Ninepoint announced this week that the Ninepoint TEC Private Credit Fund II (“NTEC II”) is gated. Ninepoint also said that “all distributions for valuation dates on and after May 31, 2024 will automatically be reinvested.” In our view, these are signs that the fund liquidity is extremely poor. Subscriptions to the fund were also suspended.

On November 24th, 2021, we initiated our coverage of the Ninepoint TEC Private Credit Fund with a rating of PoS. If you’re not familiar with this term of art, please ask an industry expert. This is the second time that Ninepoint has gated the Third Eye Capital fund since then.

John Wilson, Ninepoint Co-CEO, is well acquainted with the problems that an asset-liability mismatch can generate.

It is now clear the liquidity terms Ninepoint has offered investors and the investments they have made were not compatible. Even after those terms were restructured in mid-2022.

On February 10, 2023, Ninepoint responded to an article published by The Globe & Mail, where the latter reported that over 60% of the Ninepoint-TEC portfolio had a payment-in-kind option.

In their response, Ninepoint claimed that:

(i) “The portfolio is well positioned for the current market environment.”

(ii) “There have been no new investments made in the Fund since TEC is prioritizing liquidity.”

(iii) “Two [of the top three] borrowers are in sale or financing processes aimed at repaying the Fund in full.”

(iv) “99.8% of the portfolio are performing loans.”

Not swayed by these claims, we analyzed the top borrowers of the fund in our piece “Third Eye Capital and Ninepoint’s money-for-nothing deals.” We maintained our PoS rating and revised our outlook to negative. We concluded that the fund's “liquidity would not improve any time soon.” To this day, we haven’t seen any evidence to change our minds.

On May 24, 2023, Ninepoint proposed to the Independent Review Committee of the Ninepoint Group of Funds a redemption cap payout of 3% of the previous quarter’s NAV for NTEC II. The IRC, in its great wisdom, determined that Ninepoint’s proposal was “fair and reasonable.”

After limiting redemptions, Ninepoint embarked on an aggressive PR strategy of issuing a press release every time an exit or partial repayment to the fund occurred. One of those press releases led to an article in the Financial Post titled: “Private credit refinancing shows concerns about sector overblown: Ninepoint co-CEO.”

Somehow, Ninepoint thinks it is relevant, to the point of issuing a press release, when they receive a partial payment from a borrower, even if that payment represents ~2% of the fund. Imagine a bank issuing a press release every time a borrower pays down a part of a loan. In the appendix below, you will find the details of these press releases.

So, assuming that the press releases reflect all material repayments, we estimate that the two Ninepoint funds sub-advised by Third Eye Capital received ~$198 million in proceeds from “liquidity events” during 2023.

Anyone who has been drinking the Kool-Aid (i.e. claims of a “well positioned” portfolio, all the press releases, and other PR) and reviewed the NTEC II financial statements might be shocked to find that the fund is now “unable to make redemption payments due to having insufficient net cash for this purpose.”

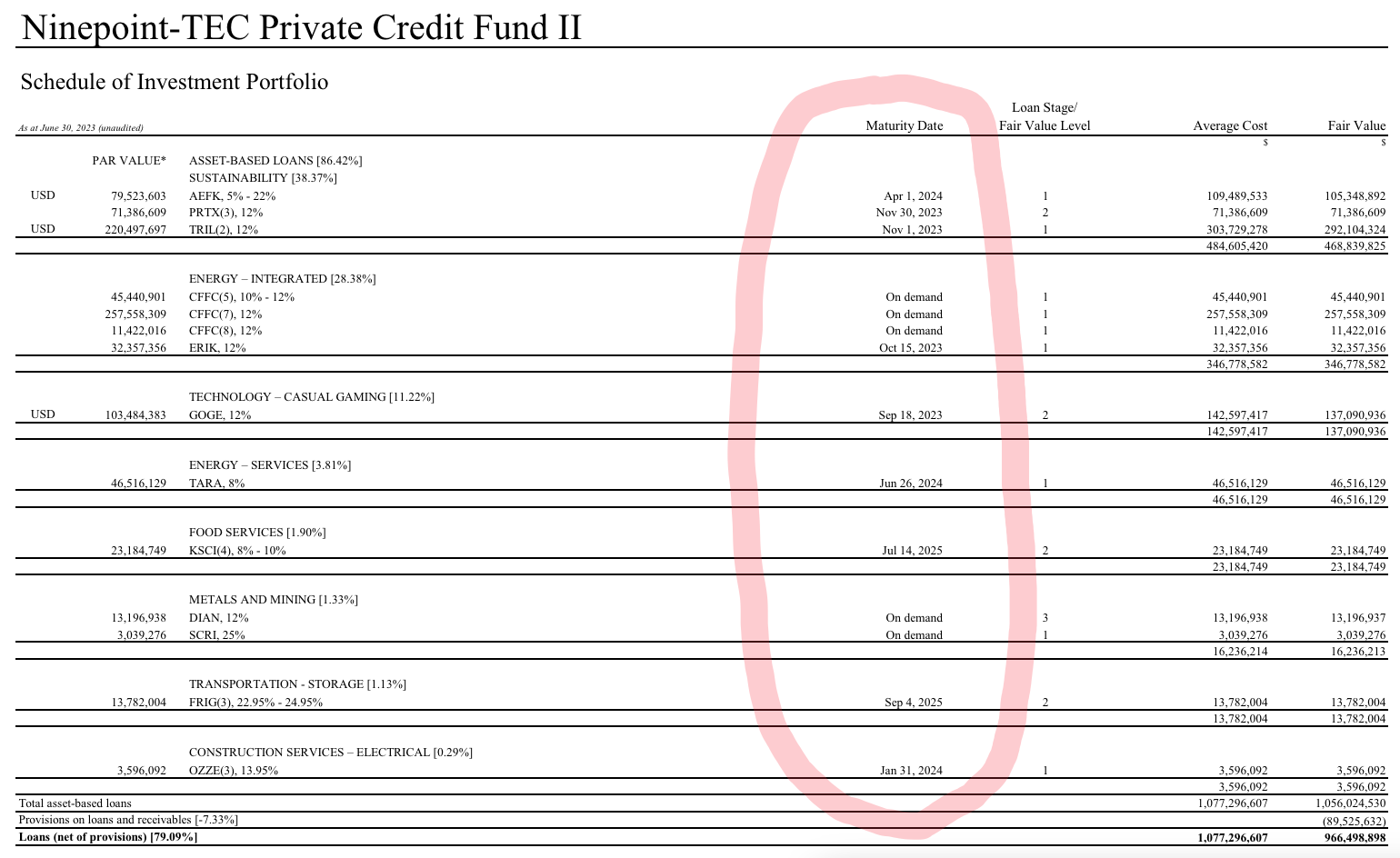

The Ninepoint-TEC Private Credit Fund II had $606 million of loans, at fair value, maturing from the second half of 2023 up to April 2024, according to the fund's interim financial statements as of June 30, 2023— available at the very end of this piece in the appendix.

Beyond the loans maturing, NTEC II also had 3 facilities to CFFC (aka Conifer Energy) with a total fair value of $314 million. These facilities don’t have expiration dates but are described as “On demand,” implying that NTEC II can call them at their discretion.

Adding up:

(a) the repayments announced by Ninepoint,

(b) the expected maturities within the NTEC II portfolio since June 2023, and

(c) the “On demand” facilities to CFFC, in the last 12 months,

NTEC II should have in theory access to liquidity in the order of $1 billion— before even considering new subscriptions.

$1 billion represents more than 75% of the net asset value of the fund as of December 31, 2022— NTEC II had a $1.28 billion net asset value according to the fund’s audited financial statements as of that date.

How could a fund that has been experiencing liquidity problems since early 2022 and was expecting liquidity events of up to $1 billion (75% of NAV) in the last 12 months not have the cash to meet redemptions and distributions?

The answer might lie in a term that Third Eye Capital itself claims to have coined back in 2008: “zombie companies.” Third Eye Capital describes a zombie company as companies that are “unable to cover debt servicing costs from earnings and have assets with realizable values less than their debts outstanding but remain in the market rather than exiting through takeover or bankruptcy.” Based on our previously published research, we believe that many of NTEC II’s borrowers are “zombie companies.”

What’s next?

Over the past few years, we think that Ninepoint and Third Eye Capital have damaged their credibility by making a series of unfulfilled promises such as monthly liquidity, quarterly liquidity, an upcoming IPO or the prospective sale of a subsidiary. The crude reality is that they have failed to generate liquidity for the investors that trusted them.

We see two possible scenarios going forward.

In the first scenario, Ninepoint and Third Eye Capital quietly wind down the fund, liquidating the investments and slowly returning capital to investors.

In the second scenario, Ninepoint and Third Eye Capital decide to continue to extend and pretend. They eventually open subscriptions to the fund. Cash from new investors and realized investments will be poured into struggling borrowers and “dumpster fires,” such as Aemetis.

“More than any other time in history, mankind faces a crossroads. One path leads to despair and utter hopelessness. The other, to total extinction. Let us pray we have the wisdom to choose correctly.” — Bruce Lee

If we take into account that Ninepoint and Third Eye Capital haven’t been able to liquidate the original Ninepoint TEC Private Credit Fund and that distributions to the investors in this fund are on the order of 1% quarterly, it seems that investors who entrusted their savings with Ninepoint will have to be very patient to see cash flowing their way. We know that for investors this is a painful situation.

Ninepoint and Third Eye Capital, seeing the writing on the wall, have ramped up their marketing significantly over the past couple of years. After all, new clients improve liquidity and dilute past mistakes. Arif even recently wrote in French in a Quebec publication. We did not know Arif writes in French, he’s so cosmopolitan! He has also been marketing in Europe. As pressures mount, he may need to cast an ever wider net to catch new investors, perhaps even in his native Uganda.

In the recent French piece published by Third Eye Capital CEO, Arif N Bhalwani, CFA, he claims that investment advisors play an “essential role” in democratizing the private debt market and that they can implement “rigorous due diligence.” Ninepoint and Third Eye Capital will be hosting a webinar on June 11th at 2 pm EST. We assume that we will not be welcome on the webinar. However, advisors looking to implement “rigorous due diligence” could have a better picture of what is really happening inside the fund by asking the following questions:

- Where does NTEC II stand in terms of payment priority in relation to the other funds managed by Third Eye Capital, including those that are in a liquidation process, such as the Third Eye Capital Luxembourg fund, or the Montrusco Bolton closed-ended funds whose initial terms are about to expire or have already expired?

- How are the conflicts between all the funds managed by Third Eye Capital handled?

- What happened to the loans that were claimed to be maturing after June 30, 2023?

- Why can’t the fund call the $300-million-plus CFFC “On Demand” facilities?

- Why, as of June 30, 2022, did NTEC II still have exposure to “ERIK” after Ninepoint said that Pieridae had successfully refinanced and had made an “early repayment of term loan”?

- What happened to Trilliant’s public listing, mentioned by Arif Bhalwani in a presentation to advisors on March 30, 2022?

- What happened to the sale of Tangelo Games Spain, a subsidiary of GoGel Holdings, mentioned by Dev Bhangui in a presentation to advisors on March 30, 2022?

- Why is Daniel Jalbert, TEC’s operating principal in the oil and gas space and former CEO of Conifer and Erikson, no longer part of the Third Eye Capital team?

- Why does David Steele no longer list himself as the President and COO of Third Eye Capital, but appears as a strategic advisor? He was only appointed last year as announced in a longish press release.

- Will Ninepoint and Third Eye Capital continue to charge fees during this period when they are not originating any new loans or paying out distributions?

- If there is supposed to be a strong alignment between Ninepoint and investors, represented by insider investments in the fund, why does Ninepoint Financial Group Inc., only hold $6.6 million worth of units of the NTEC II, as reflected on the interim financial statements of the fund as of June 30, 2023?

- Why has NTEC II been delivering lower returns than those that the Ninepoint-TEC Private Credit Strategy had historically delivered, even when today's interest rates are higher than when the Ninepoint-TEC Private Credit Strategy was delivering consistent double-digit returns?

- On February 10, 2023, Ninepoint said that some of “the portfolio companies’ cash return on invested capital (ROIC) was significantly higher than the cost of debt (COD)” and this dynamic allowed for PIK structures. Where are these cash returns going?

- Why did your Stage 2 loans increase from $236 million on December 31, 2022, to $584 million on December 31, 2023? Which loans are considered to be on Stage 2, and which loans are considered to be on Stage 1? Under IFRS 9 when a loan is moved from Stage 1 to Stage 2 it means that there has been a “significant increase in credit risk.” See this guide.

Appendix

1st Exit — Pieridae/Erikson

On June 15, 2023, Ninepoint issued a press release announcing that portfolio company Pieridae Energy had partially refinanced its debt. Ninepoint said that its two funds, NTEC and NTEC II would collectively receive $123 million.

Arif N. Bhalwani, CFA, Third Eye Capital CEO, said:

“The refinancing of Pieridae’s debt today is further evidence of the high quality investments that Third Eye Capital makes, which may be overlooked or underappreciated by others.”

The press release also said:

“Third Eye Capital made the $200-million (net) loan to Pieridae in 2019 through Erikson National Energy Inc. (“Erikson”), a special purpose entity partially financially backed by Ninepoint-TEC Private Credit Fund and the Ninepoint-TEC Private Credit Fund II.”

After this repayment, As of June 30, 2023, the Ninepoint TEC Private Credit Fund II and the Ninepoint TEC Private Credit Fund still showed an investment in “ERIK” of $32 million and $3.6 million respectively, down from a balance of $146 million and $16.4 million, respectively as of December 31, 2022, according to the funds’ financial statements.

2nd Exit — Cricket

As of June 30, 2023, The Ninepoint TEC Private Credit Fund II and the Ninepoint TEC Private Credit Fund had an investment in issuer “CRIK” with a fair value of $38.5 million and $4.3 million respectively, according to the funds' interim financial statements as of June 30, 2023.

On August 3, 2023, Ninepoint issued a press release announcing that Third Eye Capital and its fund “successfully exited its senior debt and equity holdings in Cricket Energy Holdings, Inc.” We believe this referred to the investment described as “CRIK.”

Ninepoint also said that “The exit surpassed expectations for both returns and timing and provides additional liquidity to service the cash requirements of the Funds and will further position the Ninepoint-TEC Private Credit Fund II to continue to invest and grow its private credit strategy.”

3rd Exit — Aemetis

On October 16, 2023, Ninepoint issued a press release announcing a partial exit from a secured debt investment made to subsidiaries of Aemetis. Ninepoint said the TEC funds “will receive approximately US$24 million,” equivalent to $32.6 million.

John Wilson, Ninepoint Co-CEO, said:

“This is just the latest in a series of successful liquidity events for the Ninepoint-TEC private credit strategy and follows on the heels of two full loan exits in recent months.”

As of June 30, 2023, The Ninepoint TEC Private Credit Fund II and the Ninepoint TEC Private Credit Fund had an investment in issuer “AEFK” with a fair value of $105.3 million and $6.7 million respectively, according to the fund’s interim financial statements as of June 30, 2023.

Below you will find NTEC II interim financial statements.