You have probably been wondering: now that Gluskin Sheff is gone, what other firm could Onex buy and run into the ground? Nicola Wealth Management has had very high growth in recent years. It currently has 13.6B AUM. And it already has 50% of clients accounts in private assets (including 30% in real estate). Nicola is about "beyond 60/40", ie the "institutional pension approach". I previously reviewed another Vancouver-based firm with high growth and heavy exposure to private markets: Harbourfront Wealth. First things first: Nicola Wealth is way, way better than Harbourfront Wealth in every important regard. But such things are relative.

The growth story

When John Nicola started Nicola Wealth, he had already been an advisor for 20 years. He had just split off from Jim Rogers of Rogers Group Financial (another Vancouver biggie). John had been President, but Jim wanted to control Rogers Group again, so John went on his own. He started Nicola with a book of $80m at age 42. Ten years later, in 2004, the firm was approaching $300m AUM. The firm reached $1B AUM in 2010. Ten years later, it reached $8B. Just in 2021 and 2022, Nicola added a few billions in AUM. It’s the firm with the Big Mo. The firm now has staff of 430. When they had a billion, they had 40 staff. Now, they have 13x as much AUM and 11 times the staff. So the economies of scale are not that great. Today, John Nicola at age 72 is way biglier than his former partner Jim Rogers. Sad!

The threat

Nicola is clearly coming for Ontario. They already have staff of 85 in the province. Ron Haik used to hold the fort for them in Toronto, but in 2020, they hired the higher profile Danielle Skipp to oversee all Ontario operations. She was formerly with BLOOMBERGSEN. I'll give you a minute to regain your composure.

The client profile

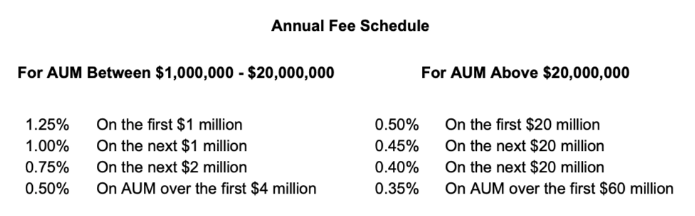

Nicola is squarely in the doctor / dentist / business owner / executive client segment. Their minimum investment is $1m. The average client relationship has assets in the $2-$4m range. But the group has always accommodated smaller accounts that are on the path to reaching the right profile in future (known as High Earners Not Rich Yet (HENRYs)). It’s one of the many ways the firm has been built with an eye to the long-term. Here's the full fee schedule:

The operations

Nicola believes in hiring people early in their careers and molding them to become advisors in the Nicola way. Being a Nicola advisor means focusing mostly on doing the best job you can for your clients with less emphasis on prospecting for new clients. By creating a “wow effect” with existing clients, the firm creates strong word-of-mouth marketing. Nicola claims a 99.4% client retention rate and that more than 80% of new business stems from client referrals.Each client is matched with both a senior and junior advisor. In effect, this is an apprenticeship model.

Nicola has a generous profit-sharing philosophy, implemented via options. In the past few years, bonus payments have been at least 25% of staff salary, more recently reaching 35%. Staff are eligible for profit-sharing without a waiting period. John Nicola and his wife own about 47% of the firm. Sixty other people own the remaining balance. The Nicola couple's ownership of the firm was 54% eight years ago, so they're giving up about 1% of the firm per year. Employee ownership is also very diffuse, there's no one else owning more than 5% of the firm. The number 2 at Nicola is David Sung. His title is President and he joined via an acquisition in 2004.

Crucially, Nicola clients belong to the firm. When an advisor joins Nicola, they transfer their clients to the firm and get shares in the firm in exchange. So there's no notion of advisors having their own "book of business" within Nicola. This is very shrewd of John Nicola. It's a less common model among the large wealth managers. The notion that the client belongs to the advisor is what led to the disintegration of Gluskin Sheff under Onex. A handful of advisors owning the bulk of the relationships meant they had the power, not the firm. Gerry Schwartz got played! Another way that Nicola the firm is powerful, is that they have proprietary alternative investing products. An advisor can't leave Nicola and easily spin the same "we have unique low-volatility products" narrative.

Another key focus at Nicola is using technology as much as possible. John’s son Chris Nicola is CTO. He was a co-founder of robo-advisor WealthBar (subsequently sold to CI).

The good

Nicola is very good at fulfilling the emotional needs of clients. This is obvious in client services. But their investment strategy is great at keeping client misbehaviours in check. First, they are very diversified, which tempers volatility. Second, they are very cash-flow focused (ie focusing on assets with strong current income-generation profile). By getting clients to focus on the income they are generating, they are less likely to be swayed by fluctuations in the values of their account. And in any event, because so much of their account doesn’t get a daily market price, the clients perceive less volatility.

The bad

A lot of what I found about Nicola is better than I would have thought. I hardly need to tell you that I am a skeptic on the industry. Here’s what I think is the main risk for clients. Nicola has taken a rather extreme allocation - 50% - to private assets in relation to the net worths of their average clients. People with $4m or so in investable assets have liquidity needs. Private markets are a whole other beast. I asked someone on Twitter who I find has incisive takes what they thought about Nicola. While they didn’t know the firm, within a few minutes, they came back with this:

it looks like a wealth mgr with limited legit direct investment capabilities - yet they claim to do every Alt under the sun? if they say its in-house i call bullshit. you cant do that many diff asset classes inhouse with a wealth mgrs DNA

I agree this is the number one concern, though I would phrase it slightly more politely. To be clear, Nicola’s approach to private markets is a combination of direct investing, co-investing with partners or syndicates and also some outsourced investing. But until a few years ago, Nicola used the tag line “more than a financial planning firm”. Their DNA is financial planning and wealth management. They have involvement in real estate going back to 2000. But over the past 10 years, they have morphed into a Brookfield for retail clients. When I look into the profiles of Nicola Wealth employees, it just doesn’t compare to the profiles I am used to seeing at leading private equity or real estate firms.

Nicola had a transaction recently where they bought a portfolio of 22 industrial properties in Minneapolis. This was as part of a competitive process run by Colliers on behalf of Blackstone. You can read for yourself the average profile of a Blackstone professional versus the profiles of even the leaders of Nicola. John Nicola’s own roots are as an insurance salesman. To be fair, he has built his firm in ways that I find astute, methodical and visionary. He says he reads one book per week. I have found much to admire and learn from. But as is often the case, there’s a big gap in talent between the builders and the hired guns.

I have never seen a firm spanning the breadth of capabilities that Nicola is trying to offer. Even Blackstone won’t sell you insurance products or offer financial planning. Either because they lack self-confidence or because they believe in specialization. Nicola does the full spectrum of financial, tax and estate planning plus wealth management and Blackstone-style wheeling and dealing. They invest in public markets. But even there, they don’t stop at basic buy and hold investing. They play with options. On the private side, they are involved in real estate (both acquisition and development), mortgages, venture capital, infrastructure, renewable energy, private debt and possibly more.

What attracted my initial interest in Nicola is that I saw their name a few times in hot tech deals. It turns out their VC deals are pretty small in the context of their $13.6B AUM. But still, we should pay attention to any hint of shoddy thinking. The VC fund was officially launched September 2021. Their VC fund with assets of $80m was marked up 19% in 2022. Does this sound in any way connected to what we know transpired in 2022?

Their private equity fund has delivered 9% annualized since 2012 and has $822m in AUM. A presentation from a few years ago mentions the potential for 5%+ higher returns from private equity vs public markets. If a private equity fund is compounding at 9% during the Golden Age of Capitalism, why bother? Either the fund is understating its returns or the benefits of private markets are illusory. An investment in the S&P500 would have trounced that. Or if you thought private equity was wonderful, an investment in the publicly-listed Blackstone is up 6-fold during that time period. Three years ago, I bought into the notion that one of the adaptations to the fact that public markets are hyper-competitive is to allocate more to private equity. But the more I have studied this, the more I believe this is simply a “grass-is-greener” delusion. The public markets allow you to express an almost infinite number of investment themes, without sacrificing liquidity.

I will cover their extensive real estate pools in a separate post. But be aware of one major conflict Nicola has. Their average client has about 30% of their account allocated to proprietary Nicola funds making direct investments in real estate. These funds have 6 months liquidity provision and amount to many billions in holdings, including leverage. If, as often happens in downturns, it's possible to buy real estate cheaper via listed REITs than private pools, do you think Nicola will just chuck their direct real estate holdings and buy the bargain REITs? Somehow, I don't think that's likely. Would you be comfortable putting 30% of your life savings in a single REIT? In a way, that's what Nicola clients are doing. The prospects of Nicola clients largely depend on the real estate acumen of a single manager, Nicola Wealth.

All this being said, Nicola seems to have avoided most of the traps inherent in pursuing “alt” strategies. It has definitely set sights higher than dealing with Ninepoint. I have found very little that is obviously catastrophic. For example, Harbourfront invested in Bridging Finance and so did another major globe-straddling “allocator” whose name I will conceal out of politeness. In contrast, Nicola hangs out with much smarter people. For example, its private debt fund took part in a deal as part of a syndicate led by Golub Capital. Golub Capital is a sophisticated debt provider to private equity transactions, similar to Toronto's own Penfund. So on the information I currently have, I mostly have quibbles with Nicola. Important quibbles. Nicola Wealth was an investor in startup RenoRun, which raised about $180m and then filed for creditor protection all in the span of three years. But such outcomes are part of venture investing. I should not have even brought it up.

The kompromat

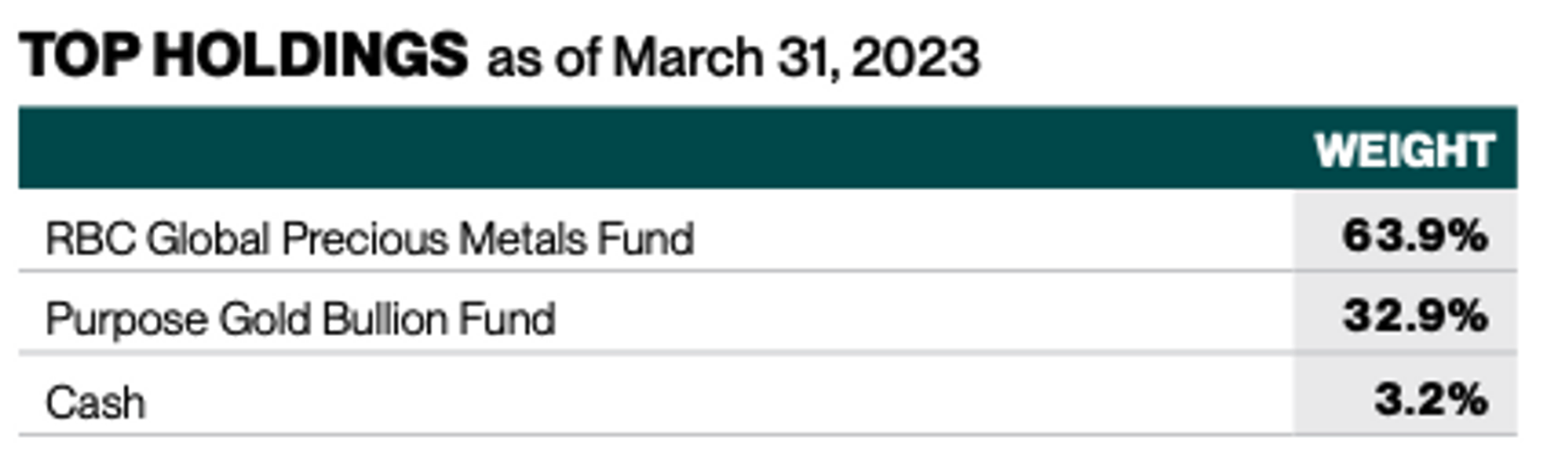

I can only assess Nicola as a third-party observer. Nicola did not answer questions I sent, so obviously we must draw adverse inferences. My information is imperfect, but I try to draw conclusions from every morsel of information I can get. Here's their precious metals fund:

I don't think any thoughtful professional would think creating this fund is an efficient way to give clients exposure to precious metals.

Nicola Wealth President David Sung has a strong predilection for wearing black shirts. Here he is delivering an investment update while wearing an all-black outfit. I am sorry, but unless he was moonlighting later that day as an African-American TV preacher, this was a mistake, in my view.

Who is the investment genius at Nicola?

I like to bet on a singular investment genius. That’s how in my view, the best investment opportunities present themselves. John Nicola is CEO and appears to be a great business builder. On most presentations I have viewed, he doesn’t even take the lead in answering nitty-gritty investment questions. I see no one at Nicola that I see as a legitimate investment genius. After the Global Financial Crisis, Nicola was the “exclusive Canadian partner” of perma-bear John Mauldin. I didn’t know much about this macro forecaster, but I watched a few minutes of him talking and I must concede that he’s a supremely talented bullcrap artist. If John Nicola is willing, a few decades into his investing career, to associate himself with the likes of John Mauldin, that’s pretty disqualifying as to any claim to be an investment genius.

There's a saying that goes: "The race doesn't always belong to the swift, nor the battle to the strong, but that is the way to bet." I'm far from an absolutist on pedigree, there is no royal road to being an investment genius. But if you peruse enough bios of members of elite investment organizations, occasionally you will come across people with the type of pedigree that makes discerning Jewish or Indian moms proud. Nicola's Head of Private Wealth was into Retail Products at CIBC. Their Head of Real Estate was a broker at Avison Young. Their big public markets guy is a CIM. I want to puke.

The results

On its website, Nicola prominently advertises its performance going back to 2000 - 7.11% annualized. That was their start as a true wealth manager, including their first incursions into real estate. Firstly, for all their vaunted sophistication of going BEYOND stocks and bonds, 7.11% is not such an impressive number. The S&P 500 in CAD did 6.11% over the same period. That's the only benchmark I care about. Their last ten-year composite performance trails the S&P 500 badly - about 7% annualized vs 15% for the S&P 500 in CAD. This despite using the leverage inherent in real estate. Nicola will of course say that they had much lower volatility. For example, being down only 5% in March 2020. Their numbers also include multiple asset classes not just stocks. Nevertheless, clients should forget ancient history and pay attention to their sub-optimal performance in the post 2008 era. And ask whether an advisor fulfilling their "emotional" needs is worth such underperformance.

I unreservedly endorse Nicola Wealth...for employment opportunities

From some of the things I have mentioned above, it should be clear that Nicola appears to be a great employer. Both if you are interested in being an advisor or on the investment side. It's a rare opportunity to work in hot fields like private equity and venture capital but with less competition. Nicola ranks well on various surveys of good places to work and that is validated by the long tenures of various people there. Or maybe the people there don't have too many options.

Conclusion

Nicola Wealth made a prescient, early bet on real estate and so had the wind at their back. They have now used the halo effect from that success to diversify into all manner of assets where they have no discernible edge. Their heavy allocation to private assets is perceived as lower volatility. However, there's no free lunch in investing and clients are simply trading away a known risk (that public markets will periodically have hissy fits) for all sorts of unknown risks in the private markets. These risks include liquidity risk (ie if many Nicola clients decide to exit or if there's a crash in the broader private markets). There's also the risk of underperformance. Over the past ten years, Nicola clients have had lower returns than you could have through simple indexing. One useful lesson from Nicola is how low the performance threshold for success is in the asset gathering game. 7% over the past 23 years is all it took. Most of the billions Nicola has were raised during the past 10 years when the firm materially underperformed the S&P 500.

I plan to write more about Nicola Wealth starting with a post on their real estate activities, so I am very interested in any additional info or thoughts you might have.