If you’re looking for a money manager who has made a lot of money from the Nvidia/AI meltup, Irwin Michael would be a local candidate. He runs ABC Funds. His main funds are up 20 to 24% year-to-date. People who haven’t followed him in recent years, might be astonished at the 180 transformation of this once value-obsessed manager. Contrarian, deep value investing were his trademarks along with a penchant for wearing a beige trench coat and a Tony Soprano-style man bracelet plus pinky ring.

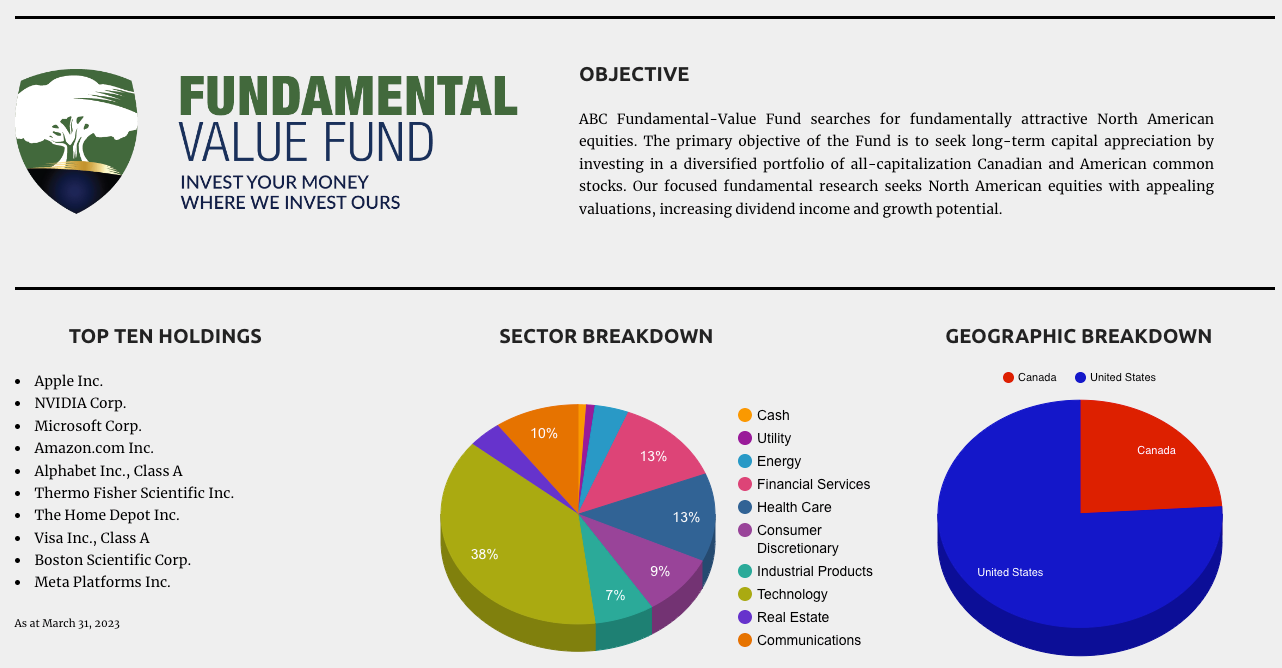

For decades, Irwin Michael cared about things like book value and free cash flow multiples. In 2000, Irwin Michael experienced deep pain for steadfastly refusing to join the dotcom bubble - when Nortel was about 30% of the TSX index. In 2006, he launched a fund called the ABC Dirt-Cheap Stock Fund. That was a typical move from the old Irwin Michael. His assets ballooned to $1.3B. But then his strategy hit some speed bumps. In the Global Financial Crisis, the flagship had a drawdown of about 52%. In 2013-2014, the flagship experienced a 40% drawdown, which was a bit steeper than what the market experienced. He was heavily exposed to resource stocks. Following that debacle, in 2015, ABC embarked on its new path focusing on free cashflowing, fundamentally sound companies. In 2016, he penned an essay entitled “New Value” explaining his transformation. He cited increased investor competition and ever more efficient markets. Today, the top 10 in his flagship includes Apple, NVIDIA, Microsoft, Amazon, Alphabet and Meta Platforms (ie Facebook). All his top ten, you will notice, are very liquid, large cap US names. The old Irwin was more about more obscure names, more centered on Canada.

Irwin made the big shift when he was around 65 years-old, 30 years after he launched his firm. I know from being a close observer of that other famous Wharton grad - Donald J. Trump - that it’s difficult for a tiger to change its stripes. So I am amazed at this transformation. What prompted such an about-face? He has his three millennial sons working as research analysts at his shop, they played a part in nudging him. The entire investment team at ABC Funds is now made up of just the 4 family members. The younger generation joined in 2011 and 2012. Ryan Michael and Harlan Michael are CFAs. They are still only Associate Portfolio Managers, so Irwin is fully in charge. He’s also Chief Compliance Officer. Brandon Michael, on the other hand, is a Chartered Market Technician.

No one knows about parenting more than me. It’s quite an achievement to have three children working in the business who seem qualified. Unlike his two brothers, Brandon is not currently on the path to achieving the full portfolio manager regulatory license. In order to promote family harmony and/or discord, I should mention that it might not be impossible for him to still get the license even without the CFA/CIM. By law, the OSC must keep an open mind about various credentials. You might think that being a technical analyst in a value shop makes Brandon the black sheep. But Irwin claims to use technical analysis to determine entry and exit points.

It’s one of several ways in which Irwin is a rather quirky value investor. Here’s an exchange from the book Stock Market Superstars in which he’s profiled (which served as a source for some of the information in this piece):

Q: I might be wrong here, but I describe your style as opportunistic value. Does that make sense?

A: Well, I’ll give you as many adjectives as I can. It’s opportunistic, deep-value, contrarian, patient, proactive, disciplined, focused, with a sense of urgency. Want more?

Prior to his come-to-Jesus moment, so to speak, Irwin has described his goal as being to buy positions that can go up 50% within 12-18 months. This implies that you find an overlooked stock now and that magically other investors correct the errors of their ways within 18 months of you buying. It’s a strategy heavily reliant on outsmarting other market participants. It has very little to do with business investing, it’s closer to a trading strategy. The deep value strategy is deeply unpopular these days. Tim McElvaine and Francis Chou are probably the only two practitioners left in Canada. When’s the last time you heard someone launching a deep value fund?

Assets at ABC are now around $500m. Irwin started his firm in 1985. He had major pedigree and a seemingly reasonable investment strategy. Of course, I have pondered why someone armed with such advantages couldn’t crack the billion dollar mark nearly 4 decades later. The two big drawdowns a few years apart definitely killed the momentum. The conditions of the past 14 years have given the opportunity for many managers to create the illusion that they’re less volatile, but 50% drawdowns are to be expected for a long only equity strategy. The overall performance since 1989 is about 10% annualized - respectable. ABC charges 2% management fees, which is a tad high. Despite being so in tune with the zeitgeist since 2016, his American Value Fund (the best performing fund in the ABC stable) has trailed the benchmark, delivering 9.53% per year over the past 5 years (vs 12.7% for the benchmark).

I don’t know how it’s possible to be running a FAANG-heavy portfolio since 2016 and still manage to underperform the US benchmark. This recent description of their process might have something to do with it:

“24-7 market vigilance, analysis of a never-ending flow of meaningful corporate and economic news as well as incessant modifications of our portfolio holdings are now incorporated into our asset management duties.”

Irwin has said: “A portfolio manager gets better over time. You learn from your mistakes, hundreds of mistakes that you make, and hundreds of wins. You develop, and you probably peak, or you level off, in performance and style, in your late 40s or early to mid-50s.”

Here at OPM Wire, anything you say can and will be held against you. Irwin is around 73 years old now - which would make his observation spot on if you chart his AUM or alpha. Or pinky rings. This concludes the polemical part of this post. If you don’t know Irwin Michael and need a perfunctory bio, read on.

Irwin Michael bio

Irwin Michael has an MBA from Wharton, just like Ninepoint CEO John Wilson. Sadly, Warren Buffett dropped out and transferred to the University of Nebraska. Irwin is originally from Montreal and started his career there at Hodgson Roberton Laing. He then worked for Morgan Stanley during John Mack’s reign. He then moved to Toronto to become a junior partner at Beutel Goodman, along with senior partners Seymour Schulich, Ned Goodman and Austin Beutel. In 1985, he went on his own, starting with managed accounts before converting to funds in 1988. This makes Irwin Michael a rare manager with such a long track record.

The flagship fund is called ABC Fundamental Value Fund. The ABC Fully Managed Fund is meant as a more balanced product. The AI boom that Irwin is currently riding is not the only epoch-defining change that he has witnessed. He also saw first hand the discovery of fire and the invention of the alphabet, for which he named his firm. He was originally going to go with the edgier “XYZ Funds”, but someone reminded him that it was important to rank high in the phonebook, so ABC it was.