The central tenet of passive investing is that lower fees are the surest path to satisfactory performance. Pioneer John Bogle took many steps to achieve this, such as setting up a mutual structure (ie the investing clients own the management company) or being based out of suburban Philadelphia. Here's a helpful mnemonic: low fees mean more cheese. How is Wealthsimple faring on cost containment? Wealthsimple recently announced that it's saving a lot of money by not sponsoring a real stadium. But in many other respects, it's the most bloated of the major robo-advisors I have studied.

It's the only major robo-advisor I can find that is setup in three countries. Even the big US robo-advisors, with double-digit billions have stuck to just the US. Being in 3 countries means 3 sets of regulatory burdens. It means dealing with 3 brokers (Wealthsimple has its own broker in Canada, uses Apex Clearing in US and SEI Investments in UK). It means managing 3 sets of ETFs, understanding 3 tax regimes. All this creates expense and complexity. In the US, Wealthfront and Betterment are self-clearing (have their own internal broker), which presumably helps keep costs low. I can't see how Wealthsimple can be competitive in the US.

In the UK, the firm has 9 people in the UK managing, as far as I can tell, well less than $100 million. This, in a market where neobank Revolut has millions of clients, is working on adding a robo-advisor service and is threatening this week to raise USD $1.5 billion in financing.

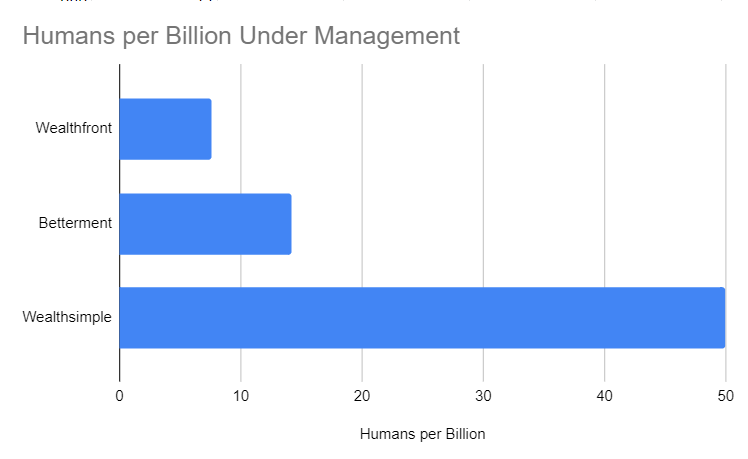

Take a look at my guesstimate for employee productivity:

HSBC estimates that Wealthfront and Betterment pull in USD $150k in revenue per employee. My analysis of Wealthsimple is that it pulls in half as much, while charging twice as much.

These are all guesstimates. The math is made more complicated by the fact that the leading robo-advisors report a single AUM figure for two very different products: passive investing and high interest savings account.

Wealthsimple has one key advantage in that for the bulk of its assets (in Canada), it's able to get away with 0.50% annual fees (vs 0.25% in the US). (To be accurate, weirdly, the UK market is around 0.70%). Nevertheless, OPM Wire advocates that Wealthsimple takes into account these realities and retrench from global expansion. We are the only media outlet to advocate this…all the other Canadian media outlets are 100% positive on Wealthsimple, in a Machiavellian attempt to make Michael Katchen complacent and see him fail.