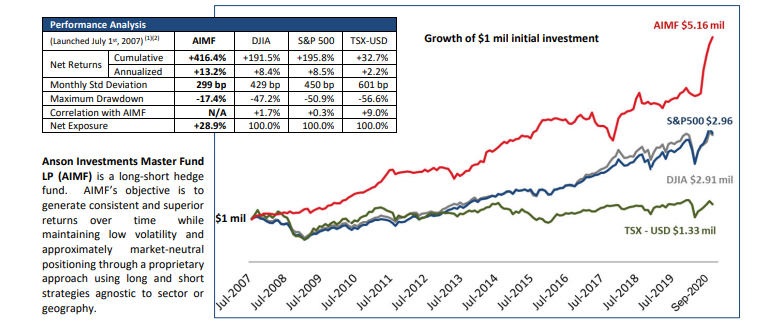

I had to talk about man of the hour, Moez Kassam, whose flagship fund is up 29.3% YTD. You can see in this chart a highly elusive pattern known as “beating the index”.

Big wins in the quarter just ended included GMP Capital, an activist situation and Apollo Healthcare, a beneficiary of the pandemic because it makes soaps and sanitizers (up 6x YTD). GMP went up 49% during the quarter; earlier in the year, it was trading near its cash value. Apollo is the cleaned up version of Acasta Enterprises, which I wrote about in my previous post. One of Anson’s expertise is to short small caps that go parabolic on little substance, like the new Eastman Kodak, which went up 20x before crashing. I am only aware of a handful of trades Anson has been involved in, but I have to say I am impressed by the opportunism of some of their ideas. It’s been a while since I have spotted someone with an eye for opportunity in Canada, no offence to any of you.

Anson now claims to manage more than C$1 billion overall ($668m in the main fund). The firm has four principals and a few other products. I say all this in reliance of Anson’s latest newsletters and the big-name fund administrator they use. Trading-oriented funds like Anson are opaque operations even for their clients.

Anson is the target of anonymous blog posts that make all kinds of allegations, mostly of market manipulation. I broadly see that it’s Anson against disgruntled promoters of junior stocks, involved in cannabis or otherwise. Anson is fighting back with lawyers, private investigators, etc. Sadly, Black Cube is conflicted out. I carefully re-read the big hit piece on Anson. It mostly talks about situations I have no knowledge of. But towards the end, it talks about a stock called Facedrive being a victim of Anson. That’s an eco peer-to-peer ridesharing horsecrap of a company recently valued at $2 billion. Revenues last time I checked were annualizing at a million or two. Anson’s alleged actions in regards to Facedrive (ie shorting or market spoofing) are described as “a mockery of everything the capital markets are supposed to stand for”. A few minutes of analysis should convince you of how little substance Facedrive has. The real mockery is that there are no effective tools to capitalize on this aberration. It’s very rare that a good company’s fate is determined by the activities of a short seller. Despite this enticing invitation on one of their websites, I strongly advise you not to “business with Facedrive.”

In the time I have been blogging, I have received some tips about “nefarious” stock promoters. But so far, I have not written them up - I find those are total dog-bites-man stories. Promoters, short-sellers, activists, newsletter writers, the Federal Reserve…it’s all part of the big-boy game that is the stock market and business generally. I’m with Fergie, when she said big girls don’t cry.