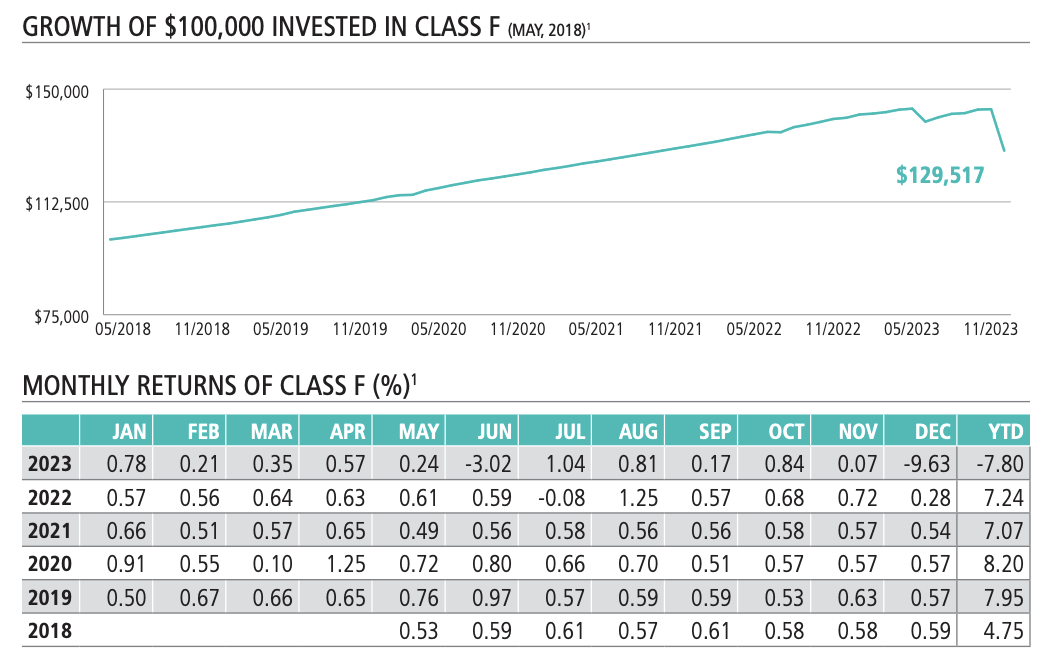

The Ninepoint Canadian Senior Debt Fund, where Waygar Capital acts as a loan consultant (the “Ninepoint-Waygar Fund”), took a massive 9.6% hit in December 2023. In a year where even the most conservative pensioner could have made 4-5% from a GIC, the Ninepoint-Waygar investors ended the year with a 7.8% loss. The fund has $260m in net assets.

The effects of this loss are not only limited to the Ninepoint-Waygar Fund unitholders. One of the largest, if not the largest, unitholder of the Ninepoint-Waygar Fund is another fund run by Ninepoint. As of June 2023, the audited financials of the Ninepoint Alternative Income Fund show that they had a $137 million exposure to the Ninepoint-Waygar Fund. The Ninepoint Alternative Income Fund also underperformed in 2023 by delivering a 2.29% return.

The ~10% drop is quite remarkable when you take into consideration that a few years ago, Waygar’s CEO, Wayne Ehgoetz, claimed that his investments were “not at risk at all,” as he said in an interview with Sightline Wealth Management.

“We just don't view ourselves as high risk, because number one, all our loans are fundamentally 100% collateralized and over collateralized. So that, in the event that they would say - we really have not had any failure in our portfolio - we liquidate, get the money back and get the interest back. And so really the investment is not at risk at all.”

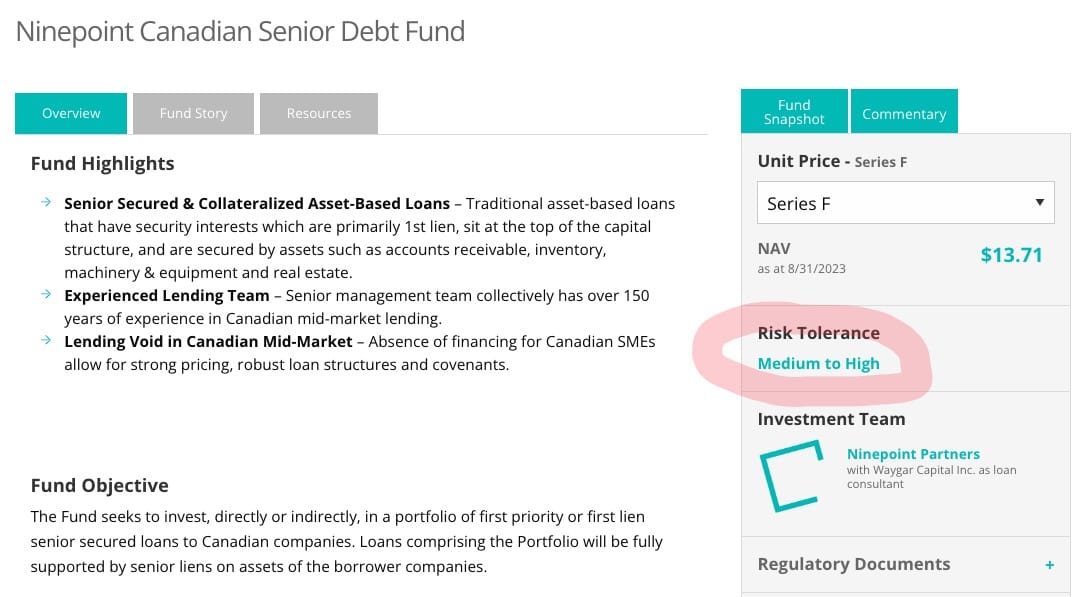

Well, Ninepoint has once again shifted the goalposts. They have changed mid-game the “risk tolerance” label of the fund. As recently as October, 2023, the Ninepoint-Waygar Fund was marketed with a “risk tolerance” of “medium to high.”

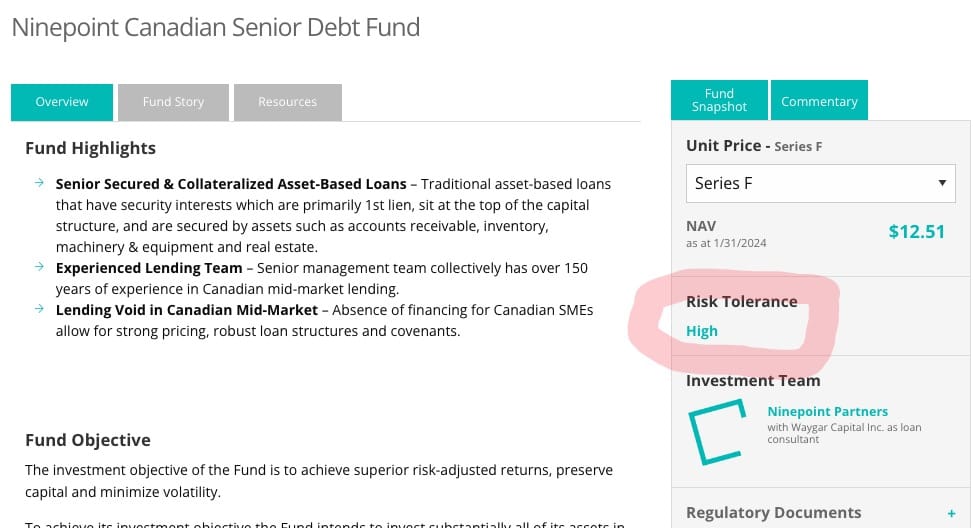

Today, the Ninepoint-Waygar Fund is marketed with a “risk tolerance” of “high.”

Last year, Ninepoint started to publish the financial statements of their private debt funds on their website - a decision we applaud.

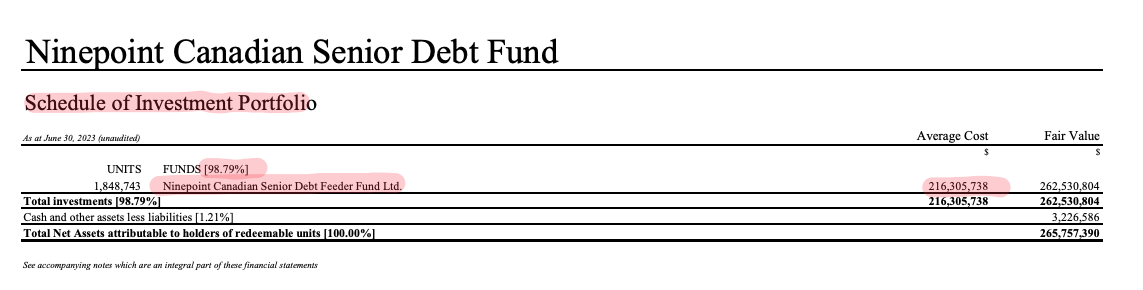

However, the financial statements for the Ninepoint Canadian Senior Debt Fund currently available on Ninepoint’s website provide no visibility into the fund’s portfolio. These financials show only that the fund is invested in the Ninepoint Canadian Senior Debt Master Fund LP, registered in the Cayman Islands,

Since we believe that Ninepoint’s transparency initiative is beneficial for the general public, we will contribute to it by sharing some observations about the top borrowers of the Ninepoint-Waygar Fund.

In our initial coverage of the Ninepoint-Waygar Fund, we identified the top 2 borrowers of the fund, Pacem and Michael Wekerle’s music venue, El Mocambo. Our findings were later corroborated by The Globe And Mail and partially by Business Insider.

Today, we will identify two other material borrowers and provide some additional information about roughly $180 million of loans advanced by the fund. We will include recent information from a presentation we saw, which was shared by Ninepoint with investment advisors, addressing the ~10% downward adjustment for December 2023’s NAV.

Issuer 15: Quality Sterling Group, a flooring company owing $50 million to the Ninepoint-Waygar Fund, which is currently in liquidation after failing to secure a buyer.

On October 19, 2019, Quality Sterling Group (“QSG”), a flooring company, and Ninepoint-Waygar Fund entered into a loan agreement. By August 15, 2022, “Waygar agreed to increase the principal amount of the revolving working capital loan from $30,000,000 to $50,000,000,” according to an affidavit filed by Don Rogers from Waygar.

After more than 5 amendments to the loan agreement, in March 2023, Waygar selected Alvarez & Marsal to “conduct an out of court sales and investment solicitation process (“SISP”) to seek additional financing by loan or equity injection, a sale transaction, or a restructuring transaction,” for QSG, according to court filings.

Alvarez & Marsal reached out “to a total of 274 potential investors, comprising 259 private equity firms and 15 lenders,” and generated a single offer from Ironbridge Equity Partners, which signed a letter of intent on July 25, 2023.

QSG also engaged accounting firm RSM to “prepare a liquidation analysis of [QSG] to serve as a baseline for comparison with the outcome of the SISP.” However, according to QSG, “the price offer by the Buyer produced through the SISP is far superior to what is obtainable through liquidation. There is no conceivable going concern liquidation approach that can match this outcome, and attempting to go that route would likely produce extremely poor results,”

As of August 1, 2023, Quality Sterling Group was indebted to the Ninepoint-Waygar fund in the amount of $50.6 million.

On October 30, 2023, Waygar “was advised by a senior representative of Ironbridge that there is no path forward for the contemplated Ironbridge Transaction,” according to an affidavit filed by Don Rogers from Waygar.

On October 31, 2023, Fuller Landau Group was appointed as receiver of QSG— meaning that Waygar ended up following the liquidation “route” that “would likely produce extremely poor results,” according to QSG.

We believe QSG is referred to as “Issuer 15” in Ninepoint-Waygar’s communications. It is the only borrower from the “flooring” industry disclosed as a top-10 holding in the fund's factsheet. As of November 2023, it represented 10.7% of total portfolio valuation. A month later, it represents 5.2% of the total portfolio value.

Ninepoint recently addressed the issues with this borrower in a presentation to advisors. They said, “Macroeconomic factors drove the company to liquidity issues which have been exacerbated by rapid increase in interest rates and supplier costs.” They also mentioned the failed bid.

In the presentation, Ninepoint provided a fair value for this loan of $17.1 million, saying that the “fair value adjustment is based on expected recoverable value” and that “expected recovery values are based on information obtained from the Receiver.”

It seems this will be the second consecutive borrower from the Ninepoint-Waygar fund that goes into liquidation, resulting in a “significant shortfall” to investors, just as happened with The Very Good Food Company last year.

These back-to-back failures show how the investment philosophy marketed by Ninepoint is flawed. See below and reach your own conclusions.

Issuer 21: A Toy Distributor owing $33 million to the Ninepoint-Waygar Fund

In late 2020, Waygar described a loan to a toy distributor as follows:

“In the first half of December, we funded one new transaction. Issuer 21 is a specialized toy manufacturer and distributes many well-known brands globally for over 30 years. During the height of the pandemic, the company secured an exclusive partnership to distribute U.S. FDA and Health Canada approved sanitization products and PPE to the likes of Wal-Mart, The Loblaw Companies (Loblaws, Shoppers Drug Mart, No Frills, etc.) and Target. The loan has an authorized credit limit of CA$31 million through a 24-month revolving working capital facility with the ability to draw on a CA$4 million accordion and a CA$2.5 million purchase order facility with a 4-month term. The loan is secured by senior liens on the borrower’s accounts receivable, inventory and purchase orders.”

Fast forward to 2024, underwriting a loan based on a business sanitization and PPE prospects doesn’t seem to have been a great idea.

In the recent presentation to investment advisors, Waygar also acknowledged that it had negatively adjusted the fair value of a loan to this toy distributor. Ninepoint said in the presentation that the “Company is experiencing liquidity issues due to the rapid increase in shipping costs and general slowdown of the economy.” Also, the company had “engaged an advisor to explore the sale of the business or multiple individual toy lines”

We thought that the Ninepoint-Waygar Fund was immune from the state of the economy, as Wayne Ehgoetz implies here:

We believe Issuer 21 is The Orb Factory Limited, based on a patent assigned to Waygar Capital as an agent for Ninepoint Canadian Senior Debt Master Fund in December 2020.

After reviewing The Orb Factory Limited's website, we have to say that we don’t recognize any of these “well-known brands globally.” Not that we are expert toy buyers.

As of December 31, 2023, Issuer 21 had a revised fair value of $33.9 million and an average loan-to-value of 100%, according to the presentation of Ninepoint to advisors.

Update On Issuer 10: Pacem used tens of millions from Ninepoint to fund research and development.

In a recent presentation to investment advisors, Ninepoint also disclosed that they had lowered the fair value of the loan to Issuer 10. They said: “Fair value adjustment is estimated based on various scenarios relating to the repayment of the loan via cash flow and / or M&A as of Dec 2023.”

However, Ninepoint provided some ostensibly positive news about Issuer 10. This borrower has a “pipeline of contracts at various stages totalling US$520+ million,” and it “signed an additional tranche of its US$126MM contract last week with a foreign government entity; successfully delivered multiple tranches of the contract.”

As you might recall from our initial coverage of the Ninepoint-Waygar Fund, Issuer 10 is associated with the then-aspiring and now-elected US Congressman Cory Mills. A recent court filing by Pacem corroborates the company's dealings with Waygar Capital, specifically that Pacem used proceeds from Waygar to refinance a bank loan.

As you would expect, a congressman dealing with selling hundreds of millions in munitions to foreign governments would attract scrutiny from the US media. In March 2023, Business Insider published a story about Rep. Cory Mills.

In their story, Business Insider said:

“An Insider examination of his business dealings, though, found that Pacem has had deep ties to foreign governments and is struggling financially.”

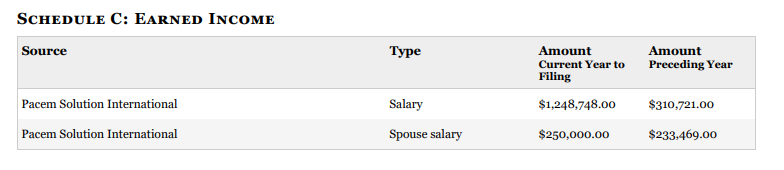

Mills told Business Insider that he had “divested from the company.” However, his public financial disclosure for 2022 still showed that he owned Pacem at the end of that year. This disclosure also shows that in 2022, Mills and his spouse received a US$1,248,748 and US$250,000 salary, respectively, from Pacem Solutions International. We would love to know if Pacem was making “Payment-in-kind” interest payments during 2022.

Beyond reporting that Pacem was “struggling financially,” Business Insider partially corroborated our findings by saying that Mills had obtained financing from a Canadian lender. They also disclosed the use of proceeds from the loan.

“Pacem is also loaded with debt: It owes $48 million to a Canadian lender, nearly five times the company's highest potential valuation. Mills said the loan was funding research and development.”

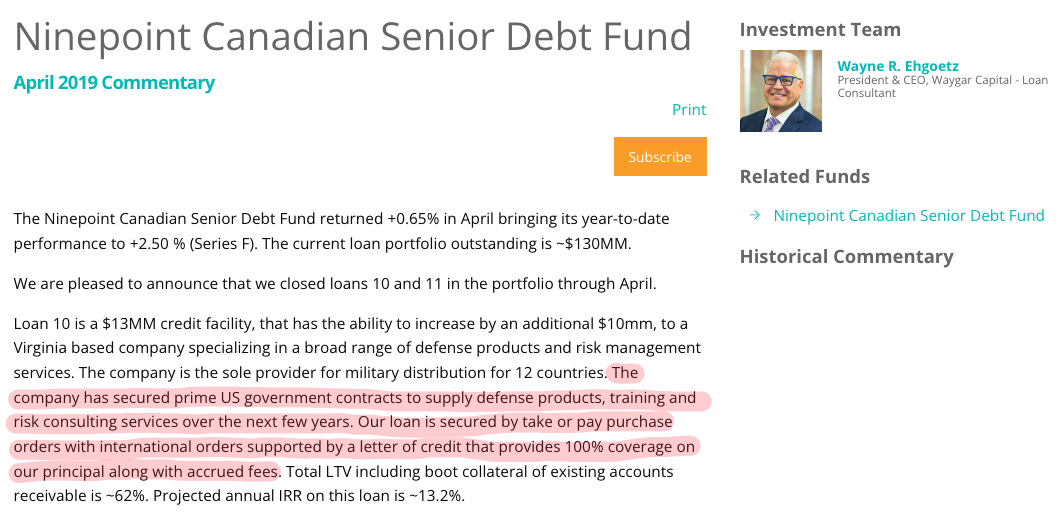

We found it odd that Mills claims this loan was “funding research and development.” We didn’t know this was part of the objective of the Ninepoint-Waygar Fund— as you can see below, there was no mention of R&D by Waygar to investors when it originated the loan back in April 2019.

Mills’s disclosure of the use of proceeds leaves us with more questions than answers. Does it make sense to invest capital in an R&D effort and have a capped return? If Pacem had many purchase orders to sustain a $60-million debt load, why didn't they use the money to fulfill those orders and earn the margin on them?

One thing seems sure, Pacem has struggled to pay down its debt. On August 10, 2022, during the Ninepoint-Waygar Fund's H1 2022 review, Wayne Ehgoetz told investors that Issuer 10 and two other issuers “will be repaying our facilities in late Q4 or early Q1 2023.”

More than a year past the expected repayment, Ninepoint said in the recent presentation to advisors that Issuer 10 had “Engaged an advisor to explore the sale of the business; currently in preliminary discussions with multiple parties on sale of the business.”

As of December 31, 2023, Issuer 10 was the Nienpoint-Waygar Fund's top borrower, representing 18.6% of the total portfolio valuation. The outstanding balance of the loan had a fair value of $61.6 million, according to Ninepoint.

In October 2018, Pacem Defense, LLC acquired for $10 million what seems to be their main manufacturing assets, located in Perry, Florida. These assets were acquired from National Presto Industries, a direct competitor to Pacem in the 40mm ammunition space.

By way of comparison, this Pacem competitor, National Presto, considers that their Research and Development costs for 2022, 2021, and 2020 “were not material element in the aggregate cost incurred by the company.”

Today, in order for the Ninepoint-Waygar Fund to get fully repaid, it seems that Issuer 10 will need to sell its assets for no less than $61.6 million. Hopefully for investors, that R&D has yielded some real value.

Update on Issuer 9: Is Michael Wekerle “under financial strain”?

As mentioned, on August 10, 2022, during Ninepoint-Waygar’s fund H1 2022 review, Wayne Ehgoetz told investors that, along with Issuer 10, Issuer 9 “will be repaying our facilities in late Q4 or early Q1 2023.” See the excerpt highlighted in red below.

However, as of December 2023, Issuer 9, the Canadian company that operates in the Media & Entertainment industry, is still the second largest borrower of The Ninepoint-Waygar fund, according to the fund fact sheet.

Again, it is odd that almost a year after the expected payment, Issuer 9 hasn’t paid their debts to the fund.

As mentioned, The Globe And Mail corroborated our findings of the dealings between Waygar Capital and Wekerle. The Globe’s reporting on a lawsuit involving the Wek paints a picture that the former CBC Dragon is struggling financially. The Globe said in March 2023:

“Over the past few years, Mr. Wekerle has been under financial strain, and Mr. Arbour claims he constantly requested money from WIN PM to help with his cash flow issues. “Wekerle would call Arbour on a monthly basis in a very depressed state because of his financial problems,” according to court documents.

In particular, he had borrowed $40-million at 12-per-cent interest from Waygar Capital, a lender in Toronto, to renovate the El Mocambo after buying it in 2014. It remained shuttered for years and only announced plans to reopen in April, 2020, but was forced to stay closed during the pandemic.

...

His lawyer, Mr. Woychesyhn, said in an e-mail that the initial loan from Waygar Capital was “for a substantially less amount” and that his client is looking to refinance the El Mocambo. (Waygar Capital declined to comment, citing client confidentiality.)”

A year after The Globe’s reporting, it appears that El Mocambo hasn’t yet found a way to refinance its debt. Perhaps we will soon hear about the Ninepoint Toronto Nightlife Fund. This fund will refinance ElMo and buy out whatever is left of Buca and Jacobs from Third Eye Capital’s funds. At a minimum, Ninepoint should earn some recognition from the City of Toronto for their efforts in boosting Toronto’s nightlife after they and their associates invested at least $50 million combined into ElMo and King Street Co

The Ninepoint-Waygar Fund’s borrowings

As of June 30, 2023, the Ninepoint-Waygar Fund had received a $30-million interest-free loan from Ninepoint, according to the fund’s financial statements. Assuming a 5% money-market rate, Ninepoint is forgoing $1.5 million a year in interest at the minimum. We are struggling to understand the rationale for this loan.

However, the recent presentation to advisors had a slide titled “Target Liquidity Events,” showing the expected liquidity events in the Ninepoint-Waygar Fund’s portfolio. This slide had a curious footnote which said:

“Payouts from liquidity events are swept to pay down the Fund's credit facility and result in changes to the borrowing base.”

It appears that the first payouts from the fund’s borrower will go to pay down the fund’s debt. According to the Ninepoint-Waygar Fund’sJune 30, 2023, balance sheet, Ninepoint appears to be the main creditor of the fund. This swept-to-pay structure effectively pushes down the unitholders in the fund’s capital structure (i.e. the risk for the unitholders increases).

Despite the visible signs of financial stress within the fund's top borrowers, the Ninepoint -Waygar Fund had net proceeds of $8.1 million during 2023, according to the fund’s report of exempt distributions. We believe those who subscribed to the fund during 2023 will have a hard time seeing any return on their capital.

In our initial coverage of the Ninepoint-Waygar Fund, we said:

“Ninepoint Partners has proven over and over again a high appetite for risk. What Ninepoint considers to be “conservative lending” seems quite risky to us. So the question is: will Ninepoint be able to control the risk? Only time will tell.”

The Ninepoint-Waygar Fund’s 2023 performance is a sign that risk might be getting out of control. Still, it is too early to tell. We will keep you updated.