Let’s go there and talk about man of the hour, Eric Nuttall. The last man limping in the active management of an energy fund. People want me to talk about Eric Nuttall - I have resisted so far, because he fails the bigliness test. Also, I didn’t want to pile-on - his fund is down 75% YTD. The 5 year CAGR is -32.64%. For weeks, I thought that there will be a more gracious and propitious time to write. But I have constituencies to serve and I have assertiveness issues, so here we go. In 2004, I actually cold-emailed Eric Nuttall who had just started working under Eric Sprott. I had read that Nuttall liked some speculative Venture company and I wanted to talk about it. Believe it or not, at that time, Nuttall was a generalist. We did have a bit of a dialogue. I subtly suggested we meet to swap ideas, but Nuttall didn’t seem too keen. And I understand - Sprott was white hot back then. Eric Sprott was at the apex of the Bay Street pyramid. I was working for a much more obscure firm.

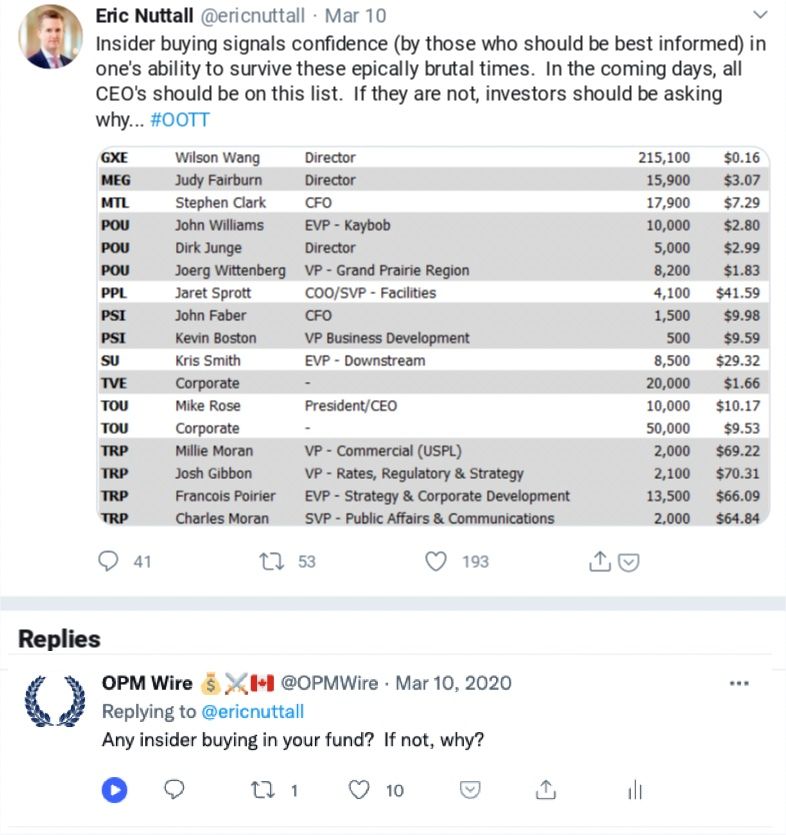

So Nuttall made nice coin when Sprott went public - the figure I hear is $10 million. I am told he has a nice home worth a few million that he’s renovating. And those extreme cut-away collar shirts he favors can’t be cheap. I know they don’t offer them at Uniqlo. People are pointing at the unfairness of this situation. A few weeks ago, in response to him talking about insider buying in energy stocks, I asked him on Twitter how much of his own fund he was insider buying. This was our exchange:

As you can see, he didn’t reply. The question still stands: how much of his own wealth did he have in his fund this year? He constantly strikes an optimistic tone in public, is he putting his money where his mouth is? Nuttall also constantly opines on the price of oil. I think he is well placed to know how delusional that is. His mentor, Eric Sprott, was the chief promoter of the Peak Oil theory back in the early aughts (the notion that oil production would soon hit a peak and then enter into irreversible decline). Remember all that? The energy people had some good times for a while. I was so gullible, I believed in anyone who could put up high numbers even for two years. There was a time I thought I should make Peter Linder my mentor. Shortly after, his natural gas-focused fund lost 99%. Ironically, watching an interview of John Embry, a close associate of Sprott, eventually gave me the insight to avoid all resource companies. He said all resource companies are in the business of liquidating their assets. Unless they trip over a mining discovery, strike oil or acquire new assets, all resource companies have a predictably finite life. Most ordinary operating companies like a Coca Cola or Disney have an indefinite life. The other weakness is, of course, the unpredictability of commodity prices. Too soon?

The other reason I didn’t want to write about Nuttall is that the “pain trade” will always reverse at some point in time. Almost everything mean-reverts in finance. Oil will probably come back strong at some point. Whether Eric Nuttall will be around to benefit from it, I don’t know. I have to say that I am very impressed by his perseverance so far, stick-to-itiveness is important. But what would be even better is some personal alignment, so I’m waiting for an answer.