It’s official. Arif Bhalwani’s record of ostensibly never realizing a “loss on invested capital since inception”, for more than a decade and a half, has ended.

Further, Third Eye Capital’s professed “core expertise” in “restructuring” or “business turnaround” is not supported by the evidence from their investment in Erikson National Energy and its predecessor.

On May 5, 2025, a Court terminated Erikson National Energy’s CCAA proceeding, since the company “does not have a viable transaction for its business or assets” and “it is not expected to make a plan to its creditors,” according to its monitor.

Below is a quick recap of the transaction, as previously detailed in our post, “Third Eye Capital: cracks in the workout playbook.”

- In 2017, Third Eye Capital made a loan of $8.5 million to an oil and gas company.

- In 2018, that borrower went kaput, and Third Eye Capital took over the borrower, which morphed into Erikson National Energy.

- By December 2023, Third Eye Capital’s total exposure to Erikson had grown to $50 million. (!)

- In October 2024, Erikson filed for creditor protection. Mark Horrox, then Third Eye Capital’s principal and also director of Erikson, said that TEC had invested “millions” into the assets of Erikson, “without return or recovery of its investments.”

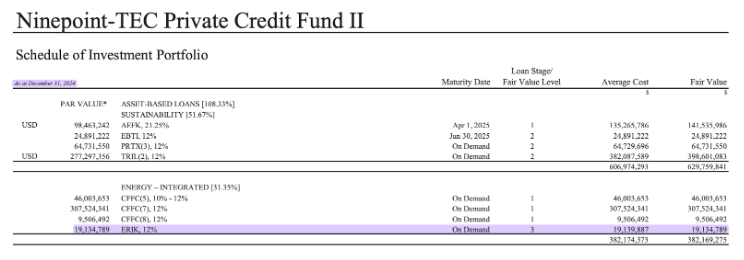

The Ninepoint-TEC Private Credit Fund II, appears to be one of the largest creditors of Erikson. As of December 31, 2024, the fund's financial statements showed an investment in “ERIK” with a fair value of $19.1 million. (Keep in mind that Third Eye manages other funds besides Ninepoint-TEC, which explains their overall $50m exposure.)

As you might remember, Ninepoint CEO, John Wilson, explained in 2019, how their conservative lending was backstopped by collateral value— the value they assigned to the collateral would allow them to recover their loan in case they needed to “burn the place down” because the borrower's business went south.

John Wilson on "conservative lending"

As you would expect, after Erikson went into creditor protection, Third Eye tried to sell the assets to recover its loan. They did find a buyer for all the company's assets for $2 million. But even at that low-ball price, the buyer decided to walk away and cancelled the purchase agreement on Valentine's Day 2025.

After Valentine's Day, Erikson continued its efforts to sell all or a portion of its assets, but that proved unsuccessful. Third Eye Capital also said it was “not prepared to continue funding” the insolvency protection proceeding, according to Erikson’s monitor.

Without any other option, the British Columbia Energy Regulator would take care of Erikson’s assets, mostly now orphaned wells, according to Erikson’s monitor.

Erikson itself would be an orphan entity, since its only director (a Third Eye Capital employee) resigned. The company will have no director or officer, according to the Court.

How much would TEC’s investors recover in this transaction? Without any reported asset sale or anyone overseeing the company, it seems investors would get a complete loss.

Third Eye Capital’s exposure to Erikson or its predecessor could have been limited to a maximum loss of $8.5 million back in 2018. However, after applying Third Eye Capital’s “core expertise” in restructuring and business turnaround, the loss seems to have ballooned and become 5x larger.

Third Eye Capital CEO Arif told us “the structure of our investment in Erikson was such that we had already realized value well before the restructuring.” This means that “there was no capital loss even after marking down the balance to zero,” according to Arif.

Arif attributed this magical outcome to Erikson dealing with Pieridae Energy— which originated in 2019 and where Third Eye Capital provided a $206 million term loan and bought $20 million worth of Pieridae shares at a price of $0.86, according to a press release issued by Pieridae.

We disagree with Arif. He realized a capital loss by initially investing $8.5 million in Ranch Energy, which morphed into Erikson, and then Third Eye Capital poured millions into it “without return or recovery of its investments,” as we explained in our original Erikson piece.

Trying to cover a capital loss, from the proceeds of another loan is just playing games. When the Pieridae loan was repaid, Third Eye proudly said that the repayment demonstrated Third Eye’s “ability to identify hidden gems.” At the same time, it failed to say that Erikson, the counterparty of Pieridae, was digging into a $50 million hole filled with junk that turned out to be worthless.

Although the loan recovery is probably close to zero, Ninepoint-TEC financial statements as of December 31, 2024,show the fair value (i.e. the price an asset could be sold for in an orderly transaction between market participants) of the loan was 100% of its $19.1-million par value. By then, Erikson had already agreed to sell all of its assets for a mere $2 million.

Arif told us that the Erikson loan was “fully provisioned” when it went into restructuring. The Ninepoint-TEC 2024 financial statements do show a $250 million provision on “loan and receivables” over a total asset-based loan fair value of $1.3 billion— without any details. With so many borrowers showing signs of financial stress, it is hard to know what the provisions account for. We asked Arif for details of the accounts, and he said that they “don’t publicly disclose detailed provision schedules loan-by-loan.”

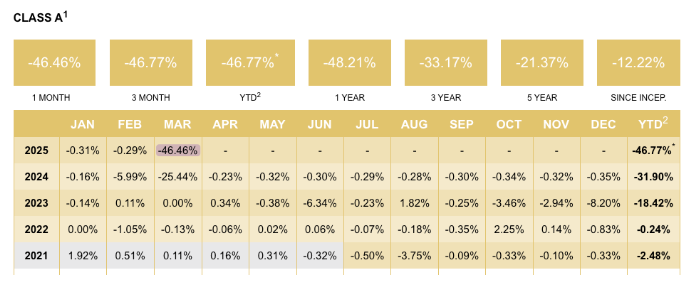

This makes us question the real fair value of Ninepoint-TEC’s loan portfolio. Speaking of valuations in private debt, it is worth noting that Third Eye Capital’s competitor, R.C. Morris, marked down its portfolio by an astonishing 46.46% just in March 2025. The loss was due “to sizable unrealized revisions to the carrying values of two of the remaining four positions comprising the majority of the value of the fund.” You have to salute their honesty.

While all this was happening, Arif’s right-hand man abandoned the Third Eye Capital ship— Mark Horrox went to Polar Asset Management, where he is now in charge of Canadian Direct Lending strategy. We wish Mark the best in this new endeavour.

Note: the original version of this article has been updated to incorporate the comments of Third Eye Capital CEO, Arif N Bhalwani.