Minor new information in the Traynor Ridge collapse: David Kaufman's Westcourt Capital was one of the largest clients. Westcourt accounted for a "significant portion of the assets" of hedge fund Traynor Ridge. The Globe confirmed this a few hours ago, straight from the horse's mouth, so to speak. I had long suspected that Westcourt was no good and this provides confirmation without me having to lift a finger. Westcourt uses a meaningless two-word tag-line: "Conservative. Alternative.", eschewing the more traditional meaningless three-word tag-line often used by financial firms. Westcourt farms out ultra-high-net-worth capital to money managers, favoring magical "alternative strategies".

Traynor Ridge was founded in January 2020 by Chris Callahan, who had 4 years worth of experience on the buyside. Conservative allocators would not invest with such an unproven manager in strategies that tend to be pretty opaque. That's just basic horse sense. There are several more established options if one is inclined to invest in event-driven strategies. You might say: Hold your horses, everyone makes mistakes, Westcourt will get back in the saddle in no time. I think the very notion of seeking magical alternatives is ill-conceived.

Earlier this year, Westcourt joined up with American advisor consolidator Focus Financial Partners, following in the footsteps of Mo Lidsky's Prime Quadrant. Or perhaps I should stay hoofsteps, since they're now stablemates. Or maybe I should say they are sister firms. These are widely accepted figures of speech in English, I am not calling anyone involved a horse, an ungulate or unusually girly. Though if they are ungulates, I hope they have split hooves and chew the cud, otherwise it's not kosher. Anyways, what I am trying to say is that it's interesting that two firms people often think of as similar and who might compete on certain mandates, now have the same owner.

The driving force behind Westcourt has been David Kaufman, a lawyer-turned-magical-alternatives-expert. More recently, one Robert Janson has taken the mantle of CIO. He's a former professional volleyball player turned magical alternatives expert. I am sorry, but no one this good looking could possibly be an investment thinker. And being a jock doesn't help his case either.

|

David Kaufman now tells the Globe: "We are diligently trying to collect any relevant information to determine the effect that these events may have had on client accounts." But that might be a case of closing the stable door after the horse has bolted.

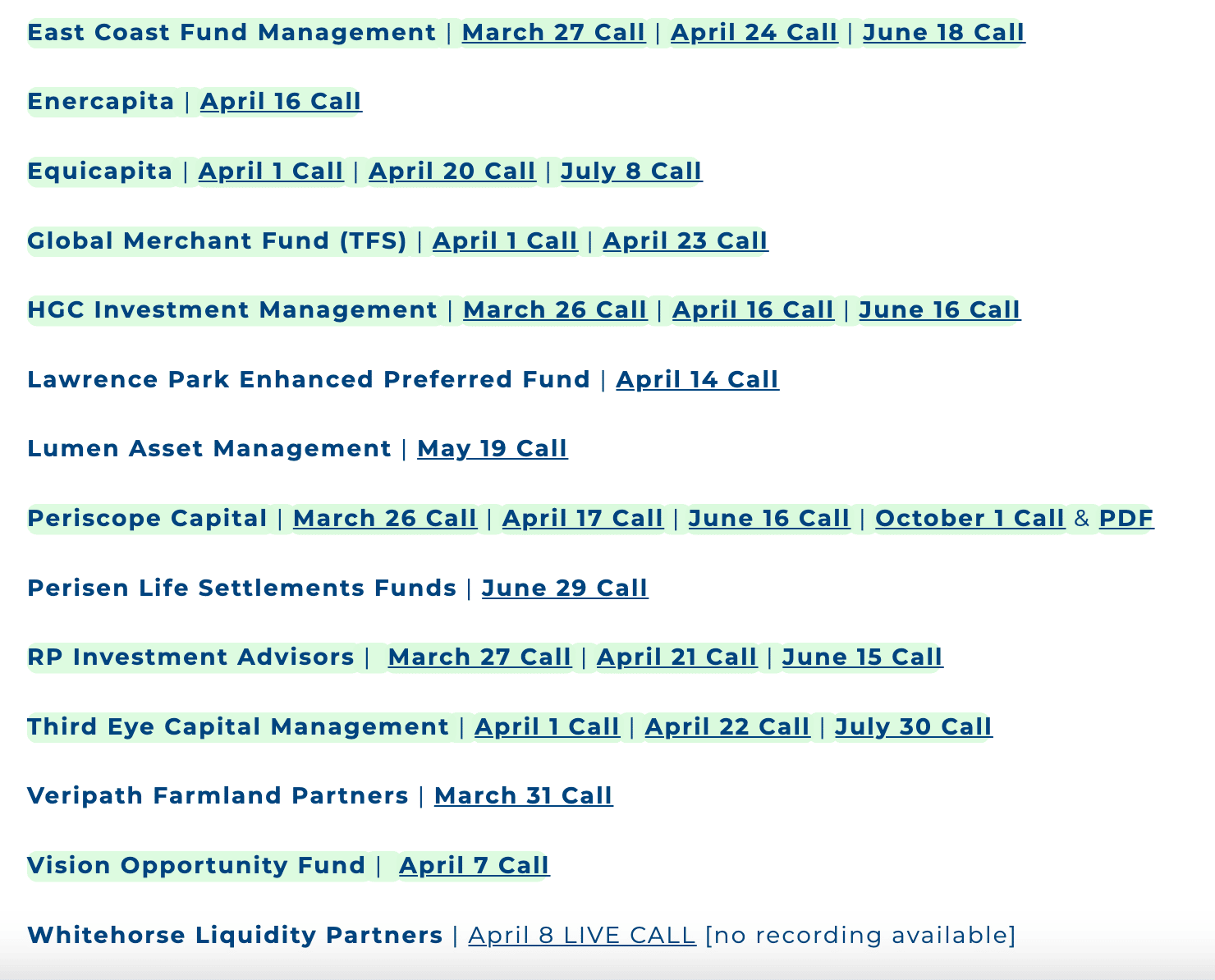

Westcourt claims to have advised on the deployment of more than $5B since the firm was founded, to clients generally worth $10m and more. Here's a sampling of some funds that Westcourt pushes (or has pushed in the past):

|

I don't know most of these funds, they really are "alternatives". But I was certainly aware of their association with Third Eye Capital. I have relayed major concerns about Third Eye and their big fund is in somewhat of a limbo as well. I don't know why there was a need to start Westcourt Capital in 2009. If you wanted introductions to crappy hedge funds, I thought [censored] had a lock on that market. That was really unnecessary, what's wrong with me. Finally, I like horsing around with language, don't overthink it.