In 1999, I arrived alone in Toronto as an an 18-year-old with a few thousand dollars of borrowed money to my name and limited knowledge of English. I was a refugee fleeing a land beset by separatist conflict - the Province of Quebec. Within a few months, I landed a full-time job on Bay Street (technically, Front Street) working for a big bank. This is how it happened.

One day in grade 12 (or CEGEP 1 as it’s called in Quebec), my French teacher asked me to stay behind after class. She was upset I had not read the assigned reading: the French translation of Wuthering Heights by Emily Brontë. I couldn’t believe her nerve. Expecting me, one of the most masculine men to ever roam the Earth, to read some romance novel. But then, I caught on to what she was doing. So I said: “Listen, I have seen many videos like this, I know exactly where this is going. I will accept to make sweet, sweet love to you in exchange for a good grade.” Turns out she just wanted me to read the book. Embarrassing.

I can trace many pivotal moments in my life to some conflict I had with an authority figure. So I am supposed to divine what some dead author from the 19th century meant between the lines? By reading a book that’s not even in the original language? What kind of horsecrap is that? Obviously, a principled man like me had to take a stand. I decided that evening that I would quit high school and go straight to university in Ontario, where I would be free to pick my courses. This was a bit of jurisdiction arbitrage: students in Ontario get to go to university one year earlier.

The only hitch was that up to that point, I had only learned English, like Ontario students learn French. I spoke Tamil at home and French with my friends. Quebec’s idea of teaching English to prepare students for the world is to make us listen to the power ballad Runaway Train and watch Tina Turner’s biopic What’s love got to do with it? I also learned some useful everyday words like “cocksure” and “flabbergasted.” I was watching Seinfeld and reading The Montreal Gazette every day. But I was still using words like “proudness” instead of pride. (Turns out that both are actually acceptable, but I think you'd agree that most native English speakers wouldn’t be too impressed with “proudness.”) I was a perfectionist, so I had to find a smooth way to transition into becoming an Anglo. The solution I found was Glendon College, the bilingual campus of York University. It’s right next to Sunnybrook Hospital near the Bridle Path, aka “Millionaire’s Row”. More than ever, Glendon is by far the cheapest way to live in that neighbourhood.

Glendon is a great experience, but it’s not exactly an academic powerhouse. I was studying economics, it was easy-peasy, so I started looking for jobs. At the time, I had been using websites operated by a company called Simvest Solutions that made simulated stock market trading software. I asked the manager there, Tony Alexander, if he could use a student. He asked me during the interview the definition of a call option. I had just started studying for the Canadian Securities Course, so obviously hit that one out of the park.

My job at Simvest consisted of auditing simulated trades every weekend. Tony called me The Klevinator. But I think he was too generous, I constantly missed stuff. I was probably the worst simulated trading auditor in history. The next semester, I told Tony - in polite terms - that I wanted to find a job with a real financial company, not a simulated one. I wrote “I’ll be back” on the white board and left. Simvest was at one point very hot and was eventually sold to CSI - the Institute behind the Canadian Securities Course. CSI was eventually acquired by Onex first and then Moody’s.

I think the staffing agency Quantum was pretty much my first stop to find a real job on Bay Street. I wore my father’s suit, which was a few sizes too big. I met recruiter Andrea Balusek. For the sake of completeness, I should mention she was a hot blonde. I would have totally accepted her as an authority figure any day, if you catch my meaning. She was so taken with my candidacy that she called over a hot brunette and a hot Asian and said: you’ve got to meet this guy! What could possibly explain their interest? When the hot Asian lady showed up, everything clicked in my mind. So I said: “Listen ladies, I have seen many videos like this, I know exactly where this is going, I will accept to make sweet, sweet love to all of you in exchange for a job.” Sadly, I was wrong again, their interest was purely professional. Who needs a heart when a heart can be broken, as Tina Turner sang.

Why would this trio of women see me as a prize - professionally speaking - in 2000? I have already given you two clues:

- I was a French speaker in Toronto.

- I had started the Canadian Securities Course (”CSC”).

You have to understand the context of the dotcom bubble in 2000. It was very similar to 2021, everyone was day-trading. There was an explosion in retail volumes and discount brokerage was going mainstream in Canada. If memory serves, the regulations in Canada at the time were such that you still had to have humans review clients’ self-directed trades. Plus, electronic trading was still clunky. I was trading myself and I remember having to spend a lot of time at pay-phones. So there was unprecedented demand for junior financial staff.

Andrea offered me a full-time job somewhere, I forget the details. So I phoned my mom and I told her: “Mission accomplished, I found a job.” Unfortunately, my mom did not share this perspective. She insisted I had to finish university. Incidentally, I should mention that dragging my mom into this story is a logical inconsistency. After all, there are plenty of other things she told me not to do, which I did. We tell ourselves convenient, but inaccurate narratives. The truth is I was just too timid to dropout. So I asked Andrea to give me part-time gigs. But a few weeks later, I decided I could both continue my studies and have a job.

And so, as a 19-year-old, I was a Communications and Research Officer in the Corporate Services division of Scotiabank. This consisted mostly of the business of Montreal Trust, a company Scotia had acquired a few years prior. A transfer agent is an unsung, but necessary part of the machinery of securities trading. Let’s say you found a stock certificate in your attic for 100 shares of Bell Canada from 1955. A hundred shares of Bell from 1955 might not be equal to 100 shares of modern day Bell. There might be stock splits. You might be entitled to spinoffs (like Nortel). There were all kinds of obscure tasks like that. I learned what a CUSIP number is. Exciting times! It was a back office job, the least glamorous part of finance. But I was totally adulting, getting a bagel in the morning at BCE Place, doing the ol’ 9-5 grind and coming home to trios of women. (My small dorm room could only accommodate 1 trio at a time.)

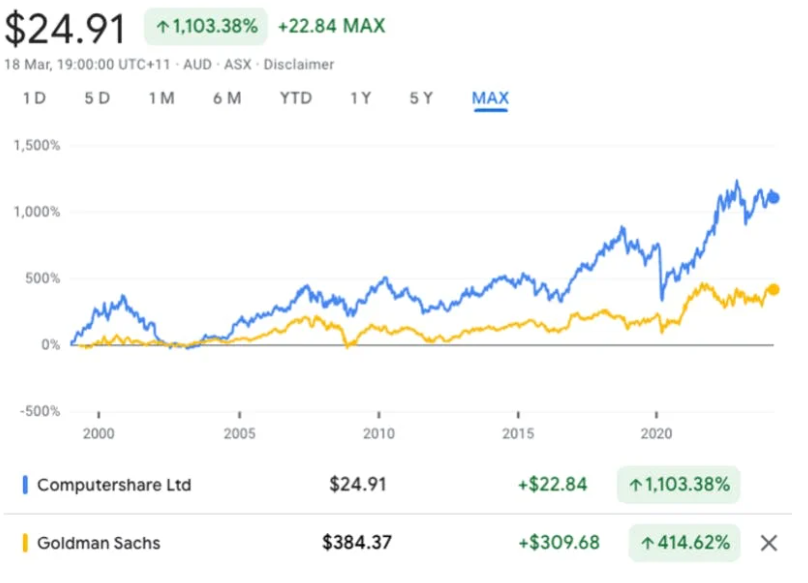

There is universal disdain on the street for "back office" jobs. And yet, Wes Hall took a similar back office job and transformed it into an opportunity to revolutionize an industry and build a 9 figure fortune. While I was working at Scotia, my division was sold to Computershare. That’s an Australian transfer agent consolidator worth $15B. Now, here are the comparative returns of Computershare vs Goldman Sachs going back 25 years. Based on this chart, who are the real financial wizards? There are riches in niches!

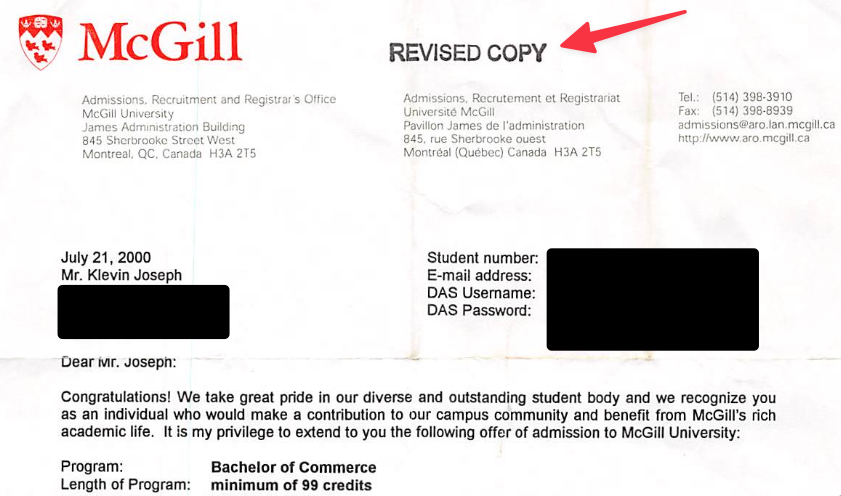

That’s just a “convenient narrative”, not very scientific. Goldman partners probably IPO'd high, then ran the company for their own benefit. But my point is that mild adversity, like ending up at a non-prestige school like Glendon or a back office job, can be an opportunity if you keep the right perspective. Ambitious people often lack a very useful instinct to have: avoiding competition. But I was a very conventional thinker back then. By the summer, I had gotten an offer to work in the forex department at TD. But I turned it down, because I had made a PLAN. I wanted to get on a path to get a real "haute finance" job at an investment bank - the type you can get with a degree. I had considered applying to American universities, but I learned that the big Wall Street banks recruit at places like McGill, Rotman and Ivey, so given my end goal, I figured McGill in my hometown was just as good.

Before Glendon, I had been on a science track with solid grades, so I considered getting into McGill’s BCom program a formality. I even wrote a letter arguing that I should be admitted directly into second year since I already had a year of university studies plus real world financial experience. McGill rejected me even for the first year! I went from being cocksure to flabbergasted, as we say in Quebec. Tabernak! My life plan was in disarray, so I had no choice but to fight (as a very masculine man). McGill made a big deal of my grades in the second semester at Glendon, which indeed had taken a hit. I was able to get a meeting with the august and diverse McGill Faculty of Management Undergraduate Admissions Committee. I simply needed to show them I had been a straight-A student until that semester when I took a full-time job. So I carefully prepared a speech with all my arguments. To this day, I am a bit self-conscious that my spoken English isn't as fluid as that of a native speaker. But when the meeting started, my instincts took over and I said: “Listen, I have seen many videos like this and I know exactly where this is going….”