Are we still doing that thing where the market falls and I write up a struggling fund? I have mixed feelings about it. It’s like that old poem:

No man is an island.

Each fund’s demise diminishes me,

For I am involved in fund-land.

Therefore, send not to know

For whom the funeral bell tolls,

It tolls for thee.

Sad!

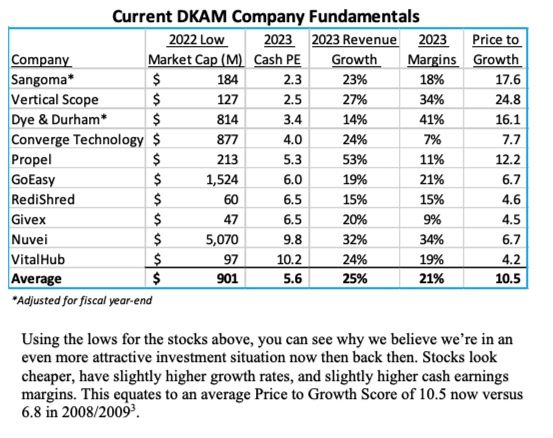

Many people have been pressuring me to write about Donville Kent - a hedge fund that is down 52% for the year to the end of October. I have resisted, in line with my resolution to be more presidential. It would otherwise be a deserving candidate, given that the 10 year number is about 4% annualized, 5 year number is -6.26% annualized and the fund has underperformed the S&P 500 since inception in October 2008. Of course, it still charges performance fees. Anyways, such stories are repetitive. But I found an interesting tidbit about the firm recently.

You might know that Donville Kent fund manager Jason Donville is a fan of Home Capital Group. That is because he likes companies that are capable of earning high ROE over the years. And Home Capital has a history of earning over 20% ROE for a few decades. I get the impression Donville did not own Home Capital at the time of the takeover deal announcement last week, as you can see from this recent holdings list.

However, Donville Kent is a partner of the RiverRock Mortgage Investment Corporation, launched by former Home Trust President Nick Kyprianou. Jason is a director and his firm is a dealer for the fund. Former Bridging Finance BFF, the notorious Ninepoint Partners also sells the fund. RiverRock lends to the subprime segment targeting an annual yield of 7% as of this month with average loan-to-value of 68%. They are very focused on the GTA and surrounding towns. They have variable rate loans, but with terms of only 1 year. More consequentially perhaps, they offer quarterly redemptions to investors after a 1 year hold. One year GICs pay 5% these days which has resulted in redemption pressures in a number of these funds. I don’t know too much about MICs, you tell me if Donville Kent will have another setback on its hands.

This leads me to the most famous debacle in Donville Kent’s glorious history. Jason Donville was a well respected financial services analyst for Sprott Securities who then started his own fund in 2008. He had good early numbers. But he tends to have concentrated portfolios. In 2015, like Bill Ackman, he was caught with a large weight in Valeant, just as the company faced a bear raid, primarily driven by Citron Research. Jason Donville bravely went on BNN to defend his holding using a rather brash tone, calling Citron Research’s Andrew Left “Some turkey in Nevada”. The full interview is worthy of a Canadian Heritage Minute feature. Around the 3:30 mark, Jason asks Amber rather overbearingly whether she knows what Valeant’s ROE is. Then Jason whines about short artists raiding stocks. To which Amber bravely asks at the 8:13 mark, how that’s different from all the longs talking their books. Most dramatically, Amber asks the very wise question: Why not just walk away? That would have been the wise course because Valeant went on to lose another 66% of its value. To her credit, Amber mostly just listens, giving Jason plenty of rope to hang himself. And she never once smirked at the banker outfit or "out there" eyewear!

After this on-air meltdown, I never took Jason seriously. Valeant was actually my last great short, after that, shorts became extremely difficult, until this year. But here’s where Jason’s setbacks hit a bit close to home: I am a strong believer in the ROE method, aka “compounders”. No less an authority than Charlie Munger concurs:

Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you’re not going to make much different than a six percent return – even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result. — Charlie Munger

I believe it takes years of dedicated study to surface this valuable insight from all the more generic things Buffett and Munger say. Or alternatively, you can spend 5 minutes on Twitter, it’s no longer a big secret. Ironically, Munger got Valeant right, rejecting it after Ackman and others pitched him on it. Of course, while ROE is an important tool, it is only one part of a toolkit. Donville buys companies that are much earlier stage. In contrast, the best ROE guy I know owns a portfolio where the average company was founded about 100 years ago. Donville’s big rant in that video was that Valeant had ROE of 45%, but that didn’t last very long. Donville also has much higher turnover - the whole point about the ROE strategy is to let the compounding magic of the company’s reinvestment of earnings work for you. Donville also shorts. In other words, he has one good basic idea (ROE matters), but then falls for many of the same traps as the average hedge fund manager. These days, his firm also has something called DKAM Boosted AI Quant Fund. I think it's worth a shot, why not! The main fund had about $30m in new money come in last year. As a result of this year’s performance, the firm is now sub-$100m - about $75m of pissed-off money, I assume. But credit where credit is due, when it comes to avant-garde eyewear, Jason is without peer.