

First National's logo is an acorn. The business was built step-by-step without some grand vision and started with virtually no equity and no backers. The key to their success was out-hustling their big competitors, especially on customer service. They also had a strong emphasis on leveraging technology. First National was like the original no branch disruptive fintech, innovating and competing against the banks. In the 90s, a pool of secretaries still had to type out mortgage commitments, which would take 30 minutes per loan. Stephen Smith had a coding background and so he started writing what would become the mortgage software MERLIN, now the industry’s leading approval and tracking software. As a result, First National went paperless 20 years ago.

For stock market investors, Home Capital Group is the better known non-bank mortgage provider in Canada, but over the past 15 years, First National has performed much better (320% return vs 120%). And with much less drama. A key difference is that First National bears minimal credit risk: for example, as of its 2020 annual report, it only has direct credit exposure to 2.4% of its mortgage book.

Moray says: The non-bank business model we have is what makes us special. We try not to take market risk and we make nickels and dimes but because we do billions of dollars a year in volumes...those nickels and dimes add up.

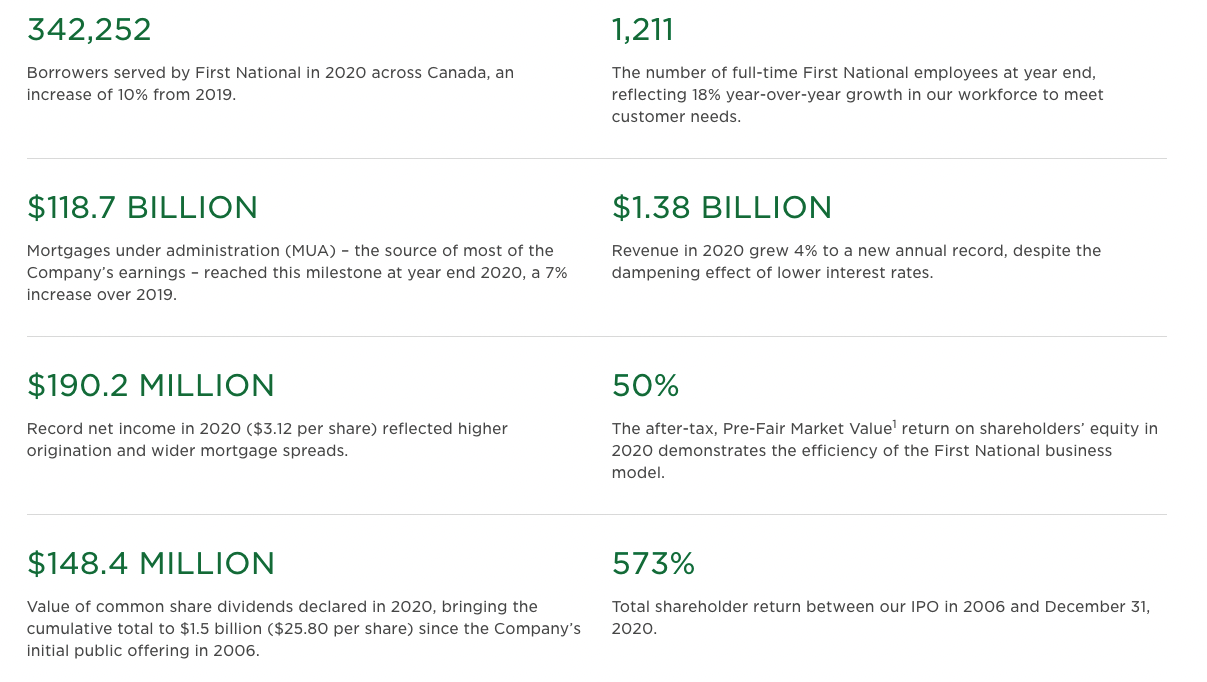

Starting from scratch, thirty-four years of following this recipe has added up to these numbers: