You have no doubt heard that on Friday evening, the OSC appointed a receiver to take control of Bridging Finance, a $2 billion private debt fund with a lot of retail money, brought in by financial advisors. Key players in this clusterf*** include:

-Ninepoint Partners, the former Sprott Asset Management. Ninepoint was previously jointly operating a fund with Bridging Finance. Then it uncovered some shenanigan at Bridging and threatened to sue. Bridging decided to buy out Ninepoint's management interest in the fund for $45m. Unfortunately, most of this was misappropriated money. While Ninepoint probably didn't know that they were getting dirty money, they don't come out looking good having been so close to such a shady firm. Ninepoint is no stranger to lapses in judgment, regularly featuring Eric Nuttall on BNN.

-Gary Ng - that's right, recurring OPM Wire character Admiral Gary Ng : he was lent money to buy Hong Kong real estate, but turned around and used it to buy a stake in Bridging Finance itself. In total, Bridging lent $100m to Gary Ng. I also learned that BlackRock lent $19.5m to Gary. He's so prolific!

-I'm told that while some banks, such as BMO and Scotia, blocked their advisors from buying Bridging funds last summer, TD did not. This story has been percolating for a while given the known links to Gary Ng. Some financial advisors are left bag holding in size. I was told some names, please send more tips.

-Bridging Finance's key people include the husband and wife team of Natasha (CIO) and David Sharpe (CEO). Andrew Mushore was in charge of compliance and its president was Graham Marr. Now, of course, PwC runs the show.

-David Sharpe was the key man. There's nothing too noteworthy about his career, except that he was once the Director of Investigations at the MFDA. So he was well-placed to know how inappropriate some of this stuff is. Like receiving $19.5m in his personal account from affiliates of a company that Bridging Finance was lending money to. That was the essence of the scheme: lending fund money to dubious borrowers and then having that money make its way back to the owners of Bridging Finance.

-Current directors of Bridging Finance include one Jenny Coco. You know her from Coco Paving.

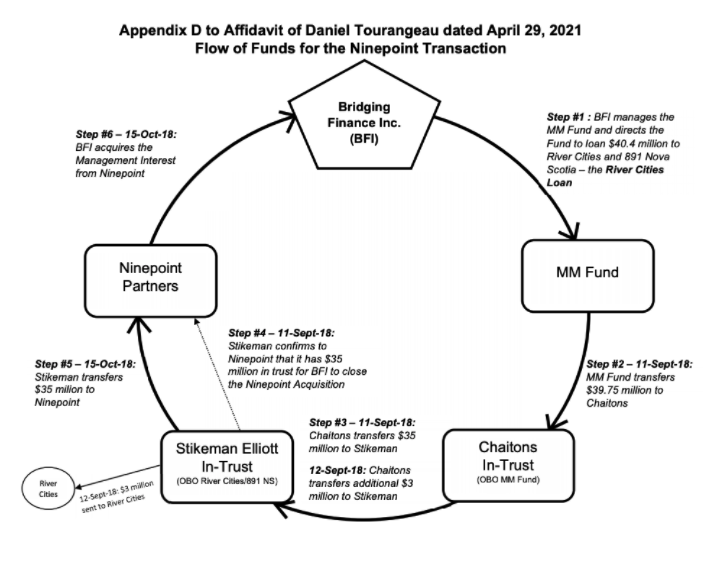

Here's how the scheme to buy Ninepoint's stake worked:

-The former CEO of pension fund OPTrust joined as chair in December, 2020. Clearly not a subscriber.

The affidavit containing the allegations makes for dense reading, contact me if you want a copy.