This is another story from Arif Bhalwani’s time before Third Eye Capital. You can read our previous story for some context of why Third Eye matters. Remember “Prime Bank” frauds? These are scammers who promise unrealistic guaranteed returns by pretending they have access to very exclusive, hush-hush deals offered by major banks. One such fraudster was Randall Treadwell, who along with at least three associates raised $65m from 1,700 investors. In October 2004, the SEC filed a complaint in federal court against Randall. He is now serving a 25-year prison sentence in Orlando.

Randy’s story was featured in an episode of the CNBC series on financial crime American Greed. His three main associates were also sentenced to prison. They operated through various vehicles, the main one was called Learn Waterhouse Inc. Learn Waterhouse was placed into receivership (just like when the OSC asked an Ontario court to put Bridging Finance into receivership with accounting firm PwC).

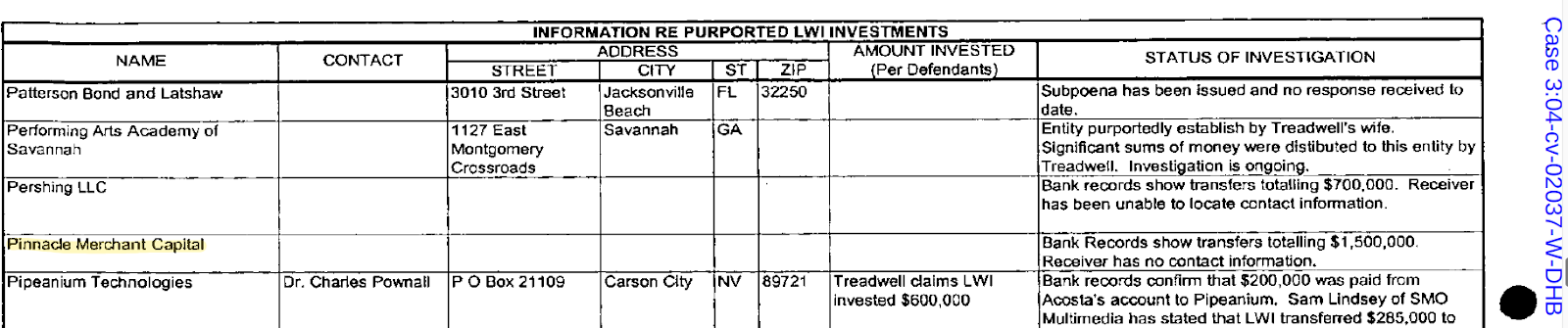

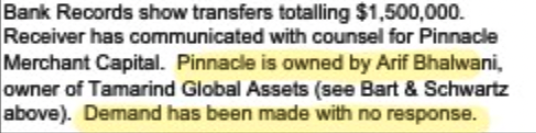

The receiver went to some trouble trying to document what happened to the money. Early receiver reports claim to have found bank records showing $1.5m in total transfers going to Arif’s Pinnacle Merchant Capital. Note that this is a different entity to Pinnacle Credit and Commerce International, the entity featured in the last post. Rightly or wrongly, the receiver labelled the alleged transfers as a “possible investment” made by Learn Waterhouse. Now, even if Pinnacle, or any other entity linked to Arif, got some money from a Ponzi scheme (whether directly or indirectly), it does not necessarily suggest any wrongdoing by Pinnacle & Co. Ponzi schemes can transact both legitimate and illegitimate business. They can have accomplices, innocent counterparties and complete bystanders. Receivers are serious professionals but they are parachuted into complex situations and have to uncover the truth in foggy conditions. They tend to issue multiple successive reports, reflecting their iterative attempts to get to the bottom of things. Even when they are under court supervision, like anyone, they can get things wrong. While our post focuses on matters referencing Arif Bhalwani, this was only a small subset of issues the receiver looked into. Bear those caveats in mind. Here’s one early receiver report that mentions Pinnacle.

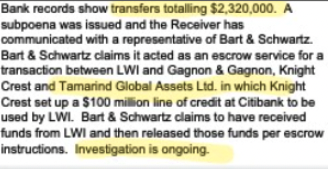

Arif, through a different entity called Tamarind Global Assets, was also alleged by the receiver in early reports to be involved along with “Knight Crest” and “Gagnon & Gagnon”, in another set of transfers totalling $2.32m. Tamarind was one alleged recipient of those funds, via a law firm. Tamarind is an entity formed in the British Virgin Islands apparently controlled by Arif Bhalwani as per some old SEC investment disclosures. The receiver started working in November 2004. Up to the 6th update from the receiver in June 2006 (20 months after the initial SEC action), the receiver seems unclear why Pinnacle and Tamarind appear to have received money from the scheme. Here are the excerpts that references Pinnacle and Tamarind Global.

The docket is missing some documents, which we attribute to shoddy archival practices at the dawn of the digital era. In any event, the receiver’s findings might well be preliminary and not conclusive. In particular, the receiver might be completely wrong when he characterises one transfer as a “possible investment.” We therefore had to turn to Arif for answers. Here’s the statement Arif’s current lawyer provided on his behalf:

More than 20 years ago, Pinnacle provided services in the ordinary course of its business to a company that appears to have done business with Learn Waterhouse, or with parties related to it. Pinnacle honoured its obligations, and received a fee from the company, paid through the company's legal counsel. In contracting with the company and receiving the fee, Pinnacle had no knowledge of Learn Waterhouse or its activities, including any improper activity on its part.

Several years after services were provided and the fee was paid, the receiver for Learn Waterhouse contacted Pinnacle, seeking to recover funds that were allegedly part of a fraud committed by Learn Waterhouse. Counsel for Pinnacle corresponded with the receiver on Pinnacle's behalf. The receiver accepted that any claim in relation to the fee was statute-barred, and did not further pursue any recovery from Pinnacle.

Mr. Bhalwani and Pinnacle were unaware of alleged improper conduct by Learn Waterhouse until long after Pinnacle provided services and the fee was paid. Neither Pinnacle nor Mr. Bhalwani were the subject of investigation or accused of wrongdoing in relation to Learn Waterhouse.

If you don’t know, “statute-barred” refers to a legal action that cannot be taken due to the passage of time. Such deadlines are set in legislation in various areas of the law. For example, your tax filings are generally immune from reassessment by Revenue Canada after three years. We immediately followed up Arif’s statement with more questions but we haven’t received any answers as of publication. Obvious questions include the nature of the services provided, the name of the company Pinnacle actually did business with, Tamarind’s specific role (if any), etc.

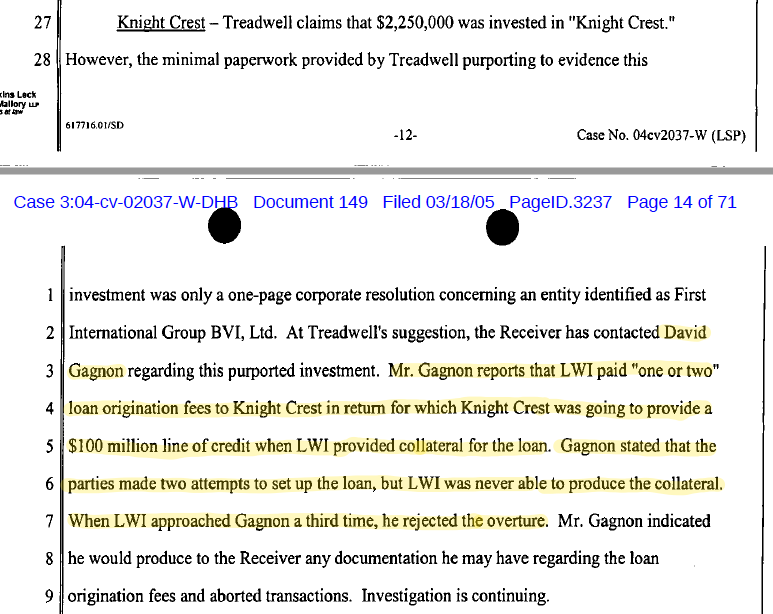

Our best guess, based on the receiver’s tentative findings, is that the services provided by Pinnacle and / or Tamarind were related to loan origination fees for a $100 million line of credit. But as with our previous story, the client did not manage to close on the loan, by failing to produce the collateral.

Given the dearth of information we have, Arif’s summary of the overall situation should be the starting point for clients who want to probe further. Unlike Arif, the receiver doesn’t have first hand knowledge. After the 7th report, the receiver does not seem to make any updates regarding Lean Waterhouse’s list of purported deals, where he included the Pinnacle and Tamarind alleged transactions. Also, the first receiver died mid-assignment and was replaced by a new one.

Pinnacle Merchant Capital Ltd is still active on the Ontario Business Registry. It was registered with the OSC as an exempt market dealer until 2014. Once again, it’s notable how young Arif was while orchestrating these deals.

In our phone conversation of August 8th, when we first brought up this incident, Arif said the matter raised in our earlier story and this are related. In other words, both this story and the previous one, he claimed, are aspects of the same incident. He mentioned a now deceased lawyer intermediary who might be the link between both deals. And so that may be an explanation for why someone can be unlucky enough to be twice dragged into the aftermath of fraud. In other words, Arif’s misfortune might have been dealing with a single intermediary connected to both cases. As they say, as of press time, we could not confirm and clarify this angle with Arif.

Although this should be clear from Arif’s statement, we reiterate the standard disclaimers (same as last story), that we have no evidence that Arif or affiliates were investigated criminally. And we have no evidence that he was knowingly dealing with fraudsters.

About Learn Waterhouse, we have little doubt that it’s a Ponzi scheme. You can get a quick flavour by watching this trailer for the episode:

You will see that the scheme targeted pretty unsophisticated investors with promises of unrealistic guaranteed payments and Biblical references. The schemers professed that they wanted to help the little guy (instead of making billions on Wall Street). You will see a key part of the lure was minimum monthly returns. There’s something magical about making monthly returns!

We continue to piece together Arif’s early background prior to founding Third Eye. In various Arif bios and promotional literature we are able to find, Pinnacle is mostly described as an investor. It should now be clear that Pinnacle also had some service business, related to the origination of credit facilities.

Here’s another interesting tidbit about Pinnacle Merchant Capital. Between 2000 and 2012, Pinnacle appears to have had a “Principal and Partner” who goes on LinkedIn by the name of The Honourable Colonel Stuart W. Ross. He describes himself as an “international humanitarian, philanthropist and advisor to civil society.” He is the Founder and Vice Chairman of G.R.E.A.T (the Global Resource Epicentre Against Human Trafficking). I have quickly checked some of his claims and they appear to have some basis in truth. For example, his title of Colonel comes from a Kentucky tradition. Does that ring a bell? The most famous Kentucky Colonel is Col. Sanders, founder of Kentucky Fried Chicken. The Governor of Kentucky has granted as many as 16,500 colonelships per year, it’s a bit of a joke. As an aside, I learned while researching all this that Colonel Sanders spent the last 15 years of his life in retirement in Mississauga.

If you think The Colonel is the most interesting character we came across in our research, it’s because we have yet to tell you about the Right Honourable Count David Gagnon, D.D., Ph.D., FWCI. Count Gagnon is the Chief Economist of Knight Crest, one of the parties allegedly involved in an escrow arrangement with Learn Waterhouse, per the receiver. We had to look up Count Gagnon and his Knight Crest entity (probably registered in the Bahamas) because of the following line in one of the early receiver reports:

Bart & Schwartz claimed it acted as an escrow service for a transaction between Learn Waterhouse, Gagnon & Gagnon, Knight Crest and an entity called Tamarind Global Assets Ltd. Knight Crest was supposed to set up a $100 million line of credit at Citibank to be used by Learn Waterhouse. The funds were released per escrow instructions.

Bart & Schwartz was a law firm, but even then, the line above comes with all the caveats we have previously mentioned about the reliability of receiver reports. Count Gagnon, in addition to his countship, is also a Metropolitan Archbishop of the Old Catholic Church Arcis Dei and an Ambassador for the USA for L’Assemblée Citoyenne Européenne. He is Secretary-General of the WORLD Humanity Commission. On his website, “Cooking with the Count”, he introduces himself thus:

I am Count David J. Gagnon, the Count of Sementra de la antiqua Capadocia Del Bizancio, and a respected member of several Royal houses and other numerous titles throughout Europe.

I hate to name-drop, but I did talk to the Count as part of research. He claimed no recollection and no knowledge of Learn Waterhouse, Arif Bhalwani, Pinnacle or Tamarind Global. He also claims no recollection of ever being contacted by a receiver. In actual fact, the receiver report makes note of interacting with David Gagnon, as you can see from the excerpt below.

On a personal note, this was the first time I talked to a member of European royalty. Can you believe it? One day, I’m a humble blogger from the colonies, next thing you know, I’m talking to European royalty! Eat your heart out, Meghan Markle.