Ian Ball, at age 38, is one of the youngest CEOs in mining and a long-time protégé of gold mogul Rob McEwen. Ian runs Abitibi Royalties, which has a market cap of about $230m. Ian has had a meteoric rise, working in McEwen’s orbit since graduating from university in 2004. He started by analyzing opportunities for McEwen Capital and then took on operational roles at various holdings. By age 31, he became President of McEwen Mining. Ian is a consummate networker, a go-getter as well as a go-giver. He's like the gold version of Tracy Britt Cool.

Ian had a lot of major responsibilities early on, dealing with big investors, raising a lot of money and advising on large M&A. Given McEwen's high profile, he had the chance to learn from Bay Street grandees like Seymour Schulich, Gene McBurney and Charles Baillie. In the early days, McEwen Capital was compounding at 80%. How did Ian get to work for McEwen? He met him by chance and from that point on just hounded him, ultimately waiting outside of a hotel for 3 hours to hand him his resume. Ian Ball was not academically inclined initially. Which might explain why he attended - forgive me for saying this - Ryerson University. But maybe that was a strategic choice, because he graduated first in his class of over 1,200 students. [I’m kidding about Ryerson - this might actually be the optimal strategy - doing your undergrad at a university where you’re the big man on campus and leveraging that into an elite masters, or a great job and a lifetime of irrational self-confidence.]

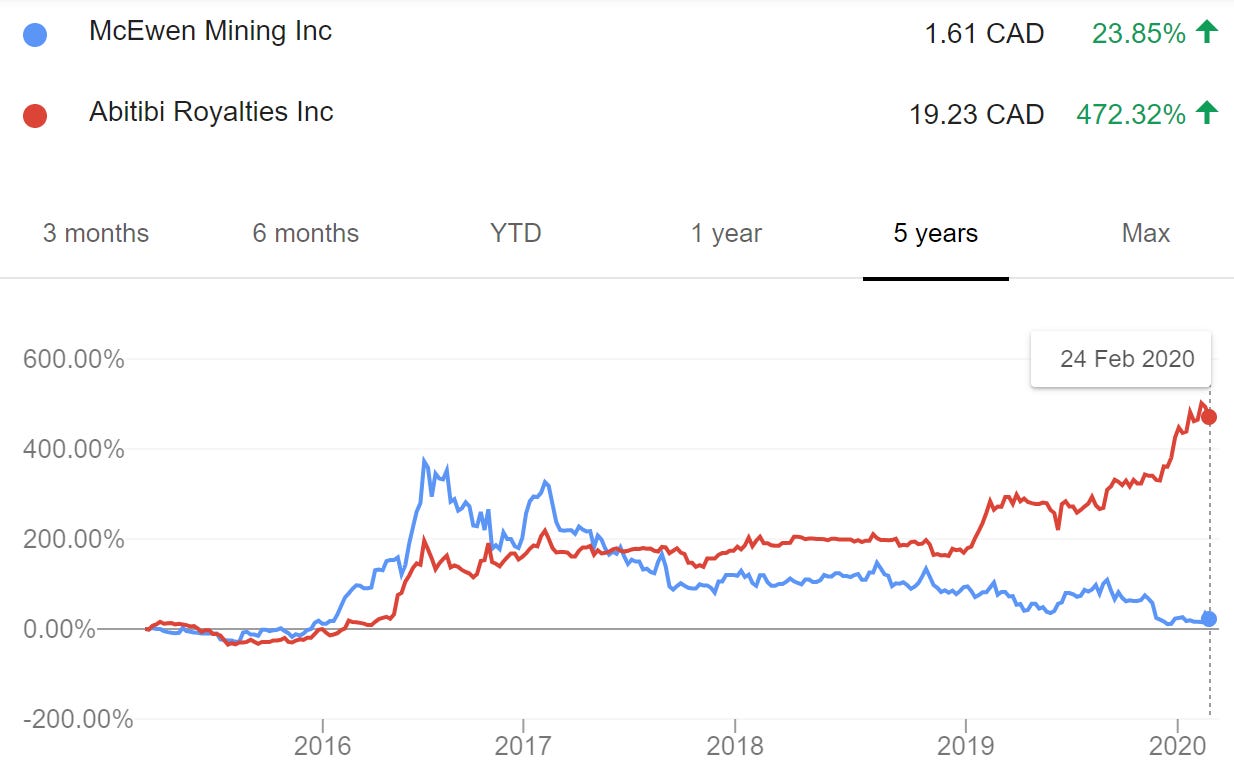

Ian found running McEwen Mining involved too much putting out fires, so in 2014, he made the bold decision to call Abitibi’s then CEO Glenn Mullan to ask him for his job. The reasoning was that Ian would bring financial skills, while Glenn had the geology background. Surprisingly, Glenn accepted and moved to a Chairman’s role. I am very impressed by this ballsy move. The company back then had a few assets, $40k in the bank and $600k in debt. Ian’s tenure so far has been transformative and the stock has gone up more than fourfold. Ian's goal with Abitibi is simple: "to become the best gold company" (measured by ROI). This presumably means better than McEwen Mining.

Ian Ball has said that he has been watching and thinking about gold mining since the age of 5. Yet, paradoxically, his hero is Warren Buffett. Some of the Buffettesque principles he has adopted include keeping his share count low and being personally invested. Also, focus: he believes the best gold companies are propelled by having One Great Mine. Ian now focuses on the royalty business model, saying it’s an easier, better game.

Abitibi Royalties has the fewest shares outstanding of any mining company in the world with a market capitalization in excess of $100m. Bringing basic capital allocation rationality to the mining world is a good idea. So Ian Ball could be the big man on campus once again. Rob McEwen also had an investing background before jumping into mining and making a fortune. Ian currently owns about $5m worth of Abitibi and uses his entire after-tax compensation to buy more shares.

I have no opinion on the stock. I was reminded of Ian Ball while reading the Canadian Value Stocks blog, which flagged him as an unconventional thinker. I once toyed with a strategy called Iconoclastic Management at Any Price (iMAP). Such a strategy would have picked up Buffett, but also Enron and Valeant. I still think this strategy is not terrible. Ian definitely qualifies as iconoclastic and talented. Also, he has said that he wants to become the Prime Minister of Canada.

Now, this would not be an authentic OPM Wire piece if I didn't inject some polemics. So here's the 5-year chart of McEwen Mining compared to Abitibi Royalties. (Though to be clear, McEwen backs both companies and Ian Ball, having been President of McEwen Mining prior to joining Abitibi, might not be entirely blameless in its fate. I will let them fight it out.)

As you may know, I am looking for the Smartest Person on Bay Street...I would especially like to uncover up and comers in the mold of Ian Ball. If you know such people, please share.