Third Eye Capital (“TEC”) is still stuck in a slow-motion train wreck. In our initial coverage of the Ninepoint-TEC fund, we described TEC’s workout playbook to handle failed borrowers as “kicking the can down the road.” The recent developments surrounding TEC’s 2017 financing of Ranch Energy, which then morphed into Erikson National Energy, provide evidence of how TEC’s workout playbook can cost investors tens of millions of dollars.

In this case, TEC was empowered to throw good money after bad for 7 years. An initial loan of $8.5 million grew to a $50 million exposure, which TEC has recently stated hasn’t generated any “return or recovery.” In fact, TEC principal Mark Horrox testified in an affidavit that “it became clear that Erikson would not be able to repay its indebtedness.” He should know, since he’s also the sole director of Erikson. So he’s on both sides of the table, acting on behalf of both the borrower and the lenders.

If only TEC had assumed a loss in 2018, when Ranch initially filed for creditors' protection, investors would have saved what seems to be a loss of a multiple of the initial loan amount. But, inconveniently for TEC CEO Arif Bhalwani, it would have invalidated his claim of “not suffering any realized loss on invested capital since inception.”

Here’s a play-by-play of how this went on - a case study of practices that can be used in what is sometimes called the “extend-and-pretend” game.

Background on Third Eye Capital, Ranch Energy and Erikson National Energy

On July 10, 2017, TEC loaned C$8.5 million to Ranch Energy Corporation. The loan proceeds were used to finance 100% of the acquisition of certain oil assets from Predator Oil and working capital requirements. On seven occasions, after the funds were disbursed, the loan documentation was amended in order for TEC to advance additional funds to Ranch¹.

On June 19, 2018 - less than a year later after the original loan - Ranch Energy became insolvent and had an outstanding indebtedness of $16.7 million to TEC, according to an affidavit sworn by TEC principal Mark Horrox.

By August 2018, the receiver had initiated steps towards a sale and investment solicitation process (“SISP”) for the Ranch assets acquired from Predator Oil. TEC submitted a credit bid and was selected as the successful bidder of Ranch assets, after no other bids were considered “qualified bids” during the last phase of the SISP (i.e. no one else seemed to want the assets).

These Ranch assets were acquired by TEC’s portfolio company Erikson National Energy (fka. Trinitae Energy Inc), mostly offsetting Ranch’s indebtedness to TEC. Mark Horrox represented Erikson National in the acquisition. The Court approved the sale to Erikson in July 2019.

In October 2019, Erikson and TEC also entered into a $200+ million financing with Pieridae Energy, which was fully repaid in the summer of 2024. The events presented below are independent of the Pieridae transaction.

Mark Horrox swears that Third Eye Capital poured tens of millions into Erikson “without return or recovery of its investment”

After the transfer of assets from Ranch to Erikson, the initial lenders (i.e. funds managed by TEC) still had not recovered in cash the $16.7 million owed by Ranch at the time of its insolvency because the sale transaction didn’t generate cash for any of the parties— as mentioned, it was settled by offsetting debts.

From the closing of Erikson's acquisition of the Ranch assets to the end of 2021, TEC provided Erikson with “$20.8 Million in working capital loans … in order to maintain operations which were otherwise cash flow negative,” according to Mark Horrox, sole director of borrower Erikson and a principal of lender TEC.

Since January 2023, Erikson has been trying to find a buyer, according to Mark Horrox.

From the fourth quarter of 2022 to the fourth quarter of 2023, TEC further extended $12.6 million to Erikson, according to Mark Horrox.

By this point, TEC’s total exposure to Erikson, backed by the Ranch assets, was at least $50 million.

“In the Summer 2023, it became clear that Erikson would not be able to repay its indebtedness to TEC and its secured lenders due to a protracted depression in the natural gas market” and other factors, according to Mark Horrox, sole director of borrower Erikson and a principal of lender TEC. [Emphasis added]

Overall, according to the affidavit sworn by Mark Horrox, “TEC and Erikson’s senior lenders have not benefited from the assets of the Ranch Transaction; in fact, TEC (on behalf of Erikson’s senior lenders) has invested millions into the assets of the Ranch Transaction without return or recovery of its investment” [Emphasis added]

In May 2024, “Erikson suspended its operations,” according to the proposed trustee of Erikson’s insolvency.

Despite the grim outlook, Ninepoint thinks that ERIK is not impaired.

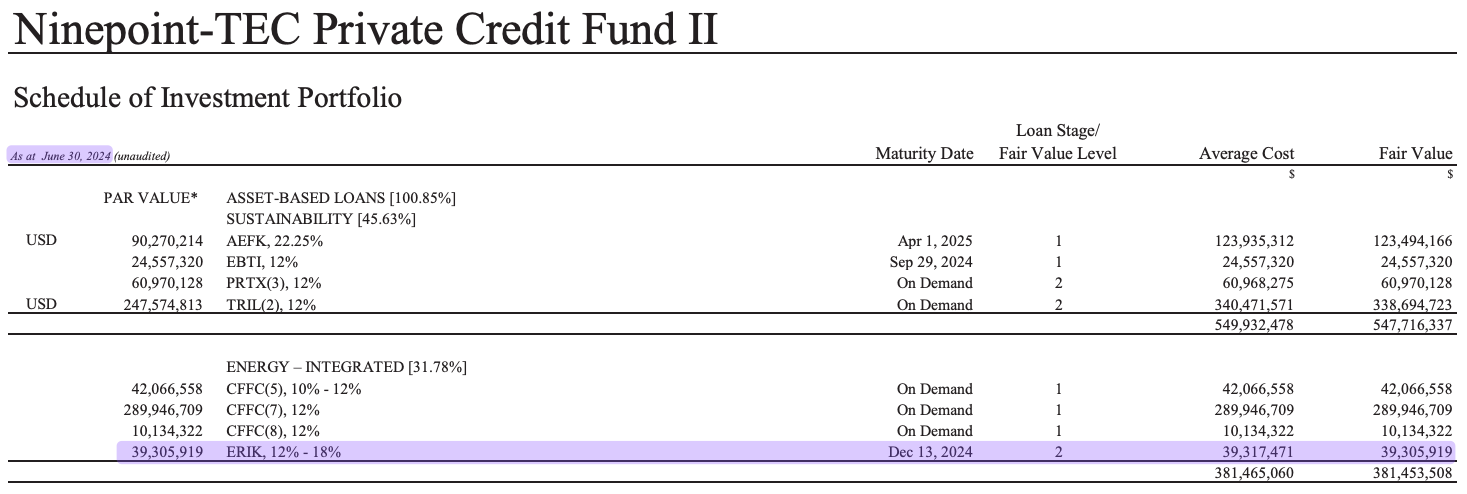

As of June 30, 2024 - a year after realizing “that Erikson would not be able to repay its indebtedness” - the loan to ERIK on Ninepoint-TEC Private Credit Fund II had a fair value of 100% of its par value (i.e. no impairments!), according to the fund's interim financial statements.

As of the date of Ninepoint-TEC’s valuation, Erikson had “recorded negative retained earnings of approximately $38.75 million, representing significant and recurring losses,” according to the proposal trustee of Erikson’s insolvency. The company also had negative gross margins for the 9 months ended on June 30, 2024.

Second insolvency of the Ranch Assets under Third Eye Capital’s Watch

On October 1, 2024, Erikson filed for creditor protection on “an urgent basis as one of Erikson’s creditors had sought to garnish Erikson’s bank account, which put at risk its ability to pay its employees,” according to Mark Horrox. Out of $42.6 million of Erikson’s listed liabilities, Third Eye Capital is owed $31.6 million— this figure doesn’t include any capital contributions made by TEC to its “portfolio company.” The company's internal balance sheet also lists “approximately $33.61 million in assets retirement obligations."

One of Erikson’s joint venture partners is Canadian National Resources Ltd, which is opposing Erikson and TEC’s motions in the insolvency proceeding. Canadian Natural Resources claims that Erikson diverted “$174 million in interest and fees to TEC at a time when it was in breach of both regulatory obligations and its obligations to working interest partners like Canadian Natural.” Also, Canadian Natural Resources says that Erikson’s insolvency disclosures lack financial statements and the company “failed to provide any information about its finances, its liabilities (other than that owing to TEC) or the value of its assets.” In short, they say that TEC took a “nothing to see here” approach. Canadian Natural also highlighted the need for an “independent third-party to ensure fairness and transparency for all stakeholders” since TEC controls Erikson and there is no separation between lender and borrower.

Following TEC’s workout playbook, the insolvent Erikson will try now to sell its assets. It expects to close the asset sale by November 30th, 2024. Since this will be the third time since 2018 that TEC will try to sell these assets, we suspect that the company will struggle to receive an offer that provides a purchase price sufficient to repay senior lenders in full. Perhaps Conifer Energy, another “portfolio company” of TEC, which acquired the assets of the O&G failed borrower, Accel Energy, might end up playing a role in Erikson’s SISP.

It is important to note that Third Eye Capital’s CEO, Arif N. Bhalwani, told The Globe and Mail a year ago that “Part of our core expertise is in restructuring and business turnaround.” Investors should ask what happened to Arif’s expertise while turning around Ranch Energy. Canadian Natural Resources, for one, is not impressed and accused TEC of “gross negligence” in its filing.

Will Arif continue to claim that he has never realized a loss on investment capital since inception?

Sadly for TEC investors, in our opinion, material TEC borrowers have many similarities with the Ranch-Erikson transaction we just described. For example, Conifer Energy, which, as mentioned, acquired the assets of failed Accel Energy and USA Synthetic Fuels Corp. Another example is GoGel Holdings, which acquired the assets of failed Tangelo Games.

Footnotes

- Prior to this transaction, TEC had already provided financing to OpsMobile another entity associated with Ranch, but to keep things simple, we will just focus on the transaction with Ranch Energy.