There has been a lot of activity surrounding the private debt funds managed and marketed by Ninepoint over the last few months. But first, we would like to remind you of Ninepoint’s assurances to investors after they gated their private debt funds in early 2022. Since then, there has been almost no rotation on the top holdings of their private debt fund portfolios.

When Ninepoint communicated its initial decision to gate its funds in late February 2022, the company wrote to advisors:

“Each of the fund’s portfolios is well positioned to continue to generate strong risk-adjusted returns for investors.”

During a webinar held on June 6, 2022, to update advisors on the status of Ninepoint’s private debt funds, Co-CEO John Wilson told the audience:

“We are extremely proud of all our private debt funds … and the current portfolios are extremely well positioned”

After Ninepoint halted payouts and gated three of its private credit funds on May 31, 2024, Bloomberg reported that the company said:

“Investors will continue to have access to the ongoing benefits of being invested in private credit as we remain focused on ensuring the sustained performance and stability of our current portfolio.”

Ninepoint’s assurances of an “extremely well-positioned” portfolio and promises of sustained performance and stability appear increasingly out of step with reality.

Fund 1: The termination of the Ninepoint Canadian Senior Debt Fund (aka The Ninepoint-Waygar Fund)

In June 2022, we initiated coverage of the Ninepoint-Waygar fund. We didn’t take Waygar’s claim that their investments were “not at risk at all” at face value, nor Ninepoint’s “conservative lending” claims. We considered their approach anything but conservative.

Some of our thinking back then: Michael Wekerle, was someone without any “background in the music industry, other than going to shows.” And yet, Waygar saw fit to lend him $25 million to renovate a small music venue. Another head-scratcher was lending millions at a high-single-digit fixed-rate to a “plant-based technology company” (i.e The Very Good Food Company) — even though it was incinerating cash and had only a few million dollars in sales. How could such a rate compensate a lender for the underlying risk of a borrower with such characteristics?

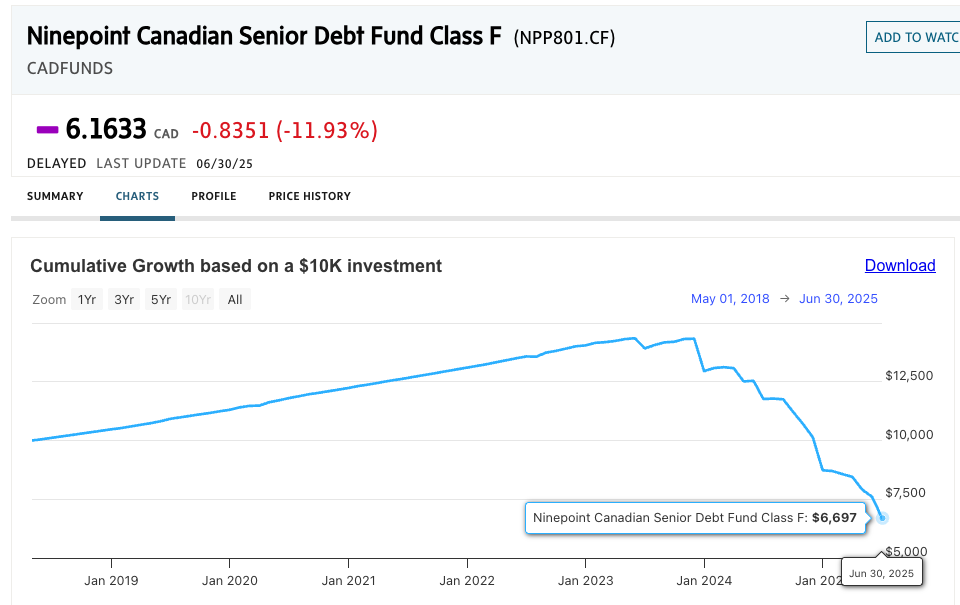

All that investment acumen has led the fund to destroy capital— despite all the assurances from Ninepoint & Co. If you invested $10,000 at inception in May 2018, your investment would have been worth $6,697 seven years later, according to The Globe and Mail. The latest Net Asset Value figure showed a monthly decline of 11.9%.

Three years after our initial coverage, Ninepoint communicated to its investors that it was terminating the fund. The decision was made “in the best interest of all unitholders,” according to Ninepont.

As part of the decision to wind down the fund, Ninepoint also terminated its relationship with Waygar Capital.

It is unclear how long it will take to liquidate the fund.

In the meantime, US Congressman Cory Mills, the largest borrower of the Ninepoint-Waygar fund, who used the capital from Ninepoint’s investors to fund research & development, is facing an investigation from the US Congress Ethics Committee, involving his financial disclosures. Cory Mills has a dubious background, rife with controversies, some of which have begun to make the news. This week, Miss United States accused him of sextortion.

Also, "three other women described Mills as a liar, saying he confidently misled them about fundamental facts of his life," according to Drop Site News. Two former romantic partners described Mills as a "psychopath," according to the same source.

A few weeks ago, it was reported that Mills was facing eviction from his apartment in DC, after its landlord accused him of failing to pay $20,833 of monthly rent from March to July. Unlike Ninepoint, Cory’s landlord doesn’t allow for payment obligations to be PIK’d. Strangely, all of this happened while Mills claims to donate his entire salary as a congressman—a strange choice, given the amounts he owes to Ninepoint, they could have used the money. Anyways, he has since reportedly paid the rent owed.

Coincidentally, Waygar Capital itself had trouble meeting the terms of the lease for its office space located at 25 King Street West. In February 2024, its landlord filed a statement of claim with the Ontario Superior Court of Justice, after Waygar failed to pay rent for 6 months, totalling $275,958.67.

The fund‘s second-largest borrower, Michael Wekerle’s live venue El Mocambo, has found a buyer. An entity associated with Brookfield bought it, according to the asset purchase agreement filed in Court. The purchase price was redacted from the filings.

Remember Ninepoint co-CEO John Wilson’s claim that their credit strategy is safe because they can always pay themselves from the collateral? In order for this “senior-secured lending strategy” to work for this particular loan, the El Mocambo should have been sold for at least $55.5 million - the amount that the Ninepoint-Waygar fund was owed by El Mocambo entities as of January 2025, according to Waygar’s application in Court.

John Wilson "conservative" claim

It is only a matter of time before we find out how much El Mocambo was sold and the merits of Ninepoint’s senior secured approach.

Ninepoint points out that it is the largest holder in the Ninepoint-Waygar fund. This happened after they advanced up to $30.3 million to the fund in the form of a promissory note, as of June 30, 2023. By December 31, 2024, a balance of $23.5 million of the note was converted into units of the fund, according to the fund's financial statements.

Ninepoint is offering a modest concession to affected fund clients: a 30% reduction in management fees starting around September 30th. But this feels like a hollow gesture—especially given that it likely costs Ninepoint nothing, since they’re no longer splitting those fees with their now-terminated “Loan Consultant,” Waygar.

Fund 2: Ninepoint is still selling any old crap: AIP Convertible Private Debt Fund has 60% of its portfolio in a zombie borrower.

In September 2021, we wrote about the AIP Convertible Private Debt Fund as a case in point of how Ninepoint would sell any old crap. Nothing has changed since then— they are still offering the AIP fund on their website as “other funds from Ninepoint.”

AIP’s most significant holding is IotaComm, a US-based wireless communication and data analytics company. This company shows several signs worse than mere financial stress. We want to share our observations so that Ninepoint can’t claim ignorance in the future.

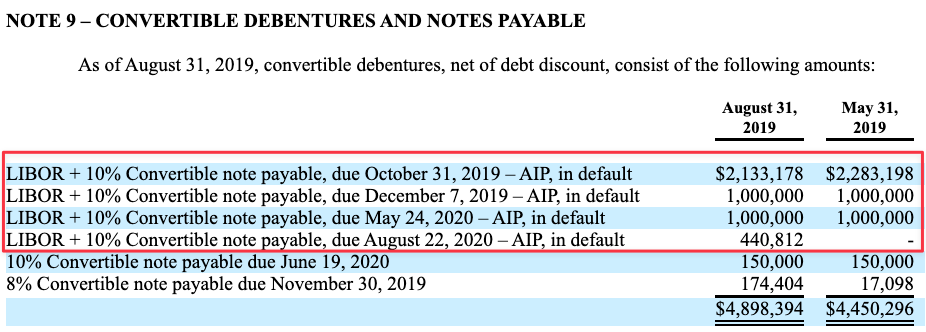

It all started when AIP provided $2.5 million to Arkados Group in May 2017 in exchange for a convertible note. Arkados became the Solbright Group, which was later renamed to Iota Communications, which ultimately took its current form of IotaComm, Inc.

AIP’s CEO, Jay Bala, showed his conviction about the potential of IotaComm (then named Solbright Group) by pitching the stock on BNN in September 2018.

By August 2019, IotaComm was already in default to AIP, according to the company's financials.

In August 2020, IotaComm restructured its capital structure, which included almost $5 million in debt owed to AIP and certain shares and warrants owned by AIP. This resulted in the company issuing 2 new notes to AIP with a combined face value of US$15 million, according to a current report issued by IotaComm.

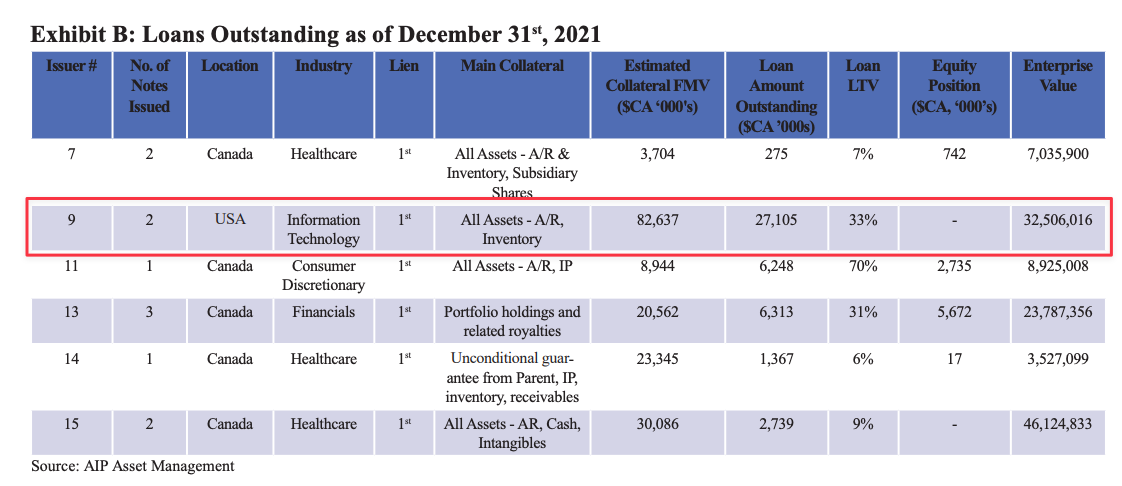

As of December 31, 2021, AIP’s largest loan, representing 61% of all loans outstanding, was to Issuer 9, located in the US within the Information Technology industry— this very likely means that Issuer 9 is IotaComm.

In April 2022, IotaComm’s securities registration was revoked by the SEC after it failed to file its periodic reports. By then, the stock price had become a fraction of a penny.

Following the SEC action, AIP told investors, in its Q1 2022 commentary, the following update on Issuer 9:

“Delays with financial reporting have caused the stock to become untradeable as per SEC ruling in 2021. This restriction on the stock and potential audit costs have the Company’s management contemplating taking the company private and re listing once requirements have been met. AIP has several exit options for this position, including the sale of assets valued at ~USD 1 Billion, according to a 2021 industry comparable transaction report by JP Morgan. It is worth noting that the borrower continues to make coupon payments and prepay interest for any extensions that are being given.”

As of April 1, 2024, IotaComm owed US$30.2 million (~C$41 million) to AIP, according to the company's financial statements.

IotaComm is attempting a comeback by trying to raise $4.99 million from the public, in what seems like a desperate move, by conducting a crowdfunding offering. They are selling their common stock at US$12 per share— valuing the company at US$125 million.

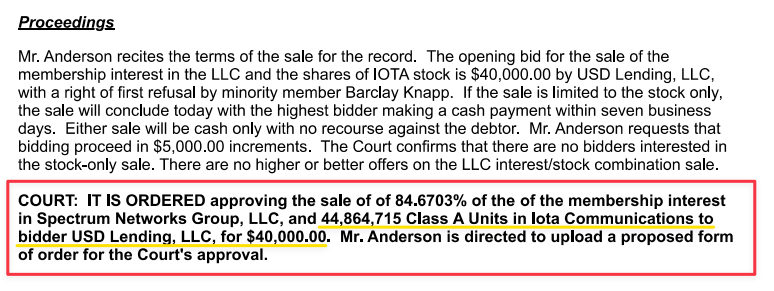

Nevertheless, a few weeks ago, on July 15, 2025, the United States Bankruptcy Court for the District Of Arizona approved the sale of 44,864,715 shares of Iota Communication (that figure is pre a 200:1 split that occurred on July 8, 2024, when the company officially changed its name from Iota Communications to IotaComm) and another asset for US$40,000. This implies that the court-supervised auction valued IotaComm shares at best at US$0.178— a 98.5% discount from its current crowdfunding offering.

(Excerpt from the Minute Entry of the July 15, 2025, Court hearing)

Despite years in business and continuous financing and concessions from AIP, the company's negligible sales have decreased since 2018 while it has burned millions of dollars in operations, according to IotaComm’s financial statements.

| Fiscal Year Ended (in USD) |

May 31, 2018 |

May 31, 2019 |

May 31, 2023 |

May 31, 2024 |

|---|---|---|---|---|

| Net Sales | $290,491 | $2,305,144 | $83,628 | $152,286 |

| Net Cash Provided by Operating Activities |

$(13,683,723) | $(20,185,177) | $(3,287,071) | $(8,372,864) |

These financial results cast doubt on AIP’s claim that the company assets were worth US$1 billion— after all, if that were the case, AIP could have forced the liquidation of these assets at a 96% discount of that value to get paid back by IotaComms and earn a good return for investors.

If you still had any remaining hope of a bright future for IotaComm, we are sad to inform you that the company is led today by Terrence DeFranco, the same guy who has run IotaComm since at least 2012, per the company's SEC filings.

IotaComm checks all the boxes of a zombie borrower

We see AIP’s investment in IotaComm as similar to Third Eye Capital’s investment in Erikson National Energy. When an initial investment of $8.5 million ballooned to an exposure of $50 million, which resulted in Third Eye Capital investing millions “without return or recovery of its investment.” You can read more about that case here and here.

Sadly for investors in the AIP Convertible Private Debt Fund, we believe that IotaComm’s historical inability to generate any material revenues that can sustain a C$41 million debt load, compounded by the decade-long leadership of its CEO, who has consistently squandered cash without delivering any results, will eventually translate into material impairments for the fund.

Fund 3: Third Eye Capital’s lieutenants keep abandoning the ship, while Ninepoint-TEC’s performance lags

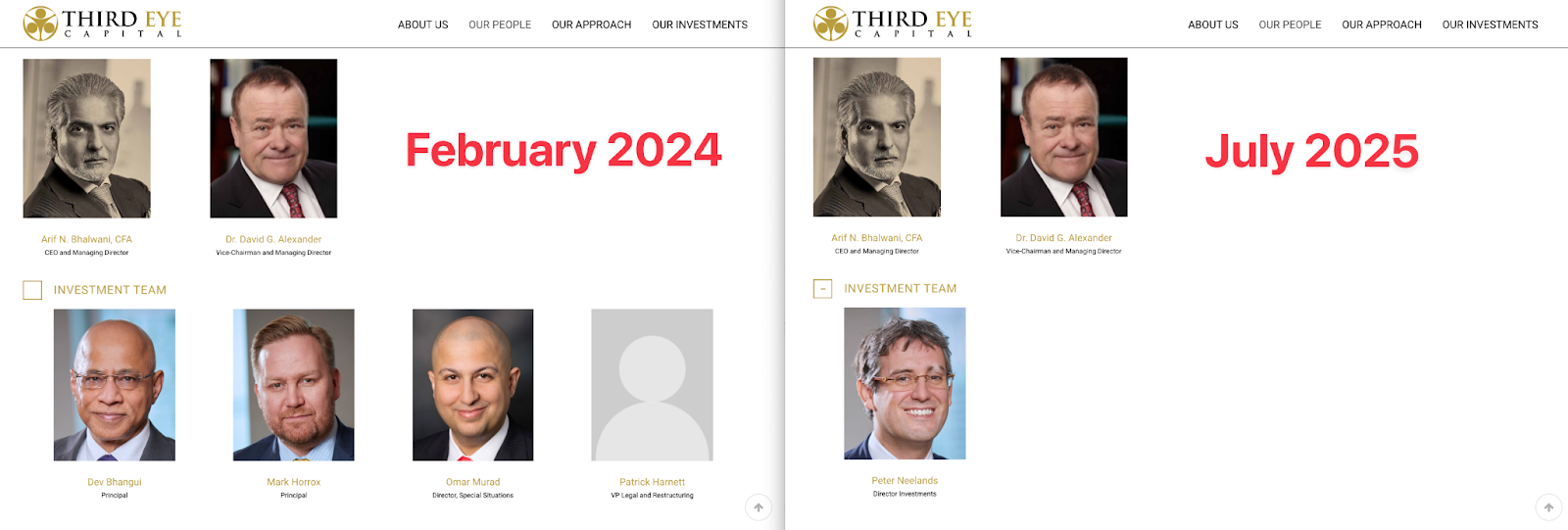

Meanwhile, the manager of Ninepoint’s largest private credit fund, Third Eye Capital, has experienced an executive exodus lately.

In July 2023, David Steele, former CEO of Russell Investments Canada, was announced as President and COO of Third Eye Capital. According to his LinkedIn profile, he transitioned to a role as “strategic advisor” in April 2024, a position he held until November 2024. He is now CFO of Lysander Funds.

As we previously mentioned, CEO Arif Bhalwani lost his trusted lieutenant, Mark Horrox. Mark was involved in several of TEC’s messier files. Since January 2025, Mark has been with Polar Asset Management, per his LinkedIn profile.

Third Eye Capital’s former director of Special Situations, Omar Murad, also left the company. In January 2025, he founded Sigma 7 Capital Partners, described as a “tactical North American private debt platform,” per his LinkedIn profile.

Principal Dev Bhangui is no longer listed as part of Third Eye Capital’s team on their website. He simply retired.

Overall, Third Eye Capital has lost two principals, a strategic advisor and its head of special situations in the last 12 months. The two principals and the head of special situations occupied the first line of Third Eye Capital’s “Investment Team” section of their website, just below Arif.

The executive exodus had “no impact on the operations [of Third Eye Capital]. Any key portfolio responsibilities were transitioned in advance to existing experienced team members and strong new senior hires,” according to Third Eye Capital CEO, Arif N. Bhalwani.

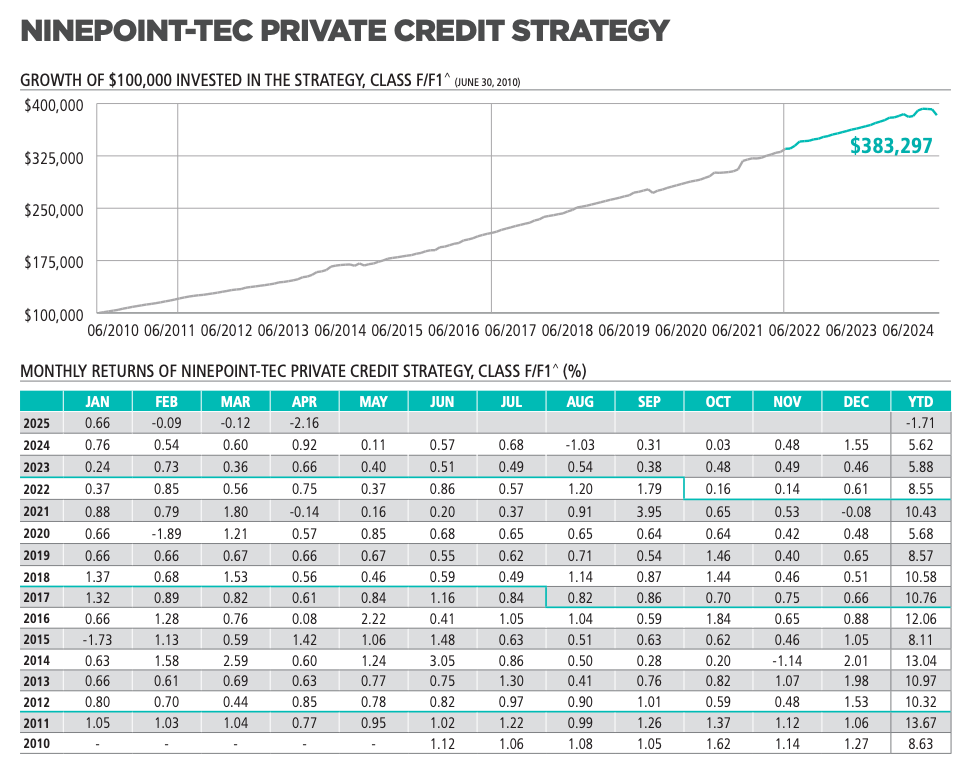

As for the Ninepoint-TEC fund's performance, the fund has posted a YTD return of -2.10%.

The negative performance has been “the result of loan loss provisioning and FX movement due to unhedged USD exposure,” according to Arif Bhalwani. He sees this negative performance as “nothing dramatic, just standard course in managing a private credit strategy.” However, for the first time since the inception of the strategy, it has posted consecutive negative monthly returns, according to its marketing material.

The fund’s AUM sits at $1.2 billion, with 3 borrowers representing 63% of the portfolio, per its marketing material.

Over the last few years, Ninepoint has made numerous claims, attempting to demonstrate its expertise as a private debt investor. But over that period, Ninepoint has fallen short of its promises to investors. We see ourselves as friends of the capital markets— we believe that the information provided here contributes to a more efficient, fair, and beneficial market for all participants.