What you can’t do is mislead people. This is a very fine line. It’s not an easy line to walk knowing that if I slip over to the side of grey, it’s game over.

- Reza Satchu (as quoted by Next Canada)

Today, OPM Wire is lobbing truth grenades at the heart of the New Toronto Establishment. Reza Satchu is at the nexus of the whole Rosedale, Upper Canada College, SickKids Foundation scene in Toronto. Some of Reza's friends include: Nadir Mohammed (former CEO of Rogers), Mark Wiseman (former big deal at Canada Pension Plan Investment Board and Blackrock), Ira Gluskin and Tim Hodgson (former CEO, Goldman Sachs Canada). Reza owns Alignvest which is a significant, multi-faceted investment operation. Reza is most well known as the Simon Cowell-like organizer of the Next Canada accelerator for young entrepreneurs. Next has raised millions from a who's who of Canadian business as well as taxpayer money. The three founding patrons of Next are among the top 10 richest men in Canada:

I am usually not given to sentiment, but sometimes when I think of the size of my balls, my eyes well up. Pay attention, I'm in full prosecutorial mode in this post, I have no time for knock-knock jokes, aside from that one.

Kevin O'Leary, a former business partner of Reza, built his profile through the story of selling his software company to Mattel. Many people have questioned the profitability of that deal, but it's undeniable that he was the directing mind, so to speak, of that venture. Reza Satchu's stature rests in large part on him "co-founding" a B2B marketplace software startup called SupplierMarket in 1999, which according to the story, was sold to Ariba for US $924 million in 2000. By the time I am done, you will agree that Reza's foundation myth is even more ridiculous than Kevin's.

SupplierMarket is a business that was started in February 1999 and was sold in June 2000 (with the transaction closing end of August 2000). That's what happens in a bubble. The sale was a stock-for-stock deal. The $924 million figure is based on the value of buyer Ariba's stock around the closing of the deal. A few weeks after the deal, Ariba stock would peak and then plunge almost 99%. The real proceeds to shareholders depend a great deal on whether they had the alertness to bail out. Management is often restricted from selling. At the Ariba bottom, the proceeds would be around $12 million. In its short life, SupplierMarket raised $48 million in funding. That affects ROI too. From inception to the last full quarter before the sale of the company, SupplierMarket had a grand total of $267k in sales. 90%+ of those sales came from a single client, mattress maker Simmons. Simmons was owned by a key investor in SupplierMarket. The company lost $20 million while generating that manna of sales.

The SupplierMarket story, to anyone who bothers looking, is akin to selling a tulip during tulipmania and then claiming you are a business genius. Worse, according to all the records I can find, Reza Satchu was hardly a "founder" figure. As best as I can make it, he had relatively minor official involvement and is simply coattail riding on the success of his younger brother.

Before we get to that, realize that SupplierMarket is material to the Reza story - almost every Reza article will mention it, often it's the first thing that's mentioned. It's his primary claim to business bona fides. It's the stepping stone he used to build his subsequent endeavours and profile.

Here are some examples:

-Alignvest on its website references a 2017 Globe article as follows:

So 17 years later, he’s still talking about the deal.

-A 2008 Globe article, which I believe might be his citation for the top 40 under 40 award says:

In 1999, he and his brother, Asif, created SupplierMarket, [...] two years later, they sold the company for $925-million.

-A 2012 Globe article on Reza begins with:

"Reza Satchu sold his first startup – a supply-chain software company – at the height of the dot-com boom, for just shy of $1-billion."

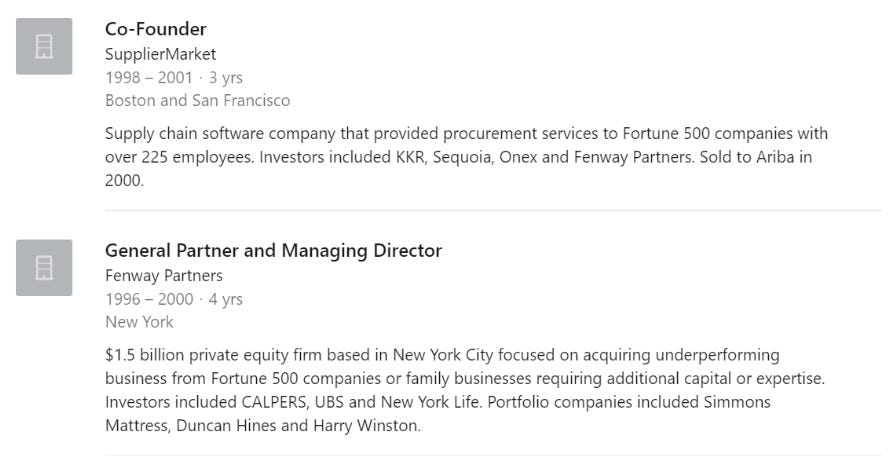

On LinkedIn, Reza claims to have been a co-founder of SupplierMarket:

I do wonder how he could simultaneously be the GP of a $1.5 billion private equity firm based in New York while also the Co-Founder of SupplierMarket (HQ in Boston), but let's leave that aside.

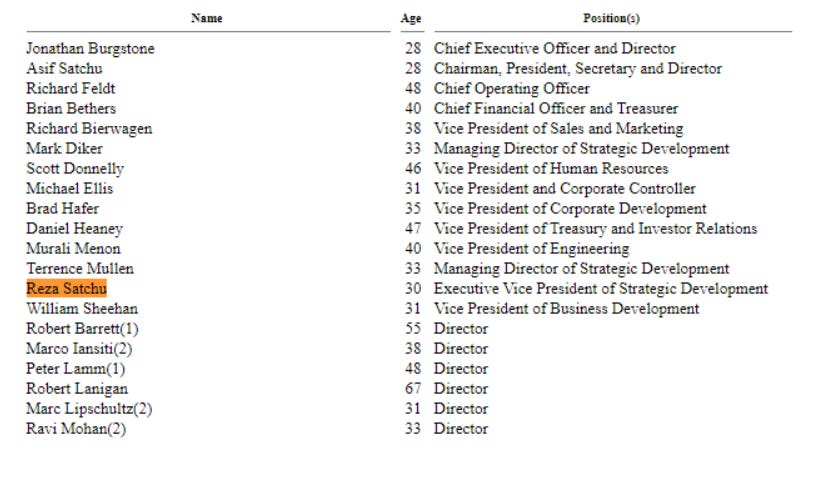

A month or two before it was sold, SupplierMarket had an aborted IPO process. Therefore, an S-1 filing was made with the SEC. Here's how staff of the company is listed in that IPO document:

You will see that Reza is not CEO, nor COO, nor CFO. His brother Asif Satchu is listed as Chairman, President, Secretary and Director. Reza is way down along with the rest of the staff and he is not a director. How much clout did he really have? He is listed as an "Executive Vice-President of Strategic Development”. You will notice that there are two "Managing Directors of Strategic Development" above him. (On Wall Street, MDs rank higher than EVPs). I suppose if I had been an Uber driver, I could say I helped build Uber. So it's a matter of degree. Let's dig deeper to figure for ourselves what to believe.

In the IPO document for SupplierMarket, only two founders are listed: Reza's brother Asif Satchu and CEO Jonathan Burgstone. Here's how Reza is described in that IPO document:

Reza Satchu has served as our Executive Vice President of Strategic Development since February 2000. Mr. Satchu began his affiliation with us while a managing director at Fenway Partners, a private equity investment firm, which is one of our principal investors. Mr. Satchu has taken a leave of absence from Fenway Partners.

So he officially joined SupplierMarket in February of 2000. That's four months before it agreed to be sold to Ariba. How instrumental could he have been? SupplierMarket lists 8 directors, including Asif and CEO Jonathan- but not Reza. Do you have any clout if you're not a director of "your" startup? Reza worked for Fenway Partners, one of the key investors in SupplierMarket, but he's not even Fenway's rep on the board of the company (Fenway founder Peter Lamm is). Fenway was not a Series A investor, they joined in the Series B in late 1999. Sequoia and Battery Ventures were the initial investors. Together, they owned 45%, while Fenway owned 6.3%. If you recall the environment of that time, it was all about momentum. Once those two marquee VCs anoint a deal, anyone with some sense would have jumped on the opportunity to buy. You would think if Reza was so instrumental, his employer Fenway would have joined from the start. That line above says it all: "Mr. Satchu began his affiliation with us while a managing director of Fenway Partners". If he was a founder, did he really have to "begin his affiliation" For all we know, it's actually Asif who did Reza a favour by letting Fenway buy shares in the second round of a hot startup.

I have also read the acquisition agreement between SupplierMarket and Ariba. Two people are designated as founders: again Jonathan Burgstone and Asif Satchu - not Reza. Whereas those two are considered "key men", all the agreement provides for Reza is the possibility of employment with the new company. The clause is as follows:

EMPLOYEE STATUS. If Reza Satchu is eligible to become an employee of Company in compliance with applicable laws, Company shall use its commercially reasonable efforts to cause him to become an employee of Company prior the Effective Time.

I have to say that I am puzzled by this clause, but it hardly seems to be something you would say about a vital contributor.

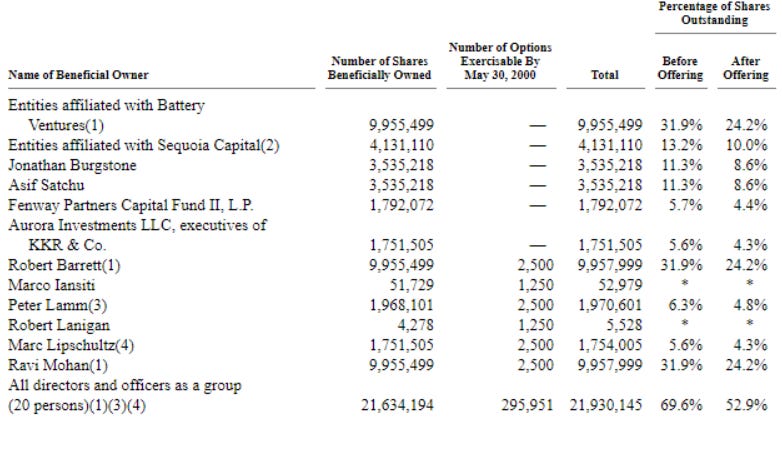

Another indication of a person's relative importance to a startup is shareholding. Reza is not listed among the principal shareholders of SupplierMarket. Both CEO Jonathan and brother Asif owned 3.5m shares each (or about 11.3% each). My quick math on the best info I have, is that shortly before the sale, Reza probably owned about 0.56% of the company. These were shares he acquired as part of financing rounds, just as the Satchu parents did. In fact, the parents bought more shares than Reza. If he was a founder, you would think Reza would get founder shares? Reza was awarded options for about 1.1% of the company, first for advisory services, then later for joining as EVP. There's a difference between building a company and advising a company. The advice services are described as follows:

"His services included assistance in identifying potential financing sources and advice on growth strategies and product offerings"

Here's the list of "principal stockholders" as disclosed in the IPO document. Look at all the people listed, and you have to wonder if Reza was such a big deal for SupplierMarket, why did he fail to secure an adequate equity interest in it? I thought he was tough and all. Or at least, he is in front of novice entrepreneurs.

It may well be that Reza made important contributions to SupplierMarket. Advice, ideas, introductions. He probably introduced SupplierMarket to Fenway Partners. But it's difficult to see how SupplierMarket is "Reza's startup". There have been several stories written about SupplierMarket in the American press, independent of Reza. Most of them name Jonathan and Asif as co-founders, none of them I can find, even mention Reza.

CEO Jonathan Burgstone, on his own bio on his website, describes the foundation of SupplierMarket as follows:

In a studio apartment on the campus of Harvard Business School, Burgstone and co-founder Asif Satchu formed the idea for SupplierMarket.com.

This explains why SupplierMarket was based in Massachusetts, while Reza was in New York. I find it curious that when CEO Jonathan Burgstone is profiled, Reza is nowhere to be found. Conversely, when Reza is profiled, there's no mention of Jonathan Burgstone.

CEO Jonathan has told of the story of his and Asif's intimidating meeting with legendary Sequoia. No mention of Reza! Yet in Reza's telling of VC meetings to the Globe, there's no sign of Jonathan:

I like to say that all these financiers saw two Indian kids across the table and just assumed we knew something about technology.

When you take all these points together, there definitely appears to be some whitewashing going on.

Read Part 2: That time I called Reza Satchu's mom.