Unlike the Ninepoint Third Eye Capital Private Credit Fund private debt fund, the Canadian Senior Debt Fund uses the figure of a Loan Consultant (instead of a sub-advisor). The role of the consultant is to “originate and underwrite transactions” and to “procure, service, administer and monitor the portfolio”. The consultant is also “responsible for collections and payments relating to the loan portfolio and maintaining appropriate accounting records.” As compensation, the loan consultant receives a management fee and a performance fee. The investment decisions are made by Ninepoint Partners.

This is also not the same arrangement Ninepoint had with their former BFF, Bridging Finance. If something goes wrong with the fund’s investments, Ninepoint will not be able to play the I-had-no-idea-what-these-guys-were-doing card.

The loan consultant for the Ninepoint Canadian Senior Debt Fund is Waygar Capital. Its President and CEO is Wayne Ehgoetz. Terrance Kruk and Aaron Ehgoetz act as Managing Directors for Waygar.

Waygar showing up at Ninepoint’s door was one of the reasons for the Ninepoint/Bridging breakup. According to a communication sent by David Sharpe to James Fox in May 2018, Bridging’s relationship with Ninepoint “would appear to have soured about the time Ninepoint opted to launch a competitive product to the Fund [Bridging Income Fund] last year (the “Waygar Fund”).”

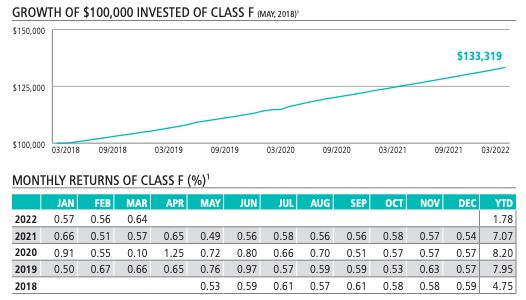

Indeed, the Waygar Fund looks very competitive with the Bridging Income Fund. Both claim to use a strategy of overcollateralized asset-backed lending. So far, the Waygar Fund seems committed to beating Bridging’s perfect track record of never posting a negative month (outside of receivership, that is). The monthly returns in both funds land within a tight range between 0.50% and 0.70% with an occasional outlier.

During an interview from 2021, Wayne Ehgoetz described his secret sauce (the same strategy claimed by many private lenders) to tackle risk:

“We just don't view ourselves as high risk because number one, all our loans are fundamentally at 100%, collateralized and over collateralized. So that in the event that they would fail, and we really have not had any failure in our portfolio, we will liquidate and get the money back and get the interest back. And so really the investment is not at risk at all”

Ehgoetz also talked about the interest rates charged to borrowers “generally in the 11% to 12% range. Then we also do have closing fees and monitoring fees. So our gross IRR today on our loans ranges in the area of 13.5 and 14.5%”

As of February 28, 2022, Ninepoint suspended the Waygar fund’s redemptions for 90 days. Nevertheless, Ninepoint has emphasized that they still expect an “exceptional upside” from the investments made by the gated funds.

We wouldn’t take Ninepoint’s word for anything. So we went looking for the facts.

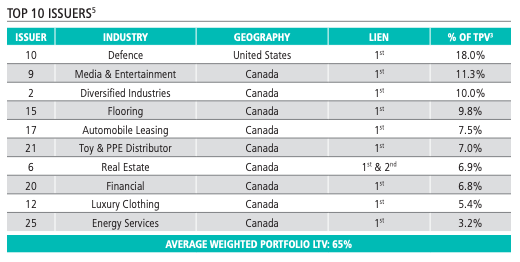

As of March 31, 2022, the Waygar Fund had $351 million in AUM. Like its peers Third Eye Capital and Highmore Group, Waygar Capital runs a concentrated fund. Just two issuers, taken together, owed $100 million to the fund, which represents 29% of AUM.

We were able to connect a lot of dots. We found some surprises, so let’s take a peek into who we believe are those two borrowers.

Issuer 9: A Canadian Media & Entertainment Company - 11.3% of Portfolio

In a communication to investors discussing March 2019 events, Wayne Ehgoetz, described Loan 9:

Loan 9 is a senior secured $25.3m credit facility to a state-of-the-art Toronto based media company that owns and operates an entertainment venue for live music, recording studio, corporate events and nightlife. The borrower has built strategic alliances with media and event sponsors to get premier artists, performance and content at launch. We are overcollateralized with an LTV of ~29% consisting of senior positions on the proprietor’s personal real estate portfolio, investment portfolio, personal guarantee as well as a second lien on the media venue itself. Projected annual IRR on this loan is ~14.4% with interest charges and fees upfront.

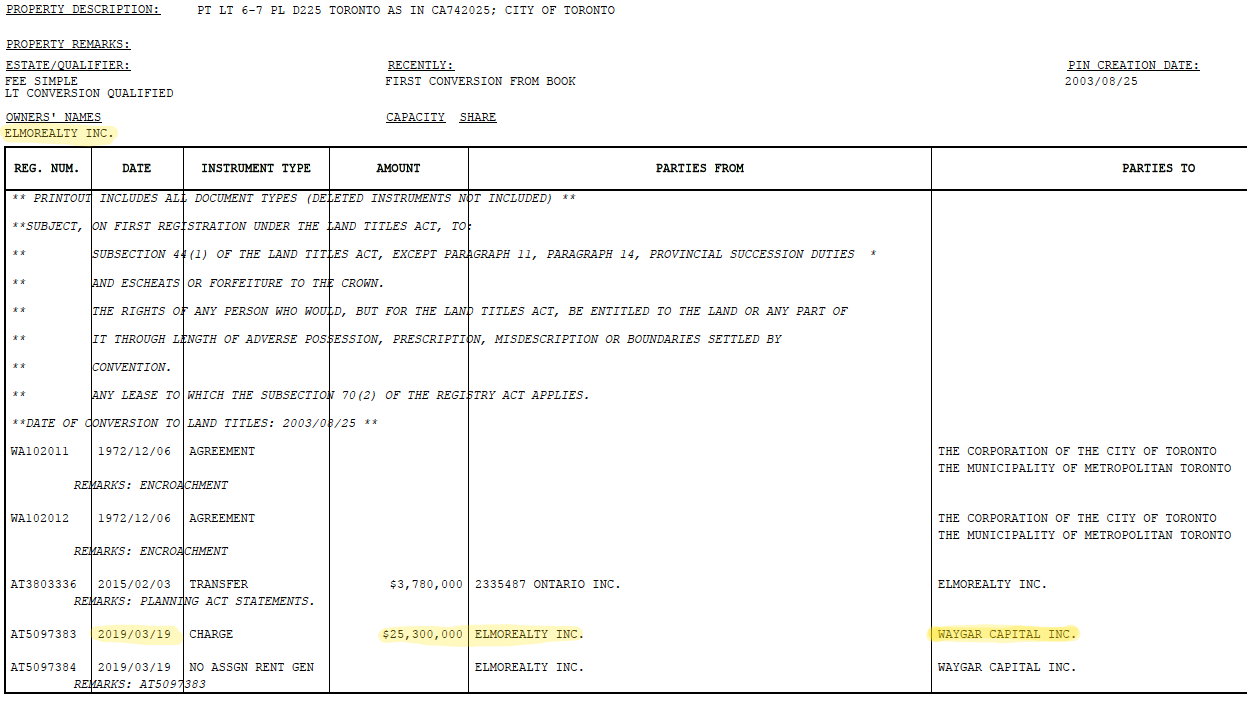

On March 15, 2022, Waygar Capital Inc was party to a loan agreement with Elmorealty, Inc, El Mocambo Entertainment Inc, and El Mocambo Productions Inc as borrowers. Four days after the agreement, Waygar Capital registered a charge in the amount of $25.3mm on the property located at 462 Spadina Ave, home to Toronto’s landmark small concert venue, El Mocambo.

The guarantors of the loan were Michael Wekerle, Wekerloo Developments, Chieftain Holdings and Downsouth Limited.

That’s legendary bad-boy trader Wek. Aka Mick Jagger meets Warren Buffett. The Wek made his money as a trader at GMP. Then he had a public vehicle called Difference Capital and for a while, enjoyed a high media profile. The Wek has some history with debt: in 2015, the Globe queried whether he was running out of money (based on rumours at the time). His reply was: “If I was bankrupt, I wouldn’t have just flown to Europe in my own jet, which was about $100,000.” The Wek has some assets too: last year, he sold an estate in Fort Lauderdale for $17m. But his Difference Capital, which at one point was his biggest holding, was a flop. Incidentally, Difference often invested in the same startups as that other great Bay Street iconoclast, Maverick John Ruffolo.

Difference went nowhere and eventually merged with a fintech called Mogo. As of mid-2021, The Wek owned about 5m shares worth some $8m at the current trading price. He now lists his principal occupations as Chairman of Waterloo Innovation Network, (which is a collection of commercial buildings in Waterloo) and CEO of El Mocambo Entertainment Inc.

According to The Star, back in 2015, Wekerle paid $3,780,000 for El Mocambo. Wekerle said then: “It’s going to take a few million bucks to turn this back into what it should be.”

In March 2022, Toronto Life, reported that the few millions turned out to be an order of magnitude higher. The article says “Wekerle spent more than $30 million digging a new basement, adding an elevator and otherwise bringing the place up to code while preserving its legendary mojo.”

Just as Ehgoetz described Loan 9, El Mocambo now has state-of-the-art facilities as per Toronto Life. “There are tour-grade sound systems and a full recording suite that enables artists to both livestream and record album-quality tracks. Soundproofing allows for, say, a high-energy EDM concert in the upstairs hall, while something unplugged and intimate is happening downstairs.”

Ninepoint Partners seems to be attracted to the nightlife business. They had also poured money, via their Third Eye Capital fund, into Buca, Jacobs and other “beloved set of restaurant brands.” We know how that story turned out.

A year after Waygar registered its charge on El Mocambo, the pandemic hit. El New Mocambo was set to open its door in March 2020 but Covid delayed the plans.

However, Waygar claimed the pandemic had no detrimental effects on the fund’s portfolio. In early 2021, Wayne Ehgoetz told investors “when Covid-19 restrictions were imposed in March of 2020, over 96% of our portfolio was comprised of essential service companies […] Our portfolios come through the pandemic extremely well. And currently, all borrowers are meeting debt service obligations.”

In one interview Ehgoetz disclosed that only two borrowers were not deemed essential services companies during the pandemic. One of the businesses was described as “a clothing manufacturer and has just remorphed into production of medical masks and gowns.” The “other non-essential they just leaned a little bit more on their internet sales.” Somehow, the “state-of-the-art Toronto based media company that owns and operates an entertainment venue for live music, recording studio, corporate events and nightlife” was not affected by the pandemic.

As The Wek’s plans got derailed by the virus, the reported amount outstanding to the media & entertainment Issuer 9 has grown to $39.9 million as of March 31, 2022.

Assuming the low range for the usual interest rates charged by Waygar, Issuer 9 must be facing $4.3 million of interest expenses annually.

At least, the Waygar team and The Wek have been having fun at El Mo.

Issuer 10: A US Defence Company - 18% of Portfolio

Since its inception, the Waygar fund has advertised a willingness to finance the Defence & Security industry. As early as September 2017, Ramesh Kashyap of Ninepoint told Bloomberg that the Waygar fund “will focus one-third of its business on lending to the defence sector.”

In a communication to investors discussing April 2019 events, Wayne Ehgoetz, wrote:

“Loan 10 is a $13MM credit facility that has the ability to increase by an additional $10mm, to a Virginia based company specializing in a broad range of defense products and risk management services. The company is the sole provider for military distribution for 12 countries. The company has secured prime US government contracts to supply defense products, training and risk consulting services over the next few years. Our loan is secured by take or pay purchase orders with international orders supported by a letter of credit that provides 100% coverage on our principal along with accrued fees. Total LTV including boot collateral of existing accounts receivable is ~62%. Projected annual IRR on this loan is ~13.2%.”

Boot collateral refers to secondary assets that are used as additional loan security, including trademarks and patents.

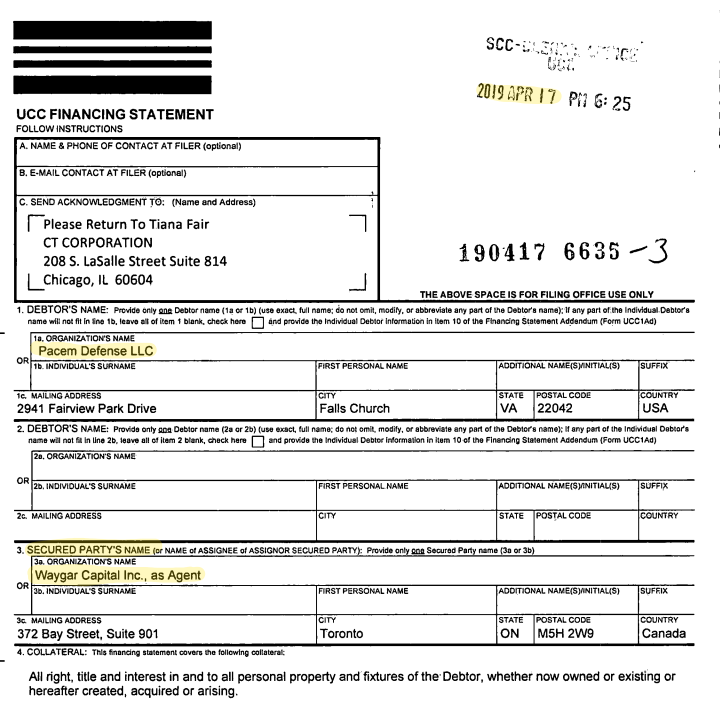

According to Virginia State’s Uniform Commercial Code (UCC) database, in April 2019, Waygar as agent placed a lien on Pacem Defense LLC and its parent company, Pacem Solution International LLC.

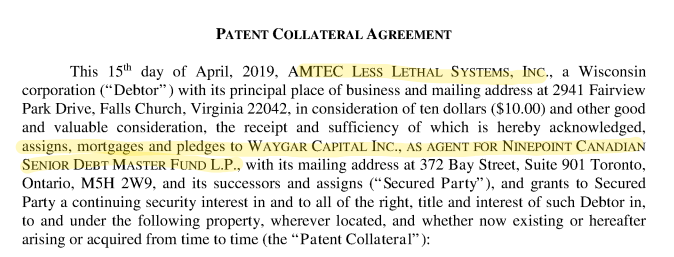

As well, in April 2019, Amtec Less Lethal Systems, Inc, a company previously acquired by Pacem, assigned some patents to Waygar Capital as Agent for Ninepoint Canadian Senior Debt Master Fund.

Pacem’s Executive Chairman and co-founder is Cory Mills. His wife, also a cofounder, acts as Executive Vice Chairman. Mills, a combat veteran, explains that he “came home and started a company making riot control munitions for law enforcement.”

According to a Politico article titled “GOP hopeful sold tear gas used on Black Lives Matter protesters,” Cory Mills is a wealthy candidate running for Congress in this year’s mid-term elections. He made his ostensible fortune by “selling tear gas that was used against Black Lives Matter demonstrators and purchasing a company that sold rubber bullets to Hong Kong to crack down on protesters.”

Politico describes how Mills is funding his campaign “mostly with money he earned through the company.” As of 2021 US$641.5k in campaign funding comes from Mills’ personal loans.

The article also reports that US Congressmen initiated an inquiry requesting information about the safety of tear gas products manufactured by Pacem. As part of the process, Pacem disclosed a list of all entities within the US to which they sold tear gas products. From 2018 until 2021, they sold US$ 1.28 million in tear gas products to law enforcement entities, distributors and corrections facilities.

Mills was not happy about the Politico article. Weeks after the publication, he published an ad suggesting he’d tear-gas the liberal media.

According to Waygar, the borrower had “prime US government contracts to supply defense products, training and risk consulting services over the next few years.” US Government contracts tend to be a matter of public record. We found several contracts awarded to Pacem and its subsidiaries, but none of them for seven figures. Politico reported contracts with DOJ, Federal Bureau of Prisons and the Department of Homeland Security, totalling more than US$680k in 2020, and US$360k in 2021.

Waygar also told investors that the borrower “is the sole provider for military distribution for 12 countries.” Politico states that “according to Mill’s former LinkedIn profile, which was recently taken down,” Pacem Solutions is registered to work in Pakistan, UAE, Iraq, Kenya, Malaysia and Kuwait, while it has provided “support and advisory” services in Ukraine, Democratic Republic of Congo, and the Kurdish region.

As reported to investors Waygar’s exposure to Issuer 10, has increased by 200% in the last two years. The borrower’s business must be booming.

We also wonder: if the business was booming, why didn't Issuer 10 go to a bank for the new debt? For some reason, Issuer 10 is willing to leave money on the table. Even after three years, they prefer to obtain credit from Ninepoint at a double-digit interest rate. Those dumb banks are missing out on another gem.

On June 15, 2021, the IRS placed a Tax Lien for US$ 111,815.29 of unpaid taxes from Pacem Solution International LLC. The lien was discharged on September 21, 2021. Then again, on February 24, 2022, the IRS placed another lien for US$ 592,278. Let’s hope Pacem doesn't manage the business the way they manage their tax liabilities.

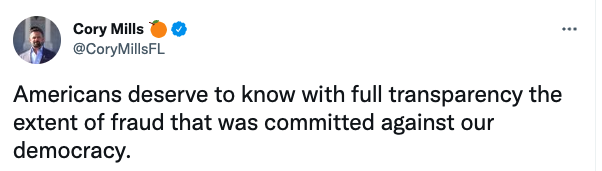

Cory Mills, you won’t be surprised to learn, is a strong Trump supporter, including buying into the election fraud conspiracy theory.

A loan that even David Sharpe was not willing to underwrite.

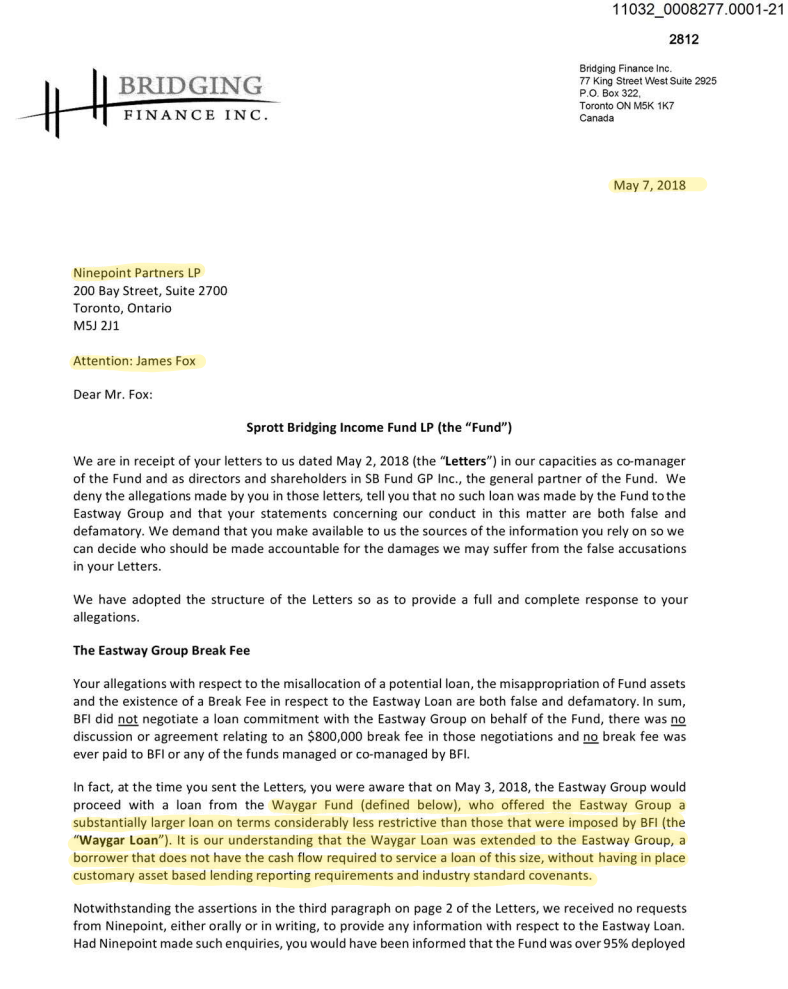

Back in 2018, Ninepoint and Waygar received some criticism on their lending practices, from none other than David Sharpe. In the letter sent to Ninepoint’s Co-CEO James Fox, in May 2018, Sharpe said:

“It is our understanding that the Waygar Loan was extended to the Eastway Group, a borrower that does not have the cash flow required to service a loan of this size, without having in place customary asset based lending reporting requirements and industry standards covenants.”

Of course, Sharpe considered Waygar competition, so this statement has to be taken with a grain of salt.

A credit facility to a “leading plant-based technology company”

On June 7, 2021, The Very Good Food Company, a “leading plant-based technology company,” announced that it had entered into a loan agreement for a $70 million senior secured credit facility with Waygar as agent for Ninepoint Canadian Senior Debt Fund.

The Credit Facility has an interest rate of 9.95% with a 2-year maturity with an option to extend for one year. Waygar received 225,000 common shares purchase warrants at a price of C$ 5.62. Beside the regular fees, The Very Good Food Company paid a $2 million finder’s fee for it.

Plant meat companies have failed to deliver on their growth promises. The Globe and Mail recently reported some of the challenges these companies have been facing.

As some indication, we can refer to the poster child of the plant-based movement, Beyond Meat. Despite reporting US$ 464 million in revenue during 2021, the stock price has tanked more than 75% during the last year. A convertible senior bond maturing in 2027, has recently traded at 37 cents on the dollar. Reality check: the word senior, on a debt instrument, doesn’t mean risk-free or immune from volatility.

The Very Good Food Company has been experiencing their own challenges. For Q1 2022, the company reported $2 million in revenues, a 24% decrease compared to the same period in 2021. During Q1 2022, the company burned $15.5 million of cash. In the last 12 months, the stock price has cratered by 92% and currently trades at $0.23 per share.

On April 4, 2022, CEO and cofounder Mitchell Scott, was terminated. Co-founder James Davison and Chief Research & Development Officer resigned on the same day. Was this “a good management team” of the type that Waygar likes to deal with?

The Very Good Food Company has not drawn all of the $70 million credit facility. As of March 31, 2022, the company owes approximately $7 million under the credit facility, including payable fees.

Ninepoint Partners has proven over and over again a high appetite for risk. What Ninepoint considers to be “conservative lending” seems quite risky for us. So the question is: will Ninepoint be able to control the risk?. Only time will tell.

We will refrain from issuing any judgment on the creditworthiness of borrowers described here. We hope that the observations related above on some quite material relationships offer an alternative view of the Ninepoint Senior Debt Fund’s underlying assets.

Wayne Ehgoetz claims that he is “happy at any time to answer any questions that anybody might have about our fund, about what we are doing, or any other thing they liked to ask.” You can test that claim. We tried. But as far as we know, you will need to be screened and approved by Ninepoint first.

One thing that differentiates Waygar Capital from other private debt promoters like Third Eye Capital, Bridging Finance, Highmore Group and RCM, is that they haven’t been Gary Ng’d … yet.