This is a comprehensive post on Third Eye Capital, primarily of interest to their clients and prospective clients.

I have been a little bit ambiguous on my position on Third Eye Capital (aka TEC). I will now correct that. Some people have said that they would not touch it with a ten foot pole. Security analysts use a term of art to designate an investment opportunity for which they have contempt. That term is “PoS”. I am not spelling that out, I am getting too many complaints about salty language. In our considered opinion, Ninepoint’s Third Eye Capital private debt fund is a PoS.

You might recall that Arif N. Bhalwani, CFA, the CEO of Third Eye Capital sent us two long whiny emails. One complaint he did not make about us is that we have an axe to grind. And you can rest assured that I barely knew anything about Third Eye Capital, until I was presented with some information. Information that came from a party that is just as distant and detached from Third Eye. We are simply going where the facts lead us and bringing to light analysis that is of public interest. Arif dismisses the King Street Food Company troubled loan we previously mentioned as a small weight with bright prospects. We'd be the first to say that it's the least of their problems.

Third Eye Capital's borrowers

You will notice in the Ninepoint Third Eye Capital fund’s marketing material that they don’t name their borrowers and they only list borrower initials on the audited statements. That’s a bit odd, but based on our team’s research, we were able to match the initials to various borrowers of TEC. Our grounds for the matches, beyond the letters game, are based on dealings of Third Eye with each of the mentioned entities.

Here we share some of our likely matches:

A common thread between some of TEC’s borrowers, representing more than 30% of Ninepoint Third Eye fund’s assets.

There is something that many of TEC’s borrowers have in common. Their board of directors is composed of TEC’s key-management personnel. We'll discuss how this comes about later. Here's what we found in the corporate records:

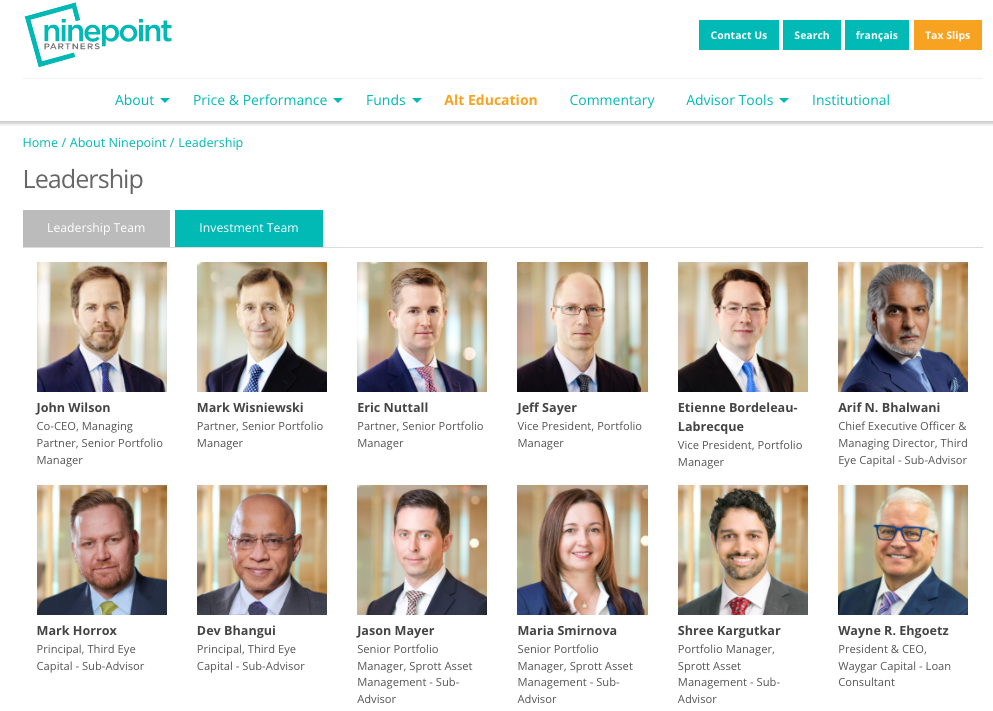

Ninepoint lists Arif, Mark Horrox and Dev Bhangui, as members of their investment team.

We asked Arif, why Ninepoint TEC Private Credit Fund’s Annual Financial Statements don’t disclose any loans or investments in related parties, and as part of his reply, he said:

Ninepoint-TEC Private Credit Fund (“NTPC”) does not have control or significant influence over any portfolio company and therefore its portfolio investments are not considered related parties of NTPC. Even though TEC entities manage or advise different funds that participate in the equity of portfolio companies (including those where the funds are collectively greater than 50% of the fully-diluted ownership), TEC does not have control or significant influence because each fund has different investment objectives, time horizons, and restrictions. No single fund controls the majority of voting equity or has significant influence over the portfolio companies.

If there is a governance expert out there, please help me understand his answer and why that doesn’t create a conflict worth disclosing.

The Third Eye workout playbook

Ninepoint Co-CEO John Wilson once characterized their private debt funds as “conservative”, a label that we feel does not apply to Third Eye. Investors who bought the Ninepoint-Third Eye fund looking for a reliable source of income might be surprised by their involvement in workouts, distressed financing and equity-like exposures. From various conversations we have had, the public perception about TEC is that every loan is secured by valuable assets with a low loan-to-value. So when things go wrong, the thinking goes, TEC would be able to just sell the assets and recoup their initial investments. Our findings can’t corroborate this thesis.

Before starting our discussion, we have to quote Arif again:

There is major dissonance between reality and the innuendo underlying your questions. You ask about loans that we made which were the subject or result of court supervised restructurings or arrangements, details of which you retrieved from the public record. That record describes events and outcomes related to proceedings involving dozens of court actions, applications, motions, rulings, appeals, judgements and orders over multiple years conducted in open, transparent, and fair legal forums. As I wrote to you in my email of September 23, we have occasionally and in rare circumstances had to intervene, takeover, or reorganize the assets and businesses of defaulted borrowers. TEC does not make loans to companies with the intention of taking them over; however, in rare circumstances, we must be prepared to do so in order to protect our investors’ capital. Distressed borrower restructurings require highly specialized and unique skills and experience, and TEC has made this a core competency. TEC has an exceptional track record of taking over defaulted borrowers, fixing them, and then harvesting or selling them for significant value. Restructurings are complex public processes that are costly and intimidating to the uninitiated, but it is precisely such complexity and inefficiency from which we derive our edge.

It would be naive to think that a lender has never done a losing deal. So, as Arif concedes, Third Eye has had to intervene and take over the assets of defaulted borrowers. But we wouldn’t qualify Third Eye being embroiled in insolvencies as “rare” and question the claim of an “exceptional track record of taking over defaulted borrowers, fixing them, and then harvesting or selling them for significant value.” Taking over an asset is not the same as getting paid back.

The borrowers we document in this post are quite material to the overall Ninepoint Third Eye fund - representing more than half of the value of their investments - and should compel investors to ask serious questions, as we tried. You will see multiple instances of the King Street Food Company pattern repeating. That pattern is broadly as follows:

- TEC extends an ostensibly “overcollateralized” loan to an ostensibly “underappreciated” company, with prospects of getting double-digit interest rate payments and in some cases, significant equity sweeteners. A clear sign of conviction in the underlying business fundamentals.

- Time passes, the company assets can’t generate enough cash flow and struggles to make a profit. The financial condition deteriorates. Third Eye grants concessions.

- The company becomes insolvent and asks a court for creditors’ protection.

- The collateral goes to market, and none of the offers received provides a purchase price sufficient to repay senior lenders (chiefly, Third Eye) in full.

- TEC emerges from the process as the buyer of the assets and assigns them to a new entity controlled by key personnel of TEC, blurring the lines between borrower and lender. And yes, while a court does oversee the process, it is not a court’s responsibility to check how a creditor accounts for their profit or loss on their books. Imagine a court policing how a bank accounts for loans to insolvent entities. That just doesn’t happen!

On to some examples of this pattern.

One of the oldest vintage TEC loans … USA Synthetic Fuels Corp mutates into American Future Fuels Corp

In 2012, Ninepoint-Third Eye fund's predecessor bought some notes from a subsidiary of USA Synthetic Fuels Corporation. The borrower had big ambitions, intending to develop a synthetic natural gas facility to convert coal, petroleum coke and biomass into environmentally cleaner energy sources. Then in mid-2014, USA Synthetic Fuel disclosed that its accounting practices were under investigation by the SEC. In March 2015, the company filed for Chapter 11 bankruptcy.

TEC had an outstanding claim of US$31.6mm and agreed to acquire all of the assets of USA Synthetic Fuel. They paid US$15mm using their claim as currency (ie a credit bid). As part of the agreement, TEC assumed all the liabilities related to the notes issued in 2012. The assets were bought under the name of a newly created company, American Future Fuels Corporation.

When TEC first got a hold of the USA Synthetic Fuels project post-bankruptcy in 2015, Arif expressed confidence, declaring to a local newspaper: “We remain very enthusiastic about the project and have the means and conviction to see that project ultimately get built.” (Incidentally, Arif always expresses himself with supreme confidence. He is very smooth and knows all the best words.)

However, three years later, American Future Fuels Corporation sold the land where the project was supposed to be built for US$1.9m. The mayor of the city said about the transaction: “I just felt that the folks who owned it in Toronto did not have a plan for development and I thought it was very important to get the real estate back into the hands of a local set of decision makers.”

American Future Fuels Corp invests in an O&G producer and Conifer emerges

In June 2017, American Future Fuels Corporation steered away from its predecessor’s goal of producing clean energy. They decided to provide just under US$19mm in preferred equity to Accel Energy Limited, the parent company of Accel Canada Holdings Limited, an oil and gas producer in Northern Alberta. That deal opened the door to further investments in this new oil venture.

Then, between November 2017 and April 2018, TEC committed over $240mm in loans to Accel Canada Holdings. Ninepoint-Third Eye fund alone committed a total of $135mm (10% of AUM today). In connection with the credit agreements, Accel Canada Holdings issued warrants to TEC, to acquire 15.0% of the company’s equity. Two years after TEC’s initial investment, Accel Canada Holdings Limited became insolvent.

TEC's Mark Horrox summarized the insolvency in an affidavit as follows:

“TEC is by far the largest creditor of the ACCEL Entities and as such it will be impacted and potentially prejudiced, more materially than any other creditor in this restructuring. TEC is owed over $350 million by the ACCEL Entities and their affiliates, and the next largest creditor of Accel Entities, Stream (or possible Regent/ICC) is owed approximately $90 million.”

Stream Assets Financial Winterfresh LP was the secured creditor of a subsidiary, Accel Energy Canada Limited. TEC claimed they had seniority over the subsidiary, but Stream thought otherwise. Accel Canada Holdings also showed an indebtedness of $41m to ARC Resources, for a residual balance from an asset sale previously funded by TEC.

When the collateral went to market, before the pandemic, none of the bids received were commercially and/or economically viable and none were acceptable to the secured creditors. Then, Stream and TEC each submitted a bid for the assets. When comparing the bids, the monitor said to the Court, that Stream’s offer provided “no recovery of the approximate $335 million owed to Third Eye” In order to select a bid, the Judge asked the parties to negotiate. TEC reached a confidential agreement with Stream.

Following King Street Food Company’s playbook, TEC acquired the assets. Again, Mark Horrox said that they paid $471 million, “comprised of a credit bid of existing debt owed by ACHL to the secured lenders arranged by TECC in the amount of approximately $335 million, and approximately $136 million in cash to pay certain amounts.” It’s worth asking if part of the cash went to Stream in order to compensate their seniority. In any event, $471m is a lot of money in the context of a $3b AUM firm, wouldn’t you agree?

This time, the bid was assigned to another newly-created entity called Canadian Future Fuels Corp. CFFC ended up acquiring all of the assets of the Accel entities. The whole insolvency proceeding lasted almost two years. Canadian Future Fuels Corp has since changed its name to Conifer Energy Inc. This is not what we would call an exit from a troubled loan. The secured lender became the owner of the borrower’s assets. The same assets that were not able to cover their cost of debt and that no one seemed to like. It looks more like kicking the can down the road.

What about the condition of Accel’s assets? Earlier this year, Accel Energy Canada spilled over 100,000 litres of “sour emulsion” from a pipeline. No impact to water bodies or wildlife were reported. But the receiver expressed concerns about the age and condition of some of Accel’s assets as an ongoing risk of more serious incidents. Third Eye recently signed the United Nation’s Principles for Responsible Investment pledge and is committed to including ESG in its investment decisions. The ESG commitment is at odds with TEC’s decision last year, of just acquiring half of the wells of another failed borrower, Ranch Energy Corporation. The rest of the wells were dumped into the BC’s Orphan Site Reclamation Fund, doubling the number of orphan wells in BC. Those assets were assigned to Erikson National Energy. If you want to know more about Erikson’s ventures you can read this article.

Remember the Accel warrants? Well, it seems that Ninepoint-TEC Private Credit Fund thinks that ACHL warrants have appreciated in value, as reflected in their December 31, 2020 audited statements. ARC Resources, in contrast, “re-estimated the likelihood of collection as zero percent” and wrote down their claim, even as it had a higher priority than warrants. See ARC's audited statements here. Who is right? We will let the reader decide. Here’s the discrepancy in summary form:

As you have seen, we had reasonable grounds to ask Arif about their expected credit losses. Rather than answering specifics, he just ranted on with this: :

You question our expected credit loss provisioning. Our valuation framework is robust with several checks and balances involving internal committees and multiple parties independent of and external to our investment team or the management of our funds generally. This includes a large expert, third-party valuation firm, responsible for independent oversight over the valuation process and independent verification of key determinants of the valuation analyses prepared by the valuation manager (another outside party), to provide objective valuations of our loan portfolio every quarter. Our internal control environment has been lauded as “best-in-class” and is regularly tested through operational due diligence audits conducted by and on behalf of our direct institutional clients, including Ninepoint Partners.

If you feel protected by the oversight of Third Eye, provided by firms like Ninepoint and Montrusco Bolton, you could ask investors of Ninepoint Trade Finance Fund and Montrusco Bolton/Ardenton Private Equity Income Fund what they think about those firms' ability to supervise an advisor.

Ninepoint very recently deleted from their website their Ninepoint Trade Finance Fund. The fund, which used Highmore Group as an advisor, dropped more than 6.5% in June and posted subsequent negative months. A steep fall for a fund that was sold as senior secured and “fully collateralized and insured.” You can read more about the Highmore debacle here.

Montrusco also took offline the references for the MBI/Ardenton fund after the advisor and debtor to the fund, Ardenton Capital, became insolvent. Montrusco is currently involved in the CCAA restructuring, hoping to get investors’ money back. The equivalent of Arif at Ardenton Capital, resigned during the summer, saying that business operations are not his particular skill set. And yes, he was supposed to be a private equity manager.

If you still have faith in auditors being infallible, just a quick reminder that Ninepoint-Third Eye fund is audited by KPMG, Bridging Finance’s auditor.

Third Eye is not the only private debt manager with equity-like exposure to the Accel entities. An entity called JBC-BC Holdings, also had a $21 million exposure to a preferred shareholder of Accel Canada Holdings Limited. JBC-BC has R. Christopher Morris as director, and shares a mailing address with RCM Capital, one of the private lenders duped by Gary Ng and Bridging’s lender of last resort. Consequently, another entity represented by Christopher Morris, DGDP-BC Holdings went for a long legal battle with TEC, over the terms of the DIP financing to the Accel Entities.

A borrower targeted by an investigative short-seller.

Aemetis Advanced Fuels Keyes is a subsidiary of Aemetis Inc, listed on the Nasdaq under the ticker AMTX. The company had more than US$200mm of accumulated losses in the last 10 years - reporting an operating profit in just two years out of the last ten. Fortunately, Third Eye was there to finance this deficit with over $150mm in loans and $30mm in preferred equity, since 2008. But TEC’s business expertise, which Arif claims is how they add value as a lender, has not helped AMTX to make a net profit since 2014.

Of course, in the meme-stock era, losses mean you have vision. So with recent announcements of entering the EV truck industry and “below zero carbon renewable fuel”, the stock price has soared by 8x in the past year, to nearly US$600m in market cap. Lately, insiders have been dumping their shares.

This price movement attracted skeptics. Culper Research, an investigative short-seller, has issued two scathing reports on the company. Nate Anderson of Hindenburg Research, who has a great track record of calling BS from EV transportation companies (eg Nikola and Lordstown Motors) also expressed his concerns.

$AMTX:

— Nate Anderson (@ClarityToast) November 12, 2021

-Cash: $6.3m

-Quarterly cash burn: ~$6m

-Debt: ~$152m

-Current ratio: 0.23

-Preferred: $47m

-Mcap: $633m

That balance sheet + bucket shop brokers issuing “buy” ratings…

My guess is an offering and Stifel leads…$37 PT wins the turd polishing contest. pic.twitter.com/3LhNx3sxWA

We could keep writing about other aspects of Ninepoint-Third Eye fund’s portfolio, like their +20% concentration to companies controlled by Steven Muzzo and how the playbook has repeated with some twists, like GoGel’s acquisition of Tangelo Games. But the above should provide more than enough red flags to justify our PoS rating.

You can read our previous posts on Third Eye Capital in the private debt funds section.