I found a recent article by James Bradshaw and Sean Silcoff on Ontario Teachers’ VC arm revealing. Private market investments are increasingly being pitched to high net worth investors. Groups like Nicola Wealth Management will say they are bringing “sophisticated” pension-style investing to the mass affluents. If you have clients or principals who buy into this, the Teachers experience is worth studying. Here’s my analysis of some salient success factors and how Teachers Venture Group (”TVG”) measures up:

First, basic background: TVG started in 2019 and focuses on late stage venture, aiming for 30% annual returns. Typical investments of $50m-$250m. TVG currently has investments in 36 companies that make up more than $7.5B

Adverse selection: This is crucial to understand. If a Calgary-based oil and gas explorer is raising capital in San Francisco, you’d be pretty suspicious why they can’t get a deal done in their hometown. TVG plays in the big leagues of VC. In Canada, it would probably be a great seal of approval for a tech company to have, but globally, it has scale, but little pedigree. It’s no Sequoia. Despite this, Teachers has shown an ability to get involved in big brand-name deals like Elon Musk’s SpaceX or more tragically, Sam Bankman-Fried’s FTX. In July, TVG co-led a deal with KKR. Overall, TVG seems to have good access to deals.

Decision-makers: In theory, Teachers could hire elite dealmakers. In practice, the very best dealmakers probably don’t want to work for Teachers. The pay and conditions are not as good as can be had at top VC firms. In this case, TVG is led by Olivia Steedman. She’s a civil engineer and accountant by training. She started in 2002 in Teachers’ Infrastructure and Natural Resources. And then, in 2019, it turns out magically that she was qualified to lead big venture deals. No respect for expertise, specialization and hiring the best, proven dealmakers. No respect for how intensely competitive things are in modern capital markets! I am tempted to call her the new John Ruffolo, but I feel that joke is getting tiresome. Or is it?

Process: The Globe article mentions that some early stumbles have “tested TVG’s resolve, prompted it to do post-mortems on what went wrong in some cases and think clinically about what happened.” Olivia Steedman adds:

“This is risky and there’s going to be some uncomfortable things happen. Obviously we undertake to never repeat them. And that’s why [we do] the lessons learned exercise. But it is hard.”

I am relieved she has gone on the record about never investing in a scam like FTX again! I’d be the first to say that even what Buffett does is hardly scientific. And then the farther you go into investing in less proven, unprofitable businesses, the more it’s a complete crapshoot.

I myself, spending many years as a trader, collected such “lessons.” Like, if a stock had a big earnings miss, you sell because The Cockroach Theory says there’s never only one! I’d like to think I was, then and now, a somewhat rational person. But the human mind is so easily fooled by randomness, seeing patterns where there are none. Many VC (or late stage growth) investors come up with elaborate theories. But I suspect most of them are just vibe-vesting subconsciously. One part of their brain makes intuitive decisions based on vibes and then another part of the brain is busy coming up with a post-decision rationalization.

The results: TVG was only setup in 2019. The first investment, in SpaceX, was a homerun. But of course, there was US$95m in FTX that got wiped out. It’s obviously way too early to even begin to draw any conclusions. OK, OK, I will make a one-time exception to intellectual honesty. TVG is compounding at 7%. That’s it! In contrast, the S&P 500 has more than doubled in that timeframe. Keep in mind that most of this value has not even been turned to cash and so you are relying on valuation guesswork. In any case, it's a far cry from the 30% annual return objective. The title says it all: Ontario Teachers’ Pension Plan doubles down with more focused ventures after tech bubble stumbles.

John Ruffolo got very favorable press. And then no one knows why he suddenly left OMERS! This is effective PR. I am puzzled why Olivia Steedman collaborated with an article and poses for a photo when she has no good news to deliver. Zero judgement! Olivia “thinks of herself as the captain of a patrol boat, scouting the horizon for treasure and perils just ahead of its much larger ship - the $256B Ontario Teachers’ Pension Plan.” I am sure we are all impressed.

After starting out as a generalist investor, TVG has narrowed its focus to a handful of sectors, such as health care, cybersecurity, software and climate tech. Olivia says “As interest rates came down and company valuations started to settle, TVG’s investment activity picked up in 2024…In total, TVG made eight direct investments in 2024, compared with two in 2023.” Sounds like after the bubble burst in 2022, they spent a year in hiding.

TVG took another hit on an investment in a Chinese education tech platform, Zuoyebang, after China’s government summarily converted all ed-tech providers into non-profits, “literally overnight with no consultation” according to Capt. Olivia.

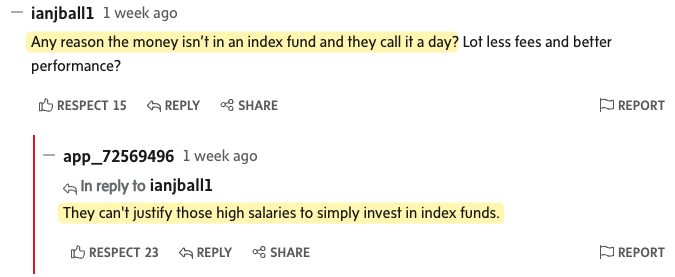

In conclusion, TVG has scale, considerable resources, access to quality dealflow, semi-qualified staff and yet underperforms the average index investor. If Teachers can't do private markets right, where does that leave Nicola Wealth Management? The people know: