Do your days seem a little grayer without a little OPM Wire? This post is so tame, I could have sold it to Advisor’s Edge. Rather than pointing out the deficiencies of various funds, for a change, I want to bring to your attention a pool of capital that’s actually interested in backing money managers.

Walter Global Asset Management (WGAM) is lead by Sylvain Brosseau who used to be the second-in-command at Fiera Capital. Fiera Capital, if I have to explain everything, is a money management consolidator with about $170 billion in AUM. Jean-Guy Desjardins, who previously built and sold TAL Global to CIBC, started Fiera from scratch in 2003. Fiera is thought of as the big man on campus in Montreal, but in actual fact, the stock price is the same as it was 10 years ago, despite many acquisitions around the world since then. Sylvain left Fiera in 2017, then founded WGAM. He’s a powerful figure in Quebec financial circles and he also sits on the board of the Caisse. Fingers crossed that I will have the wisdom to not take potshots at him.

WGAM is backed by the Somers family who made their money with a company called Walter Surface Technologies (WST). WST specializes in power tools and abrasives, you have probably seen the Walter brand at the hardware store. Control of Walter was sold to ONCAP, the middle-market arm of Onex in 2018. The family has been redeploying across a range of asset classes. Their private equity interests, including WGAM, amount to some $240 million. WGAM itself has $100 million to buy minority stakes in boutique asset managers. The Somers put $40m into WGAM and also stand ready to invest in the funds of the managers WGAM partners with. The rest of the $100m comes from other “sophisticated investors” (as that term is commonly understood).

WGAM’s first deal was done in 2019, backing Andrey Omelchak’s LionGuard Capital, also based in Montreal. Andrey has a great story, he comes from the city of Perm in the Ural Mountains of Western Russia. He is tall and extremely good-looking, with enviable hair and facial bone structure. He came to study in Montreal, eventually worked as a financial services analyst for Montrusco Bolton, then launched LionGuard in 2014, while still in his 30s. It’s not easy to launch a startup fund in Montreal, so it’s really to his credit that he was able to survive and grow LionGuard. I have been especially impressed by his ability to network. Already as a buyside analyst, he was able to get one-on-one meetings with bank CEOs. And him bagging Sylvain Brosseau as a director is almost as impressive as Arnold Schwarzenegger moving to America and marrying a Kennedy. What’s Andrey’s secret? When I watch him on BNN, I find his calm, measured delivery enhances credibility, particularly if you manage to stay awake through it.

Now, some people are saying that he had support from well-off parents, but boo-hoo, many people have wealthy parents, they don’t all build an OPM firm of some substance. I have taken a quick look at the returns of his three funds, which are only a few years old. But even if we were to overlook that, I see no basis to believe that LionGuard adds meaningful value, if any. If your reaction to that was: “How’s that a problem?”, you have perfectly understood how the OPM industry works.

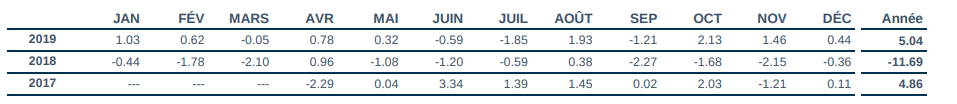

I always look for signals of shoddy thinking and found it when I saw that LionGuard manages a “conservative” mandate. I have never understood what a “conservative” strategy is. To me, being a fund manager and being a cab driver comes with the same mandate: you drive as fast as is prudent. Not getting killed is a pretty big part of the job, I think that goes without saying. This is how the conservative mandate has performed to date, I will let you figure out what WGAM saw in this:

Also, I don’t know why such a small firm already has three strategies. A single strategy is the sincere way of doing it and also the efficient way. Of course, Andrey shorts and charges performance fees - get with the times.

LionGuard is only one of three WGAM deals so far. If I understand correctly, they’re already looking to raise another $400m, ultimately aiming to back 15-25 asset managers over time, anywhere in the world. And they are long-term minded, Sylvain has said: “There is no exit strategy here, no horizon for disinvesting. My goal is to build something for the long term that will survive me.”

Incidentally, buying stakes in money managers is probably one of the smartest, safest plays out there - provided it’s done right. There are now private equity firms that specialize in taking stakes in private equity firms. If done right, you are essentially buying a piece of the world using other people's money. But you need discernment to back the right jockey. Do Sylvain and WGAM have it? Thanks for your question, upon reflection and advice, I must respectfully decline to answer.