This is the conclusion of The Second Mouse Plan essay (Part 3). Make sure you have read Parts 1 and 2 first. Start here: The Second Mouse Plan — Introduction.

They call me Jay-Hova ‘cause the flow is religious. -Jay-z

You probably thought I had moved on from religion, didn’t you? Wrong! Hang on to your loincloth, the Jesus references will be coming fast and furious. If two religious entrepreneurs were starting out, one creating a belief system from scratch and another promoting their own spin on Christianity, I am sure you can guess by now on who I would bet on. Star TV preacher Joel Osteen is an example of the latter approach. He is reportedly worth some $50 million. He lives with his hot blonde wife and family in a 17,000 square-foot mansion in Houston. He is a bestselling author, ministers at a church with 50,000 seating capacity and is known the world over. I find Joel Osteen to be a great speaker and I am sure he has many personal qualities, but is he even half as talented as Jesus? No way Jose! Fat chance! Did Joel Osteen found Christianity? Of course not. All Joel Osteen does is repackage Jesus’s words and preach it at his megachurch and on TV. He comes along some two millennia after Jesus and evangelizes without any danger since Christianity is now the dominant religion in the Western world.

Jesus was flogged, made to carry his own cross and generally humiliated before being crucified. I wonder what happened the rest of the day for it to become known as Good Friday. Did you know that crucifixion typically culminates in death by asphyxiation as the condemned struggles to lift his upper body in order to breathe out? It’s a slow, painful death. Now, compare the sweet life of Johnny Come Lately Joel Osteen and the tragic fate of pioneer Jesus Christ and tell me that there really is a first mover advantage. That the early bird gets the worm.

Joel Osteen flies private. He charges six figures per speaking engagement. Jesus once had to feed a crowd of five thousand with five loaves of bread and two fish. I know envy is a sin, but come on, this injustice is so great that even Jesus would roll over in His tomb - if He hadn’t escaped, that is. Jesus said in the Sermon on the Mount: “Blessed are the meek, for they shall inherit the Earth.” I do not mean to criticize Jesus in any way, but considering that speech, it’s a mystery to me why He then went around town showboating His supernatural powers, thereby upsetting authority figures and setting in motion his arrest. For us lesser mortals, I believe we are far better off, not counting on brilliance. Buffett says all the time: “In investing, there are no extra points for degree of difficulty.” Charlie Munger has said: “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

I see no downsides to assuming that you are not that smart and seeking to compete where there’s less competition. All this goes against advice that are very in vogue these days: how to wake up at 5AM, “ideation” techniques and of course, the pervasive celebration of failure as inevitable and a sign you are on the right track. Consider the mission of a leading Silicon Valley VC: At Social Capital, our mission is to advance humanity by solving the world’s hardest problems. Social Capital tried to reinvent the VC model and ran into some difficulty, which the founder described as an “identity crisis”. One of the most famous Silicon Valley books is called: The Hard Thing about Hard Things. The book is 300 pages long, which in itself is a hardship. Fortunately, the easy thing about hard things is only two words: avoid them.

Pioneering entrepreneurs and their early backers are more often than not sacrificial lambs for society’s benefit. They are there to serve the greater good. There were thirteen major search engines before Google. Billions in capital got destroyed in the fiber optic bubble of the 90s, but out of that society got faster, more widespread broadband internet. Meanwhile, investors lost their shirt in Global Crossing, 360 Networks, Nortel, etc. Alexandria Ocasio-Cortez could not design a more collectivist scheme. No wonder governments everywhere are so interested in boosting “innovation” and entrepreneurship. There are movements afoot to boost the number of female entrepreneurs, African-American entrepreneurs, etc. Eight out of 10 startups fail. Haven’t African-Americans suffered enough?

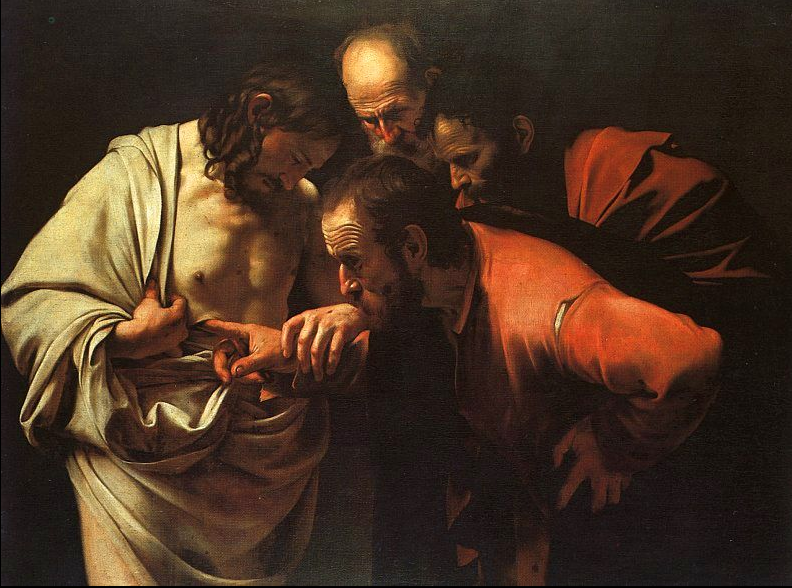

After Jesus had been buried, rumors started spreading among His followers that He had risen from the dead. But one disciple, Thomas, said he would only believe that Jesus had resurrected once he was able to see and touch Jesus’s wounds from crucifixion. When resurrected Jesus eventually met Thomas, He expressed disappointment at this attitude, saying “Blessed are they that have not seen and yet have believed”. This pretty much nipped the Skeptical Inquiry branch of Christianity in the bud. So waiting for proof might make you bad at religion, but all reasonable investors operate on this Doubting Thomas “wait and see” Moment of Clarity basis. A Doubting Thomas neither buys the hype nor dismisses it. He keeps an open mind and simply sets some logical milestone at which point he becomes a believer.

With a Doubting Thomas Second Mouse approach, you don’t have to pick the bull or bear camp on some battlefield stock, wrap up all your ego around that call and then stubbornly cling on even as evidence mounts that you may be wrong. You can simply decide to become a believer when it reaches some production or market share metric or best yet, some profitability metric. Even VCs say that they look for evidence of “traction”. The only question is what milestone constitutes meaningful traction. Some might be happy if your startup lands a few experimental clients or a certain number of “eyeballs”. At the other end of the spectrum, some investors will only invest once they see a 10 year history of profits. At some point, a good idea that works becomes a good business. Determining when this milestone is reached is an art form. In today's hypercompetitive investing landscape, insisting on waiting for 10 years of profit history, might be too complacent. But investing in startups is an even more costly mistake. I have nothing against tech investing, I only question the stage of company maturity at which an intelligent investment can be made. The best investments are low IQ - Innovation Quotient. Smart capital allocation is about being a humble “wait and see” investor, not an eagle-eyed prophet.

Blessed are the unimaginative, for they become dentists or tax lawyers.

In an attempt to explain the nature of entrepreneurs, Peter Thiel says that of the six PayPal co-founders, four had built bombs in high school. Psychologists have a term for this: stupidity. The children who had bombs blow up in their face are presumably not boasting about the experience. I do believe there is much to learn from the strategic and managerial thinking that Silicon Valley produces. And some Buffett disciples have outsmarted the master in adapting to the tech zeitgeist without straying from the basic philosophy of investing in known quantities. Nevertheless, when a capitalist kneels down to pray, he should still make sure to face Omaha. Peter Thiel says it's difficult to make a profit running an Indian restaurant because there are too many of them. But I feel the solution he offers - to build a monopoly - is like jumping out of the tandoori oven into the fire.

I hope some of the solutions I have provided to build wealth are a little more practical and realistic. My Church of Warren Buffett of Latter-Day Mice shows an alternative path to having rare talent, working nonstop, being brilliant, having vision, imagination, building something from scratch. And that is to wait, watch and make other people’s proven, quality creations your own. Warren Buffett bought Coca Cola 100 years after its founding and made 18 times his money. Michael Jackson bought Beatles songs 20 years after Beatlemania and it saved him financially. Two millennia after Jesus, people are still monetizing His message. In investing and business, our messiah is Warren Buffett, the most Second Mouse of investors. Has the Buffett playbook been fully exploited only a few decades after he has shown the way?