In the four months I have been paying attention to Wealthsimple, no one - with the possible exception of Mike Katchen - has done more to refocus the company on the bundling opportunity in Canada than me. I think the banking product they launched this week is the best everyday bank account in the country and I expect to move there as the features are launched. I think you now need "real" bank accounts mostly for contingent purposes, like sending a large international wire. Or if you're between apartments and want to sleep in an ATM lobby for a few nights. I can see how Wealthsimple can lock in an entire generation of users, who will never form a bank habit, not unlike an entire generation never formed a newspaper habit. Now, let me poke some more holes in the international story, so that they may focus even more on services for Canadians.

It continues to be my prediction that they will retrench from the UK market (I am less sure about the fate of the US market because two co-founders are based in New York). Just analyzing job openings would tell you that the US and UK are relatively stagnant. I think they're hiring more of a technical team in the UK rather than a client team. If they double down in the UK, only spite towards me could explain it. There are several fintechs with millions of users in Europe. There are now a few credible robo-advisors in the US who offer their services for free. Online lender SoFi, which has raised USD $2.3 billion in funding alone is one. Only a bundling, Fortress Canada strategy has some chance of working for Wealthsimple. Everything else is a distraction.

Let's analyze the meaning of the news mid-last year that Allianz lead a $100 million financing. CEO Mike Katchens called it "a major endorsement of our company and growth trajectory". Chairman Paul Desmarais III said: "Bringing Allianz into this investment is a landmark transaction in Canadian Fintech". Naturally, the media was impressed and repeated these lines. I was impressed too, but let me be Debbie Downer and point out the following:

-As was well understood, the actual investor was the corporate VC arm of Allianz, called Allianz X. If you know the history of corporate VC arms, you know they are haphazard and start and close in an equally haphazard manner. (Look at Google's various VC arms or BCE Ventures).

-Wealthsimple cast a global net to find a big international partner and Katchen was described as travelling the world for that. By any measure, raising tens of millions is a considerable achievement. But in the UK, there are now major robo-advisors with partners like Blackrock and Goldman Sachs. As large as Allianz is, I think it is a less powerful brand in the UK and US than those two.

-There's a UK robo-advisor called Moneyfarm. Allianz Global Investors itself invested in Moneyfarm. Allianz offers the Moneyfarm service to its own UK employees. Allianz also formed an exclusive partnership with Moneyfarm to launch in Germany.

Allianz Global Investors manages 500 billion euros. In contrast, Allianz X, the VC arm, deploys about 1 billion euros. And so Allianz has a much deeper European partnership with Moneyfarm than it does with Wealthsimple. So if I was in the UK (and if I was research-inclined), I would see that the real player that Allianz has endorsed is Moneyfarm, not Wealthsimple. Incidentally, Wealthsimple is fully licensed to operate anywhere in the EU. It has a fancy Luxembourg structure along with a German license through the Grenzüberschreitender Dienstleister regime. Full disclosure: I have no idea what that means either. So Allianz could have partnered with Wealthsimple in Germany, it simply chose Moneyfarm. (Or maybe Wealthsimple declined the opportunity).

To be clear, Wealthsimple, because of its strength in Canada, has way better prospects than Moneyfarm, in my view. I am just pointing out that its global ambitions have little substance to them - they're sort of like Kim Jong-un creating global intrigue for domestic consumption.

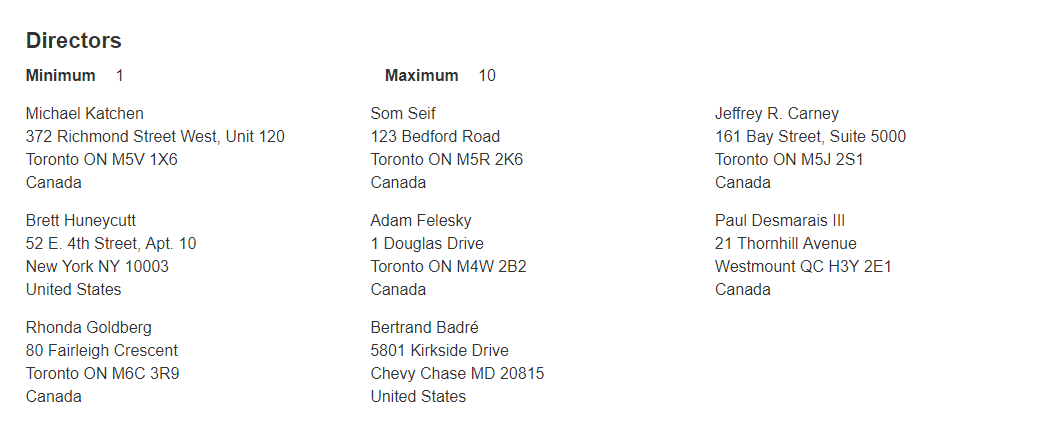

As part of the deal, Allianz was supposed to appoint a director on Wealthsimple's board. They did appoint Joseph Engelhart, CIO of Allianz X as director back in August. But they appear to have neglected to update the federal corporate registry:

So they forgot to add the Allianz rep (which they had to do within 15 days). And they say they want to go public. Actually, this is a minor oversight. I hope an aggressive competitor like WealthBar won't apply to the court to have Wealthsimple dissolved. In more careless days, even I was once in default of a corporate filing. And I am an unusually talented corporate secretary. I always try to be constructive, so I should remind them that they have to file an annual return before February 5th. And there's no need to disclose residential addresses on these forms. Fun fact: Paul Desmarais III lives in Brian Mulroney's old home. Som Seif lives minutes from a Whole Foods. I am running out of material, so look for a post soon where I compile how all their homes look on Google Maps. On the other hand, try to find where the Justwealth directors live. I expect better from a Power-backed, Osler-advised firm.