In 2018, Wealthsimple founder Michael Katchen penned an essay saying "Canada is bad at thinking big".

Wealthsimple launched in the US in January 2017. By then, US robo-advisors had been around since 2008. So it was pretty bold of Wealthsimple to try to break into that competitive market.

Let's check on how they're doing. Overall, Wealthsimple assets are around CAD $5 billion. In the US, assets are of USD 89.5 million from 14,869 clients (figures from Q1 2019). Of the client count, 39 are high net worth (ie having assets of more than $750k). The High Net Worth segment at Wealthsimple US amounts to USD $3.5 million. The average retail client with Wealthsimple has $5,737 with them. So the average retail US client might pay them $29 per year. I will let you judge whether that's a strong financial business.

Even that may be an overly optimistic analysis on my part, because until recently, Wealthsimple didn't charge anything for the first $5k. There are all kinds of other nuances, but it's very likely that Wealthsimple US is well under $500 million in assets, at a time when US leaders like Wealthfront claim $20 billion, Betterment $16 billion.

Fees have dropped in the US - they are now at 0.25% vs Wealthsimple at 0.50%. Robo-advice is by and large a commodity service - a glorified Excel spreadsheet. In order to stay competitive, Wealthsimple US will have to lower its prices. But then, how will it justify charging more to Canadians?

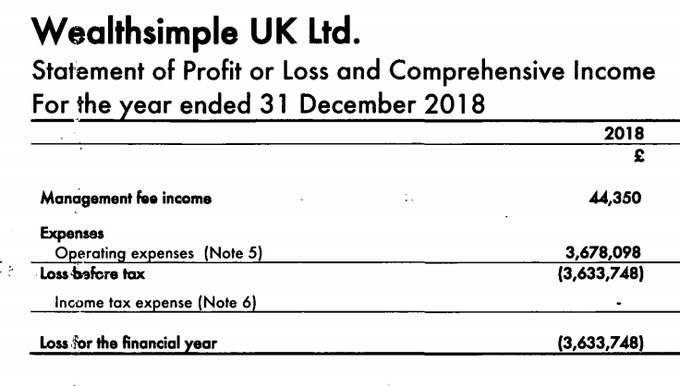

The UK business, also launched in 2017, is likely even weaker. Take a look at these financials:

A fee income of £44k would imply AUM of about £10m or CAD $17m.

I absolutely believe that Canadian companies can be world leaders. Shopify is a great example. I like this nation more than Donald Trump likes Donald Trump. But realistically, Wealthsimple started in Canada with a 6 year lag versus US pioneers. It was probably a bit hubristic to think that they could make a splash internationally by offering a commodity service. Albeit with quirky ad copy.