I called arbitrageur Jeff Banfield once. I found him overbearing. Do I let that influence my commentary about his fund? Of course not, I am a professional. I am told he took my previous post about him with equanimity. I respect that.

William Jefferson Banfield has left his Bahamian hedge fund Caravel Capital and will be focusing on his own investments. The party line invokes the natural cycle of life, perhaps with an accelerated timing due to disagreements about some positions between the two partners. Jeff's own money is a material portion of the fund, perhaps $10-$15m out of a fund that might be around $50m. His co-founder Glen Gibbons will continue to run the fund. And whippersnapper Jack Hidi, 5 years out of Ivey is stepping up as partner. Some investors may be redeeming (or have already redeemed). I have previously expressed skepticism about the Caravel fund. But today is not the time for that. This is a Jeff Banfield appreciation.

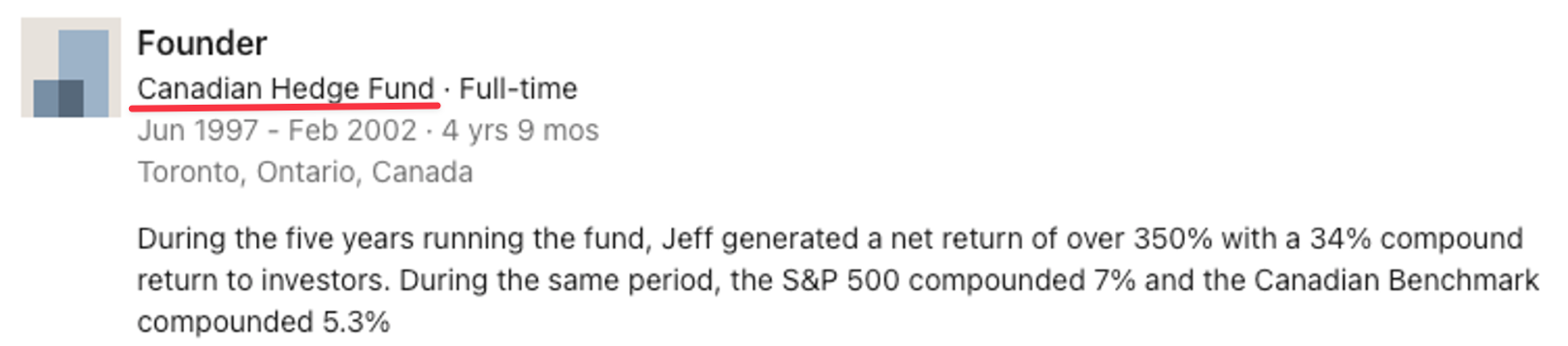

The last time Jeff handed over a firm to junior partners, the fund grew by a bazillion percent and then crashed-and-burned in 2008 due to heavy commodity bets. That firm - Salida Capital - had some assets caught in Lehman's bankruptcy. Let's hope and pray that this time, Jeff's successor will have better luck. Jeff Banfield mentions this experience on his LinkedIn, as working at a mysterious "Canadian Hedge Fund."

As for Glen Gibbons, he was a portfolio manager with K2, which is sort of like the Tiger Capital of arbitrage funds in Canada. In that it has spawned many cubs. I have some old notes on Glen from before I became a serious journalist. Many of these notes are likely wrong, but that doesn’t mean they aren’t worth repeating:

K2 likes to give its analysts trading authority early in their career. Apparently, Glen once had a year with a $10m bonus at K2 (that probably sounds too high). This allowed him to retire at age 29. He bought places in Hawaii and/or The Bahamas. Maybe not, but his current Caravel Capital is indeed based in Rihanna's birthplace.

In 2009, Glen had co-founded Radian Investment Management with another K2 alumnus, Norman Kumar. Radian started with $30m in assets and the backing of GMP founder Gene McBurney and CI Financial honcho Bill Holland, among others. But in 2013, Radian closed and Glen joined Brett Lindros’s HGC Investment Management. Why did Radian close? I am told they had some performance issues.

As for Caravel, it had some good moves and had some differentiated performance, for instance being only down about 2% in March 2020. Onex was a big recent win for them and they got some big American hedge funds to follow them in that position. Every month, they write in their letter about some genius trade they are putting on and some scintillating macro perspective they have. But what does it all add up to? It doesn’t add up to a hill of beans. Over the past 5 years, the fund is compounding at 6.76% vs 14.74% for the S&P 500 and 9.34% for the TSX. The fund is up fractionally for 2023 and the same year-to-date. Caravel's October letter talks about some presumably clever trade they were doing with bank preferred shares. But I find the following line far more revealing:

We expect to rebound nicely in November, having recouped >200% of October’s loss at the time of writing.

Are they allowed to talk about future performance like that? After all, there were still several days left in November. The October loss was 0.76%, is that even worth talking about? If instead of being up in November, he had been down 5%, would he have written: “If you thought October was bad, wait till you see November.” This sort of emphasis on complete noise is a telltale sign of a manager who is fooled by randomness. Caravel, will never have the spectacular blow-ups of former Banfield acolytes such as Salida or Leeward. But the fund is well on its way to mean-reverting.

Perhaps presaging his retirement, Jeff wrote in May 2023: “The last 12 months have been the most challenging in my previous 30 years.” It also sounds like he was building a house, as they wrote at the beginning of 2022:

The partners reinvested all their performance fees from the 4th quarter. As is our policy, we also report that Jeff redeemed $500K of his units to pay for the build of his house.

Caravel, despite being a Bahamas-organized fund with a Bahamas-based management company, advertises Toronto area code phone numbers on its website’s contact section. I don’t know what the securities regulation ramifications of that are, given that regulators love to protect their turf and sometimes try to reach extra-territorially. In 2022, Caravel had a fully compliant Canadian feeder vehicle managed by David Jarvis’s Corton Capital. That vehicle has since shut down. On the tax side, to the extent that a Canadian non-resident wishes to avoid being liable to Canadian taxation, they would be well advised to sever as many ties as possible to the country, including by not using Canadian phone numbers.

In 2022, Caravel also added a client relations guy, Drew Ramsey. Drew, sensible man he is, appears to be based in Toronto. Now, you are probably wondering, would having a client relations guy in Toronto bring Caravel’s operations within the purview of the OSC? Why are you trying to stir s*** up? I am no fan of regulations, it would be hypocritical of me to bring up these inconsequential minutiae. It’s probably a consulting arrangement. I am not qualified to pass judgment on securities regulation matters. I'm not a taxation expert either, so I don't know whether dating a high visibility Toronto real estate broker, would bring one within the Canadian tax net, if you are wondering. Though I do believe the safest course is to sever all links.

Lately, Caravel is long the uranium theme, an archetypical move for a Canadian hedge fund manager. The fund makes prominent use of the standard hedge fund tagline: “Above market performance, below-market volatility”. They have not delivered on the performance part over the past five years. But at least, Caravel’s self-reported Sharpe ratio is at 1.22. Anyways, Caravel will sink or swim by virtue of its long-term performance, not these phoney-baloney awards. I can't say I am holding my breath.

“The need to change the way managers are compensated, how they treat their investors’ capital, and how they provide liquidity and transparency has never been more important than it is today."

- Jeff Banfield, in a speech called Heads They Win, Tails You Lose during his first retirement