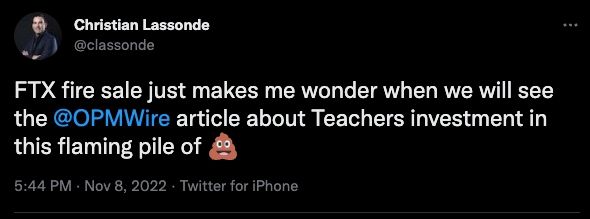

Following an in-depth Google search, OPM Wire can reveal that Teachers’ biggie Olivia Steedman bears responsibility for the pension fund’s investment in crypto flameout FTX. This is by virtue of her being the Big Cheese at Teachers’ Venture Group, the $8B growth investing arm. She also provided a supportive quote as part of the October 2021 $420m series B funding. Teachers was the lead investor in that round (with 80% confidence). Or alternatively, Teachers was at minimum a co-lead investor along with the venerable VC Sequoia (with 99% confidence). This is probabilistic reporting, a field I invented. Teachers invested again in January of this year, though not in a lead capacity. That money has now been essentially vaporized. Teachers’ has confirmed the exposure was US $95m. If you need background, FTX was the third largest crypto exchange in the world and was founded by one of the most famous crypto geniuses, Sam Bankman-Fried. In January, it got funding at a $32B valuation. It essentially blew up in the past week.

Olivia Steedman has been with Teachers since 2002. From her start up to April 2019, she was with the “Infrastructure and Natural Resources” division. Inexplicably, she then became Global Head of Teachers’ Venture Group. I am the first to say that venture investing is closer to voodoo than a science, but I would still think some actual VC experience helps. So she established that group and her first move was to invest in SpaceX, led by unstable genius Elon Musk. I also don’t understand why zero-judgment Teachers CEO Jo Taylor provided supportive comments about FTX as recently as September, saying:

“In terms of the risk profile, it is probably the lowest risk profile you can have in that it’s everybody else is trading on your platform.”

This is after he had the benefit of observing the various crypto implosions this year, including an investment by fellow pension fund the Caisse in Celsius. And I don't know why the CEO overseeing such a massive entity comments on an individual position overseen by a subordinate.

Teachers’ Venture Group has a strategy of generally being lead investor in series B rounds for growth companies with investments in the $50m-$250m range. In April 2022, Teachers announced it wanted to take venture assets to 10% of the pension plan’s net assets within 5-10 years vs a current 3%. They also want to open an office in San Francisco, in addition to their bases in Toronto, London and Hong Kong. That’s very reminiscent of what John Ruffolo wanted to do at OMERS shortly before he left under mysterious circumstances. I expect those plans will be adjusted as the tech nuclear winter is upon us.

Olivia trotted the ol’ pick and shovels line about FTX:

“FTX, importantly, is not crypto itself, it’s an exchange. We think of it as sort of an infrastructure play for us to enable the broader crypto markets as distinct from investing in a particular digital asset itself, which we haven’t done yet.”

Both Olivia Steedman and Jo Taylor’s quotes betray a spectacular lack of understanding of the structure and exposures of their investment. But that may well have been due to concealment or even fraud by the company. FTX failed because of its ties to a crypto trading hedge fund and its exposure to its own crypto token. There were some warnings signs, for example, in a 2019 lawsuit. Another strong red flag is that 99.99% of anything crypto is complete horsecrap. Many people now call the FTX founder, Sam Bankman-Fried, Scam Bankster-Fraud. As a practitioner of name-calling myself, I have to respect that. The Pension Pulse guy, the official propagandist of pension fund people as investment geniuses, has already delivered a lengthy apologia, which you are welcome to not read.

As a matter of basic intellectual honesty, it’s rarely OK to pick apart the outcome of a single investment. Especially in a venture strategy, which always implies many blowups in the pursuit of extreme gains. On the other hand, it’s fun. It will also prove right, simply because of adverse selection. Saying that FTX was a tiny weight is like saying “I only stole $20”. It’s what’s revealed about principles that matters. To second Olivia, she recruited a “bona fide” VC guy whose often repeated claim to fame is an investment in Instacart. Say it with me: even a blind squirrel occasionally finds a nut, that is no basis for an investment strategy. A sleepy Ontario pension fund has no business competing in global VC, just as I would say Sequoia probably shouldn’t try its luck doing oil and gas deals in Calgary. (Or consider as well, Lowe’s departure from Canada after losing more than $2B in 7 years.)