I have been following Balkar Sivia from the inception of his firm White Falcon Capital Management. Balkar runs an unconstrained strategy that invests globally. I think Balkar is worth considering for anyone who still believes in active stock management and is preparing for a mean reversion away from the US megacap / tech zeitgeist of the past few years. I had a conversation with Balkar early on and was really impressed by how straightforward and transparent he was. I treat emerging managers with kid gloves: I only write this for knowledgeable and experienced investors who want to take manager risk and maybe even invest in the management company itself. I think it's reasonable to bet on a resurgence of active management (ie alpha). These are not endorsements. I think of these posts as encouraging managers that I will be able to mock in 10 or 15 years.

Manager background

Before setting up his own firm, Balkar was an analyst and portfolio manager at Burgundy for eight years. Burgundy is generally highly regarded for its value investing and serious analytical bent. Balkar’s first job in money management was working for deep value investor Tim McElvaine. Tim is also highly regarded, one of the few deep value investors left in Canada. Balkar’s formal training is as an electrical engineer. Currently, White Falcon is a one-man shop.

Investment strategy

I like this quote from Balkar:

“Good business and good managements tend to surprise to the upside. There is an option value in good quality businesses that mediocre businesses at cheap valuation just do not provide!”

Balkar only manages one portfolio, aiming for 15-25 holdings, ie “diversified enough to survive but concentrated enough to matter”. He thinks of his portfolio in 3 buckets:

- Compounders - Compounders are good quality companies with a runway for growth run by competent management teams . They typically have intangible assets or market positions that are difficult to replicate due to which they earn a high rate of return on capital.

- Value Today - Opportunistically buying businesses that are cyclical or businesses that are facing temporary problems as long as it’s at a deep discount to the intrinsic value.

- Value Tomorrow - When the markets present an opportunity to own high growth businesses at reasonable valuations. These dislocated growth stocks also have the potential to be future compounders.

Balkar leans towards the more price-sensitive camp of the business investing spectrum. This is reflected in a higher turnover than the more purist buy-and-hold investors.

Balkar pays some attention to market timing considerations, such as "macro fundamentals, technicals, flows, sentiment, and positioning." He writes he is prepared to deploy hedges "cautiously and tactically to protect partners against large drawdowns." and that "bonds, cash, gold and selective ETFs can act as effective hedges in times of uncertainty." To be clear, I don't believe in any of this macro / market timing stuff.

Current holdings

Balkar has a number of positions that might shine (or at least prove more defensive) once the current AI-driven market narrative changes. For example, his positions in IT services companies EPAM Systems and Endava suffer from fears of AI disruption. But Balkar feels those fears are overblown. He also owns precious metal royalty companies.

Performance

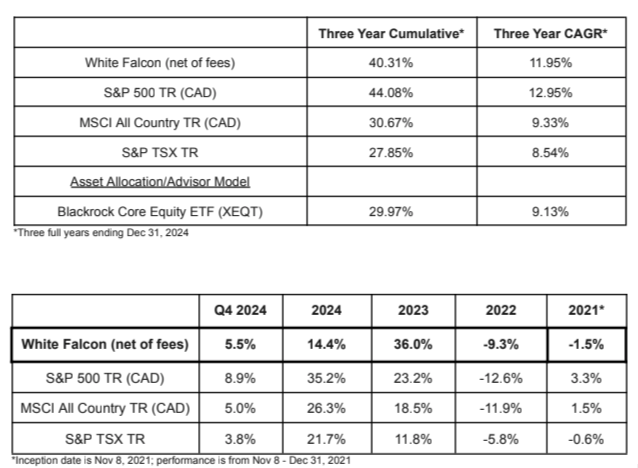

Since there's only been 3 full years of operation, the short track record is not statistically meaningful. But if you insist, Balkar has kept up with the all-mighty S&P 500, while having very little of the zeitgeist stocks, avoiding in particular most of the Magnificent 7. The underperformance vs the S&P 500 in CAD can be explained by the portfolio being half in CAD during a time when CAD has gone done (vs 100% USD for the S&P 500).

Fees and terms

White Falcon doesn’t charge a management fee. Instead, it charges a 15% performance fee on gains, subject to an account making a new high (high watermark clause). This is easy to implement via managed accounts. If we assume that the average managed account charges 1% fixed fee per year, then White Falcon needs to earn an approximate gross return of 7% to earn the same fees as a a typical managed account. This would be a simplified calculation. But there's an additional detail to consider: performance fees are charged quarterly. Such quarterly charging (as opposed to annual) benefits the manager rather than the client. (Deferring fees, like deferring taxes, is pro-compounding.) Sophisticated investors can decide for themselves the balance of these risks and rewards.

The custodian is Interactive Brokers - which keeps costs low. The minimum investment is only $50k. All of Balkar and his family's liquid net worth is invested in the same strategy as the partners of White Falcon.