“Zero-coupon (or PIK) bonds offer one overwhelming advantage: It is impossible to default on a promise to pay nothing.” - Warren Buffett

The sultans of private debt are in dire straits with The Globe. Last week, The Globe’s Tim Kiladze reported that 38% of the loans in the Ninepoint TEC fund have not required cash interest payments since inception (aka payment-in-kind or PIK loans). Also, 25% of the loans had the option to pay-in-kind. Meaning that loans representing 63% of the loan portfolio are allowed to accrue interest until maturity rather than making regularly scheduled cash interest payments. Third Eye disputes the figure, though not to the point of providing its own.

According to Bridging Finance’s receiver, “62% of the total Asset balance [of the Bridging Funds] as at March 31, 2021 were PIK Loans.” Third Eye Capital would certainly want to distance itself from any similarities with Bridging Finance.

Here again is the famous investor and bigamist Warren Buffett with some thoughts about PIK debt securities:

“The zero-coupon or PIK bond possesses one additional attraction for the promoter and investment banker, which is that the time elapsing between folly and failure can be stretched out. This is no small benefit. If the period before all costs must be faced is long, promoters can create a string of foolish deals - and take in lots of fees - before any chickens come home to roost from their earlier ventures.”

Ninepoint and Third Eye Capital published a long rebuttal to The Globe piece. Their stated goal was “to correct the misinformation contained in the article published”. Ninepoint expressed its disappointment “that a major Canadian news organization published an article without proper due diligence and sufficient analysis.” Sad! I hate when that happens.

As you know, I hate conflict, so I am happy to mediate between these formerly close friends.

The Globe also highlighted the contradictions between Ninepoint and Third Eye Capital’s assessment of their strategy’s underlying risks.

The article mentioned that three borrowers made up 55% of the loan portfolio! We already raised the concentration risk and many other red flags in our review of the Ninepoint TEC fund, available here.

Events after our initial coverage of Ninepoint–TEC

Ninepoint blamed our review and the mood after Bridging’s collapse when in early 2022, it received redemption requests amounting to about a quarter of the fund. They then decided to gate the fund and split the Ninepoint-TEC fund into a liquidating fund, for those investors who really wanted to get out, and a continuing fund, for those investors that wanted to stay (Ninepoint-TEC II).

Ultimately, the liquidating fund was left with $144m in AUM as of October 2022 (just one month after the fund was terminated), while the continuing fund, Ninepoint-TEC II, currently reports $1.28 billion in AUM. This implies that Ninepoint-TEC was not able to withstand a ~10% level of redemption requests, despite Ninepoint’s promise of monthly redemptions.

Before all this redemption rush, John Wilson appeared well acquainted with the problems of asset-liability mismatch, which can often “cause some problems”, as he says here:

John Wilson on liquidity

Ninepoint and Third Eye Capital always seem to have a ready answer for every concern, but words only go so far. It’s very healthy that a fund that has been around for more than 10 years, during “the free-money era”, faces the crucible of having to deliver cold hard cash.

Ninepoint’s rebuttal to The Globe & Mail would fail a Finance 101 exam.

We found a theoretical flaw in Ninepoint and Third Eye’s assessments of PIK loans. We noticed some inconsistencies with Ninepoint’s statements, as well.

Let’s start with the theory.

Ninepoint and Third Eye seemed to be mad at The Globe for making PIK loans sound risky. Third Eye explained that PIK loans do make cash payments upon the occurrence of certain events, such as asset sales, third-party financings, grants or insurance claims. But the essence of a PIK loan is clear: it minimizes cash disbursements to the lender until loan maturity. The eminent credit guru Howard Marks referred to these kinds of loans as “loosey-goosey structures.”

Third Eye’s position can be summarized from their response to The Globe’s claim that PIK loans pay a higher interest, as follows:

The Globe: "These loans can reward investors with more interest when they mature, because the borrowers typically pay a higher interest rate in a lump sum. However, PIK loans can also be riskier debts because no income is promised until maturity, which can be years out."

TEC Response: “The interest rate does not increase by virtue of a loan being structured with a PIK. And it is untrue that “no income is promised until maturity” as described above.”

The response shows a lack of understanding of the most basic concept in finance: Time value of money. All else being equal, any rational investor will demand a higher interest rate from a PIK borrower than a cash-payment borrower. As Buffett said: “In the end, it all goes back to Aesop, who in 600 BC said that a bird in the hand is worth two in the bush.”

We consulted the millenial’s bible of finance, Investopedia, which says “in-kind payment assessments are often charged at a higher rate of interest than cash payments.”

Now, let's go to the evidence.

We base our research on Ninepoint and Third Eye Capital’s fund update presentation from March 30, 2022, where they discussed its top-5 holdings. The borrowers were: Conifer Energy, Trilliant, Erikson/Pieridae Energy, Aemetis and GoGel Holdings. Taking into account public information and the current fact sheet of the fund, we believe these top-5 borrowers haven’t changed. According to the fund fact sheet, the top-5 issuers today represent a staggering 71% of the fund’s NAV.

Third Eye Capital claims that the fund historically exits investments in less than 24 months, excluding defaulted borrowers. Top-5 borrowers have been in the portfolio for at least 3 years.

In the rebuttal, TEC claimed that “The average time to exit for the Fund’s investments have historically been less than 24 months, excluding renewals of performing investments or portfolio companies that were acquired as result of a foreclosure or restructuring due to default and enforcement.”

That average, without including the failed borrowers, is meaningless. What really matters for Ninepoint-TEC’s investors is how long the top-five borrowers have been part of the fund’s portfolio. The answer is more than a couple of years. For example:

- Pieridae Energy, closed its financing with TEC in October 2019, 39 months ago (3.25 years).

- Conifer Energy’s predecessor, Accel Energy received financing from Ninepoint-TEC on November 3, 2017, 63 months ago (5.25 years).

- GoGel Holdings' predecessor, Imperus Technologies completed a financing with Third Eye Capital on January 30, 2015, 96 months ago (8 years).

- Aemetis has been financed by Third Eye Capital since May 2008, 176 months ago (14 years).

In our initial review, we explained how Conifer Energy became the roll-up of Accel Energy and USA Synthetic Fuels. We have nothing to add on that front. Instead, we will focus on the top borrowers that we didn’t discuss previously.

The reader will then have enough evidence to test the claims made by Ninepoint and Third Eye Capital such as that “[c]urrently 99.8% of the portfolio are performing loans.”

Trilliant: a “pure-PIK” loan to finance an MBO by a management team that has repeatedly failed to tap equity markets.

One top borrower with “pure-PIK” terms is Trilliant Holdings, an affiliate of Ozz Electric (also a borrower of Ninepoint-TEC as of March 2022), an entity controlled by Steven Muzzo. Muzzo appears to be part of the bloodline of the billionaire family involved in construction, although he’s not a managing member of the family’s main businesses. According to Toronto Life, Muzzo was also involved with the King Street Restaurant flop.

In a Report to Limited Partners of the Montrusco Bolton-TEC fund, Third Eye described Trilliant as a “spin-out from Ozz Electric in Toronto, Canada in 2007 with Steve Muzzo (“Muzzo”) as its founding shareholder.” According to the report, “In Nov-2018, Muzzo approached TEC to finance the purchase of the Preferreds [convertible preferred shares issued by Trilliant between 2008 and 2010 to venture capital investors to raise $188m] in order to stop a forced liquidation of Trilliant by the Preferred Holders, which had reached the end of life on their investments funds.”

The Trilliant buyout wasn’t the only time that TEC has backed Steven Muzzo’s buyback of businesses he had founded. In December 2020, TEC financed Muzzo’s acquisition of Cricket Energy, a provider of energy/metering solutions. The transaction was “valued at over $200 Million.”

On March 30, 2022, Third Eye Capital communicated to Ninepoint-TEC investors that “the contractual maturity for Trilliant is November 2023 … but we expect … an exit prior to that, in the back end of 2022 through a public listing.” In the call, Arif N. Bhalwani said “we are also in discussions for [sic] Trilliant about an IPO.” 2022 ended, and the IPO didn’t happen.

We have doubts about the feasibility of Ozz-Electric affiliates going public. In 2007, it was expected that Ozz Corp (a company founded by Steven Muzzo that provided software to run energy-efficient houses and businesses) would file paperwork to raise $70m. There are no traces of an issuer named Ozz Corp in Sedar or Edgar. In 2017, Ozz Electric itself couldn’t complete a mere $23-million private placement, on acceptable terms, and terminated its plans to go public through a reverse-take-over. If Muzzo couldn’t make it in the free-money and spac-mania era, we doubt he can now attract capital to pay a nine-figure debt to a lender. We believe that Ninepoint-TEC investors should expect more promises similar to Trilliant’s IPO.

Aemetis: the “case-study” of how Third Eye Capital is willing to pour money into a “dumpster fire.”

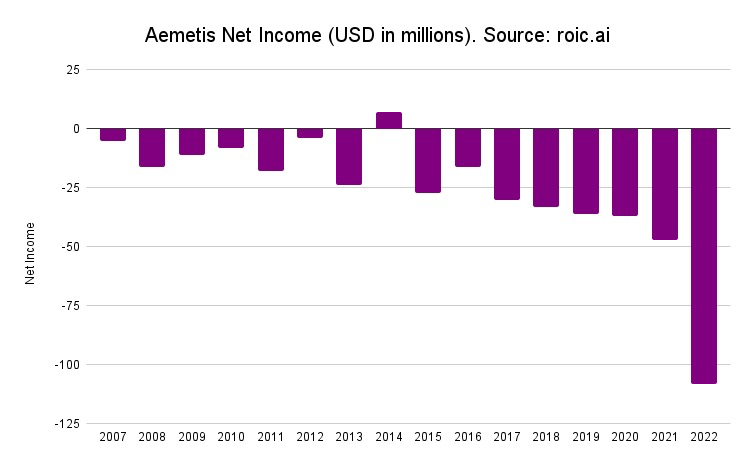

Let’s look into what Arif Bhalwani refers to as a “case-study” borrower, AEFK, a subsidiary of Aemetis. Despite Third Eye Capital’s claim that AEFK is “performing,” Aemetis financials paint a different picture. According to the latest quarterly financial statements, during the first nine months of 2022, Aemetis reported negative gross margins. For every dollar of sales, it lost 2 cents, before any SG&A and interest payments to TEC. Aemetis' cash balance as of September 2022 was US$251k.

With Aemetis’s precarious cash balance and an unprofitable top-line operation, on February 9, 2023, Third Eye Capital, as the agent of Protair-X (another borrower of Ninepoint-TEC controlled by TEC) had no other option but to waive and defer a US$116m payment from Aemetis. Besides that commitment, Aemetis owes ~US$150m to Third Eye’s funds.

How can you sleep when you are owed ~$350m by a company with US$251k in cash, that operates with negative gross margins, and that has reported a loss in 14 of the last 15 years? I guess Arif sees a different reality. He tells Ninepoint-TEC investors that Third Eye has been “an instrumental part of their [Aemetis] growth.” Maybe he means growth in net losses.

Aemtis, has been described by a short seller as a “dumpster fire” with a history of making unrealistic promises. On February 10, 2023, the company filed a presentation projecting a 77% 5-year CAGR for its EBITDA. However, the company also disclosed capital expenditures of US$214m for 2023 and US$419m in 2024 in order to complete the projects that will enable the EBITDA growth.

In 2006, the SEC sanctioned Aemetis’s CEO Eric A. McAfee with a cease-and-desist order, after he provided misleading disclosures regarding revenues of a public company he ran previously.

How Aemetis will generate cash in the next few years to fulfill its capital expenditures and pay Third Eye Capital is one of those questions that will yield enchanting answers from Third Eye and Ninepoint. Despite all the claims made by Arif Bhalwani, all the evidence suggests that Aemetis is a PoS.

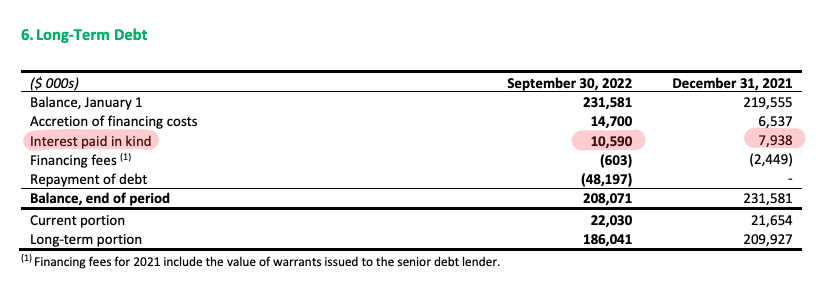

Pieridae Energy: a top-3 borrower deferring payments and paying interest in-kind in contradiction to TEC’s claims.

Aemetis is not the only top borrower to have deferred payments to Third Eye Capital. In October 12, 2021, Pieridae Energy announced that Third Eye Capital agreed to delay a $50m payment until January 4, 2022. When that day arrived, despite finding itself in the midst of redemption pressures, Third Eye Capital agreed to defer Pieridae’s payment again until October 2023.

Pieridae's current priority is to refinance TEC’s debt, which bears a 12% interest rate. Pieridae has been a beneficiary of higher commodity prices. But even under the current environment, the company posted a net loss for the quarter that ended in September 2022. Net income for the first 9 months of 2022 is positive.

In March 2022, TEC described Erikson/Pieridae as one of its top-5 borrowers. The latest fact sheet from Ninepoint-TEC II, shows that among the top-3 borrowers, there are only two Canadian “Energy – Integrated” borrowers. We assume that one is Conifer and the other is Erikson/Pieridae. There are no other Canadian energy borrowers in the current top-5.

In their rebuttal, Third Eye Capital, referring to the top three portfolio companies by NAV said: “None of these borrowers are ‘deferring cash interest.’” However, Pieridae’s Q3-2022 financials contradict TEC’s statement. The financials read: “For the three and nine months ended September 30, 2022, interest was paid-in-kind in accordance with the term loan facility agreement.”

GoGel Holdings: another roll-up of a failed borrower promising the sale of a subsidiary that has declining revenues and negative EBITDA.

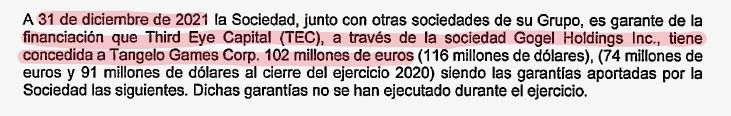

As a brief recap, GoGel Holdings is the roll-up of publicly-traded Imperus Technologies (later renamed Tangelo Games), which in 2015 received close to US$70m in financing from Third Eye Capital, to acquire two social gaming companies. One was Dwipi Ltd in Israel, and the other was Akamon Entertainment in Spain. The acquisitions failed to generate growth, and the stock price tanked. In 2018, GoGel Holdings took the company private for $4.7m.

Back in 2018, GoGel Holdings was described as an affiliate of Third Eye Capital. GoGel’s only directors as of October 2021 were Dev Bhangui and Casey Howell, both members of Third Eye’s investment team. They were appointed as directors in June 2018, shortly before Tangelo going private. As a reminder, a board is elected by shareholders to represent their interests in a company. Interests that are often in conflict with those of debt holders. Ninepoint’s Independent Review Committee, serving the Ninepoint-TEC fund, didn’t discuss this transaction in its report covering the period from January 1, 2018 to December 31, 2018.

On March 30, 2022, Arif told Ninepoint-TEC investors they were in “discussions for partial exits … at GoGel for the sale of a subsidiary.”

Later in the same presentation, Dev Bhangui provided more details about GoGel Holdings. He said: “one of the subsidiary businesses is in Spain, is being prepped to sale by Q3 of 2022, and we are already engaged with the bankers and potential suitors.” The slide accompanying the presentation said “Tangelo expects to sell business in Q3-2022 engaged with bankers and potential suitors.”

Tangelo Games Spain SL is Tangelo’s subsidiary in Spain. The company's latest public filing, from July 2022, contains its audited accounts for the years 2021 and 2020. Here is what we found:

According to public records, there hasn’t been a recent change of directors. One would expect that would be the case if the subsidiary had been sold. Based on the reported figures, we will let the reader decide how much Tangelo Spain can fetch in a sale.

Tangelo Games Spain SL's audited accounts also reveal that Tangelo Games Corp, through GoGel Holdings, is the beneficiary of a €102m financing from Third Eye Capital as of December 31, 2021. That figure was €74m at the end of 2020.

Third Eye Capital claims Ninepoint-TEC has never realized a loss on invested capital since its inception.

In its rebuttal, TEC highlights that its “downside risk protection (i.e. capital preservation)” is based on the seniority of its loans and the valuable assets available as collateral. According to TEC, “These attributes have resulted in the Fund not suffering any realized loss on invested capital since inception.”

With loans to insolvent companies such as King Street Restaurants, USA Synthetic Fuels Corp, Accel Energy, OpsMobile, Ranch Energy and Noveko International, we found the no-loss claim odd and somehow magical. Third Eye’s claim reminds us of the classic bagholder quote: “You don’t lose if you don’t sell.” However, those borrowers did try to sell their collateral, as touted by Ninepoint, but they fail to do so at a price sufficient to repay their debt.

Last time we heard this magical no-losses claim was from Bridging Finance.

David Sharpe's no-losses claim

Coincidentally, David Sharpe also touted a senior secured and overcollateralized strategy as a secret to his ostensible success. Don’t forget that Bridging Finance was part of the Ninepoint family of funds until 2018. Ninepoint even provided supportive comments when they parted ways and highlighted the positive monthly returns. Ninepoint is the closest I will ever come to witnessing unconditional love.

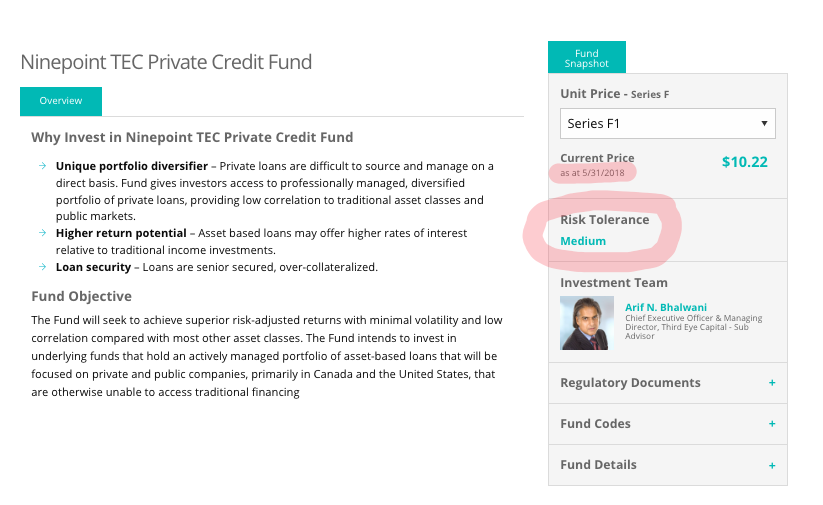

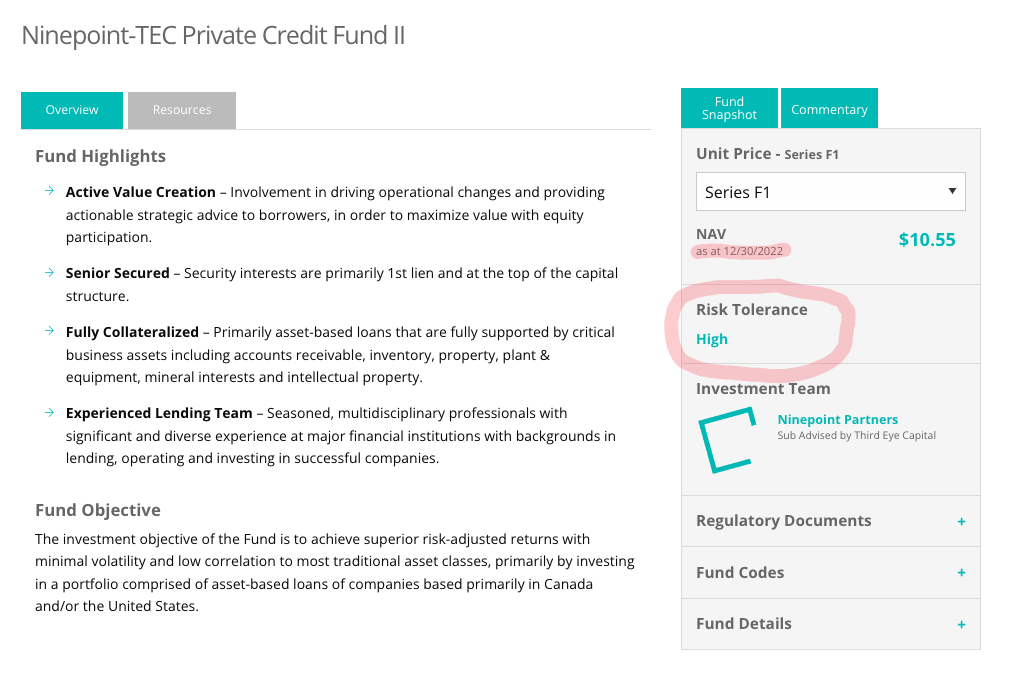

Ninepoint has changed their representation about the Risk Tolerance of the Ninepoint-TEC strategy from Medium to High.

Opening the rebuttal, Ninepoint and TEC maintained that they “have never represented the investment strategy to be anything other than what it is: managed by a sophisticated team that can analyze and structure complex senior secured loans with borrowers that traditional cashflow-based lenders won't lend to.”

However, back in 2019, John Wilson didn’t mention any complexity or high risk when promoting Ninepoint’s private lending strategies, of which Ninepoint-TEC has always been the most significant. Instead, he described how their managers looked at the collateral value in case they need to “burn the place down” in order to get their money back. That sounds safe. When asked if it was a “pretty conservative view” he replied “yeah.”

John Wilson on "conservative" strategy

Third Eye Capital differs, its recent marketing material highlighted that “TEC strategy is high risk.” In that presentation, TEC described its well-known strategy as: “To provide secured loans to good companies that are stressed or undergoing change and fall out of scope of banks and other financing sources due to their complexity and perceived riskiness.”

Contrary to Ninepoint and Third Eye Capital’s assertion, their representation about the strategy has changed over time. Older versions of Ninepoint-TEC website, from June 2018 until August 2021, showed that Ninepoint marketed the strategy with a “Risk Tolerance” of “Medium.”

Today, the “Risk Tolerance” of Ninepoint-TEC II is “High.”

That bank memo also mentions that 56% of the loan portfolio is to entities either owned or controlled by Third Eye Capital’s funds.

According to the internal bank memo that has been circulated and reviewed by The Globe, 56% of the loan portfolio is composed of borrowers that are either owned or controlled by other Third Eye Capital funds.

Here is where we see really complex situations. Third Eye often owns the whole capital structure of a borrower, as a result of asset impairments, as we previously reported. This creates a conflict, that as of the 2020 audited financial statements of the funds, was not disclosed to investors of Ninepoint TEC.

In its rebuttal, Third Eye acknowledges that some of these “owned” borrowers have the option to PIK. TEC claimed: “decisions whether to pay interest in cash or reinvest the cash are based on the ongoing cash flow needs and investment plans of the portfolio company.” Definitely, accommodative terms negotiated between TEC as a borrower and TEC as a lender. Most owned borrowers are the result of failed borrowers. This makes us question if these businesses can even generate a positive ROIC?

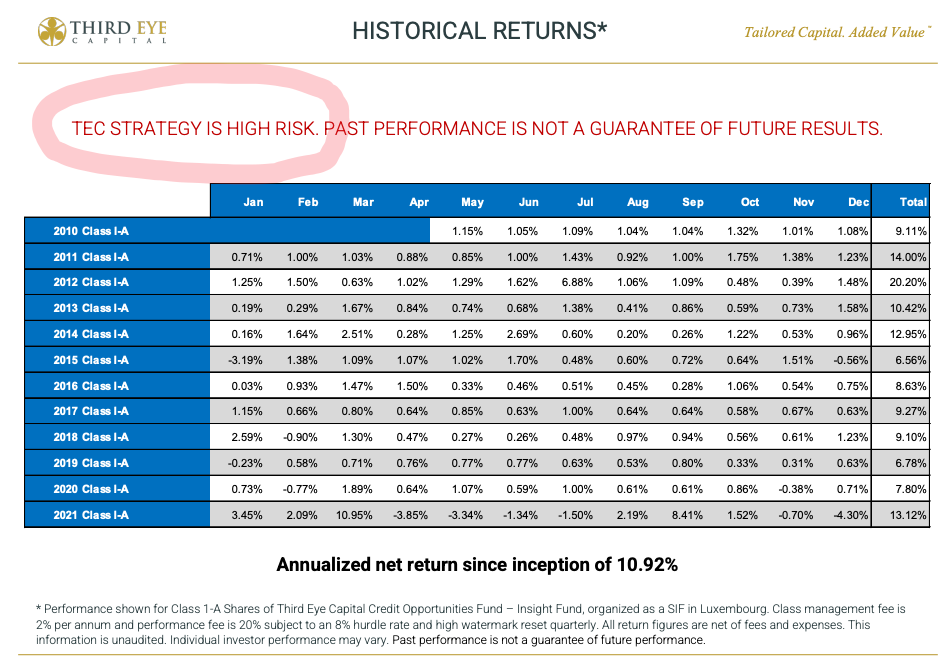

Third Eye Capital's investment allocation between its own funds generates further conflicts. As a result, some TEC funds have better returns than others. For example, in 2021, Ninepoint-TEC returned 10.43% net of fees. While Third Eye Capital Credit Opportunities Fund – Insight Fund, which charges a 2% management fee plus 20% subject to an 8% hurdle rate, delivered a 13.12% during the same period, as can be seen in the image above. TEC claims its principals have invested $130m in the strategy. Investors should ask in which specific fund.

We reiterate our PoS rating and revise our outlook to Negative.

Ninepoint-TEC's exposure to “owned borrowers” resembles more a private equity fund, than what most advisors thought was a fixed-income alternative investment, that would enhance yields in an ultra-low interest rate environment with a promise of low volatility with downside risk protection.

Tim Kiladze makes the point that Ninepoint only sells to accredited investors, "typically people having an annual income of over $200k or assets worth over $1m." However, the full definition of an accredited investor includes any account that is managed by a registered advisor regardless of the client's wealth. Ninepoint uses this full definition on its website.

Ninepoint has an affiliated investment dealer Sightline Wealth Management that provides managed account services; both are owned by Ninepoint Financial Group. Do you think Sightline advisors survey a marketplace of thousands of products and occasionally arrive at the conclusion that the very best product for some clients is a Ninepoint fund? I would bet my life that this occasionally happens.

Third Eye Capital stated that “there have been no new investments made in the Fund since TEC is prioritizing liquidity.” In our opinion they should have prioritized paying out the $144m to investors currently in the liquidating fund. Those investors were promised monthly liquidity. As per Ninepoint-TEC 2020’s audited statements, the portfolio had ~$450 million of loans “On Demand” or maturing in 2021. What happened to that liquidity? So much boasting about experience and complex situations, yet they failed to predict that the market will become nervous after the truth of their main competitor, Bridging Finance, was revealed?

We see Ninepoint-TEC failure to meet redemptions as a validation of the red flags we raised in late 2021. They had over six months to “burn the place down” - to get their money back from borrowers, quoting Ninepoint Co-CEO John Wilson. Enough time to generate some liquidity to meet $144m in redemptions and avoid “some problems.” But they failed.

We believe liquidity will not improve any time soon. The current condition of Ninepoint-TEC’s borrowers will do little to help. Ninepoint’s marketing machine seems to have encountered some problems. According to reports of exempt distributions, the Ninepoint-TEC strategy had net proceeds of less than $7m in 2022. In contrast, in total over the previous 3 years, it had net proceeds of ~$885m.

After evaluating the fund’s top positions, we maintain our PoS rating on the fund. Since our initial rating, the fund was unable to meet ~10% redemption requests. We revise our outlook to Negative.

It is worth noting that after getting the cold shoulder from both the Globe and OPM Wire, Arif has been forced into the arms of CEOworld.biz:

He provides this gem of a quote:

“Even today, in running a multi-billion dollar financing company, I manage the business as if it could all be gone in an instant. “- Arif N. Bhalwani