The only time that new kings are born is when there’s chaos. If everything’s hunky dory, the new kids never get a shot.

- Admiral Gary Ng

(I originally wrote this in July last year, but felt it was too weak and petty to be sent to the mailing list.)

Reader,

This is a message of hope. Except for Stan Wong and his ilk. When I wanted to break into the industry on my own, I had a premise. I figured that as someone obscure, I could only get traction through world-class performance. Especially influenced by magical hedge fund thinking, I wanted to deliver great performance no matter what. This worked well during a period of high volatility between 2006 and 2009. But as the market emerged from that and steadied into a strong bull market, I noticed that long-only, plain-vanilla types had an unfair advantage. They were beneficiaries of the relentless march of progress and the overall trend of rising markets. I refused to coast on this beta, but ultimately, in a relentless buy-the-dip market, I was just churning my portfolio. It’s much easier, on the investing side, to succeed and fail conventionally, by going along with beta. When the market falls, everyone is losing money, the clients have no alternative. But some people will be completely offside (hello, Ark Innovation) and you can peel off their clients if you are more reasonable. I hate to come across as a total square, but today, I do not believe there’s a reliable alternative to buying and holding quality businesses with no intention of selling. To be frank, I am personally experimenting with other approaches, but I won’t know if it works for another 20 years.

It’s very empowering when I realized I don’t need to displace Stanley Druckenmiller. All I needed to do was to displace some broker at Canacuity. That’s a name I made up so as not to needlessly offend people. I got a really good reminder of this while reading a recent Globe article. The Globe still publishes horoscopes, but I am nevertheless a regular reader.

The article from April 22nd, profiles a certain Stan Wong, a portfolio manager at Scotia Wealth Management. A critical reading of that article would reveal that Stan Wong suffers from many delusions common to portfolio managers:

-he plays with gigantic stocks like Pfizer, Netflix and Chevron

-he regularly goes on BNN to opine on a laundry list of such stocks with Jim Cramer-level disregard for the notion of a circle of competence and epistemological humility

-he draws a distinction between “growth” and “value” stocks and is pivoting from the former to the latter, implying he can add value by making such deft moves

Here’s a typical horsecrap quote:

I believe that rising interest rates, inflation concerns and geopolitical pressures will likely keep volatility levels elevated this year. However, I am constructive on the equity markets as the global economy emerges from the pandemic-induced lockdowns and continues to rebuild and reopen.

“Constructive”is a favorite weasel word of bullcrap artists.

I looked for his bio and found this:

As a qualified and registered Portfolio Manager, Stan retains one of the highest levels of registration in the investment services industry. The Portfolio Manager title is a designation that requires a high level of academic achievement and success in the investment industry.

I am surprised this kind of misleading horsecrap made it past bank compliance. The fitness requirements for registration as PM are perfunctory and formulaic. They have nothing to do with “a high level of academic achievement” and “success”. Unless you consider not having a criminal record to be “success”. Most licensing bodies frown upon licensees claiming that their license is some sort of badge of skill.

I have not even bothered checking his performance, I can give you my personal guarantee that he’s underperforming a properly constructed benchmark over any meaningful period. It’s nothing personal against Stan Wong, I am just using him as an example of a certain type of high-fee, low skill plain vanilla advisor. In fact, from now on, I’ll call him Rob Chan, just to avoid making things personal. Earlier this year, Rob Chan was commenting on Alibaba. What are the chances, that Rob Chan, on top of his marketing, operational and compliance duties, working out of Markham, has enough time to gain an edge over all the thousands of other people trying to figure Alibaba? How much does Rob Chan manage? $400m! How many other Rob Chans are out there, managing high-fee plain vanilla portfolios? Hundreds! Collectively, they manage billions and billions and billions and billions and billions and billions...

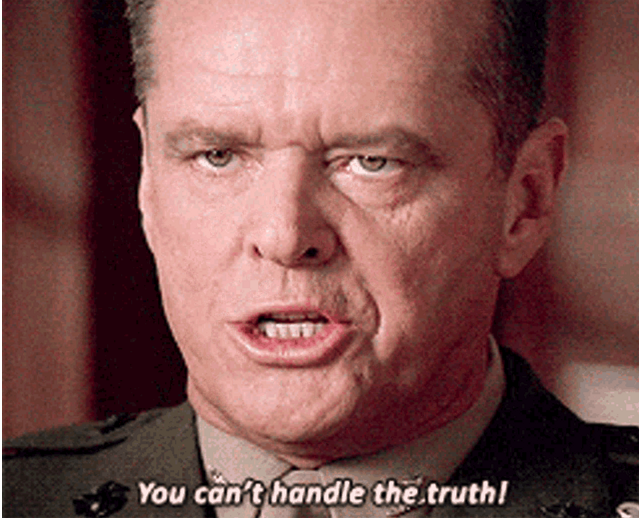

Sorry, I got carried away. I don’t mean to hurt Rob Chan’s feelings. But I figure I could cheer up hundreds of semi-delusional managers by singling out one hopelessly delusional manager. These are the difficult tradeoffs you entrust me to make, as Bay Street’s Chief Kompromat Officer. You weep for Rob Chan, but I have a greater responsibility than you could possibly fathom. My existence, while grotesque and incomprehensible to you, SAVES LIVES. Sorry, I got carried away again.

Anyways, always remember that all you need to do is displace the Rob Chans of the world, not George Soros. I can guarantee you can outperform Rob Chan simply by charging lower fees, reducing turnover and ignoring all macro considerations. Persistence is all that’s needed. Of course, that still leaves the question of how to gain some initial traction without market trouncing results. I am disappointed you even have to ask. We are, after all, contemporaries of the greatest marketing genius of all time, Donald J. Trump. Whatever his faults may be, he has taught us so much about branding, getting attention and communicating.