Wide is the gate and broad is the way that leadeth to destruction. -Bruce Lee

Here are some performance updates on some noteworthy funds, keeping in mind that any discussion of short-term performance is for amusement only. And also that I do not consider a fund that falls 30%+ to be disqualifying. In fact, I expect my favorite managers to undergo such experiences occasionally. It just has to be commensurate with the upside. Also, keep in mind that this blog focuses on Canada. And the title is an exaggeration, I do not expect every fund mentioned here to be in inevitable decline.

The most noteworthy "outperformance" is a "fund" called LSQ fund, run by Spartan Fund Management. Spartan runs a stable of funds, it's sort of an incubator or aggregator of funds managed by a variety of PMs, with various degrees of independence. In LSQ's case, it's "run" by a former prop trader, Todd Heaps, who works directly for Spartan. So LSQ was "up" by 21.46% in "March" and is "up" 27% YTD. It was "up" 32% last year and 100% in 2018. Those are incredible "numbers". The reason I am using quotation marks is that I have not been able to directly check those very high numbers, so I must be cautious not to make a fool of myself. LSQ claims to use a quantitative long/short strategy in North American equities. The fund is currently closed to new investors. Some people are saying hurtful things about LSQ, but I have very little concrete information about it.

Staying within Spartan, they sponsor an arbitrage fund run by MMCAP. MMCAP has been around for a long time, run by two managers who went on their own early in their career with the backing of $1million from, I believe, Arrow Capital. They have delivered good, if occasionally volatile, numbers over the years. They have used increasingly creative trading, that may not be properly described as arbitrage. That fund was down 26% in March. I have no interest in event-driven and the like, but these numbers are probably not inconsistent with the parameters you would expect from the strategy. MMCAP underwent similar drawdowns in 2008 and bounced back strongly.

Let me conclude on Spartan by saying that it's run by Gary Ostoich, the former president of legendary (not in a good way) Salida Capital. Some Spartan funds appear to be internally administered by Spartan. That is not best practice.

Venator's Founders Fund was down 18.8% in March and is now compounding at 8.3% since inception in 2006. Here's an obscure Venator reference: Avner Mandelman is now very active on Youtube and Twitter:

He is the inventor of the word "sleuth" and was briefly an advisor to Venator. He only has 28 followers and low double-digit views on Youtube. Can someone help?

Barrage Capital, the FANG-heavy hedge fund with 20% performance fee was only down 2.81%. Waratah Performance - which I so wisely identified as a less crappy hedge fund might have been up slightly for the month. That hedge funds might outperform in bear markets appears to have been news for some of my less perceptive readers (you know who you are). Ships in port are safe, but that’s not what they were built for. Barrage, on the other hand, I mostly wish they would drop the performance fee and use stricter concentration limits.

Jason Russell's Acorn fund is now housed at a place called ReSolve. It's a CTA, which in theory, should benefit from volatility or trends or something, I forget. In practice, it's down 25%.

Donville Kent was compounding at 3% for the past 5 years, and that’s before March. I see his original partner Jordan Zinberg is no longer there. Sad!

In March, Roundtable Capital merged with Barometer Capital. Roundtable was founded many years ago by Jim Allan, who is married to a Basset, the family behind CTV. The fund started with $50m, but I don’t think it had strong performance. And starting late last year, VertexOne of Vancouver, which at one point had more than a billion in AUM, merged away all its funds. That was great timing to exit the business.

Peter Puccetti's Goodwood Fund, one of the oldest hedge funds around has a negative 10 year number and that's BEFORE February and March.

Turtlecreek is down some 35% while BloombergSen is down about 30%. Thanks to Twitter and those who send tips….please continue to do so. My appetite for kompromat is second only to Putin.

If there's one indisputable winner in all this, it's Sharon Grosman. I see her fund administration firm, SGGG, now has a virtual monopoly among Canadian hedge funds. And I think she charges fixed fees, not based on AUM! Even Spartan does business with her for many of their funds.

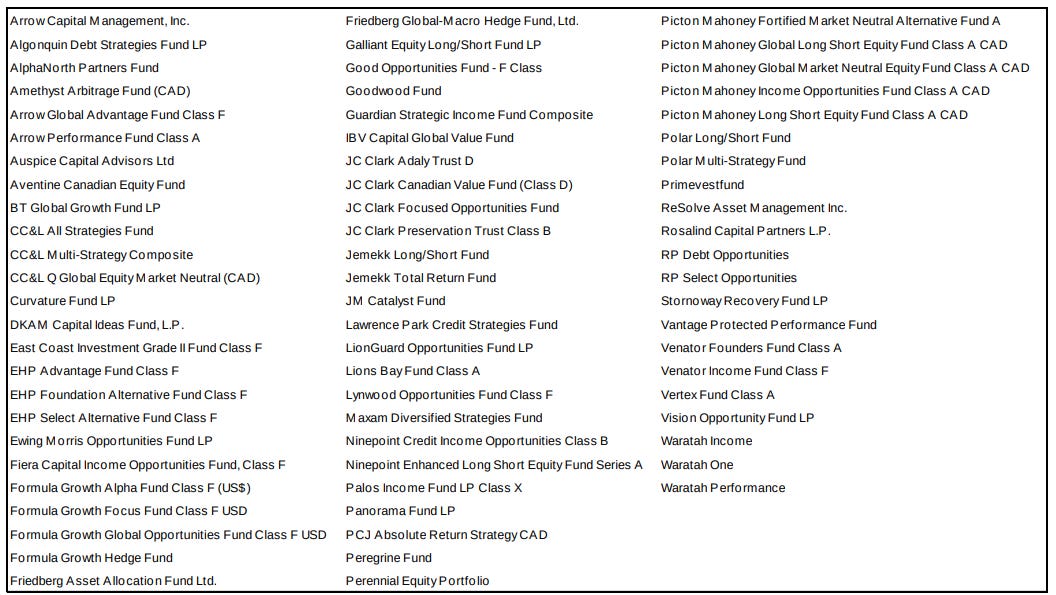

How much longer is the Toronto High Net Worth Dumb Money going to support these clunkers? I and other industry observers expect many more active funds to close in the next 10 years. In fact, Scotiabank has put together a list of funds that are expected to be under pressure. It's called the Scotiabank Canadian Hedge Fund Index.