This story should be read along with our follow-up: Arif Bhalwani, the Count and the Ponzi schemer.

This story will feature a Florida-based conman, a British scam artist, a dead woman with drugs in her system and bruises on her body and money stashed in offshore accounts. And somehow, our very own Arif N. Bhalwani, CFA managed to get himself dragged in the midst of it. Watch out Quentin Tarantino, OPM Wire is where it’s at.

If not receiving money from scam artists is a principle that Third Eye Capital CEO Arif N. Bhalwani holds dear, he has failed. Arif has an extensive history of litigation, which goes back to his twenties when Wannabe was topping the charts. The Spice Girls sang “If you want my future, forget my past.” Arif must have been a fan because he lists as an investment principle: “Look at potential, not past.” He also argued in our discussion yesterday that a 20-year old lawsuit is not relevant for our readers. We, however, think the past is always worth looking into. On more than one occasion in his career, entities affiliated with Arif have received 7-figure payments from shady operators that were then convicted or condemned for major financial fraud.

The Arif entities’ payoffs were allegedly proximate enough to the frauds that he got embroiled in the ensuing investigation and/or litigation. We cannot conclusively say whether Arif was an unlucky bystander in these matters or a knowing co-conspirator. Arif claims the former. But at a minimum, these incidents raise the question of whether he is capable of assessing the honesty and character of his business partners.

In his official bio, Arif mentions co-founding Pinnacle Capital, the “Canadian unit of Pinnacle Investments, a renown (sic) early-stage and specialty venture capital firm based in California”. He goes on to say his Canadian Pinnacle Capital had a “successful ten-year track record from investing its own capital.” Renowned means “widely acclaimed”. Have you ever heard of Pinnacle?

Pinnacle Credit and Commerce International was part of the Pinnacle group. It was led by Robert Baskin, who recruited Arif. Arif was President and COO. It turns out, Pinnacle was not exclusively focused on venture investing. Arif’s current bio omits it, but in the court filing we are bringing to light, he mentions that besides venture capital, Pinnacle Credit arranged “trade credit facilities for importers and project developers.”

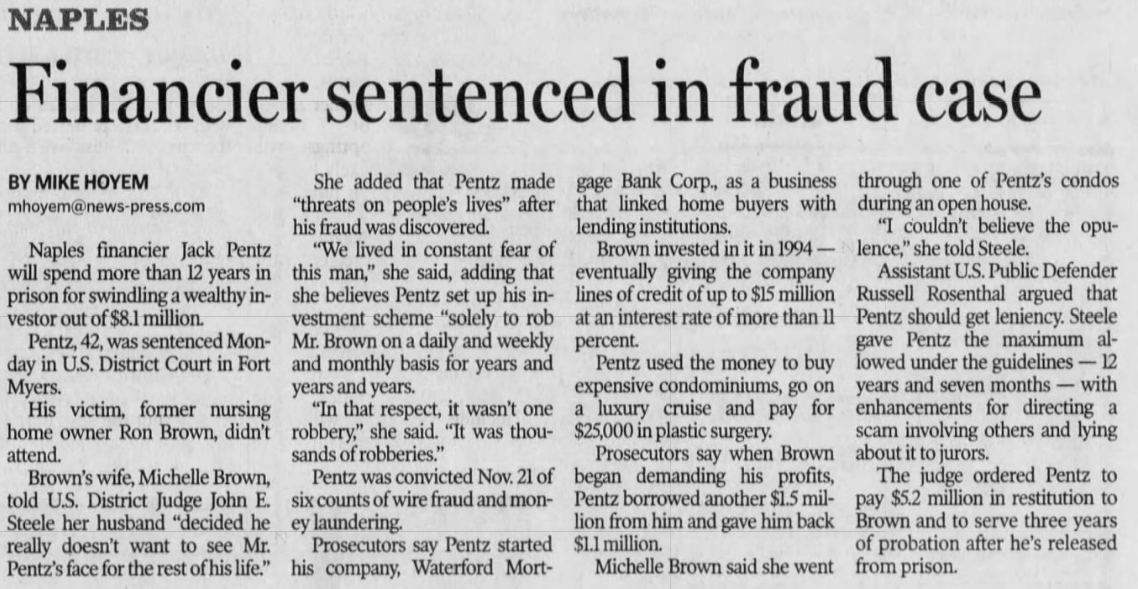

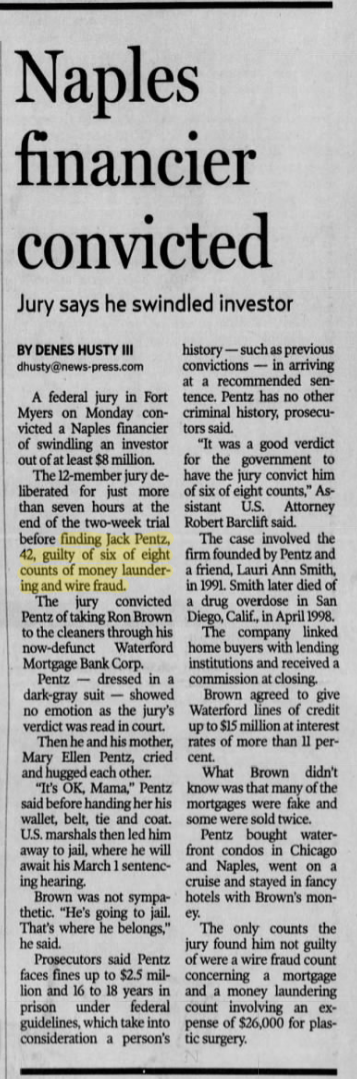

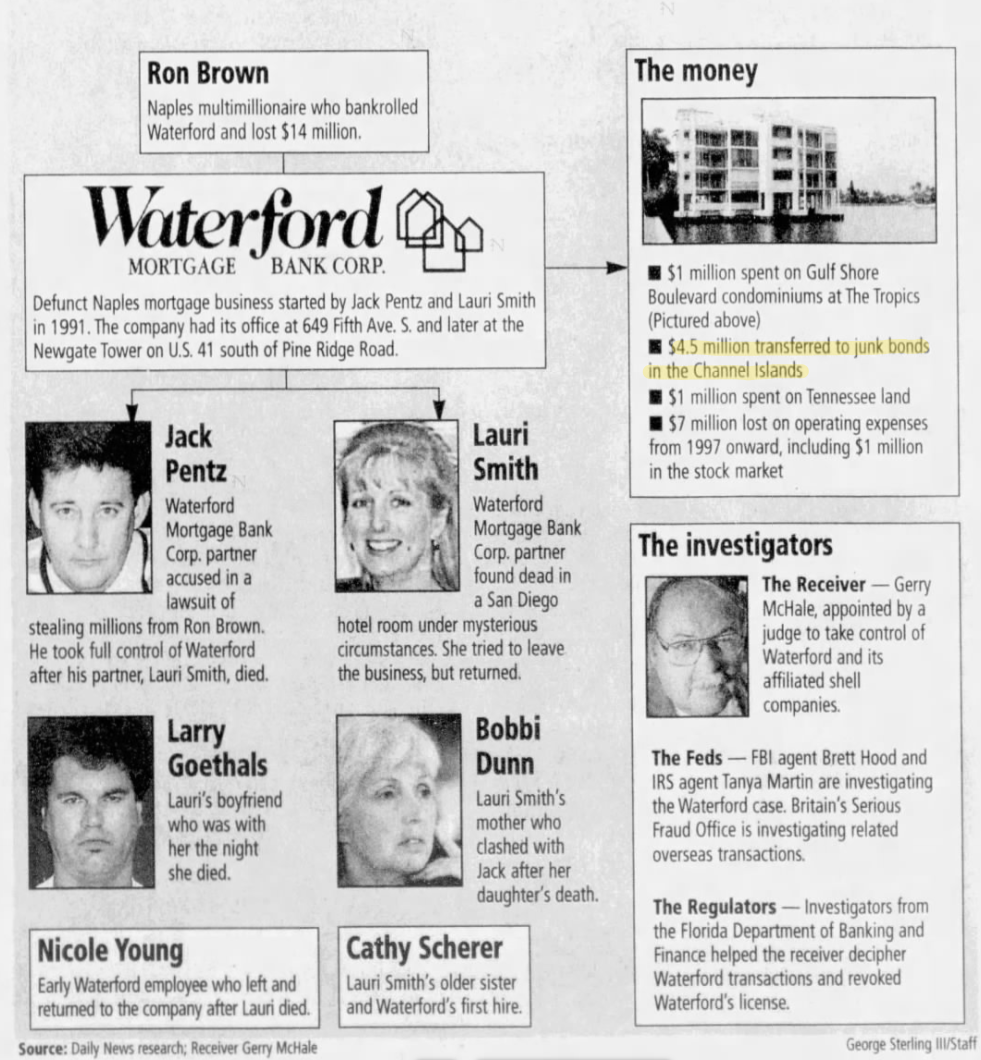

In 2003, Florida-based mortgage broker Jack Pentz was convicted of swindling a private investor of $8m. Jack was sentenced to 12 years in prison on 6 counts of money laundering and wire fraud. Jack’s victim was a retired businessman. In the late 90s, Jack pretended to arrange mortgage deals, but spent the investor’s money on condos for himself instead and some plastic surgery - no Bentleys though. Jack blamed the deceit on a former business partner, Lauri Smith. This was pretty convenient since Lauri Smith had been found dead in a San Diego hotel room with cocaine in her system and bruises on her body from an apparent struggle.

Would you believe that Pinnacle Credit & Commerce somehow managed to get hauled into court as one of Jack’s co-defendants in the civil case of this very fraud?

Indeed, it was alleged that in 1998, an Irish entity called Trinity Project Management got $2.5m of swindled money from Pentz into the Channel Islands. It was further alleged that in turn, Trinity funnelled $1.6m of that to Pinnacle Credit. Arif wasn’t a defendant in his personal capacity, but he’s the one who answered the lawsuit as President and COO of Pinnacle.

It is not in dispute that Pinnacle did receive $1.6m from Trinity Project Management - in Arif’s contention, for services rendered. That by itself is problematic because Trinity was run by one Kenneth C. Nunn. A separate, unrelated SEC sanction leaves little doubt that Nunn is a fraudster, I’ll get to that later.

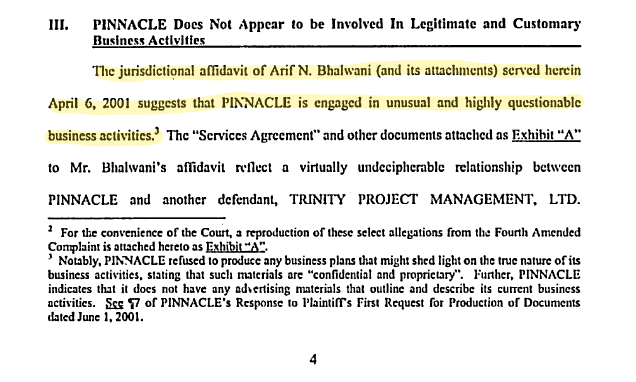

But Arif’s Pinnacle also came under blistering attack for this deal. The plaintiff (more accurately, the lawyer of the wealthy retired businessman who was the victim) seemed quite intent on dragging Pinnacle into the case. So Arif at first tried to evade the complaint by asserting that the Florida court lacked jurisdiction since Pinnacle had no nexus to the state and that the service of process was out of time. In response, the plaintiff’s lawyer argued that the allegation (in their unproven contention) that Pinnacle is “squarely implicated in the Naples-based theft and money-laundering scam” was sufficient to bring Pinnacle within the jurisdiction of the Court.

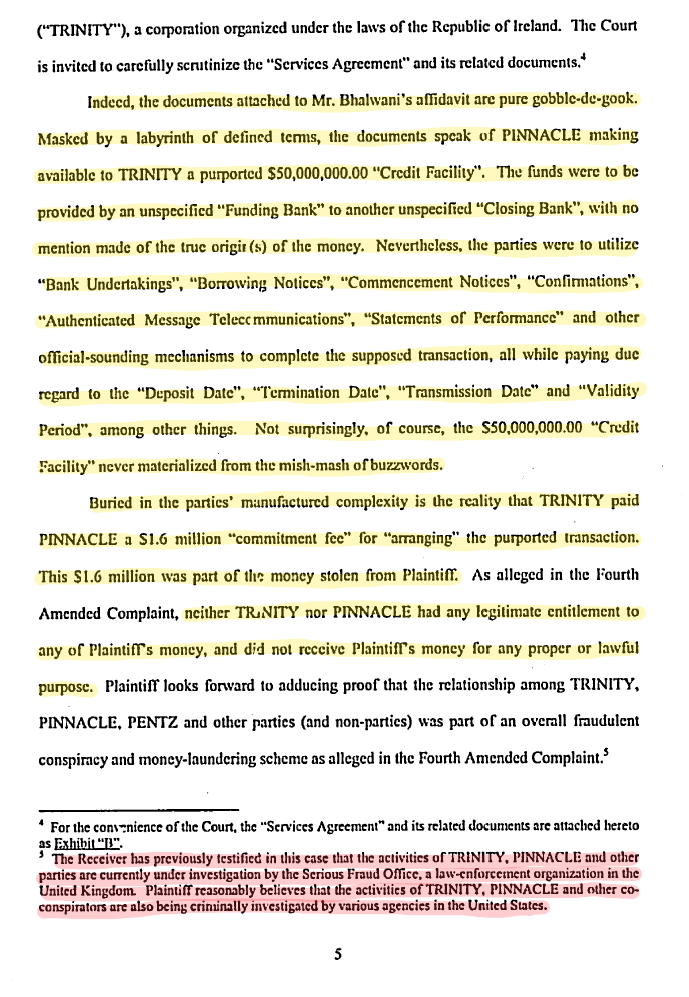

The plaintiff then goes on to say some very hurtful things about Pinnacle. I only bring up these allegations if you pinky-swear that you will keep in mind that these are unproven, one-sided allegations made in a legal pleading where there is always an incentive to cast adversaries in the most sinister light possible. And promise me to read this story to the end to see how the case was resolved.

With those disclaimers in mind, you can read some relevant excerpts from the court filing for yourself below. But in essence, the plaintiff alleged that Pinnacle “does not appear to be involved in legitimate and customary business activities“ and that it is engaged in “unusual and highly questionable business activities.” Plaintiff alleged an “undecipherable relationship” between Pinnacle and Trinity with a “pure gobble-de-gook” contract; and ”that Pinnacle may be strategically located outside the United States does not insulate it from the long-arm jurisdiction of Florida’s courts.”

Again, these are the allegations and legal posturing of a party that was trying to recover money in the aftermath of a fraud. It’s entirely possible they were barking up the wrong tree. We’d caveat, among other things, that even if Pinnacle was under investigation by the UK’s Serious Fraud Office as the Receiver alleges, nothing came of it, as far as we know. Arif states Pinnacle was never contacted by authorities. I take particular offence at the insinuation that Pinnacle is based in Canada for “strategic” reasons. Is Canada some sort of banana monarchy, that exists primarily to facilitate financial shenanigans? That’s not even 5% of our GDP tops. 2% if you exclude Vancouver.

One point of our own that we would make about the agreement is that Pinnacle claimed it could arrange credit facilities from a “top fifty bank in the world” at a 25 bps spread over the fed funds rates. Interested parties, like Trinity, had to pay a 3.2% Commitment Fee, in advance. This, at a time when AAA Corporate bonds traded at a 160 bps spread over T-Bills. A pretty magical deal. It’s also noteworthy that Arif at 27 years of age was a rainmaker, the prime mover behind getting a 7-figure fee for arranging a $50m loan with attractive terms for any borrower but the US government.

The Court didn’t buy Arif’s jurisdiction argument and forced him to provide a substantive defence. I’d describe Pinnacle’s two-page defence as dismissive, technical and evasive in that it doesn’t engage much with the substance of the allegations. I’d call it a “Prove It” defence. Nothing wrong with that - if he was not a knowing participant as he does say in his defence, he could be pretty relaxed about his defence. The burden of proof always lies with the plaintiff.

As the civil case was progressing, the main schemer was charged and convicted criminally. The record is unclear, but my understanding is that this had the effect of disposing of the civil case under the notion that the same facts involving the same main parties should not be re-litigated. As for Pinnacle, Arif says he opted to settle without admission for a figure he describes tentatively from memory as $100k to $200k. I am perplexed that Arif did not persist with his defence. Imagine the implications if every time someone is a victim of a fraud they could harass innocent third parties into coughing up money. I guess the dealership that sold David Sharpe Bentleys should expect a lawsuit soon.

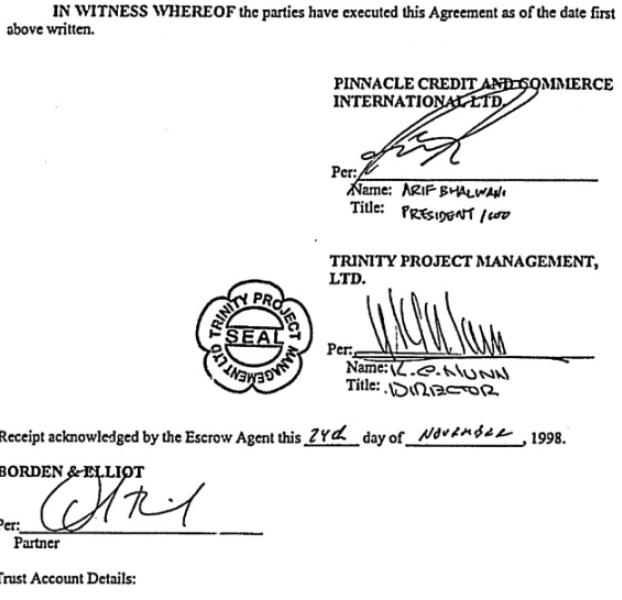

In our discussion, Arif disagreed with the plaintiff's statements. He claims his relationship with Trinity was screened and approved by his lawyer at Borden & Elliot (now BLG). They had no way of knowing about Trinity’s trading activities or that Trinity's funding came from Pentz’s fraudulent scheme. Pinnacle was arranging a loan for Trinity to invest in a gold mine. Pinnacle performed their part of the deal by bringing to the table a credit facility by a “top fifty bank in the world.” Therefore, Pinnacle was entitled to their $1.6m fee. In actual fact, the loan was ultimately not consummated, but Arif says that was Trinity’s failing.

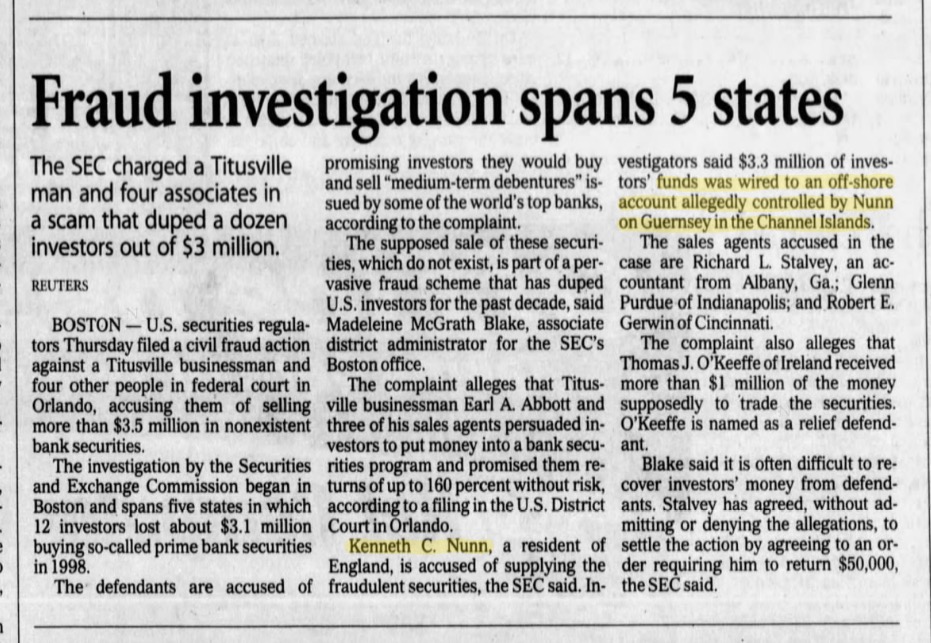

One thing is without doubt: Arif Bhalwani had associations with some bad hombres. Pinnacle and Borden & Elliot were wrong in their assessment of Trinity. Remember Trinity’s Kenneth C. Nunn, the guy Arif signed that agreement with, which was described as “gobble-de-gook”? In 2001, the SEC named Kenneth C. Nunn as the “central figure” in a “prime bank securities fraud case” (unrelated to Arif Bhalwani, as far as we know). This was in a complaint in which the SEC was granted summary judgement. Nunn was accused of soliciting US promoters and falsely telling them that his prime bank trading program would pay 15% a month for twelve months. In other instances, he would claim earning 20% PER WEEK.

Nunn was able to raise $3.55m, $400k of which he used for his personal benefit. Nunn had multiple partners, one of whom received a million dollar payoff to “conduct trading”. In actual fact, no trading took place. A “prime bank fraud” is where promoters claim to have access to “special, exclusive” financial instruments of major banks. In other words, too good to be true financial proposals that would make even promoters of retail private debt funds blush. Per the SEC, one of the hallmarks of such frauds is the use of the expression “prime” or a synonym like “top fifty world bank.”

Correct me if I’m wrong, but prudent business people would prefer their name not to appear alongside that of a fraudster in an agreement. Yet, here’s Arif’s Hancock on top of Nunn’s in that other so-called “gobble-de-gook” agreement.

This is the same Kenneth C. Nunn referenced in this Orlando Sentinel article from March 23, 2001. Which is to say, a few weeks before Arif filed his affidavit in court. So the best defence Arif can produce when his company is accused of civil fraud is to point to a deal he made with a fraudster that had by then been caught. We have all made investment mistakes. Some of us have been duped by financial fraudsters. Ideally we should learn lessons from such episodes.

If you’re thinking: “Please tell me that Arif learned a lesson and that this is the only time an Arif entity has received a 7-figure payment from someone who turned out to be a two-bit prime bank fraudster”, I have bad news for you. Another one of Arif’s counter-parties was worthy of an American Greed episode by CNBC - the major leagues of fraud. This post is already very long, so I am going to stop right there, thank you very much. More to come later.

Read our follow-up to this story: Arif Bhalwani, the Count and the Ponzi schemer.

Here’s some background about the main fraudster with whom Pinnacle was a co-defendant.